STATE OF THE GTA INDUSTRIAL MARKET, Q1 2019

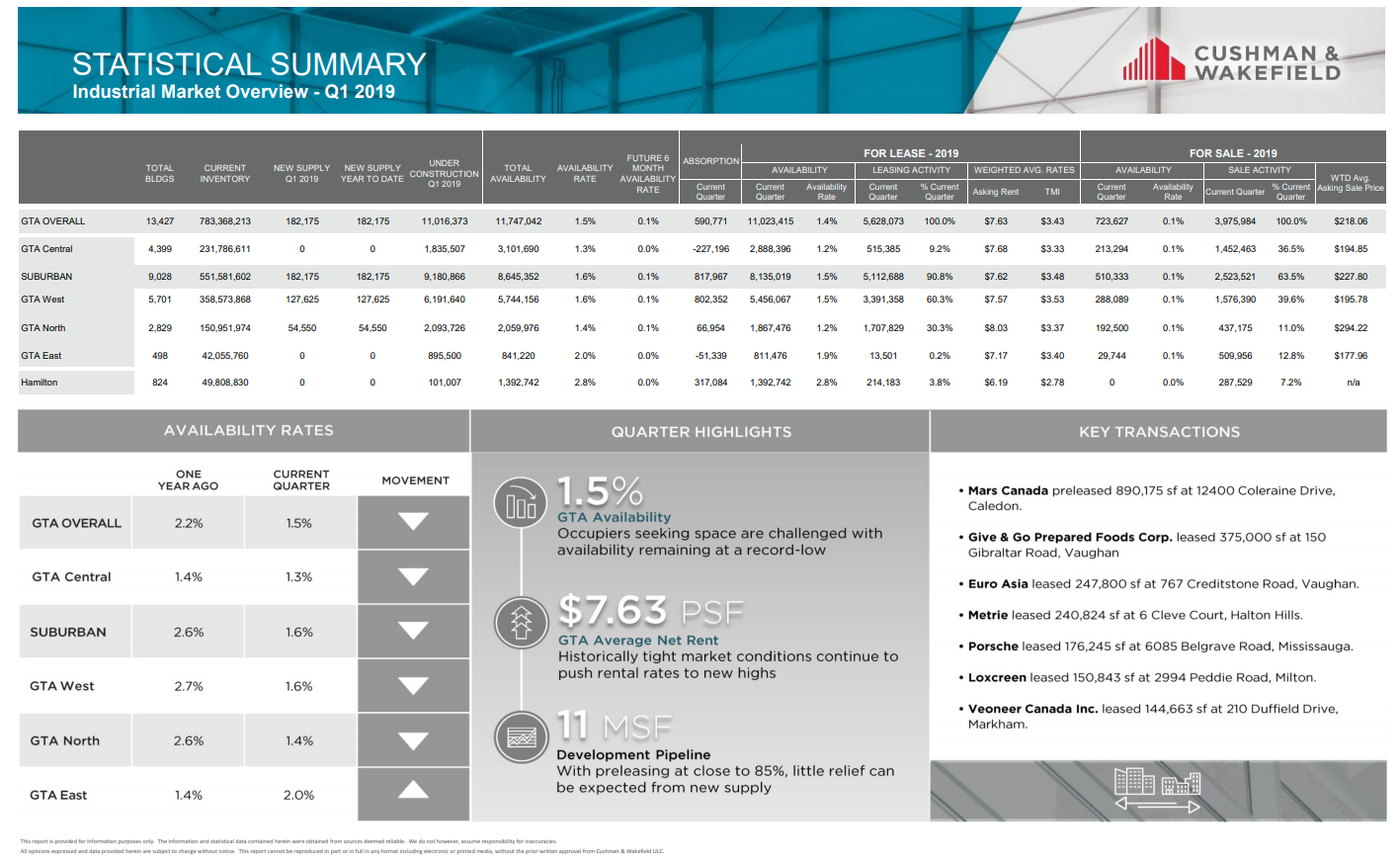

GTA Q1 2019 KEY STATS

GTA VACANCY RATE PLUMMETS TO 1.5%

The GTA Industrial Market vacancy rates remained at an all-time low of 1.5% for the second consecutive quarter while developers are in the process of delivering a record high 11 million square feet under construction. New supply delivered in 2018 was just 6.33 Million SF.

The average asking lease rate increased to $7.63 PSF, while new construction with 36’ high ceilings and greater would demand more than $8.50 PSF net.

Leasing activity reached 5.6 million SF with over 90% of leasing transactions taking place in Toronto-West (60.3%) and TorontoNorth markets (30.3%). Given the lack of available product, overall activity was sluggish in Q1 2019.

Demand from E-Commerce, 3PL, and logistics companies continue to be the main driver of the aforementioned activity across Greater Toronto Area.

As demand continues to outpace supply, rental rates are expected to increase further. A big contributor to this increase is the rising cost of industrial land, raw materials and labour, as well as an increase in development charges.

CAP rates are between 4.5% – 4.7%.

NOTABLE LEASE TRANSACTIONS

12400 Coleraine Drive

NOTABLE SALES TRANSACTIONS

GTA Q1 2019 Market Stats