Is Your Industrial Lease About To Expire? Here’s What You Should Do

Securing Your Occupancy in a Tight (and Uncertain) Market

July 31st, 2020

It has never been more important to reduce as much risk in your business as possible. When it comes to your operational footprint, this means optimizing and securing your real estate. And while many Occupiers of industrial facilities may be looking to rightsize or relocate in the coming months, this simply may not be possible given the GTA’s record-low vacancy rates being anywhere between 0.9% and 1.4% depending on the sub-market. Therefore, renewing your existing lease may be the only option; while still cost-effective.

That being said, executing a renewal is not as simple as it seems and can take much longer than most people would expect. Further, the failure to do so correctly can potentially result in increased rents, forced relocations, and discontinuity of operations; effectively jeopardizing the business.

Let’s say you currently occupy a space that works for you. It perfectly meets your needs.

Your lease is up in 18 to 24 months… maybe even three years from today, and, you heard that rental rates are moving up so you wanted to be proactive… And net rental rates have moved up significantly… and based on what we are seeing at this moment, they will continue to increase.

This is because the GTA Industrial market vacancy rates are still among the lowest levels ever despite the economic shutdowns. And regarding industrial product, in particular, the pressure coming from e-commerce seems to be sustaining demand and outweighing any businesses leaving the region or winding down (for now, at least… we’ll see what happens in the balance of 2020).

So what can you do to ensure you have some options going forward?

Well, there’s one key strategy you must have in order to negotiate successfully (which we’ll reveal later on), however, above all else…

Start the process early!

We typically help our clients prepare for their lease expiries (and renewals) 18 months in advance. As part of strategy development we recently performed for someone, we conducted market research and found very few options for them at this moment.

Does this mean we won’t find them a solution? No, it doesn’t. Yet if they had been looking to renew 6 months out (instead of 18), they would have been forced to pay up or relocate. But even in the worst-case scenarios, options do exist. We have helped a number of our clients optimize their facilities to use their existing space more efficiently (we may dive deeper into this in another issue).

Lease Renewals are potentially the most commonly misunderstood and least utilized tool for:

- improving your bottom line,

- mitigating future risks, and

- increasing flexibility.

Renewal options typically occur every five or ten years, and quite often, Tenants are busy running their business and not paying much attention to notice periods in the Lease as well as current market conditions.

In order to succeed with renewals, you must utilize one crucial strategy; and that is leverage.

Leverage is needed to negotiate from a position of strength. And it comes from knowing what the other side is thinking, feeling, and experiencing; while not being needy yourself.

Without understanding current market conditions and the landlord’s specific circumstances you will always be at a disadvantage. And being short on time, money, or options can make you lose all control. We’ll break this down further below.

This week we’ll discuss a few points that should be considered when negotiating a successful lease renewal.

FIRST: What is the renewal option?

One of the crucial terms to consider when negotiating a lease is the renewal clause. The renewal clause grants the tenant an option (or several) to renew the lease for a set term (or several) after the expiry of the initial term. It is important that such renewal rent can be fairly negotiated or determined, and that the option to renew cannot be revoked for minor infractions under the lease.

The renewal option allows a tenant to renew its lease for a predetermined period of time on terms stipulated in the Lease Agreement. Most often, the option must be exercised within a specific time frame, usually not earlier than 12 months, and no later than 6 months, prior to the expiration of the initial term. During that period, negotiation of the rent payable, and any other items to be determined, takes place.

It is common for a renewal term to be continued on the same terms and conditions of the lease, with the exception of:

- rent,

- any financial incentives offered to the tenant for the initial term (such as a tenant’s improvement allowance), and

- the renewal clause itself.

The renewal option is guaranteed to be extended at the then market value; usually defined by rates set by comparable lease transactions for similar premises in a similar area.

Further, some Lease Agreements even have a provision whereby the net rent in the first year of the renewal term is not to be less than the rental rate in the last year of the original or preceding term of the lease.

Lastly, most renewal rights are contingent on the tenant not being in default at the time the option to renew can be exercised, or having never defaulted under the terms of the lease at any time during the initial term.

Why should you have a renewal option?

Renewal options are crucial because they offer protection for tenants, especially if the tenant invested a considerable amount of capital to set up its business. Early termination or relocation contrary to the Tenant’s plans could be devastating for the business.

What usually happens when the lease term comes up?

We basically see two scenarios.

First, tenants’ needs change over time, and they may not need the same amount of space they did at the beginning of the lease term. Businesses may require larger premises if the company is growing or less space if either the anticipated growth never materialized, or the company is winding down its operations. In this case, the tenant would simply let the renewal right lapse and look for new premises.

Secondly, the space may work and there is no need to relocate. Here, we hope that Tenants are mindful of their notice periods and are not late exercising their rights on time.

If the Tenant does punctually notify their Landlord of their intent to renew, the only unknown that must be decided is the net rental rate for the extension term.

That’s normally it, as the Lease Agreement usually states the Tenant can renew under the same terms and conditions.

So how can we decide the new rental rate?

This is normally determined at the “then market value” for similar premises, along with other factors. In many cases, it is subject to arbitration in the event the Tenant and Landlord can’t agree on what that value is for the leased premises.

Yet the key phrase here is: “then market value”…

If you are occupying an industrial building in the Greater Toronto Area and your lease is coming up within the next two to three years, that means you must have executed your lease three, five, or even ten years ago. You may have negotiated a flat rate for the term or you may have been subject to some escalations over the term.

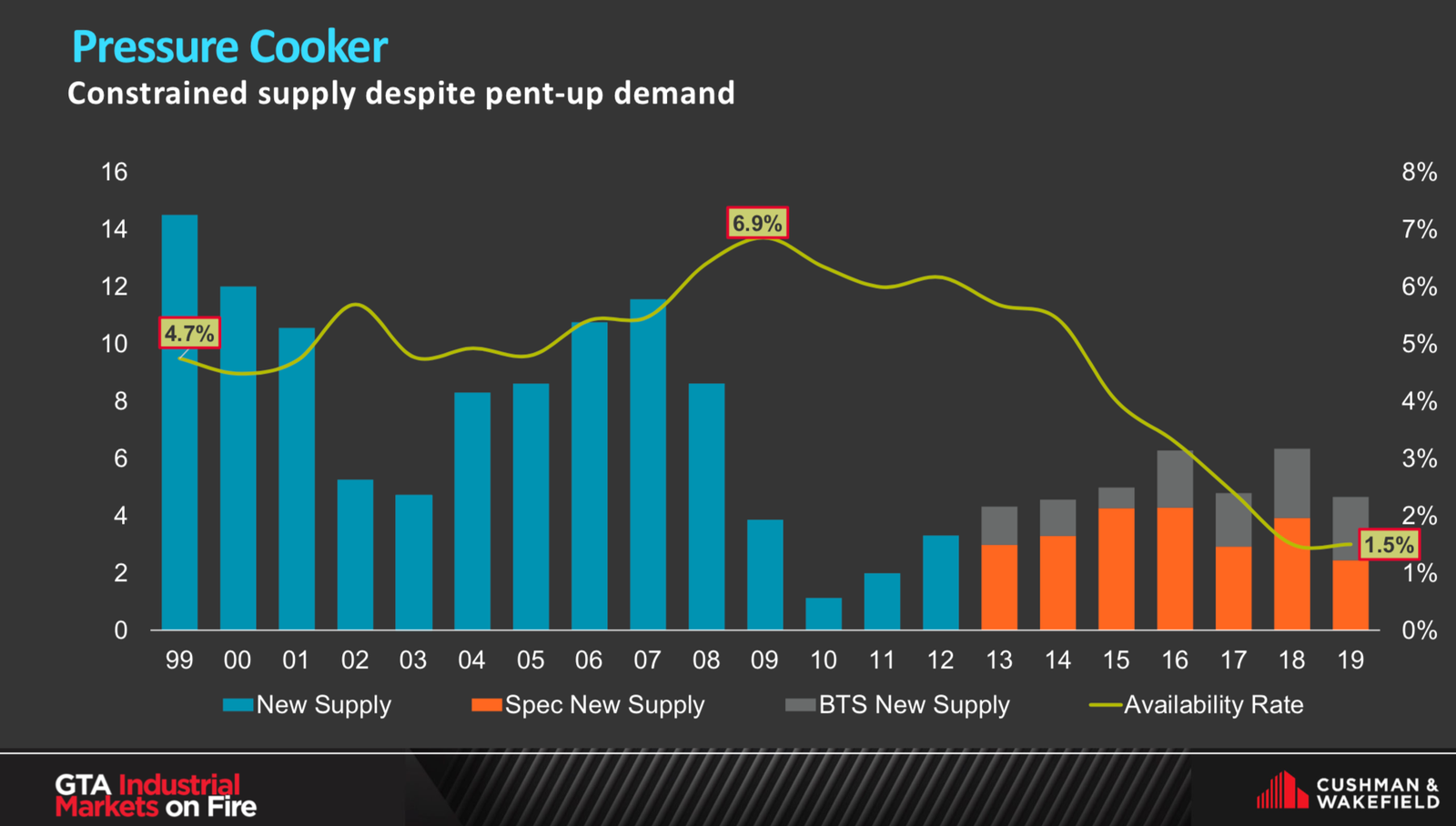

GTA Industrial Vacancy Rates – Source: Cushman & Wakefield ULC

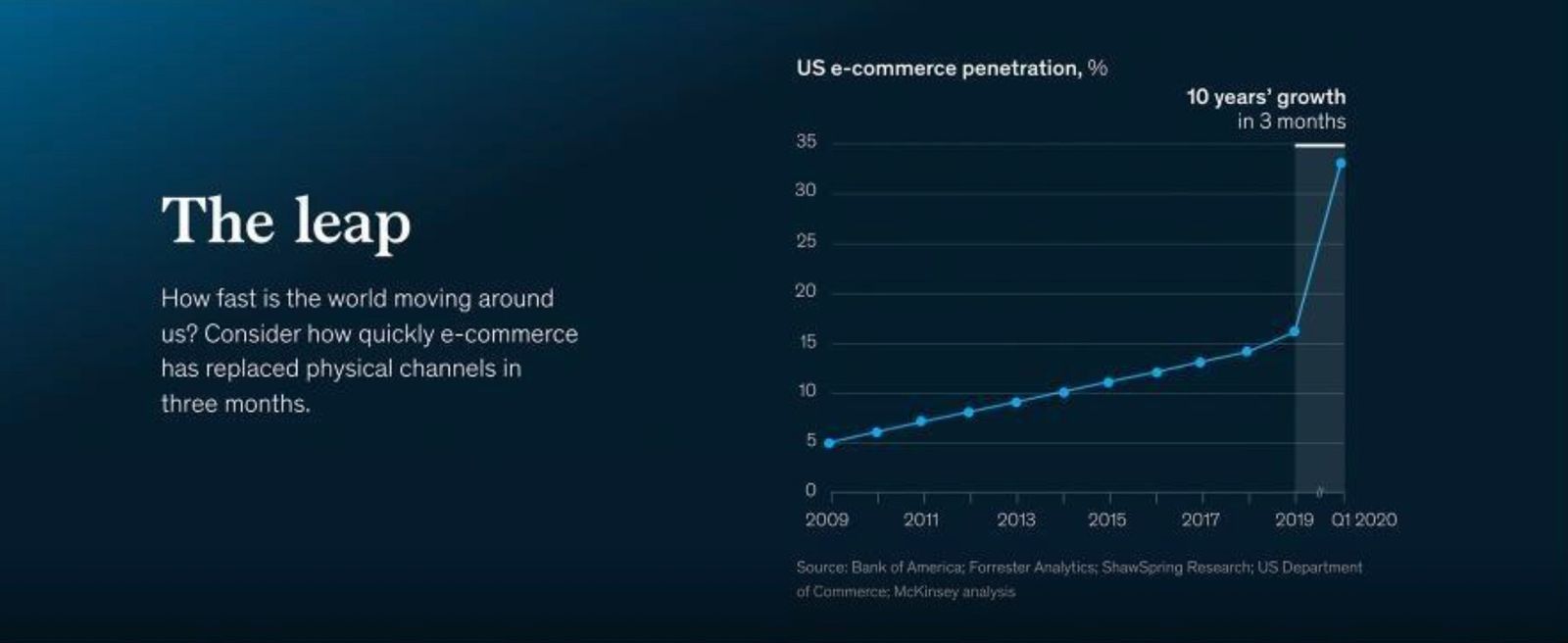

With GTA Industrial vacancy rates of 1.5% and less and net rental rates growth of more than 20% over 2019 (and with e-commerce showing 10 years worth of growth in a 90-day period since the pandemic began) you may be in for a big surprise when you begin the negotiation process.

E-Commerce is a Driving Force Behind Industrial Demand – Source: McKinsey

If you wait until the last moment (and in this case, the last moment could be qualified as your six to twelve months prior to the expiry of the term) you may not have any options in the market or any leverage to negotiate terms for your lease renewal.

So now that we have defined the basics of the lease renewal itself and what typically happens during a negotiation, we’ll close off next week’s issue with five (5) ways Occupiers can develop their own strategic renewal plan.

CONCLUSION

For many of us, our business means everything, and we are all trying our best to manage current market conditions caused by the pandemic.

That being said, Owners and Occupiers of Commercial Real Estate in the Greater Toronto Area may or may not be well-positioned to push through the pandemic and its resulting shutdowns. Few, if any, of us could have predicted what happened, and it caught many of us by surprise.

The silver lining here is that the GTA is such a robust and in-demand market with a large ecosystem of Buyers and Sellers. And with our vacancy rates, rental rates, and valuations having hit all-time highs right before COVID-19 took place, there may be plenty of opportunities to find creative solutions; whether it be through rightsizing, refinancing, bridge financing, sale-leasebacks, or otherwise.

While there may exist challenges in execution, Buyers are ever more hungry for product. Local, high-net-worth developers and investors are often active in bottom-of-market conditions. And well-capitalized institutional investors and pension funds are still willing to take a look at a deal if the numbers make sense. Partial-leasebacks and right-sizing options also exist for those looking to reduce their footprint while raising some capital at the same time.

Renewing your lease is part leverage, part positioning, part timing, and part luck. Yet all of these risks can be mitigated or removed by starting early.

Just like other areas of life, those who are best prepared will reap the benefits. And when it comes to securing the right space for your needs, a little bit of work early on can pay off for many years to come… so don’t put it off until it’s too late.

If you require guidance regarding your commercial real estate property or portfolio, please contact us.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com