Part 2 – What’s Driving the Market Forward?

The growth in the GTA Industrial Market is being driven by the relentless expansion of e-commerce.

People are changing their shopping habits; everybody is ordering more and more “stuff” online and retailers are adapting, not only to capture this audience but to keep up with their competitors.

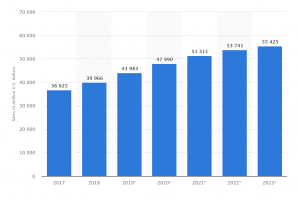

Online Retail Sales in Canada 2017 – 2023 – Source: Statista

We can see that online retail sales in Canada are predicted to grow by $18.8 billion USD between 2017 and 2023. For each $1 billion USD of sales volume, we require approximately 1.2 million SF of industrial space. Older and functionally obsolete properties don’t count here…. We need new buildings that are both designed and built for E-commerce. So, keeping with these assumptions, just to keep up with and satisfy the growth of online retail sales, we will require 22.56 million SF of new distribution space…..

Now, the scary part about this is that we aren’t even considering the full potential of e-commerce. This is purely looking at core e-commerce and online retail for mainstream products such as clothing, books, supplies, and other small goods. In addition to large e-retailers broadening their product selection, we will see additional verticals moving towards online sales, as well as market penetration within each vertical.

We are already seeing this next huge wave of change; driven by the food sector, which is adopting offerings such as home-delivery grocery and pre-made meal services. In the GTA alone, a number of major retailers are building modern cold-storage distribution centers to deal with this demand.

And when I say modern, I mean modern.

Fully automated warehouses with 90 feet clearance.

Racking systems and robotic automation. The full package.

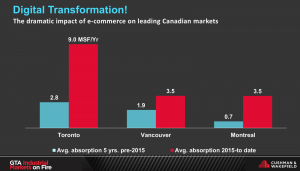

GTA Industrial Market Average Absorption – Source: Cushman & Wakefield ULC

This growth in online retail sales and surge in demand for space has created an average annual absorption of 9 Million SF; more than three times greater than that from pre e-commerce…

When juxtaposed as such, it’s unmistakable the effect that e-commerce is having on the industrial market as a whole.

The only question is, how will it continue to evolve from here?

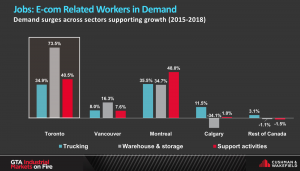

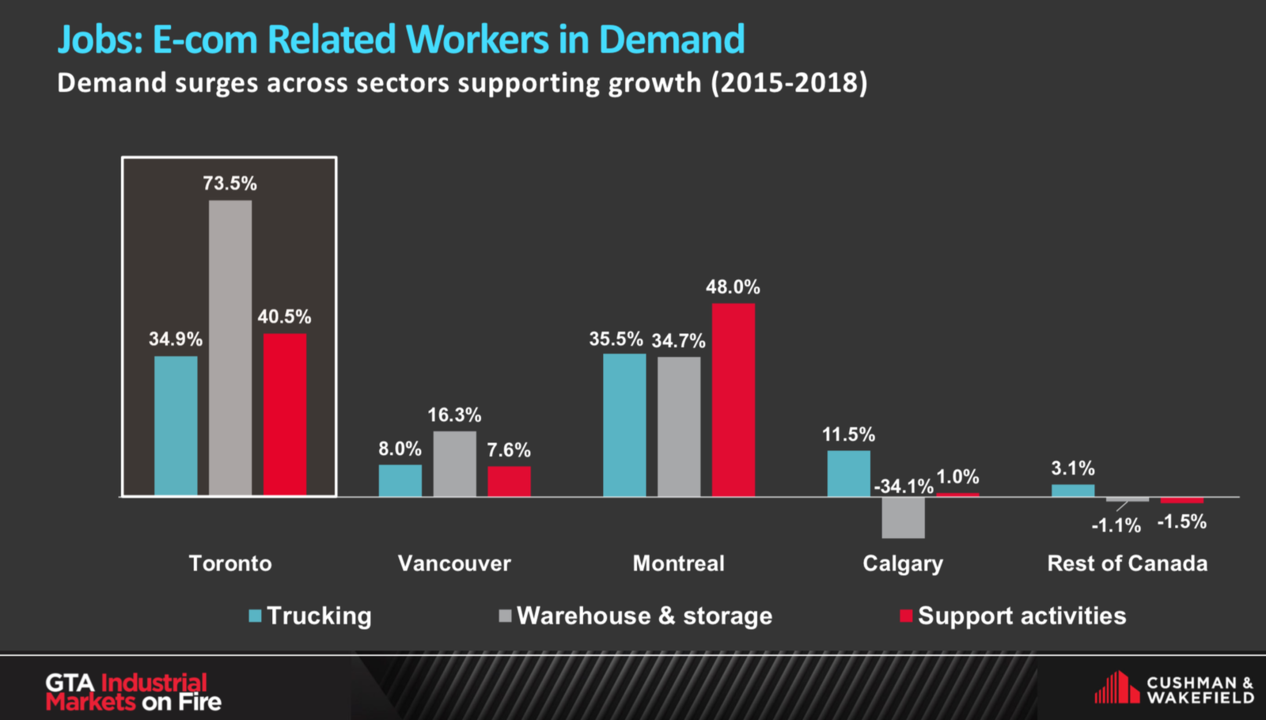

GTA E-commerce related labour demand – Source: Cushman & Wakefield ULC

Understandably, when a business expands and invests in their real estate and operational infrastructure, they need people to then operate the day-to-day activities. In the context of e-commerce, the workforce required is for:

- bringing product in,

- re-organizing it, and

- getting it out and delivered to end consumers.

It’s no surprise that, therefore, we see this surge in demand for labor in Trucking, Warehousing, & Support Activities; with the Warehouse & Storage Sector leading the way with an explosive 73.5% demand growth between 2015 and 2018…

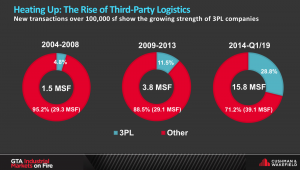

GTA Industrial Market – Growth of 3PL Companies – Source: Cushman & Wakefield ULC

To further solidify our observations and argument that e-commerce is the engine driving the Industrial World right now, it would make sense to see 3PL companies growing alongside them.

Looking at the numbers, 3PL Companies leased almost 30% of all industrial buildings in the last 5 years, compared to leasing only 4.8% between 2004 – 2008; a period that we classified as the pre e-commerce era…

GTA E-commerce Related Employment Growth – Source: Cushman & Wakefield ULC

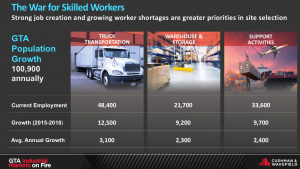

Lastly, diving deeper into the changes in demand for skilled workers, we see how strong the job market is for Trucking, Warehouse & Storage, and Supporting Activities across the Greater Toronto Area.

As any system expands and grows, its potential is always capped by the limiting agents; basically, which resources get used up first. In this case, it may very well end up being the labor pool.

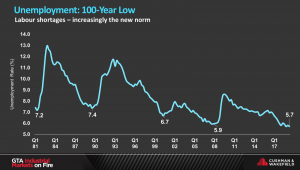

Canadian Unemployment Rate, May 2019- Source: Statistics Canada, Cushman & Wakefield ULC.

The unemployment rate in Canada fell to 5.4 percent in May of 2019 from 5.7 percent in the previous month and below market expectations of 5.7 percent. It was the lowest since comparable data became available in 1976.

Given the fact that unemployment is at 5.4% (its lowest level since 1976), labor has become an extremely important factor in the site selection process.

Availability of skilled or unskilled labor will be a challenge for any companies leasing or looking to occupy these brand-new, shiny warehouses out in West Milton or Caledon-North; so far from where people are commuting from.

Firms such as Amazon or Wall-Mart have unlimited resources, however, they are playing in an arena with finite space and limited access to both people and transportation routes; which are both extremely costly.

The implications of this are that the firms looking to find space – whether it be to lease, purchase, or build – should look to find the best location possible. The premiums to occupy or purchase space are negligible compared to other line items, and thus, as long as the supply of product is slow to come on board, there is no reason for rental rates and valuations to stop going up.

In our next issue, we will examine what will take place in 2019 and beyond.

Until next week….

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.