Investment Capital Poured Into GTA Industrial Sector At Fast Pace

While the industrial market continues to be driven by transportation, warehousing, distribution, and e-commerce, Industrial REIT’s, investment funds, private equity firms and private buyers are chasing limited available product….

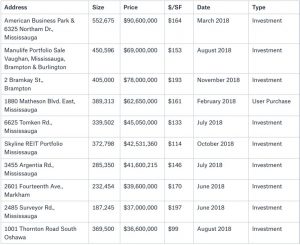

Nine out of the ten largest industrial property sales in the Greater Toronto Area in 2018 were investment transactions, while only one was a user purchase. This shows where the main activity is coming from.

A number of occupiers decided to take advantage of high valuations and move money from real estate to their operations by selling their properties and remaining as tenants on long-term lease-backs.

Industrial Investment sales volume reached $3.3 Billion in 2018, slightly less than in 2017 mainly due to the lack of opportunities to buy.

GREATER TORONTO AREA – TEN LARGEST INDUSTRIAL SALE TRANSACTIONS IN 2018

American Business Park, Mississauga

It feels like the appetite for industrial investment product coming from Canadian pension funds, REIT’s and other institutional investors, foreign money looking for a safe haven, and local private/entrepreneurial buyers will not end soon….

Cap rates for industrial product continued to compress to 4.6% for single-tenant properties and 4.8% for multi-tenant buildings.

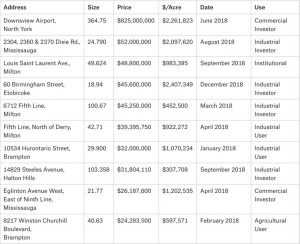

GREATER TORONTO AREA – TEN LARGEST INDUSTRIAL / COMMERCIAL LAND TRANSACTIONS IN 2018

Downsview Lands, North York

Land – they don’t make it any more!

How many times have we heard this one?

We are witnessing the explosive growth of the Greater Toronto Area from every angle. There is less and less land available, especially serviced land available for development.

Therefore, in 2018 we saw a number of record-breaking land transactions ….

The largest land transaction by far was the sale of Downsview lands to Canadian Public Sector Pension Investment Board. Given its location and proximity to the subway line, we will likely see higher-value and -density development, with mixed-use residential and commercial properties.

The few infill sites that were offered for sale in 2018 (see Dixie and Birmingham deals above), were in great demand. All sold to investors under multiple bids, in an extremely competitive environment, and at a record-breaking prices.

“Location, location, location” was the driving vision here that generated values well above $2 million per acre. While calculating/considering the final cost, low development charges within the City of Toronto boundaries, as well as development charge credits, demolition cost, and potential environmental remediation should be considered.

CONCLUSION:

The Commercial Real Estate community in the Greater Toronto Area will remember 2018 as a year when the market was pushed to new heights….

Net rental rates, vacancy rates, land values, CAP rates, sale price per square foot, construction cost, development charges…. Slowly, everybody is getting used to the “new normal”.

We shall see how good 2019 will be to us…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.