Just as we deep-dived into the Top New Developments and Land Sales last week – with our higher-level narrative surrounding the lack of available product forcing high-quality Users and/or Developers to build on spec or pre-lease new development – there needs to be something said for good, old-fashioned Sales and Leasing.

Because despite the fact that very little sits on the market, and few people are logging long hours on MLS, deals (and big deals, for that matter) are getting done.

As a whole, the industrial real estate market in the GTA in 2019 continued to dominate headlines. Rental rates have been on the rise while sustained demand is expected to keep industrial markets tight for the foreseeable future.

Specifically, over 21 million square feet leased across the GTA Industrial markets last year; continuing to push vacancy rates down to 1.3%.

E-commerce, Warehousing and Distribution Companies remain the driving force… and with ever-increasing online retail sales, this trend will only continue.

If we could point to a single culprit behind the demand for large industrial buildings close to high-density populations and transportation routes, it is this: consumer expectations for immediate, instant, teleport-to-your-living-room, same-day delivery… and it is shaping entire industries surrounding supply chains.

With new supply of about 7.4 Million square feet and an absorption of 8.8 Million square feet, it is no surprise that average net rental rates keep increasing, and reached a new high of $8.74 per square foot.

So, without further ado, let’s examine the Top Ten Largest Industrial Lease and Sale Transactions in the Greater Toronto Area in 2019.

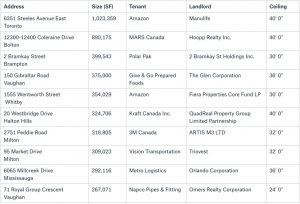

GTA TOP 10 LEASE TRANSACTIONS IN 2019

Looking at the table below, you will notice that only a few buildings are of the “old generation” with ceiling heights of 30’ or less, while the others are newer modern facilities with clear heights up to 40’. And basically, all of them fall into the e-commerce, warehousing and/or distribution categories… with the largest Lease Transaction being Amazon taking another million square foot facility.

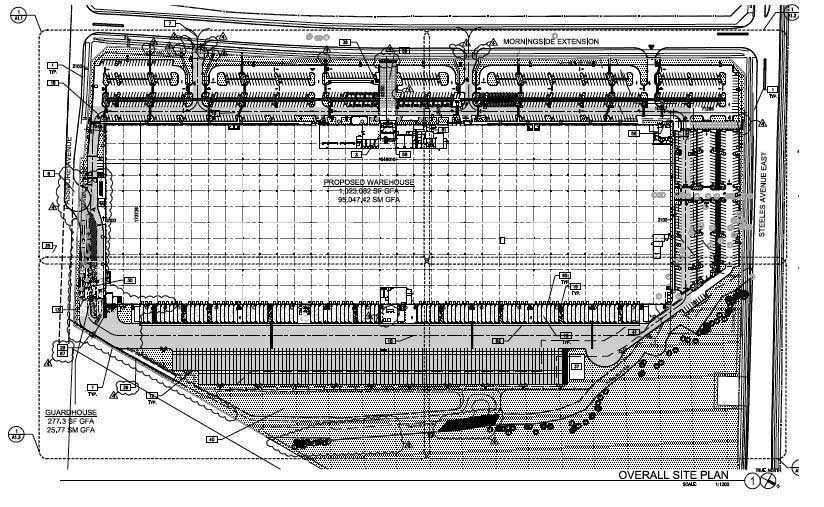

1. 6351 Steeles Avenue East, Toronto – Amazon

6351 Steeles Avenue East, Toronto

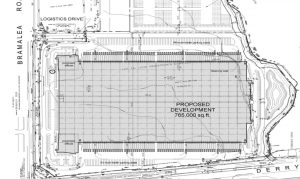

2. Bramkay Street, Brampton – Polar Pak

2 Bramkay Street, Brampton

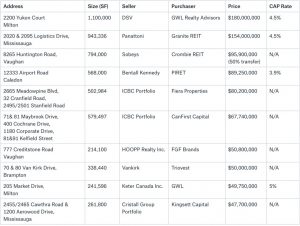

GTA TOP 10 SALE TRANSACTIONS IN 2019

Investment sale transactions, including a few portfolio sales, dominated this category… with the largest sale being the sale-leaseback of a brand-new distribution centre in Milton, located at 2200 Yukon Court.

Most of the CAP rates achieved are between 4.5% – 4.75%… but it really depends on the asset, tenant, and the lease structure (including the rental rate).

For example, in a situation where the lease term is near expiry and saddled with an older rate considerably below the current market level… then a Purchaser would be able to renew the lease or re-lease the property at a higher rental rate, effectively making a much lower CAP rate (even sub-4%) a doable proposition, as their yield would adjust upwards.

1. 2200 Yukon Court, Milton – DSV Sale to GWL Realty Advisors

2200 Yukon Court, Milton

2. 2020 Logistics Drive, Mississauga, Panattoni Sale to Granite REIT

What Lies Ahead:

- Rental Rates: As stated before, the GTA Industrial Average Net Rental Asking Rates increased by more than 20% year-over-year to $8.74, the highest level we have ever seen. And with so much demand and very little, or almost no, supply in certain markets, this will continue to a new high at the end of Q1 2020… stay tuned….. We see most of the net rental rates on lease renewals doubling and tenants not having any options… specifically in the small- and mid-bay market…

- Property Values: The Average Sale Price in the GTA is about $225 PSF, while small- and mid-bay product is fetching more than $300 PSF…. this trend will continue… CAP Rates seem to be steady between 4.5% to 4.75% for most of the product, and obviously depending on the sub-market, quality of the asset, and the lease agreement and net rental rates in place….. It could swing down to below 4% or go up to 5% and higher…..

CONCLUSION:

We will see continued demand from e-commerce, warehousing, and distribution companies as well as from companies occupying small- and mid-bay product.

Smart developers recognized this trend, and have started to build industrial condominium projects with 10,000 SF units (which have been very well received from the marketplace).

We are also seeing more multi-tenant industrial buildings being converted to condominiums, offering an opportunity to small-bay users to own their own space.

Overall, I am looking forward to what’s to come in 2020 and beyond. Given the vacancy rates, it may seem like the market is at a stand-still, but that is not the case. We are always finding land and infill development sites.

If you have any projects or developments that you would like to discuss or are looking for off-market opportunities, then please contact me.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.