December 9th, 2022

“It’s on the strength of observation and reflection that one finds a way. So we must dig and delve unceasingly.”

- Claude Monet

We all strive to move forward in our personal and professional lives.

We make detailed plans. We take relentless action. And we slowly inch our way towards our goals.

Sometimes the path ahead is clear. Other times, it is clouded with uncertainty, and we must proceed cautiously with the best-possible data on hand.

In today’s industrial market, we observe a confluence of headwinds causing investors and occupiers to re-evaluate their strategies for the coming year. On the surface, big moves are taking place, yet constraints are making it more challenging to identify opportunities that are clear winners from the outset. Deep market knowledge and access to relationships have become even more critical to those market players willing to participate.

Institutional investors continue to turn to industrial assets to find refuge from inflation and the underperformance of alternative investment vehicles. High-quality industrial product remains a prudent investment due to rising rents and cashflows, the increase in construction/replacement costs, and the broad erosion of purchasing power.

Despite the enormous volume of inventory coming on-stream, acquiring assets with AAA-quality tenants or below-market in-place rents mitigates risk and uncovers value. We observe this through the recent acquisitions of entire REITs and mid-bay industrial portfolios, as well as sale-leasebacks to firms seeking additional liquidity to navigate the economic landscape and/or reinvest into operations.

Private investors, too, can partake in the development or acquisition of modern warehousing and distribution centers. However, many are finding themselves with a unique exit opportunity – the culmination of years or decades of careful management – thanks to the robust market and the roster of active and credible buyers.

On the flipside, and as mentioned, occupiers are actively looking to compete in the marketplace and deal with rising costs and labour shortages. This often means paying a premium to secure the best-possible location, as well as investments into automation and robotics. And given how costly these upgrades can be, owned real estate can provide the funding necessary to streamline and restructure.

All of these forces and all of these differing objectives have created a dynamic whereby investors with dry powder are looking to scoop up – you guessed it – high-quality industrial assets. Although the economy has become a greater concern over the back half of 2022, investment activity from the institutional side has not appeared to slow. We expect this activity to continue and possibly ramp up should economic conditions deteriorate as, in theory, asset prices may be had for a discount.

As always, we cannot predict what will happen, but we can, as Monet says, “dig and delve unceasingly” into the data and reflect on the past and present.

That is why, today, we will recap some of the most prominent GTA industrial sales, leasing and investment sale that took place in 2022.

Notable GTA Industrial Sales in 2022

Note: while these are considered industrial sales, these transactions are not strictly sales to industrial users. The above are primarily sales of industrial properties where the end use will be a redevelopment to either industrial or mixed-use. As a result, we can sometimes see a value greater than what we would expect for the continuation of the existing use.

100 West Drive, Brampton – 883,863 SF – Crestpoint Real Estate Investments – $244 Million

100 West Drive, Brampton. Source: Google.

Crestpoint Real Estate Investments acquired the 883,863 SF Owens-Illinois manufacturing facility in Brampton in a sale-leaseback transaction for $244-million in May 2022. According to O-I Glass, the U.S.-based parent company, the deal was part of a $1.5-billion portfolio optimization program.

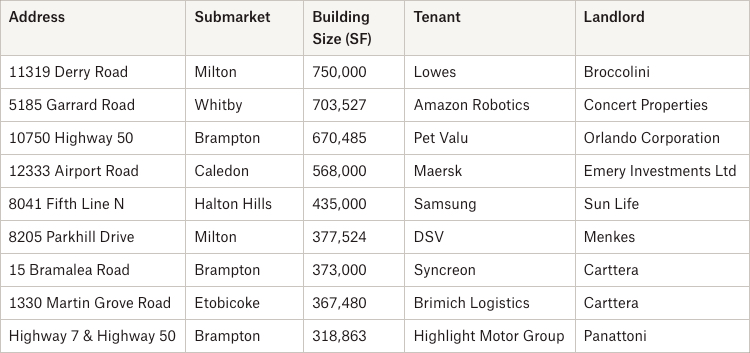

Notable GTA Industrial Leases in 2022

5185 Garrard Road, Whitby – Amazon Robotics – 703,527 SF

Amazon Robotics has signed a 15-year lease on approximately 703,527 SF of industrial space at 5185 Garrard Road in Whitby to house a robotics sortation facility. Concert Properties recently acquired the property from the developer Broccolini, who – in a press release by Concert – will continue as a 10% equity partner.

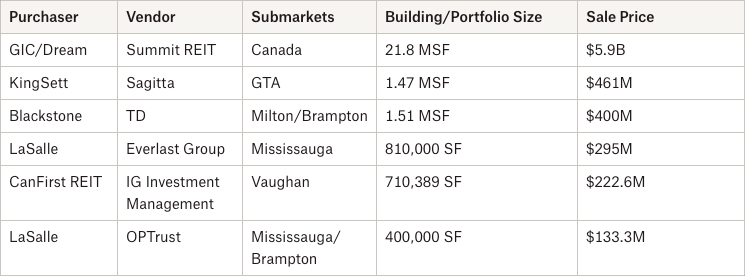

Notable GTA Industrial Investment Sales in 2022

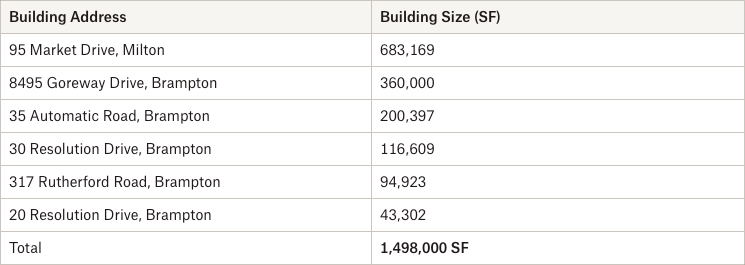

- December 2022 – Blackstone has acquired six industrial properties in the GTA totalling approximately 1.5 million square feet for $400 million from TD Asset Management.

95 Market Drive, Milton – Part of Blackstone’s Portfolio Acquisition. Source: Google.

The latest announcement to turn heads in the commercial real estate industry involves Blackstone’s acquisition of a six-property industrial portfolio for a cool $400 million.

- November 2022 – CanFirst Capital Management’s Industrial Realty Fund VII LP acquired 13 industrial properties in Vaughan totalling 710,389 SF from IG Investment Management for $222.6 million.

In what is another blockbuster industrial portfolio acquisition, CanFirst has acquired a mix of 13 small- and mid-bay properties – all located within about a kilometre of one another in Vaughan at a price of $313 PSF.

What’s interesting to note is that, with a reported occupancy rate of 99.8% and a WALT of 2.5 years, CanFirst’s executives have stated that existing rents are at 50% of the current market rate.

This potential upside is a key factor in acquiring properties in any market, however, with the accelerating rental rates, this additional future rental income is gravy on top of assets which were secured at a great value (and likely below replacement cost).

- November 2022 – Through a joint venture, Dream Industrial REIT and Singapore-based GIC have acquired Summit Industrial Income REIT for $23.50 per share, or $5.9 billion in cash, representing a 31% premium on last closing price.

The acquisition, whereby Dream secured a 10% stake (with GIC retaining the other 90%), made waves throughout the Greater Toronto commercial real estate community.

According their Q3 reports, Summit owns or has a stake in 162 properties totalling 21.8 MSF, with $3.5 billion of unencumbered assets, a 99.6% occupancy rate with an average lease term of 5.5 years, and 14 buildings under development aggregating 2.5 MSF of potential GLA. Revenues from investment properties totalled $63.048 M in Q3 2022.

Conclusion

A few years back, much of the discussion in the industrial market had surrounded the activity and leadership of Amazon in taking enormous volumes of space. The demand from the e-commerce giant had, in effect, lifted the market and crowded out competitors while also setting the standard for logistics and fulfillment.

Reflecting on activity in 2022, we notice many other retailers and logistics providers joining the conversation and taking occupancy of large, modern warehouses.

This strength in tenant activity continues to keep vacancies low while supporting the largest pipeline of industrial space ever seen across the GTA.

One question to pose as we look ahead is, what happens once all of these overlaid distribution networks are built?

Sure, there is still much left to be said about last-mile, automation, robotics, multi-level warehousing, and electric fleets. These are hot topics that are still in the early adoption phase of innovation. Yet, what about the goods flowing through these channels?

Will we see a renewed focus towards manufacturing and near-shoring? Will the providers of these components along the supply chain see more small- and mid-bay space being redeveloped, as opposed to more mega-distribution centers? And how will these assets fit into the broader industrial ecosystem to reduce transportation costs and overall consumer pricing while improving availability and customer satisfaction?

The story of how we design, make, and move goods is constantly evolving. And I am certain that 2023 will bring about new challenges, as well as opportunities, for the industrial real estate community.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com