Part 3 – What’s Next For the GTA Industrial Market in 2019 and Beyond?

As we have previously stated, we anticipate the supply of available industrial product to continue to be constrained while demand continues to increase,leading to further increases in rental rates…

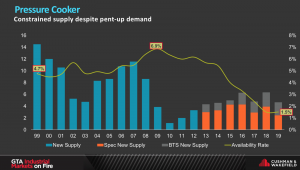

This phenomenon will continue to create a ‘pressure cooker’ in the region.

So how do we anticipate things to change moving forward?

GTA Industrial Supply and Availability Rates – Source: Cushman & Wakefield ULC

In a normal economic scenario where demand outstrips supply, we would expect to see price increases signal other producers and suppliers to either enter the market or produce higher quantities.

This is because rising rents and leverage in negotiating due to lack of availability would create higher profits. In the context of commercial real estate, that means we should see a boom in supply… but that is not what has happened.

Developers stepped on the gas but can only deliver so much; constrained with the amount of serviced industrial land. Further, everybody is building large distribution centers and moving away from (or allocating fewer resources to) small- and mid-size-bay buildings (aside from a few successful industrial condominium projects and conversions from rental to condos).

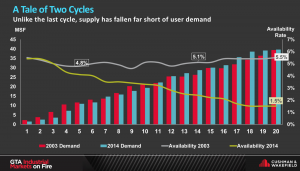

GTA Industrial Demand and Availability Rates – Source: Cushman & Wakefield ULC

Compared to the last economic cycle, supply has tapered off this time around, suggesting that there may be other factors limiting new construction.

- The GTA is limited in its size, however, there is still more than enough land to build on, if that is what you really want to do (that land is located in Caledon and Milton, where we will have issues with labour.. and that still needs to be serviced).

- Taxes and development charges can be substantial depending on which municipality you build in, yet, those shouldn’t be that much of a deterrent.

- Finally, accessing the labor pool is becoming more and more difficult as the city sprawl expands and traffic arteries clog further, yet again, it’s still feasible.

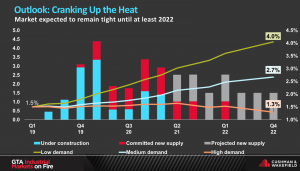

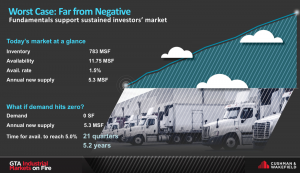

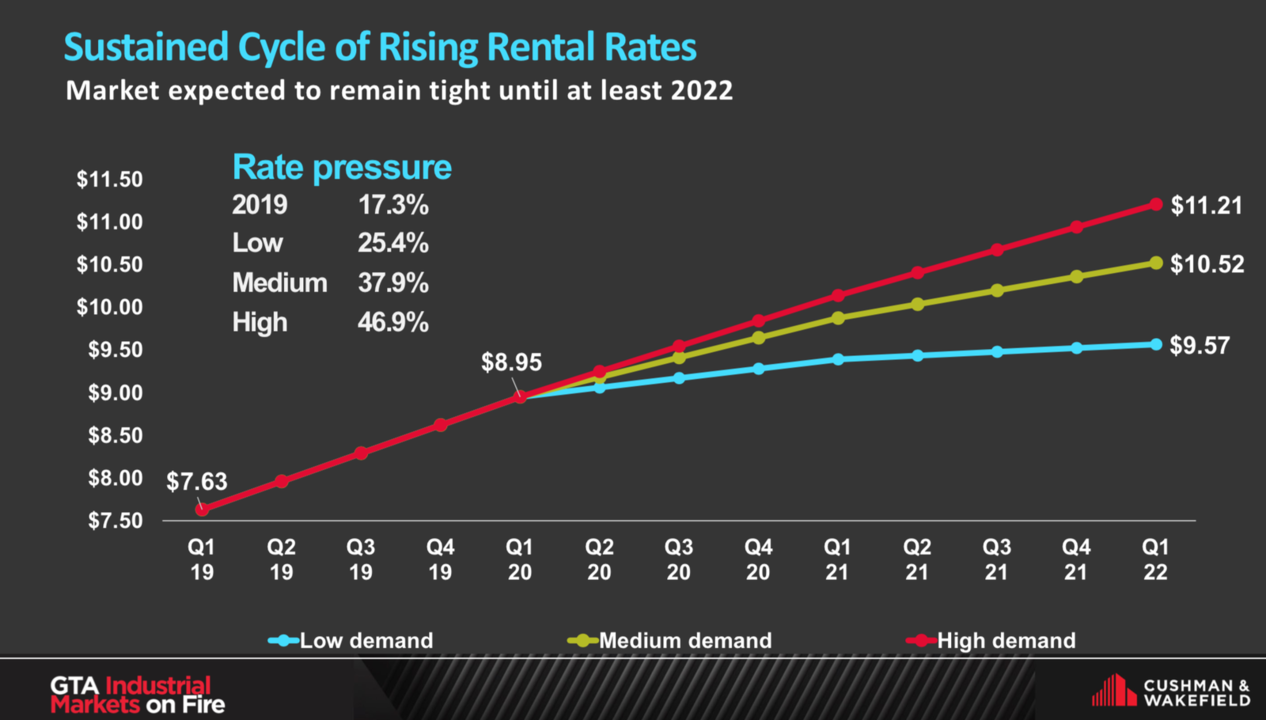

Whatever the reason may be, we expect the market to remain tight until at least 2022.

Outlook, GTA Industrial Supply vs Demand – Source: Cushman & Wakefield ULC

But what if there was another explanation?

An explanation that, if true, would change our view of this ‘pressure cooker’ demand and explain the not-so-robust rebound in supply since the last recession?

See, if we view demand through the lens of multiple tiers, then the rest of the indicators and symptoms make a lot more sense. Said another way, demand for certain types and sizes of product, in certain areas, will be greater compared to others.

Looking anecdotally, it’s obvious that location has become the most important factor for users requiring logistics, cold-storage, warehousing, or distribution facilities. Being in close proximity to major highways and population centers is the most cost-effective way to grow their operations.

The biggest firms such as Amazon, Tesla, Walmart, Purolator, etc. are all looking to create hubs or headquarters that will last for decades or even generations. They are building assets that fit into their overall strategic plan for connecting with their consumer base, not just finding ‘space’ to ‘put stuff.’ They are moving fast yet also planning for the super long-term.

If these users are willing to pay premiums, build or pre-lease, and wait years before occupying, then demand is focused on product in top-quality locations with particular specifications; which are naturally in short supply.

It would explain the rapidly rising rental rates, the high percentage of construction already spoken for, and the trend towards last-mile, last-yard, and livable cities.

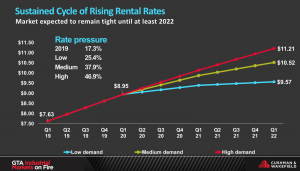

Outlook, GTA Industrial Rental Rates Increase – Source: Cushman & Wakefield ULC

And as a result of these firms and sectors driving the economy forward, other businesses will organically migrate or be born out of the abundance.

Toronto is already becoming a global city; the Canadian Silicon Valley tech hub and a financial center.

Even with low demand, industrial rental rates will continue to grow to the low teens, however, at the current pace would break $11 or $12 PSF, or go even higher.

Outlook, GTA Industrial Market Performance – Source: Cushman & Wakefield ULC

Strangely enough, if we considered demand to hit zero, it would still take the market over 5 years to adjust back to a normal 5% availability rate. This further illustrates just how much demand, albeit particular demand, remains to be processed.

Conclusion

Just as the Toronto Raptors have brought tremendous pride to the GTA and Canada through capturing the NBA Championship, the City as a whole has pushed through to a new identity under the international spotlight.

Users and occupiers recognize the value and opportunity that comes with investing in the Northern Star. While there are still many issues and growing pains that must be resolved, it looks to be that there will be a two-tiered demand for product.

Large investors and firms will pay the price to go big or buy location.

- Multi-billion landmark development projects that integrate into the City’s infrastructure will break ground more frequently.

- Specially-designed warehouse and distribution centers built to last for generations and cement a foothold, with

- Carefully chosen urban infill sites to access consumers will complete supply chains and make them more efficient.

While at the same time, lower- and mid-market players across verticals and asset classes will feel the pressure trickle down and continue to drive demandfor smaller, older, or less-ideally located product.

Toronto has an opportunity to build a metropolis that supports work, life, and play among its citizens and visitors. The optimization of businesses’ ability to reach its labor and customers by focusing on well-located, top-quality product will, in turn, help consumers and the workforce lead better lives.

Industrial real estate will require more creative solutions that are not just the most cost-effective now, but that brings about income and profit for generations to come. To that end, if you are looking to buy, sell or lease space, then you might want to consider a wide range of options before making the final decision.

If that is you, feel free to reach out and inquire about off-market opportunities, or to get an assessment of your situation and needs.

Until next week….

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.