A Story About Multi-Storey

The Future of Industrial Warehousing

November 20th, 2020

Let me tell you a story.

This isn’t the one with a daring hero or an epic journey against insurmountable odds. Nor is it one with a happy ending. In fact, it has no ending at all, as this tale continues to unfold and write itself in real-time.

Whereby most accounts are told from a personal or psychological perspective, this one simply tells of the various forces at-large that are at play, and how their effects are manifesting in the creation of a type of property that has yet to be proven and adopted by the mainstream in North America – and even – the greater world.

What’s this, say you?

It is the futuristic, feat of engineering that captures the imagination and carries us off into a world with drones and flying cars a la Blade Runner. It’s a concept so foreign and complex in execution that it would send many developers and contractors running for the hills. Strangely enough, it is also one that has its history in Asia for well over two decades; where builders have, as a response to necessity, cast aside notions of what can or can’t be done.

The reason it has yet to become a staple of commercial properties stateside is simply for pragmatic reasons. There was never a real need to go through all of the zoning, design, architectural, and financial hurdles that dramatically amplify risk and eat into pre-existing, easy, and healthy margins (analysts and underwriters beware).

As we enter into 2021, we are talking about a product in an asset class that is not only ‘on fire’ as it is so popularly described, but rather, it has become multi-dimensional in its forms and applications.

It has become the ‘legs’ for dozens of industries to operate via social distancing and same-day deliveries.

It has become the carrier of our food, the creator of our streaming content, the laboratory for our medicines, as well as the manufacturer of our goods.

The asset class is industrial.

And the property is multi-storey industrial warehousing.

When and Where Did Multi-Storey Warehousing Begin?

Multi-storey warehousing has its roots in Asia, with its vast populations and numerous urban centres. According to a feature on DailyHive, “warehouse distribution centres in Asia are as high as 12 storeys, and the tallest facility in Asia is a 22-year-old facility in Hong Kong with 22 storeys.” Meanwhile, the Goodman Interlink; a 24-level logistics industrial warehouse in Hong Kong, has broken the previous record.

According to a World Property Journal analysis, the phenomenon has “succeeded in Asia due to high land and construction costs, small site areas, limited industrial land availability, and the accessibility to serve city center populations.”

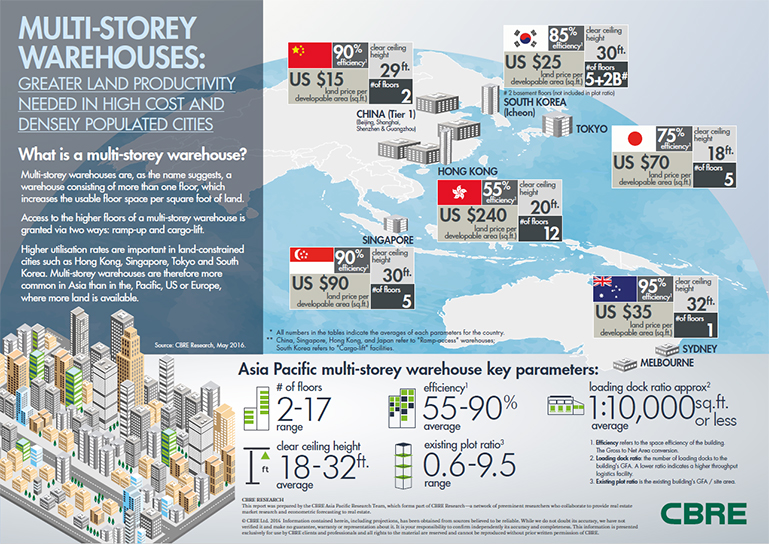

Further, it gives insight into the local markets, whereby “industrial land prices per developable area are approximately six times greater in land-constrained areas than in land-plentiful ones. Hong Kong records the most expensive land price at $240 USD per sq. ft., followed by Singapore and Tokyo at $90 per sq. ft. and $70 per sq. ft., respectively. China has the cheapest land price at $15 per sq. ft. in tier-one cities.”

While here in the Greater Toronto Area we see industrial land in certain pockets exceeding $2.5M CAD per acre… and might soon approach $3M CAD per acre ($68 CAD or $52 USD per SF). Compared with the above pricing, Hong Kong land would be $10.4M USD ($13.61M CAD) per acre, Singapore at $3.9M USD ($5.1M CAD) per acre, and Tokyo at $3.05M USD ($4M CAD) per acre.

Because of the constraints on land in densely populated cities, these types of facilities have become popular in Hong Kong, Singapore, Tokyo, China, and South Korea. However, the number of storeys and overall warehouse height will scale with the densities and land values.

The report adds, “Hong Kong is an extreme example of a land-constrained city–here, multi-story warehouses average 12 floors. In comparison, land in Australia and China has been historically large and plentiful, therefore, warehouses only average between one and two stories. Regionally, the average number of floors range from 2-17 stories.”

Finally, the continued need to distribute goods within urban centres, as well as the additional constraints of transportation costs and congestion has bolstered demand.

Multi-Storey Across Asia-Pacific

Depending on local market land values, land availabilities, utilization rates, and clear heights, a market is more or less likely to have these types of projects underwritten. As we will touch on in a future issue, the economies of scale required to recover the fixed costs are largely what deter developers from going this route. In Asia, however, the metrics make a lot more sense.

For sample statistics as of 2016, see the image below, courtesy of CBRE.

Outside of Asia, select projects having been built in Europe, Australia, and now, North America.

According to a JLL report, the trend is still “relatively new in Australia but is also being driven by e-commerce and same day delivery. Two two-storey warehouses are being developed in Botany, home to Australia’s biggest seaport.”

The report also states that “in Europe, multi-storey buildings are more familiar a concept. They were developed in Paris in the 1970s. More recently, Vailog, a SEGRO Group company, completed a ramped warehouse called Paris Air 2, which was leased up immediately. And in the UK, the first multi-storey facility was completed in 2008 by developer Brixton.”

In North America, a few have been erected closer to airports and ports, taking advantage of proximity to the flow of goods and large pockets of consumers.

Today, in the Greater Toronto Area (and less pronounced, but also throughout the rest of North America), the industrial market has chronically low vacancy rates, high-and-rising land values, and increasing rental rates. This means that, given the right headwinds, that someone out there may be willing to take the risk to give Canada its first.

Is North America Ready for Multi-Storey Warehousing?

It’s not necessarily a forgone conclusion that multi-storey will be widely accepted throughout the continent. These facilities do exist, although they would largely fall under the category of ‘speculative construction’ due to the lack of Tenants lining up to back them.

We will examine specific cases and examples of these properties later, but for now, let’s take a look at the general criteria in the GTA (and broader) market… and what may be required for said market(s) to support the underwriting of future developments and get the vote of confidence from the capital markets.

The Forces At Play

Urban Settings

Speaking generally, it is difficult to find large sites within the urban core. Sometimes, one could say this about the periphery as well. High land and development costs exacerbate the issue of constructing within the City’s core, as do potential zoning problems. One might ask, so then why even try? Well, gaining unfettered access to large city centre populations is a brilliant strategic move, and one that may have a significant payoff worth the headaches involved.

Population Growth

Since we are speaking about a property that lives within the context of high densities and strong land values, then we can safely assume future population growth. In the GTA’s case, anyway, there is considerable growth due to immigration and the attraction of talent, the retainment of students, and the blossoming of multiple industries; from finance, tech, medicine, film, and the arts.

This growth of people brings about demand for consumer good and services. Which, in turn adds to the strain on the existing infrastructure and distribution networks. In Toronto’s case, it also puts pressure on the housing market; one of the largest bubbles globally, and one with chronic shortages. Indirectly, this pits industrial land against residential and other non-industrial uses. And if you need to ask who is first choice, just look up the crane index and see who ranks #1 in North America.

Lack of Available Industrial Space

When speaking about industrial itself, Toronto is one of the hottest in North America and the second- or third-largest depending on who you ask, only trailing Los Angeles. Extremely low vacancies, coupled with high land values has kept rental rates chugging along in one direction… and that’s up. It’s only saving grace is a (relatively) weak Canadian dollar that makes double-digit rents somewhat easy to stomach for investors and occupiers.

E-Commerce and Logistics Boom

The biggest mainstream story in the CRE industry has been e-commerce. Demands and expectations for same-day deliveries has created a need for warehouses, distributors, and logistics firms to be located close to consumers. It’s probably the only way to effectively reduce transportation costs and keep up with compressing delivery times. Period.

Competing with other Users of Industrial Space

Not only do warehouses and distributors need to compete with one another, but they are also competing with other Users of industrial space. Food and cold chains are just beginning their own ‘arms race’ (see: Lineage and Americold dropping billions on acquisitions and developments)… as are the content streaming behemoths (see: Netflix, Amazon, Apple, Disney, Hulu, HBO, etc.) funding dozens of new productions with billions of cold hard cash. And to make things even more crowded, a large number of manufacturers are on-shoring their operations.

Lack of Supply of Industrial Land

This relates to a shortage of product, albeit further up the chain. The real constraints here are undisciplined zoning to residential and other non-industrial uses, the preservation of agricultural and Green Belt land (which is fine, but it is still a constraint), and delayed servicing processes due to the pandemic.

Slowdown in Construction and Pipeline

Most of the issues here relate to the fact that we had to shutdown the economy for a few months. It was unavoidable, however, it still came at a cost. The permitting process has been delayed. Building construction is slower as workers social distance and go through testing protocols. And labour and materials are simply tougher to find, in general.

The Pandemic As Accelerant

Finally, the pandemic and economic shutdowns may be the straw that broke the camel’s back when it comes to multi-storey industrial warehouses. Changing consumer patterns have instituted a need for both buffered and ‘just-in-time’ inventories to cover unpredictable and difficult-to-forecast e-commerce and essential goods demands. Further, retailers, PPE manufacturers, and packaged goods companies have looked to diversify their supply chains by bringing a portion of their manufacturing back on-shore in Mexico, the United States, and Canada.

Conclusion

The concept of a multi-storey industrial warehouse is one of creativity, imagination, and ingenuity. Its existence and operation within our society will be one of necessity and financial incentive… either that or an initiative carried out by a progressive and risk-taking developer. So far, the Greater Toronto Area does not have a backer, but, given the forces at play, the Region would likely make a great candidate.

Extremely dense pockets of the urban core may be well served by these futuristic buildings and their ability to connect with consumers. The only roadblocks right now are economics and experience. With few understanding the former, and even fewer possessing the latter, it may take a bold move to get the ball rolling. However, once successfully completed, the pioneers should inspire the early majority. From there, it will not be unreasonable to see them spaced throughout the City of Toronto.

Next issue, we will break down the economics and lay out the anatomy of a multi-storey industrial warehouse; for what is needed in form and function, as well as how its design may evolve for differing contexts.

In the meantime, if you would like a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com