A Tale of Two Industrial Buildings

How Commercial Properties Are Treated Differently for Tax Purposes

March 5th, 2021

“Nothing is so painful to the human mind as a great and sudden change.”

― Mary Shelley

Change is becoming a constant force in our daily lives.

From how we work to how we shop, live, play, and view the world, we are experiencing first-hand an accelerating rate of change.

This has been no different in the commercial real estate market.

For example, the past several years have undoubtedly brought about a modernization and reinvigoration of the industrial asset class. What was once considered ‘old and boring’ suddenly became the ‘darling’ of the CRE world.

Rental rates that had been relatively flat for 25 years grew quickly. The size of new industrial facilities also grew. And then we had the pandemic…

Each market and asset class has their own story of how the lockdowns treated them. Some fared better than others. Industrial, as we have highlighted, continued on its stellar trajectory. While others, such as hospitality, retail, and office… suffered greatly.

However, as an Investor or Landlord of these assets, many questions have surfaced, including…

How can you ensure that your properties will dependably produce income for the years to come?

How do you properly underwrite values and adjust rates based on this uncertain and unpredictable market?

And given what has already happened, how will my properties be assessed and taxed?

To that regard, we asked Property Tax expert Bob Langlois to provide us with an insight into this last question; an extremely important matter…

Here is what Bob had to say…

Exhibit A: Warehousing vs. Manufacturing Facilities

Let’s look at an example with some quick facts:

- A 90,000 SF warehouse home to a manufacturing entity is assessed at $100 PSF or $9,271,000.

- This value as determined by MPAC is indicative/reflective of ‘market value’ as at January 1st, 2016.

- The property then trades in February 2021 for $22,055,000 or $245 PSF.

- For property tax purposes, the “use” is classified by MPAC as Industrial (IT) meaning that the business activity includes producing, processing or manufacturing.

- In this GTA municipality the tax rate for IT is 1.82%, which results in current taxes PSF of $1.87.

- If this same building housed non-industrial activity (i.e. storage, warehousing, distribution, sales & services) the applicable tax rate would be 1.57%; a discount of 16.7% as compared to the Industrial (IT) rate.

Now let’s assume the purchaser is occupying a portion of the building for their “industrial” use and keeping the existing “industrial tenant” that occupies the rest of the building. For 2021, the property will continue to be assessed at $9,271,000 and attract the IT tax rate.

It is expected that the Provincial Government will mandate a province-wide re-assessment for 2022. It was planned and then deferred for 2021. Such a “re-assessment” involves updating all property types and classes to a new reference period. The 2021 re-evaluation was to be premised on January 1st, 2019 values. Therefore, it is assumed that a 2022 re-evaluation will be premised on market values as at January 1st, 2020.

What is the Impact of Re-Assessment ?

So when we finally go through the re-assessment, what can the owner expect in terms of;

- A valuation adjustment during the re-assessment; and

- What will the valuation change mean in terms of a tax adjustment?

The key principle to keep in mind is that taxation is relative and when there is a re-assessment, it’s your assessment relative to the entire population of properties in your class that drives your taxes.

Given the change in the market, when there is a re-assessment updating values, from say 2016 to 2020, there are going to be substantial shifts in value.

In general terms, it’s expected that:

- Industrial and Multifamily will see the largest increases over this period;

- Office and Retail will see modest increases over this period; and

- Hospitality and other COVID affected sectors may see flat or even decreasing values. (*)

(*) This valuation trend will be largely driven on what valuation date MPAC elects to use. If they use a pre-COVID valuation date it may not recognize the structural valuation shift in the hospitality sector.

Relative Shifts Within and Amongst Classes of Property

MPAC recognizes and uses a classification system that includes:

- Residential;

- Multifamily;

- Commercial; and

- Industrial

…as the primary classification categories. The municipalities in turn derive a tax base from each of these sectors with regulated ratios that mandate how much tax is derived from each sector and how much of an increase is taken from each sector from one year to the next.

This becomes important where you have an industrial building that is used for either Industrial (IT) or Commercial (CT) purposes.

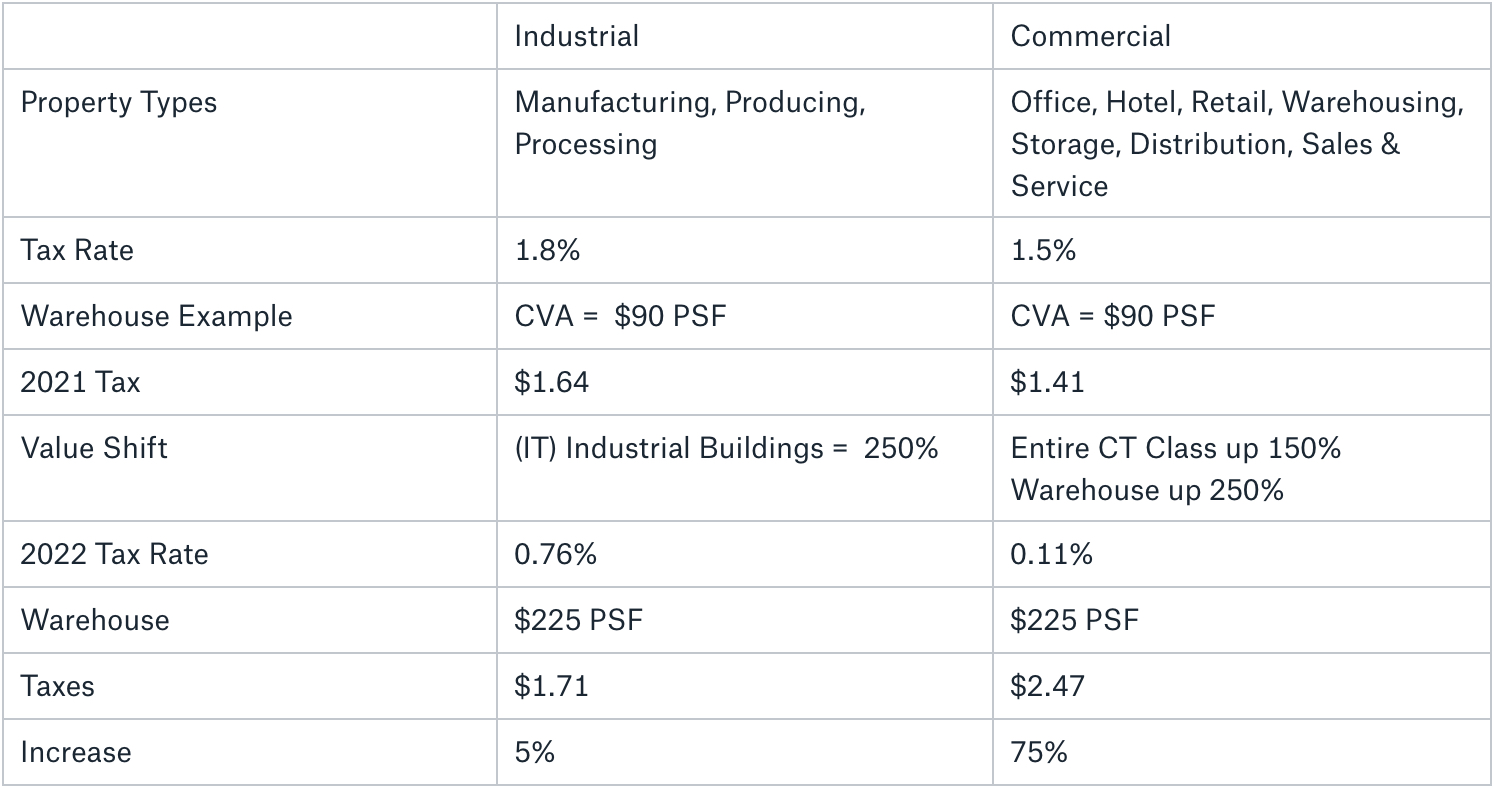

(*) 2022 Tax Rate assumes no phase-in and assumes Municipality passes through a 5% budgetary increase for each classification.

In case you were wondering… in this example/forecast the IT rate drops more than the CT rate.

Yes – there is a big difference in rates, which is in essence the pending shift that we are expecting.

The lift in value for industrial buildings used for manufacturing will be tempered/diluted by the offset in the tax rate.

The lift in value for industrial buildings used for warehouse/distribution will “NOT” be tempered based upon the diversity of this tax classification and the large variance in value changes that are going to be experienced between and amongst hotels, office, retail, and warehousing. They all have substantial different changes in value but are all subject to the same rate.

Disclaimer: While it is expected that taxable assessed values will be phased in and thus diluting the instant impact portrayed in this example, the shift within the Commercial Class, impacting Industrial buildings used for non-manufacturing purposes will be real. The relationship between IT tax rate and valuation of industrial buildings in the IT class will be linear and homogeneous. The relationship between the CT tax rate and valuations shifts within the class (Office, Hotel, Warehouse, Retail etc.) will be “dispersed” and creates winners and losers within this class.

How does this make any sense ?

On a relative basis;

- All “warehouse/industrial” properties went up 250% (from $90 to $225 PSF);

- The average increase for the entire population of IT class was 250%;

- The average increase for entire population of CT class was 150%;

- If you were an industrial building in the INDUSTRIAL class you went up at the same rate as the entire population and you will realize a budgetary increase;

- If you were an industrial/warehouse building in the COMMERCIAL class you went up 250% vs the ‘class average’ of 150%. In this instance the valuation increase for this property type will not be fully offset by the drop in the tax rate; and, finally

- This disproportionate increase of warehouses relative to the rest of the CT class results in a tax hit.

Moral of the story

- If you go up the same as everyone else in our class, the tax impact is limited to a budgetary increase;

- If you go up at a much greater rate than everyone else in your class, the tax impact is going to be steep; and

- If you go up at a slower rate than the rest of the class, the tax impact will result in a decrease.

If you use your industrial building for ‘commercial’ purposes (something other than processing, producing or manufacturing) you will be faced with a steep tax hike.

If you use your industrial building for producing, processing or manufacturing your tax increase will be limited to a budgetary/inflationary increase.

Overall, if you are an Investor, Landlord, Owner-Occupier, or Developer of commercial property in the GTA, then you should leverage a tax professional to plan and strategize your upcoming tax assessment to legally and ethically reduce and optimize your real estate tax bill.

***Disclaimer: The information provided in this newsletter is for educational purposes only. Bob is a certified expert, however, to receive the appropriate guidance for your unique situation, please contact a legal, tax, accounting, or financial expert before taking action. We are not liable for any damages – perceived or otherwise – as a result of your own personal decisions.***

On that note…

For further information on the subject of Property Taxes and Industrial Buildings in the GTA please contact:

Bob Langlois

https://www.linkedin.com/in/boblanglois/

416-625-7801

bob@argil.ca

Argil Property Tax Services

www.argil.ca

ArGil is a team of property tax professionals and real estate valuators who provide property tax recovery and consulting services to multi-residential, commercial and industrial property owners.

In addition to municipal tax application filings, strategic litigation and property tax budgeting, ArGil brings to the table an astute understanding of the assessment appeal process and the unique issues relevant to each case.

Conclusion

I wanted to thank Bob Langlois for providing his expertise on this topic and generously devoting time to making this issue happen.

For some property owners, this knowledge may be very timely, and overall, it’s importance cannot be understated, since, for the majority of people in the Commercial Real Estate industry…. who are in the business of acquiring, developing, selling, and leasing properties… the name of the game is in maximizing cash flow, property value, and return on investment…..

Every person involved in the process is crucial. We all play our part. Yet it is through the creativity and analytic-nature of professionals such as Bob Langlois, who can efficiently navigate the tax system, where we can optimize our investments to minimize costs and accrue wealth.

For those of you reading this who have had negative experiences in the past, or who have been consciously or unconsciously seeking a solution, then this may be an exciting revelation.

If you are looking for more detail on this or if you need advice on property taxes, then please connect with Bob Langlois directly (his contact info is above).

Finally, for a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com