The AI sector is driving significant investment in data center infrastructure, with $5.2 trillion required in capital expenditures for AI-equipped facilities by 2030 to meet projected worldwide demand. Major players are expanding capacity to support large-scale model training and inference.

In November 2025, key developments include xAI’s Colossus 2 facility in Memphis, where Phase 1 deployment began in July with 110,000 NVIDIA GB200 GPUs installed as part of a planned initial batch of 550,000 GB200/GB300 units, targeting full Phase 1 by mid-August.

OpenAI signed a letter of intent with NVIDIA in September for up to $100 billion in investments to deploy at least 10 gigawatts of systems, including Blackwell and Vera Rubin platforms, with the first gigawatt slated for the second half of 2026. Meta secured $29 billion in financing for its 2 GW Hyperion data center in Louisiana, led by PIMCO ($26 billion debt) and Blue Owl Capital ($3 billion equity), with Morgan Stanley arranging the structure; the project includes 1.5 GW of renewable procurement, primarily solar. The Stargate joint venture (OpenAI, Oracle, SoftBank, MGX) targets up to $500 billion for 10 gigawatts of U.S. AI infrastructure by 2029, with nearly 7 gigawatts planned across five new sites announced in September.

These investments reflect growing demand for compute resources, straining power grids and prompting innovative energy solutions. Tesla’s integration with xAI, including Megapacks for Colossus 2 reliability and xAI’s October expansion near Tesla’s Palo Alto hub, supports potential synergies like Dojo sharing.

In parallel, Southern Ontario—particularly the Greater Toronto Area (GTA)—has emerged as a key North American hub, with $14 billion in data center construction starts in July 2025 alone and 312 MW of operational capacity as of mid-year.

The region benefits from a 90%+ low-carbon electricity grid (hydro, nuclear, wind), cooler ambient temperatures reducing cooling energy by 20–30%, and high-reliability operations (99.99% uptime SLAs). Ontario’s Bill 40, introduced June 3, 2025, proposes to prioritize grid connections for large data centers based on economic impact, with regulations pending. Qscale’s planned $2.5–4 billion Toronto hyperscale campus and CPP Investments’ $225 million commitment to a 54 MW Cambridge expansion are among the largest commitments. These factors position the GTA as a stable alternative to U.S. regions facing power constraints.

Boom or bubble? As firms like BlackRock acquire assets, including a $40 billion deal for Aligned Data Centers in October, the race for exaflops is redrawing maps—and Toronto’s in the fast lane.

Key Data Center Developments

xAI & Tesla: Musk’s Memphis Megafactory Momentum

xAI began deploying Phase 1 of its Colossus 2 facility in Memphis in July 2025, installing 110,000 NVIDIA GB200 GPUs as part of a planned initial batch of 550,000 GB200/GB300 units, with full Phase 1 targeted for mid-August onward. The project is backed by an ongoing $20 billion funding round, including debt and equity for NVIDIA chips, and incorporates Tesla Megapacks for power reliability. xAI’s March 2025 all-stock acquisition of X—valuing X at $33 billion and the combined entity at $113 billion—provides real-time data access for Grok model training.

Tesla’s Dojo supercomputer may benefit from synergies with xAI, given the latter’s October 2025 expansion into Palo Alto facilities near Tesla’s engineering hub. Local concerns in Memphis center on air quality from unpermitted gas turbines at the facility and xAI’s mid-2025 acquisition of a nearby Mississippi power plant, with modeling estimating a ~1% increase in fine particulate matter; the EPA and Shelby County are reviewing permit applications amid calls for enforcement.

OpenAI & NVIDIA: The $100B Compute Covenant

OpenAI and NVIDIA signed a letter of intent in September 2025 for up to a $100 billion investment to deploy at least 10 gigawatts of systems, including Blackwell and Vera Rubin platforms, for OpenAI’s AI infrastructure; the first gigawatt is slated for deployment in the second half of 2026. OpenAI is collaborating with Oracle and Vantage on a nearly one-gigawatt Wisconsin hub under the Stargate initiative and with SoftBank on the broader $500 billion, 10-gigawatt Stargate project to build U.S. AI infrastructure.

The company is exploring sovereign AI infrastructure in the Greater Toronto Area, including potential data center capacity, as part of its “OpenAI for Countries” efforts. This is supported by a $300 billion, five-year Oracle cloud and compute agreement for up to 4.5 gigawatts of Stargate capacity, alongside at least five U.S. sites (with more under review from 300+ proposals).

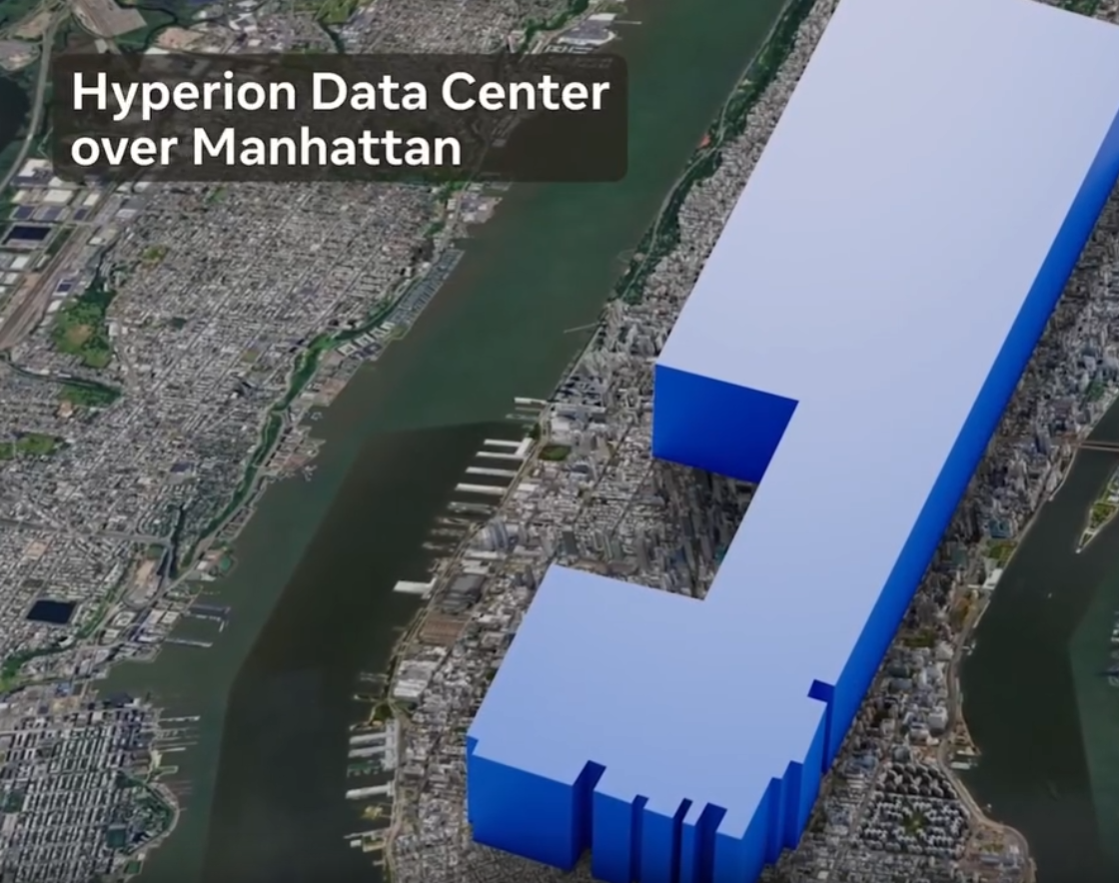

Meta: $29 Billion Louisiana Project

Meta has secured $29 billion in private credit financing for its 2 GW Hyperion data center campus in Richland Parish, Louisiana. PIMCO is providing $26 billion in debt, Blue Owl Capital is contributing $3 billion in equity, and Morgan Stanley is arranging the overall structure. Meta retains 20% ownership via a joint venture.

The project supports 1.5 GW of new renewable energy procurement, primarily solar, to power AI workloads including Llama model development. This aligns with Meta’s 2025 capital expenditure guidance of $35–40 billion.

Greater Toronto Area: Canada’s AI Infrastructure Hub

Southern Ontario recorded $14 billion in data center construction starts in 2025, with 312 MW operational and 1.2 GW under development—a 400% increase year-over-year.

- Qscale Campus: $2.9 billion investment, with Phase 1 (200 MW) starting construction in Q1 2026. Backed by $320 million in equity from CDPQ and $1.1 billion in debt. Uses liquid immersion cooling and hydroelectric power, targeting PUE below 1.15.

- Yondr Group Toronto Facility: 27 MW three-storey data center on a 4.5-acre site in Toronto, with ground broken in January 2025 and ready for service by mid-2026. Features closed-loop cooling design that eliminates ongoing water consumption after initial fill

- CPP Investments JV: $225 million commitment to a 54 MW expansion of an existing hyperscale data center in Cambridge, involving Related Digital, TowerBrook Capital Partners, and Ascent. The facility has been apparently “pre-leased to a market-leading GPU-focused AI cloud compute provider on a long-term basis.”

- eStruxture Toronto Expansions: Part of C$1.35 billion financing package (announced July 2025) to develop AI-ready capacity across Toronto facilities (TOR-1 to TOR-4), including enhanced power and cooling systems for hyperscale deployments.

Policy and Ecosystem Support:

- Ontario’s Bill 40: Introduced June 3, 2025, and under active debate, the Protect Ontario by Securing Affordable Energy for Generations Act proposes regulatory powers to prioritize and accelerate grid connections for large data centers that support economic growth, with thresholds to be defined in forthcoming regulations.

- OpenAI Engagement in Toronto: In October 2025, OpenAI Chief Global Affairs Officer Chris Lehane met with Canadian AI Minister Evan Solomon during the Elevate Festival in Toronto to discuss Canada’s sovereign AI strategy and potential infrastructure partnerships.

- Vector Institute Talent Pipeline: The Vector Institute supports over 500 AI graduate students and researchers annually through scholarships, training programs, and industry partnerships, contributing to Ontario’s leading AI talent ecosystem.

- GTA Infrastructure Advantages: The Greater Toronto Area benefits from a 90%+ low-carbon electricity grid (hydro, nuclear, wind), cooler ambient temperatures reducing cooling energy by 20–30%, and high-reliability data center operations (99.99% uptime SLAs), attracting hyperscalers including Microsoft, Amazon Web Services, and NVIDIA for AI and cloud deployments.

Conclusion

The current wave of data center investment—led by xAI, OpenAI, Meta, and regional hubs like the GTA—supports the infrastructure required for advanced AI systems. Challenges include power availability, environmental impact, and financial sustainability.

The GTA’s combination of renewable energy, policy support, and talent density provides a model for scalable, lower-risk development.

By 2027, multiple gigawatt-scale facilities will be online across North America. The long-term viability of this buildout will depend on energy innovation, regulatory alignment, and demand validation. Infrastructure planners and investors should monitor grid capacity, regional incentives, and technological efficiency gains.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com