Blockbuster GTA Industrial Portfolio Sales

February 11th, 2022

If you find yourself thinking that the GTA Industrial market is a little bit crazy – that’s because it is.

From over 800 million square feet of space with 0.6% vacancy and rents doubling over the past five years, to industrial land selling for up to $4 million an acre and beyond… What we are currently experiencing is a rare confluence of events.

Industrial occupiers are fighting for space. Investors are repositioning portfolios and pouring billions into the asset class. Meanwhile, developers (and brokers) are scouring planning reports for newly designated parcels of land. Product is most definitely king.

The ironic part of it all is that the frenzy seems to be coming to a head just as inventory dries up and both shortages and inflation make development more costly than ever. Or perhaps I’m wrong and we’re just getting started. Only time will tell.

Does this mean there are no deals out there? No!

Acquiring and developing industrial assets has certainly become more expensive, however, opportunity awaits those who can creatively dig it up. The market is as busy as ever, although it feels as if it is on a never-ending treadmill trying to bring onboard more supply.

Industrial facilities are the backbone of our real (and quickly digitizing) economy. Supply chain shortages have spurred the slow trickle of manufacturing on-shoring. Booming online sales have made logistics and warehousing facilities highly sought-after. The behemoths who have profited the most over the past two years have an insatiable appetite for space and are willing to pay a premium. As a result, and thanks to their relative simplicity, dependability, and low risk, these facilities have attracted enormous amounts of capital.

Which is why – over the next several weeks – we will examine some of the major transactions that have recently occurred in the GTA industrial market.

Investment and portfolio sales. Land transactions. Value-add plays. Proposed developments.

Because, whether you are an investor or occupier looking to buy or sell, it’s important to gauge the market in order to develop the right strategy.

For this week’s newsletter, we’ll kick things off with a look at some of the more prominent GTA Industrial Portfolio Sales over the past year.

Select GTA Industrial Portfolio Sales

- PIRET acquires Northlea Portfolio – 13 Properties – $312 Million – December 2021

110 Woodbine Downs Blvd, Toronto

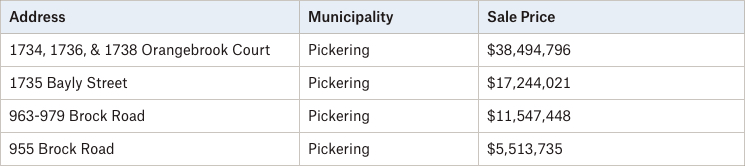

- Soneil acquires Invar Portfolio – 6 Properties – $73 Million – May 2021

1738 Orangebrook Court, Pickering

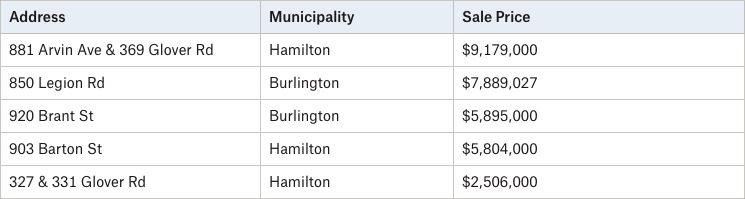

- Nicola/First Gulf acquires Fengate Portfolio – 7 Properties – $31.2 Million – March 2021

881 Arvin Ave & 369 Glover Rd, Hamilton

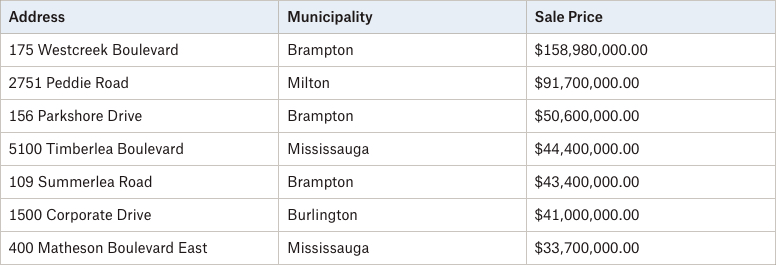

- PIRET acquires Artis Portfolio – 28 Properties – $750 Million – July 2021 – Select transactions below

2751 Peddie Road, Milton

- Shelborne acquires Barrie Industrial Portfolio – 21 Properties Totaling 549,962 SF – $90 Million – November 2021

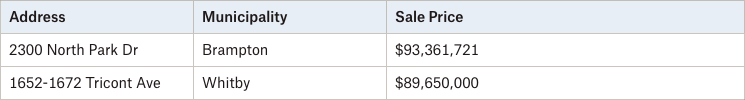

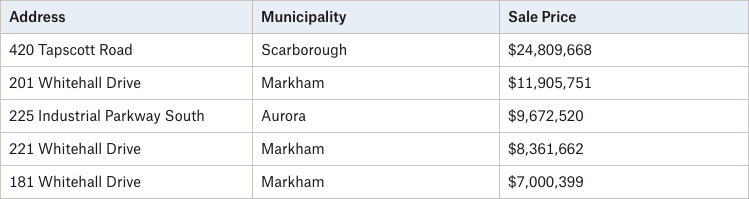

- LaSalle acquires Carterra Portfolio – 3 Properties – $183 Million – August 2021

2300 North Park Drive, Brampton

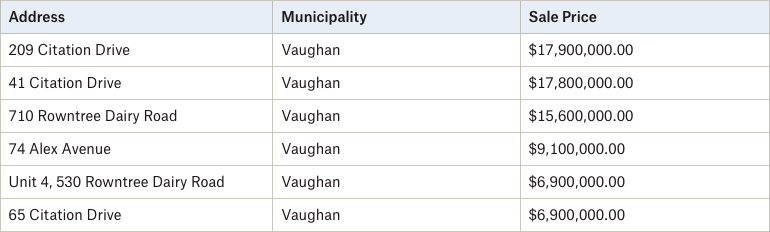

- PIRET acquires Rinomato Portfolio – 6 Properties – $74.2 Million – November 2021

41 Citation Drive, Concord

- KingSett acquires Huntley Portfolio – 5 Properties – $61.75 Million – March 2021

420 Tapscott Road, Toronto

Conclusion

While not every deal will be a blockbuster portfolio sale, these transactions are a reflection of the broader appetite for industrial product. With availabilities at all-time lows, investors are keen to deploy capital.

And with headwinds such as inflation, shortages, and a general economic uncertainty, these same assets can provide shelter and a hedge against risk.

Acquiring entire portfolios is a swift and leveraged way to get into the industrial game. The way things are going, we may expect to see an even frothier market in the year to come.

Those who employed a ‘buy and hold’ strategy in the past are now reaping the rewards as rising rents and compressing cap rates push values to new watermark levels. That said, investors who got in just a few years ago have seen noticeable appreciation when values were thought to be ‘expensive’ then.

Will they keep rising? No one knows, however, there are plenty of institutional buyers looking to pay for cashflow if you have assets and are considering selling or completing a sale-leaseback.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com