Cap Rates and the Greater Toronto Industrial Market

August 12th, 2022

Numbers can be deceiving.

When we measure something, we are taking a thin-slice view of the subject in question, at that point in time, with our biased interpretation, and with several assumptions and variables held constant.

It’s incredibly difficult to predict how markets may move based on analytics; nevermind trying to anticipate how people may react, as they are by nature unpredictable.

Throw in multiple variables, trends, and forces; and this calculation becomes exponentially more complex. Supply chain woes, labour shortages, inflation, interest rates, international conflict. All of these things impact supply and demand in their own ways and to varying degrees.

So, for the many investors and occupiers looking at the Greater Toronto and broader industrial markets… they may be reading the tea leaves and trying to ‘time’ their decisions to secure the best possible deal before capital becomes increasingly expensive… or after a potential correction. Let’s examine this further…

Interest Rates and Industrial Cap Rates

We understand that – in theory – raising interest rates is meant to cool demand, curb inflation, and bring down general pricing levels. This is true in a simplified economic model.

However, there is one key assumption here: that inflation has solely been a result of demand exceeding supply. Another assumption is that we are operating in a normal market, at all.

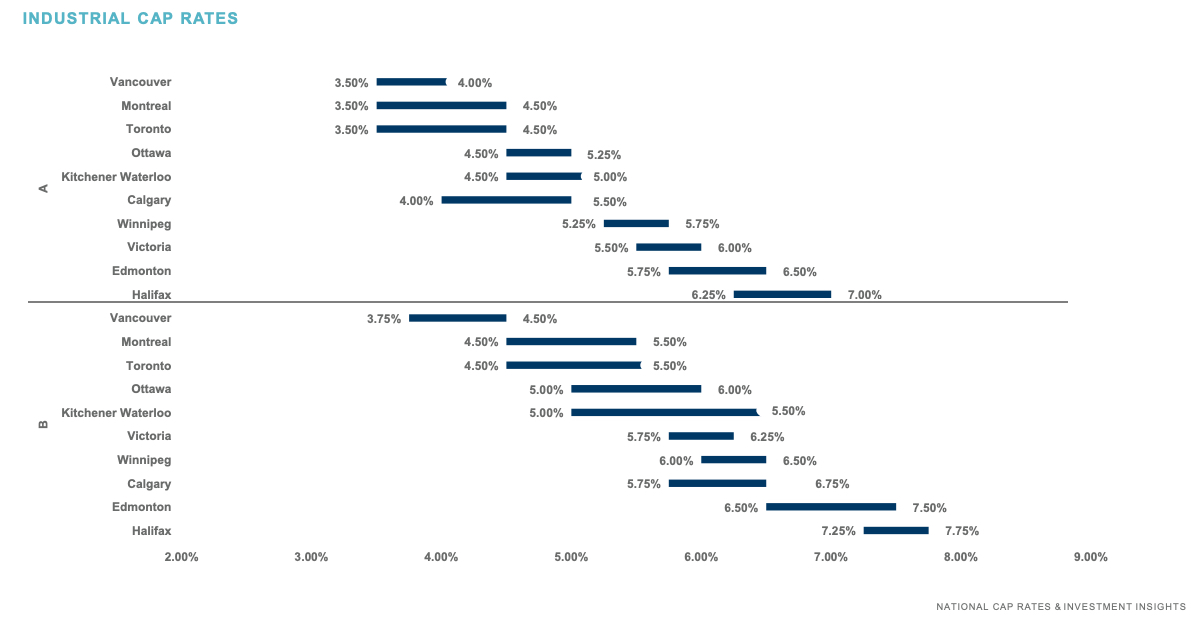

Canadian Industrial Cap Rates. Source: Cushman & Wakefield.

The fact is, everything changed during the economic shutdowns. The resulting shift in consumer demand flipped the retail paradigm. As a result, it instantly took the industrial market out of balance and created a gap between supply and demand. A gap which far exceeded the number of square feet historically delivered. Thus, no matter how quickly developers moved to bridge this gap – in a normal market – would have taken several years, at the earliest.

However – and what is important to note – this demand shift also coincided with a massive supply-side shock, reducing deliveries temporarily and making it more expensive and complicated logistically to produce new inventory. The result is a strained market with rents and values driving ever-upward – which we have observed over the past two and a half years.

This legacy effect of increased costs, coupled with rising interest rates, is what will drive most of the change in the coming year. Industrial cap rates will be forced to ease up as investors demand a return above borrowing costs, and as fewer suppliers provides them with greater leverage. We may see the investor and developer community grow more cautious with a resulting ‘flight to quality,’ fewer speculative builds, and a market dominated by institutional capital.

The saving grace is, as the industrial market prices out some investors – who may pivot to alternative geographical markets or asset classes – and as input prices begin to fall, we may begin to see a slow return to normalcy.

2750 Morningside Avenue, Scarborough. Source: Oxford.

Conclusion

In the interim, given we are already in a sub-1% availability industrial market, investors and occupiers will have limited options. Pricing may stabilize but should remain strong, especially due to real estate being historically viewed as a risk hedge. Borrowing costs will limit speculation and squeeze growth.

One final data point is regarding the composition of industrial stock. As global events put supply chains at further risk, we may see a revitalization of domestic manufacturing. This should see small- and mid-bay redevelopment, as well as industrial condo conversions, receive more of the spotlight than their Big Box counterparts. Only time will tell…

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com