Clarington Industrial Market: An In-Depth Look

April 22nd, 2022

“Nothing is more expensive than a missed opportunity.”

- H. Jackson Brown

The Greater Toronto industrial market is growing at a pace never before seen. What was initially pushed to new heights by untapped potential in the warehousing and logistics sector is now being driven by scarcity and fear.

As retailers captured new market segments in online sales, an entire ecosystem of suppliers, integrators, 3PL, and transportation firms blossomed to support the flow of goods from production line to doorstep.

This enormous chunk of demand was – for the most part – unaccounted for, and took the industrial community by surprise. Had it gradually rolled out over decades, it would have been easier for developers, investors, and businesses to adapt more slowly. However, as we have learned, technological growth is exponential, and change is accelerating.

Under normal circumstances, things would also have been easier. But again, looking to cliches and aphorisms, we know that things that can go wrong, do go wrong. The shift to e-commerce and its resulting effects on the industrial market coincided with a level of chaos and uncertainty that shook the economy to its core.

From labour and materials to zoning, permitting, and a scarcity of land itself, bringing new supply to market has become increasingly challenging. The net effect is that businesses must plan far in advance to secure ample space. And investors must be financially and operationally ready to pull the trigger at any moment’s notice should opportunity arise.

Just a few missed opportunities, compounded over the long run, can separate the most prominent and successful players from the rest. That’s why having that ‘edge’ when it comes to market insight and potential availabilities can be the most important strategic element for any investor looking to deploy capital and construct or acquire income-producing industrial assets.

Studying the overall market may arm you with a foundational knowledge, however, making real estate decisions lies in understanding the nuance and differences.

This more focused and tailored approach is the key to unlocking value, especially in a landscape where apparently nothing is available for sale, for lease, or for development. Yet, each week, we see major announcements made online as owners and occupiers capitalize on opportunities through creative solutions and ‘seeing past the numbers’.

That’s why we will begin a weekly analysis of various submarkets to give you a better sense of how each may fit in with your real estate strategy.

For this week’s newsletter, we’ll feature the Municipality of Clarington and examine the state of its industrial market, including trends, transactions, and developments.

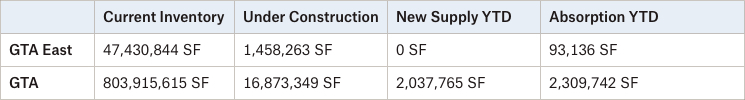

Durham Region Industrial Market Snapshot – Q1 2022

Source: Cushman & Wakefield Research.

Looking at the current inventory numbers, we have over 803M SF of industrial space across the GTA, with Clarington’s inventory estimated at around 4M SF (or 0.49%). Through the first quarter of 2022, Clarington had no industrial space leased, with two industrial sales totaling approximately 47,000 SF.

The availability rate in Clarington – to our knowledge – sits at 0%, with the only availabilities being industrial or agricultural land; a spillover effect from the broader land craze sweeping the region by developers looking to construct on spec or land bank. If anything were available for lease, the rental rates would be at a considerable discount to other submarkets, yet these too would catch up as overall supply further diminishes and businesses look to the GTA East for opportunity.

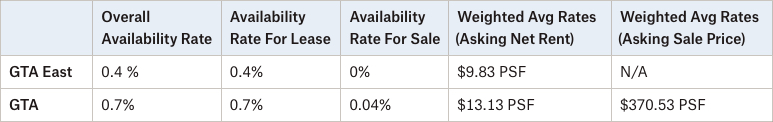

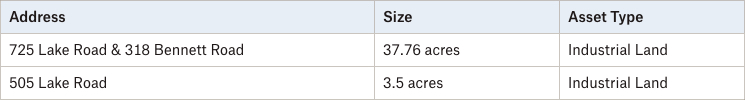

Clarington Industrial Properties Available for Lease – 20,000 SF+

Clarington Industrial Properties Available for Sale – 20,000 SF+

3 Interesting Facts about Clarington’s Industrial Market

- Ontario Power Generation Building New Headquarters

Ontario Power Generation Headquarters Rendering. Source: Globe & Mail.

Ontario Power Generation is expected to break ground on a new corporate headquarters and campus, with expected completion in 2024. Some industry insiders have estimated that OPG currently leases out approximately 1M SF of commercial space over 15 sites, with annual rents thought to be around $25M per year. Through a consolidation, it is thought that the organization will reduce its leasing costs by half.

The new campus intends to incorporate the existing Darlington Energy Complex, as well as a training center for collaboration with nearby Durham-based secondary education institutions.

- Toyota Canada’s 475,000 SF Head Office and Parts Distribution Centre Located in Clarington – 1050 Lambs Road, Bowmanville, ON

Toyota Canada’s Eastern Canada Parts Distribution Centre. Source: Toyota Canada.

In late 2020, Toyota Canada opened its new LEEDv4 Gold head office and Eastern Canada Parts Distribution Centre. The 475,000 SF facility sites on 30 acres and includes a number of innovative features, such as dynamic self-dimming glass to reduce glare, solar panels, geothermal heating, and a roof rainwater and snow collection system to save more than 325,000 liters of water per year.

This project represents a trend of large corporate employers seeking well-located sites with access to transportation on the ‘edge’ of city boundaries, providing a cost-effective solution for both the development, as well as its employees’ standard of living.

- EastPenn Canada Consolidates Into a 200,000 SF Battery Facility

In 2019, EastPenn Canada announced plans to consolidate its Ajax head office and warehouse, as well as its Pickering warehouse, into a new industrial and head office development at 1840 Energy Drive in Courtice, Ontario. Opened in 2021, the 200,000 SF battery facility produces and distributes Duracell batteries for vehicles and large machinery.

Conclusion

If we keep at our current pace, it’s conceivable that we may get to a 0% availability across the GTA, aside from brief periods between Tenants, design-build projects, or speculative construction (which are themselves often pre-leased well in advance). For those businesses looking to purchase or lease existing space, things will only become more challenging and competitive.

These points underscores the tremendous value of land. While land is becoming increasingly expensive, municipalities such as Clarington are hungry to attract investment from developers and businesses, and offers both incentives and a relative discount to other submarkets. Land also offers a level of predictability in cost and assurances in occupancy, should you get your hands on some.

In the coming weeks, we will continue our examination of various submarkets with the aim of uncovering potential opportunities and strategies for industrial Owners and Occupiers. In the meantime, if you are an owner of industrial land or property with redevelopment potential, there are plenty of institutional and private buyers who would be willing to pay a premium to take it off your hands.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com