Don’t Sell or Lease Your Real Estate Until You Read This… Part 3

It’s no surprise that Buyers and Sellers want to know what an industrial building is worth.

It’s also no secret as to how Real Estate Professionals come up with the ‘number,’ at least when performing one of the three generally accepted Approaches to Value.

And we will dig into the weeds on these approaches shortly…

Yet is it really that simple?

Do these valuations always ring true and accurately predict the trade value after it’s all said and done, and the ink has dried?

Looking back, you may have noticed that whatever ‘had to be the number’ and ‘just felt right’ ended up looking more like ballpark guidelines than precisely engineered models.

That’s normal, though.

Because determining a property’s value is a mix of both art and science.

And that’s due to the fact that expectations of both the Market and the Buyer(s), along with leveraged demand and emotional drivers, can push values in either direction.

In fact, it’s possible to manufacture this demand and market your asset to provide an environment conducive to a feeding frenzy, however, it is not always reliable nor predictable. That process is something we execute for private clients and perhaps may reveal another day.

But back to conducting a valuation…

Today, we will analyze the three main approaches to value, and how you can determine what your property may be worth…

Knowing what a property is worth – right now – is crucial for anyone involved in real estate in any capacity. It can determine your exposure, allocation, profitability, and drive several decisions moving forward, and it is found using two main ‘vehicles’; a Broker’s Opinion of Value, and a Commercial Appraisal.

Now, a Broker’s Opinion of Value or Commercial Appraisal are generally required for the following scenarios:

- During the due diligence process for the acquisition or disposition of a property, mergers and acquisitions, and estate matters; and when

- Large real estate companies such as REITs conduct quarterly, semiannual or annual valuations of properties for investor reporting purposes and balance sheet updating;

Determining a property’s value is based on asset attributes, net income, and current market conditions. We need to collect information on comparable sales, current offerings, occupancy, and tenant composition, income and expenses, capitalization rates, property description, etc.

It is crucial to apply the right approach given the property type and characteristics as it relates to the current market conditions.

There are three accepted methods of valuing real property:

- Direct Comparison Approach;

- Income Approach; and

- Cost Approach;

The selection of the relevant methodology depends on the characteristics of the real estate being analyzed.

- The Direct Comparison Approach to value considers the cost of acquiring equally desirable and valuable substitute properties, indicated by transactions of comparable properties, within the market area. The characteristics of the sale properties are compared to the subject property on the basis of time and such features as location, size, and quality of improvements, design features and income-generating potential of the property.

- The Income Approach to value is used to estimate real estate value based on property income generating capabilities using the Direct Capitalization Method or the Discounted Cash Flow method.

And there are two traditional methods for conducting income valuations.

- Direct Capitalization Method – the division of a required yield (inverse of a required income multiple) into Net Operating Income to yield a value.

- Discounted Cash Flow Method is a method that accounts for the anticipated growth or decline in income over the term of a prescribed holding period. DCF is a more comprehensive and accurate way to value an asset.

Two rates are required for a DCF analysis:

- a. Discount Rate applicable to future cash flows based on the relative risk profile of the cash flow; and

- b. Exit Capitalization Rate used to determine the reversionary value of the asset based on estimated future market requirements.

- The Cost Approach to value is based on the economic principle of substitution, which states that the value of a property should not be more than the amount by which one can develop (by the purchase of a site and construction of a building without undue delay) a property of equal desirability and utility.

Selection of Valuation Approaches

The selection of the relevant method of valuation depends on the nature and characteristics of the real estate under consideration.

The subject property is considered both an income producing/investment property and an owner-occupied building for which both the Income Approach and Direct Comparison Approach to value is considered to be appropriate.

An estimate of value via the Cost Approach is not developed as measures of actual depreciation can become problematic.

The Direct Comparison Methodology

The Direct Comparison Approach is based on the Principle of Substitution which maintains that a prudent purchaser would not pay more for a property than the cost to purchase a suitable alternative property which exhibits similar physical characteristics, tenancy, location, etc. Within this approach, the property being valued is compared to properties that have sold recently or are currently listed and are considered to be relatively similar to the subject property. Typically, a standard unit of comparison (i.e. sale price per square foot, sale price per acre) is used to facilitate the analysis. In the case of properties similar to the subject, the sale price acre is the most commonly used unit of comparison.

In valuing the subject site, a comparison was made to each of the index sales.

The basis for comparison included the consideration of the following:

Date of Sale:

- Adjustments with respect to transaction date (or time adjustment) are necessary for comparable sales whereby contractual dates are different than the effective date of appraisal.

Property Rights Conveyed:

- When real property rights are sold, they may be the sole subject of the contract or the contract may include other rights. In the sales comparison analysis, it is pertinent that the property rights of the comparable sale be similar to the property rights of the subject property. All the sales considered were fee simple transfers, and as such, no adjustments were deemed necessary.

Financing Terms:

- The transaction price of one property may differ from that of a similar property due to different financing arrangements. Financing arrangements may include existing mortgages at favorable interest rates or paying cash to a lender so that a mortgage with a below-market interest rate could be offered. All of the sales were purportedly on a cash basis and as such, no adjustments were deemed necessary.

Conditions of sale:

- Adjustments for conditions of sale usually reflect the motivations of the purchaser and vendor. In some cases, the conditions of sale significantly affect transaction prices. Sales that reflect unusual situations require an appropriate adjustment for motivation or sale condition. For example, power-of-sale conditions involve a certain degree of urgency on part of the lender – leading to a somewhat lower sale price than what would otherwise be expected. All of the sales were considered fair market transactions.

Location:

- An adjustment for location within a market area may be required when the locational characteristics of a comparable property are different from those of the subject property. Exclusive locational differences may disqualify a property from use as a comparable. Although no location is inherently desirable or undesirable, the market recognizes that one location is better than, similar to, or worse than another. Locational adjustments were based on both geographic and neighborhood location.

Site Area Size:

- The price per acre of the site area is expected to vary with the size of the lot area. Generally, the price per acre decreases as site size increases where all other features are similar. This is typically referred to as marginal diminishing utility.

Site Utility / Land Use:

- This adjustment takes into account site size, configuration, current use, improvements, and other encumbrances that may impact development. The configuration of the site will impact the maximum developable area. Oddly configured sites tend to have more leakage of usable land. Furthermore, topographically-challenged sites such as the subject will require a fair amount of site work.

Building Size:

- The price per square foot of building is expected to vary with the size of the building. Generally, the price per square foot decreases as building size increases where all other features are similar. This is typically referred to as marginal diminishing utility.

Building Condition:

- Adjustments for improvements were considered; where estimated remaining economic life was different; finished materials (where possible), and overall aesthetic influence.

Overall Utility:

- This adjustment takes into account site size, configuration, current use, improvements, and other encumbrances that may impact development. The configuration of the site will impact the maximum developable area. Oddly configured sites tend to have more leakage of usable land. Furthermore, topographically-challenged sites such as the subject will require a fair amount of site work.

Other Conditions:

- Adjustments for items like occupancy (vacant versus occupied buildings), coverage (properties with low densities have additional lands), as well as other items deemed relevant by the appraiser are taken into account.

The Income Approach Methodology

The Income Capitalization Approach is a method of converting the anticipated economic benefits of owning property into value through the capitalization process.

The principle of “anticipation” underlies this approach in that investors recognize the relationship between an asset’s income and its value. In order to value the anticipated economic benefits of a particular property, potential income and expenses must be projected, and the most appropriate capitalization method must be selected.

The two most common methods of converting net income into value are Direct Capitalization and Discounted Cash Flow.

We also need to analyze the:

- Tenant Profile, to determine the quality of the tenant, and the

- Market Rent, to determine if rental rates are within market range.

As well as the:

- General Vacancy,

- Realty Taxes and Operating Expenses,

- Structural Allowance,

- Management Fee, and

- Capital Expenditures.

Once we collected all of the above information we can develop a stabilized income pro forma statement which represents stabilized calculations pertaining to the forthcoming twelve month period.

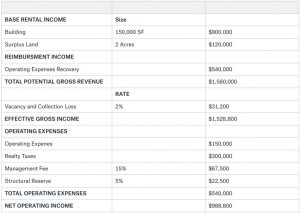

Stabilized Income Proforma

Then we will analyze alternative investments like 5 year and 10 year Government of Canada Bonds comparing to which, real estate represents higher risk investment due to its poor liquidity and need for ongoing management.

Next steps would be to study overall Capitalization Rates for this asset class, in our example, a single tenant industrial property, terminal CAP rates and Net Present Value (NPV) or Internal Rate of Return (IRR) achieved on similar transactions.

The Direct Capitalization Method

Net Operating Income – Stabilized NOI is estimated at $988,800.00

Capitalization Rate Selection

After reviewing recent market transactions we determined that an Overall Capitalization Rate (OCR) of 4.75% is considered appropriate for the subject property.

Based upon the above example, the market value of the subject property using the Direct Capitalization Method is $20,816,000.00 (rounded).

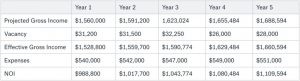

The Discounted Cashflow Method

To arrive at a property’s value using the Discounted Cash Flow Method, we need to forecast all of the property’s future cash flows and calculate what they are worth today.

The discount rate applied is basically the required return investor would need to achieve for the level of risk assumed. For a corporate investor discount rate is the Weighted Average Cost of Capital (WACC).

Lower discount rates are applied to investments with lower risk characteristics and higher discount rates are applied to investments that exhibit higher risk characteristics.

A property’s cash flow is determined by incorporating annual cash flows and sales proceeds, also known as the terminal or residual value. The residual value is calculated by taking the NOI in the year following the forecast hold period and dividing it by the future capitalization rate.

Using Discounted Cash Flow Analysis we can determine Internal Rate of Return (IRR) and Net Present Value (NPV) for the property.

- In order to determine property value using the DCF method we need to:Forecast Future Cash Flows – net rental rates, vacancy and collection loss, and operating expenses;

- Estimate Resale Value – by forecasting an expected annual growth in property value or by applying Direct Capitalization Method to the end of the holding period which is usually five or ten years;

- Determine Discount Rate – which in the corporate world is usually the company’s weighted average cost of capital. Private investors usually use their desired rate of return on real estate investments or expected rate of return on alternative investments with similar risk tolerance.

Property acquisition at 4.75% CAP rate:

4.75% CAP – Value is $20,816,000.00 (rounded)

Resale Value based on the terminal capitalization rate:

5.0% CAP – Resale Value is $22,192,000.00 (rounded)

Net Present Value of future cash flows in our example, discounted at 5% is $6,000,000.00 (rounded). Since our Net Present Value is positive, it means that the present value of future revenues exceeds the present value of future costs so this is a viable project that should be invested in.

Direct Capitalization Method vs. Discounted Cash Flow Method

It is important to mention that the Direct Capitalization Method uses a first year’s income to estimate the market value of a property while Discounted Cash Flow Method analyzes performance of a property by using a multi-year forecast of cash flows and discounts such cash flows back to the present in order to determine a present value for the property and viability of such investment.

In the end, we provide a Final Opinion of Value, which, in this particular example was based on the Direct Comparison Approach to Value and Income Approach to Value.

Conclusion

So, is determining the value of a Commercial Real Estate Property Art or Science?

It’s likely a nice mix of both, as there are many factors that influence value which is complicated to measure (and not at all scientific).

If we are using a Comparable Sales Approach to Value we need to compare the subject property with other “comparable” sites which may not be that similar but may just be decent indicators of value.

Adjusting for building size, lot size, and building features is pretty much straight forward, however adjusting for time, overall utility, and location require a well-developed “gut feel” as well.

While using an Income Approach Methodology, a Direct Capitalization Method is easier to apply since it only looks at the first year’s income; where that data is available.

Using the Discounted Cash Flow Method, we need to estimate and project income and expenses over an estimated holding period as well as the value of the property at the end of such holding period.

As some people say, “garbage in, garbage out”…. It is important that your broker or consultant has intimate knowledge of the local market where the subject property is located, as well as all comparable properties sold and available for sale.

Other important factors include net rental rates, reasonable expense, CAP rates for such asset class, and so on, including the market forces shaping the area and trends for years to come.

The Industrial Real Estate Market in the Greater Toronto Area has experienced unprecedented growth in values over the last three to six months.

Net rental rates have increased anywhere between 15 – 25% year over year; the highest increase among all North American markets. Such an increase in net rental rates, coupled with compressed CAP rates, have created huge value for property owners.

Is it going to get better in the near future, meaning, will values continue to increase?

Or will it get worse?

One thing is for sure, we haven’t seen valuations higher than this, and therefore, it may be the best time to sell your industrial real estate property.

Until next week….

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.