Durham Region Has Secured Its Spot on the Development Map

September 30th, 2022

Ever since the industrial asset class took off and became the prize of the commercial real estate industry, capital has flooded in, trying to get a piece of the proverbial pie.

And although there is money to be made across all asset classes – depending on the individual asset – the past two years have only seen more and more players re-allocating funds towards Big Box warehousing and logistics space, as well as industrial condos and last-mile infill distribution centres.

Despite the fact that there is a housing shortage (and industrial land values have skyrocketed), developers have shown a preference towards product that is relatively easy to construct, is always in demand, and that is sought-after by corporations with some of the strongest covenants around. To say that industrial projects are as close to risk-free as possible would be controversial, however, even cryptocurrencies, stocks, and bonds, as of late, might also agree.

As both a broker and analyst of the industry, I have covered many of the highlights and milestones during this period. The brokerage and investment community collectively sounded the alarm that pricing was appreciating rapidly, while available opportunities were becoming rarer and rarer by the quarter. Some may have felt this was grandstanding or embellished language; yet it has all come to fruition.

Now, it seems as if we may have reached the point we had all been warning about. Back in 2019, and even throughout 2020 and 2021, these statements remained true. Values were at all-time highs, and securing the right space was as difficult as it had ever been. But many a decision maker may be happy to travel back in time and deal in those conditions compared to today.

The truth is, it’s becoming even more difficult to purchase, lease, or develop. If you have an asset, you’re assuredly in the driver’s seat, however, this doesn’t grant much comfort to those sitting on the other side of the negotiating table.

Developers, investors, and tenants are moving West and North to ‘secondary’ markets, looking for value in below-market rents and newly blossoming communities. That said, they are meeting with the same competition, and you can only go so far before you find yourself far outside the City.

There will always be opportunities in markets with tight supply, slimming margins, and expensive values. But, what if there was a geography seemingly overlooked? What if there was a jewel nestled among the chaos; missed by those hyper-focused on the Western corridor?

Well, in this writer’s opinion, almost all of the GTA’s submarkets are a viable source of opportunity. Yet, Durham Region is one that is both in closer proximity to the Core than many of its counterparts while offering tremendous value in the market value of space and land, as well as rental rates.

That’s why, for this week’s newsletter, we will begin a closer look into Durham Region – examining what separates it as a key destination for Investors and Occupiers, while highlighting some new projects you need to know about.

Durham Region: Key Opportunity Zone

Durham Region is a regional municipality directly east of the City of Toronto and is comprised of Pickering, Ajax, Whitby, Oshawa, Clarington, Scugog, Uxbridge, and Brock.

The first four municipalities, however, (namely Pickering, Ajax, Whitby, and Oshawa) have excellent access into the Core through Highways 401 and 407, as well as numerous corporate occupiers – including H&M, Kubota, Aosom, Bad Boy, Gordon Food Services, Toyota, and Geodis – relocating their operations to realize significant cost savings; bringing employment to the Region.

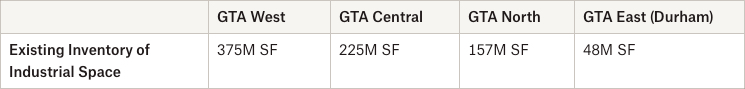

Finally, looking at the table below, we can see just how little industrial space has been constructed in Durham compared to the other GTA Regions.

So, what is all the fuss about?

While it may seem trivial or difficult to believe in our current market, Durham Region offers a significant discount in terms of the price of industrial properties and land, as well as industrial rents and development charges.

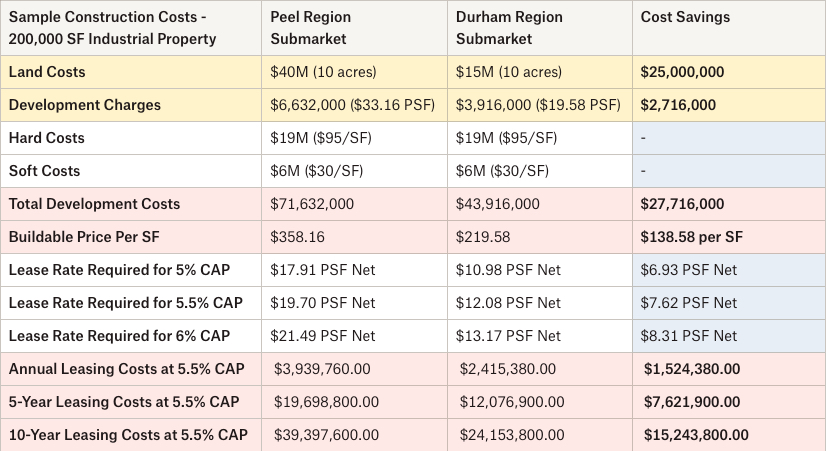

To investors: Industrial land costs and development charges are the key levers with which to maximize yields and reduce overall project costs. This is because most other line items in a development are relatively equal, no matter if you decide to build in Markham, North York, Mississauga, Brampton, or Whitby.

The table below exemplifies this concept by showing the industrial rents required to hit the same yield in two differing submarkets. Because of the vast gap in land cost and DCs, a developer in Whitby can afford to pre-lease space at a 63.1% discount to hit the same return. Or, per the example below, should you secure a Tenant at $14 or $15 PSF net (not unheard of), your margins would increase dramatically thanks to the aforementioned gap in total development costs.

This means you can easily incentivize new businesses to move, build in buffers to mitigate construction risks, and still take home more at the end of the day; not to mention the option to further increase rents at a faster rate in the future.

Comparative Development Cost Analysis – Peel vs Durham Region

Durham Region Increasing But Still a Value Play

Conclusion

If you are looking to construct an industrial property in the GTA, then you should be aware that, for the foreseeable future, the cost to do so will only go up. Of note, materials, labour, industrial land, and development charges have all significantly increased; and are not expected to go back down anytime soon.

It is because of these reasons that Durham Region makes the case for Investors and Occupiers of industrial space in the GTA to consider developing, expanding, or relocating.

While much of the focus has been on the GTA West and North Regions, as well as the Greater Golden Horseshoe extending into Guelph and Waterloo, Durham Region can provide phenomenal value, excellent upside, and great location and access to the Core.

For those Investors and Occupiers looking to find or develop space in 2023 and beyond, Durham Region should be included in your shortlist of target markets.

It is for that reason that we will profile several of these new and upcoming opportunities in our next issue.

In the meantime, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com