Etobicoke Industrial Market: An In-Depth Look

June 10th, 2022

When it comes to strategy, one of the most popular approaches is to go after low-hanging fruit. That’s because, only after the more straightforward aspects have been executed or put into place does it make logistical sense to go after the more complex, harder-to-reach objectives.

Another common method used time and time again is that of the 80/20 or, more recently, the 90/10 rule. Since the vast majority of outputs are correlated to a small minority of inputs, why not focus on the components that really move the needle?

With these two concepts in mind, let’s revisit the GTA industrial market and its development pipeline. Over the past decade or so, the focus has largely been around massive, Big Box facilities located on the periphery.

From the perspective of large Users, such as Amazon, these accomplished the task of getting vast quantities of goods within a reasonable drive time of the entire municipal or regional markets.

From the point-of-view of developers, much of the industrial land at the time was significantly cheaper, the projects offered economies of scale, and little to no rezoning or redevelopment was needed to bring these projects on-stream. While it is highly likely these developments will continue on, we may begin to see a shift towards the back-half of this strategy.

As industrial land values, construction, material, and labour costs, development charges, and rental rates have increased dramatically, the margins on these projects are not the same. Furthermore, many of the early adopters and early majority have already absorbed significant amounts of space. To add to this, competition from other developers is beginning to crowd the space, albeit, the top players aren’t having too much difficulty operating successfully.

That said, as transportation costs continue to rise, coupled with labour shortages and a strong need from retailers towards improving their same- and next-day deliveries, it is a natural next-step to begin focusing on the last-mile. Last-mile, however, is a different animal altogether when compared to Big Box centres. Although final-mile facilities may, in some cases, be equally as large in size, they are typically smaller, and the process to build is radically different. Infill redevelopment sites within the Core are much tougher to dig up, cost a lot more to acquire, and are more complex.

However, with risk comes reward. Being centrally located is a huge strategic advantage when looking to gain better access to consumers while reducing transportation costs. It is because of this fact that we expect developers and users alike to be on the hunt for prized assets in the Core submarkets over the coming years.

That’s why, in the coming weeks, we will continue our submarket analysis, with a focus on the GTA Central markets. We will aim to provide some deep insight into each, as well as provide some detail on potential opportunities that may fit in with your real estate or investment strategy.

For this week’s newsletter, we’ll feature the Municipality of Etobicoke and examine the state of its industrial market, including trends, transactions, and developments.

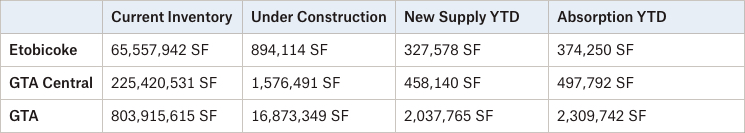

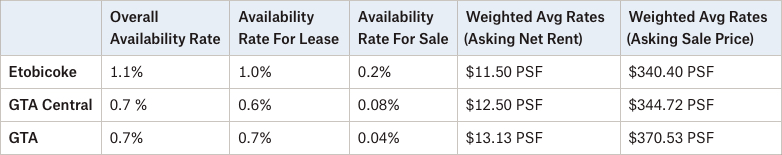

Etobicoke Industrial Market Snapshot – Q1 2022

Source: Cushman & Wakefield Research.

Looking at the current inventory numbers, we have over 803M SF of industrial space across the GTA; yet Etobicoke’s share is just over 65.5M SF (about 8.15%). In Q1 2022, however, Etobicoke had approximately 374,250 SF of absorption and 327,578 SF of new supply; the total being net negative.

The availability rate in Etobicoke sits at just 1.1% and should further tighten with the broader market. Furthermore, rental rates are at a modest discount relative to the GTA West and North submarkets, yet these too will catch up as excess supply is reabsorbed due to the Central market’s highly desirable location.

Three Interesting Facts about Etobicoke’s Industrial Market

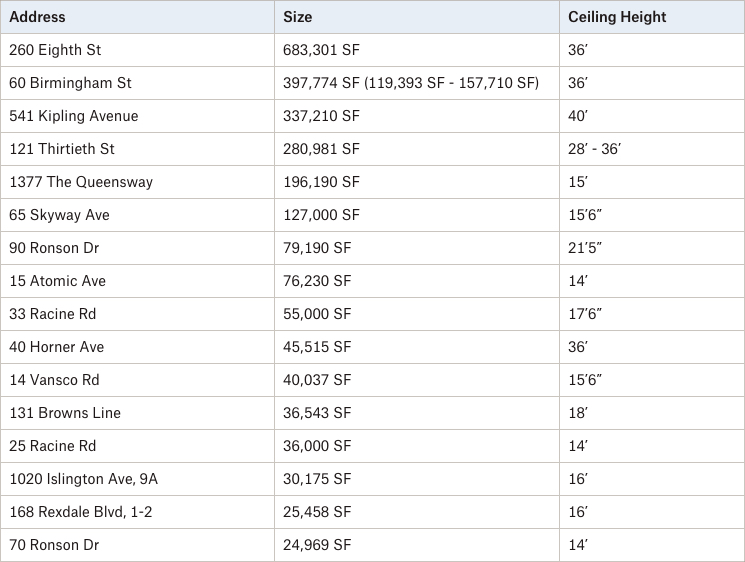

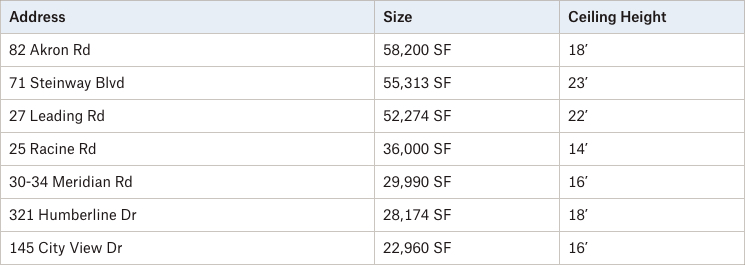

Over the past few years, Etobicoke has seen a number of redevelopments of older infill sites. Below, we are featuring three of the most recent, larger, state-of-the-art distribution facilities that are either under construction or in final planning stages.

Rendering of 260 Eighth Street, Etobicoke. Source: PIRET, Hopewell, CBRE.

Pure Industrial REIT and Hopewell have partnered to construct a 2-storey, 683,301 SF last-mile logistics facility on 20 acres. Level 1 is reportedly 460,714 SF with 31 truck-level doors and 2 drive-in doors, while Level 2 will comprise 222,587 SF with 25 truck-level and 2 drive-in doors. Both floors will have 36’ clear heights. Located in proximity to the QEW and Highway 427, this opportunity would cater well to any User looking to fulfil general or last-mile distribution and warehousing needs. CBRE is leading the leasing of the facility.

2. 1330 Martin Grove Road – 367,480 SF Redevelopment

Rendering of 1330 Martin Grove Road. Source: Carterra, CBRE.

Carterra is redeveloping the site at 1330 Martin Grove Road to construct a 367,480 SF industrial property situated on 14.1 acres. The logistics and warehousing facility will have a 40’ clear height, and 51 truck-level and 2 drive-in doors. The project is at or near completion and has been pre-leased by CBRE to two tenants.

3. 541 Kipling Avenue – 337,210 SF Redevelopment

Rendering of 541 Kipling Avenue. Source: OneProperties, AIMCo, Avison Young.

OneProperties and AIMCo have partnered to redevelop the site at 541 Kipling Avenue in Etobicoke, Ontario. The 337,210 SF state-of-the-art, last-mile distribution facility will have 78 truck-level and 2 drive-in doors with 40’ clear height. Avison Young is leading the project.

Conclusion

If we keep at our current pace, it’s conceivable that we may get to a 0% availability across the GTA, aside from brief periods between Tenants, design-build projects, or speculative construction (which are themselves often pre-leased well in advance). For those businesses looking to purchase or lease existing space, things will only become more challenging and competitive.

These points underscore the tremendous value of land. While land is becoming increasingly expensive, municipalities such as Etobicoke mostly present opportunities for infill redevelopment or intensification of use. Projects, such as the redevelopment of 1330 Martin Grove Road in Etobicoke or 601 Milner Avenue in Scarborough, exemplify how older inventory within the Core is being turned over for modern industrial facilities. With rents continuing to escalate at a rapid pace, we may see more owner-occupiers building or redeveloping sites for their own use; giving them back some control in their cost forecasts and general occupancy.

In the coming weeks, we will continue our examination of various submarkets with the aim of uncovering potential opportunities and strategies for industrial Owners and Occupiers. In the meantime, if you are an owner of industrial land or property with redevelopment potential, there are plenty of institutional and private buyers who would be willing to pay a premium to take it off your hands.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com