GTA Construction Material Cost Breakdown

September 16th, 2022

Intensity and endurance have a simple but balanced relationship. Demand too much of one and the other will suffer. However, it is so in order that we return to a state of equilibrium; as nothing, or no one can charge forward, unrelenting, forever.

The saying to “burn the candle at both ends” exhibits this phenomenon perfectly.

Typically, we view this in the context of hard work and sleepless nights. Yet, this concept too exists when speaking of business, and markets, and economies.

Over the past decade, the Greater Toronto industrial market has raged on, becoming a shining example to its counterparts across the world. Market forces have absorbed almost all availabilities, spurred swaths of space to shape, and raised rental rates to record highs.

For those working within the industrial real estate market, business was and is still phenomenal. However, it is no secret that finding, constructing, and securing space has become incredibly difficult. This was to be expected as the low-hanging fruit of developable land and e-commerce demand were gathered.

Now, with whispers of an economic downturn, coupled with rising interest rates and inflated material, labour, and real estate costs, one must ask the question:

Have we burned the candle at both ends?

Are we at a turning point? Or is this simply a bump in the road to continued success?

While it is impossible to predict outcomes, one should note that costs are themselves, too, squeezing stakeholders from both sides. Developers must pay more to borrow and build, forcing rents ever upward to justify the opportunity. As a result, this begs the question if tenants will be able to continue to pay more and more as their input costs soar. Will investors continue to support the delivery of new inventory, or will they re-allocate capital elsewhere with greater yields?

These are just some of the questions and concerns being raised by decision makers looking to formulate a strategy for the coming months and year.

That all said, ingenuity and creativity are the prerequisites to finding solutions when they are not readily apparent. It is this writer’s belief that the market will eventually return to a healthy state, even though opportunities may be more difficult to uncover or riskier to execute.

On that note, for this week’s newsletter, we will dive a bit deeper into industrial construction costs in the Greater Toronto Area, with a focus on various input and material costs.

Industrial Construction Cost Deep Dive

As we explored in our previous newsletter, the true cost of developing an industrial property is a moving target.

Along with all of the various components that go along with such an undertaking – from labour and materials, to site servicing, land costs, taxes, and professional fees – each of the constituent parts is continually changing and evolving as the economy and supply chain bring uncertainty.

Furthermore, cost guides are just that – guidelines – and are done to provide a rough estimate. They are prepared with many assumptions in mind, and do not accurately reflect highly-custom specifications; which can have a dramatic impact on the final cost.

The point is, each project is different, and circumstances evolve as each project unfolds. With that said, let us examine the constituent costs associated with industrial development.

The Turner Construction Company is a well-respected firm and known for its Building Cost Index, which analyzes a broad range of construction inputs and factors.

According to their most recent report:

- the North-American-wide Building Cost Index increased 2.23% quarter-over-quarter and 8.09% year-over-year in Q2 2022.

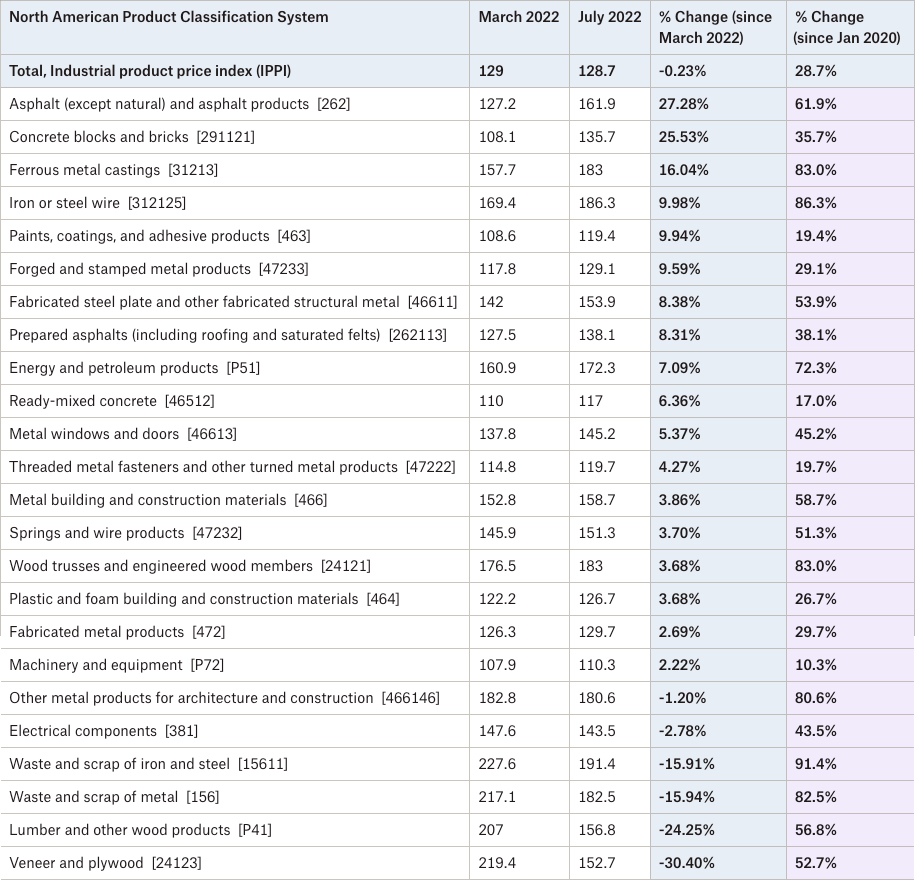

- the Industrial Product Price Index increased 14.3% year-over-year, led by an 82.8% annual increase in energy costs, and a 24% yearly increase in metal products and construction materials. The sole exception has been a 27.7% annual decrease in the cost of lumber and wood products.

- The per-unit labour cost has increased 9.5% in the past 12 months, while industrial construction costs across Canada have increased, on average, 15.7% year-over-year.

- Industrial building permits across Canada have gone up by 53.59% since Q2 2021, with non-residential permits in Ontario increasing by 28.74% in the same period.

- At the same time, pricing for concrete, steel, glass, drywall, elevators, mechanical, and electrical have all gone up, due largely to material input prices and wages.

Summary of Component Costs, Scarcity, and Lead Times

Bottlenecks: Curtainwall and glass; drywall and steel studs; HVAC & electrical equipment; fasteners; transportation and shipping costs. All of the aforementioned components are either seeing significant price hikes or increased lead times due to demand and/or labour issues.

Stabilizing: Steel, joists, deck, and rebar; roofing; doors, frames, and hardware; cement; chemicals. These components are either seeing moderate price increases or improving lead times.

Canadian Industrial Product Price Index

If you are looking to construct an industrial property in the GTA, then you should be aware that, for the foreseeable future, the cost to do so will only go up. Of note, materials, labour, industrial land, and development charges have all significantly increased.

Even if the market cools or should we enter a downturn, labour and development charges are unlikely to go down quickly, if at all, due to unions, contracts, and legislation. Materials and industrial land could, in theory, become less costly. However, there are no clear signals that this will happen any time soon.

The big question mark remains around the full impact of interest rates on investors and developers, and whether or not rents can continue to rise to create the yields necessary to outstrip borrowing cost increases. Should we find ourselves in an environment where construction and financing costs disincentivize investors, then market forces may indeed push costs down over time. How and when this may occur remains to be seen.

For those who own existing industrial properties, these assets may become even more sought-after should supply be further constrained; something hard to conceive of given our historically low availabilities and high valuations. The buyer pool may thin, but those with cash on hand and economies of scale will still be able to execute.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com