April 21st, 2023

The Greater Toronto industrial market appears to be living in its own world.

Whether as a result of management or insulation, we have yet to see any persistent effects seeping through from the plethora of economic uncertainty and news around the world.

Rising interest rates – as we explored in previous issues – did result in a temporary drop in acquisitions through mid-2022 before bouncing back by end of year.

Prior to this, supply chain bottlenecks, labour shortages, and immense increases in construction costs did little to stop the emergence of the largest industrial pipeline we have ever seen.

Now, a crisis with certain financial institutions south of the border is brewing. And as of writing, these events seem to have been contained – at least for the moment.

To add to this, the AI revolution is taking off.

And despite being in the early days, we are already seeing some amazing applications impacting every industry sector, including manufacturing, warehousing, and transportation.

It is difficult to imagine how these technologies will affect industrial real estate, however, we can be certain that how these facilities will be operated will change… and the needs of future tenants might manifest in building design and construction, as they have for the proliferation of high-clear Big Box warehouses. Specifically, the removal of labour and the addition of cutting-edge robotics could see smart racking systems and robotics rooms, among other things… but who knows.

On that note, construction costs remain a hot topic of discussion for developers and tenants looking to meet their space needs in a market with sparse available inventory.

That is why, for this week’s newsletter, we will analyze the GTA industrial market’s historical construction cost data to gain a better understanding of how the market has evolved, and to help get a sense of what is to come.

GTA Historical Construction Costs

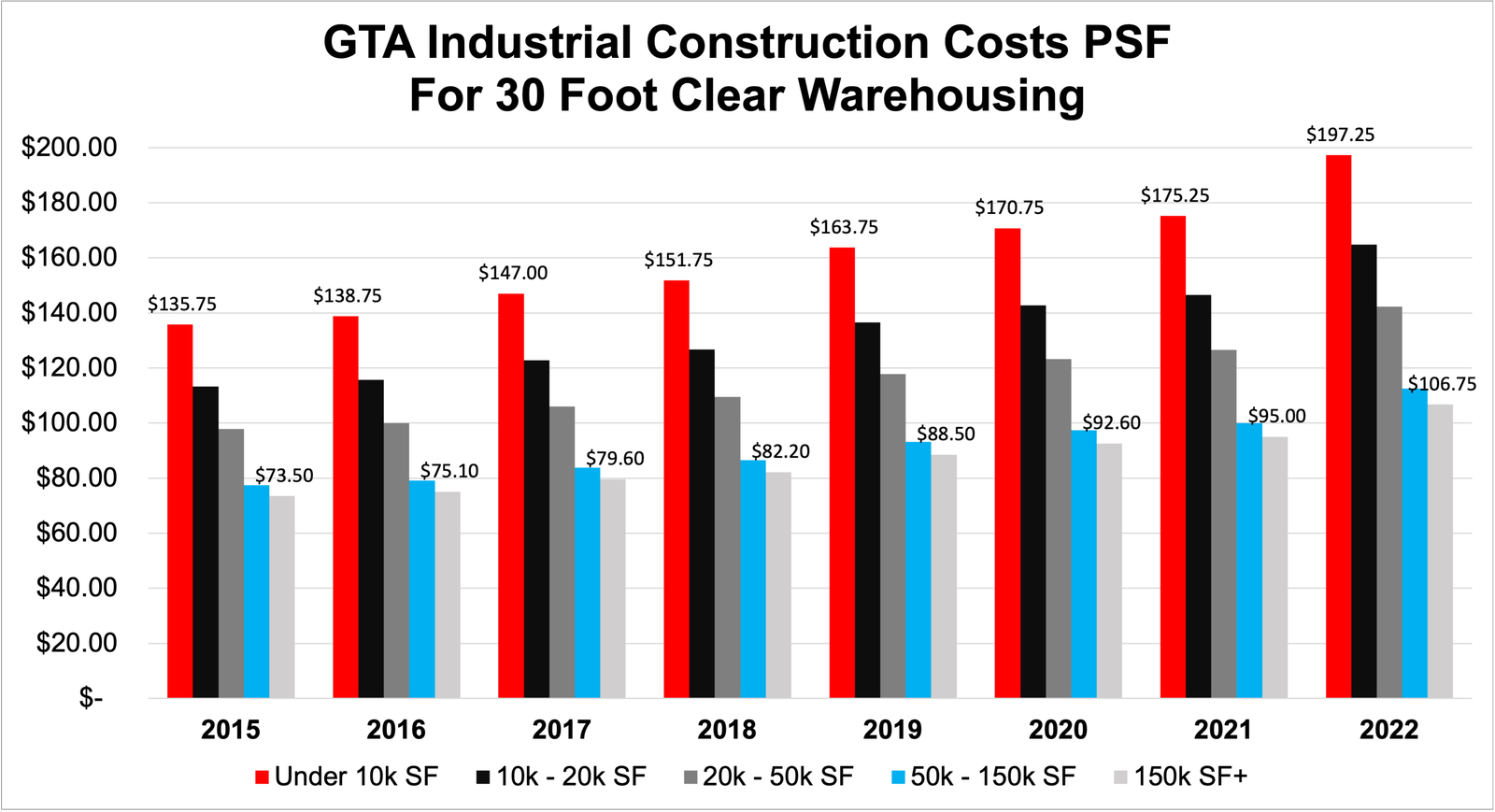

As you can see below, the cost to build industrial product in the GTA has steadily increased year after year. In 2015, a 30’ clear warehouse cost $135.75 PSF and $73.50 PSF for properties over 150k SF and under 10k SF, respectively. Those figures have ballooned to $197.25 PSF and $106.75 PSF, respectively, in 2022 – and continue to increase.

Looking at Big Box warehouses, which obviously benefit from economies of scale, this still represents a 45% cost increase in just 7 years. Strangely enough, the data shows that these costs were increasing ahead of the pandemic and only accelerated further from 2021 to 2022.

We can infer that this uptick was lagging behind the initial supply chain bottleneck effects of 2020 and given the surge was in the most recent period, we have yet to see if costs will plateau in 2023 or if they will accelerate further.

The question we should ask ourselves is, how have these cost increases affected the pipeline of new inventory?

GTA Historical Industrial Construction Cost PSF – 30 Ft Clear Warehousing. Source: TREB.

GTA Industrial Under Construction vs Cost to Build PSF

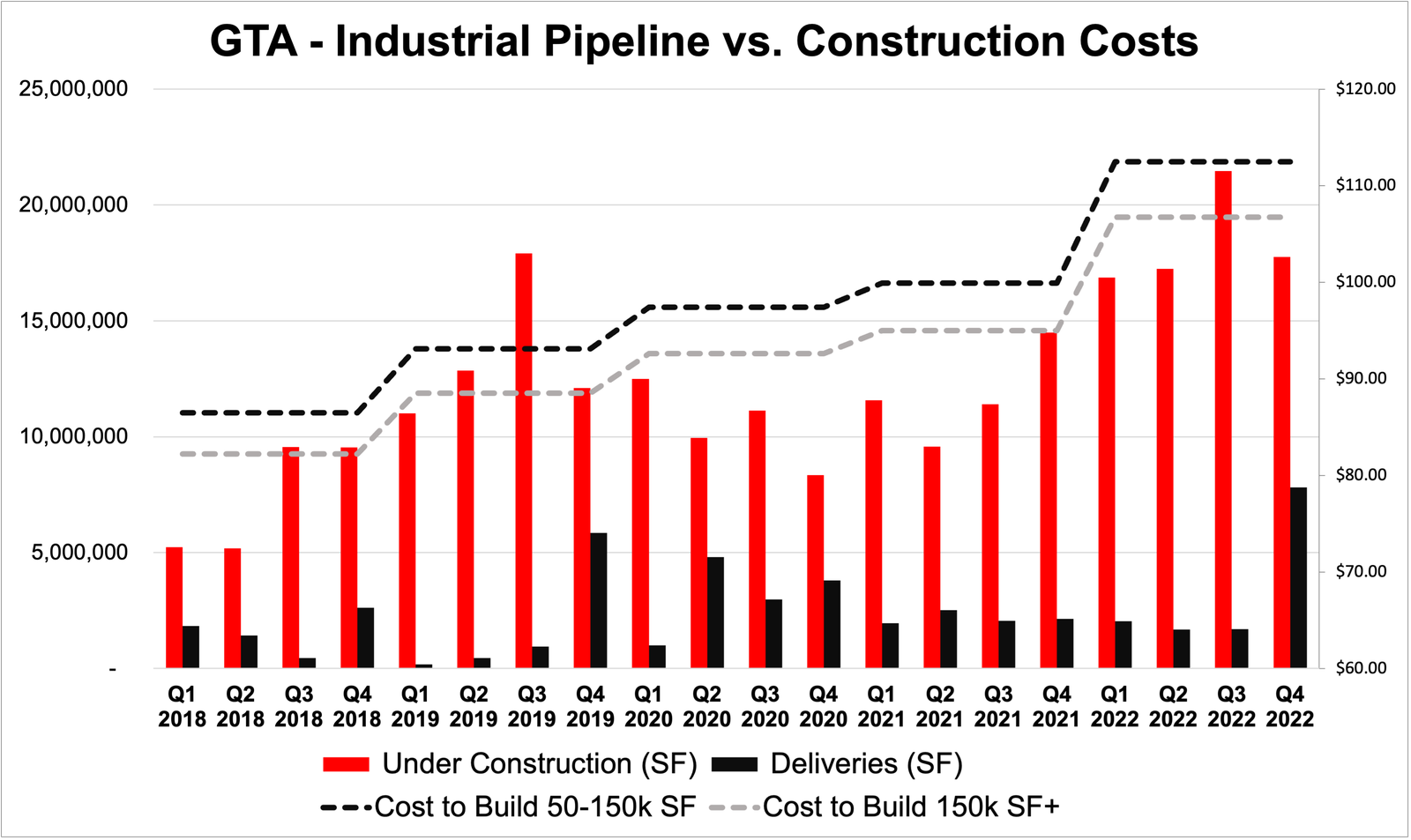

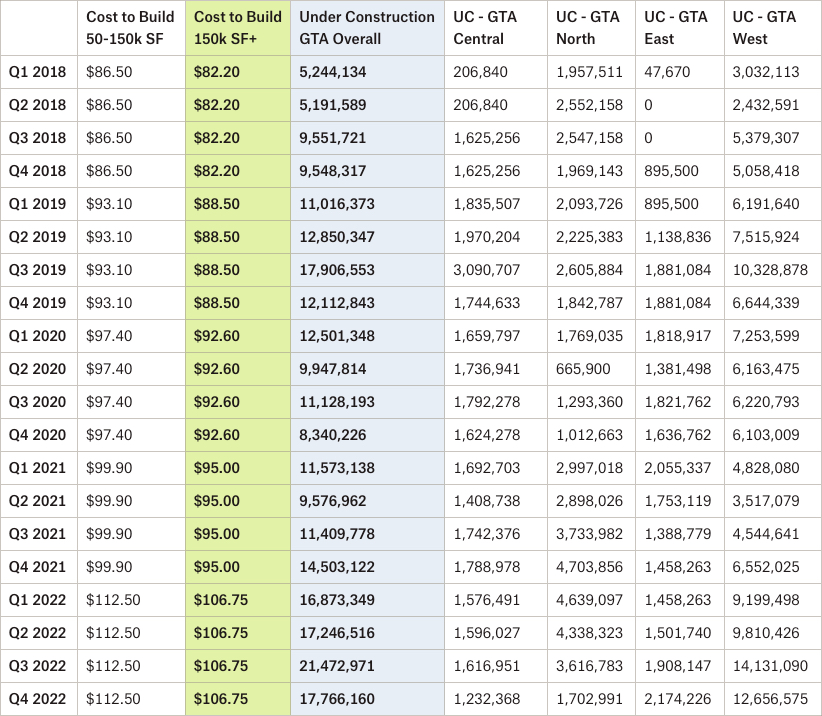

Below, we see the differences in the cost to construct industrial properties between 50k and 150k SF, the cost to construct buildings over 150k SF, as well as the quarterly deliveries and industrial space under construction by region from 2018 through 2022.

What’s important to take away from these graphs is:

- For industrial properties between 50k – 150k SF – costs have increased from $86.50 PSF in 2018 to $112.50 in 2022;

- For industrial properties over 150k SF – costs have increased from $82.20 PSF in 2018 to $106.75 PSF in 2022;

- Note: these figures are a general approximation and will vary for different designs, layout, materials, and even submarkets… and do not represent total development costs;

- While fluctuating and dipping throughout the pandemic, the average amount of new development continues to increase, with a substantial square footage of new space forecast in the coming two years;

- The pipeline of new inventory does not appear to correlate directly to the cost to build, which would make sense if we agree that developers both plan and react to changing demand, bringing forth as much space as is possible or feasible, according to supply constraints;

- We observe a spike in construction costs in 2022, which could be a self-fulfilling prophecy – in the sense that – limited pipeline and deliveries throughout 2020 and 2021 created a bottleneck in production for the very materials produced by industrial manufacturers to build the very facilities they occupy.

GTA Historical Industrial Pipeline vs Construction Costs. Source: TREB.

GTA Industrial Space Under Construction and Cost to Build – 2018 to 2022.

Conclusion

Looking ahead, the industrial market continues to defy the broader economic uncertainty by remaining highly sought-after. Rising interest rates, an uptick in construction costs, material and labour shortages, and a myriad of other macro concerns have not put a dent in the pipeline of new industrial inventory.

A wave of expected deliveries in the coming two years may bring forth challenges in leasing new space, however, the vast majority of projects are currently pre-leased well in advance and often at new watermark rent values. So, even with a bit of slack introduced into the market, we would still expect warehouses to fill up quickly, barring any major macroeconomic shocks.

As is with common sense, it may certainly be more challenging to build. That said, there remains a hunger for modern, well-located facilities with strong connectivity. Industrial users continue to expand throughout Southern Ontario, building out their warehousing and distribution networks.

The caveat here is, rising costs may ‘lock in’ rents at our current ‘new normal’ even if demand subsides in the future. However, given real estate costs are but a fraction of the cost to transport goods, we may see these same businesses double down on location and pay even more to reduce delivery distances and times.

On that note, if you have considered constructing a facility as a means to expand your operations, or as a cash-flowing investment, the GTA industrial market is as robust as ever and full of opportunity. Connecting the dots and executing your project in the most efficient manner is where engaging an experienced broker can help most.

In the meantime, for a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com