GTA Industrial Costruction Costs in 2022

September 9th, 2022

“My candle burns at both ends; it will not last the night; but ah, my foes, and oh, my friends – it gives a lovely light!”

- Edna St. Vincent Millay

Intensity and endurance have a simple but balanced relationship. Demand too much of one and the other will suffer. However, it is so in order that we return to a state of equilibrium; as nothing, or no one can charge forward, unrelenting, forever.

The saying to “burn the candle at both ends” exhibits this phenomenon perfectly.

Typically, we view this in the context of hard work and sleepless nights. Yet, this concept too exists when speaking of business, and markets, and economies.

Over the past decade, the Greater Toronto industrial market has raged on, becoming a shining example to its counterparts across the world. Market forces have absorbed almost all availabilities, spurred swaths of space to shape, and raised rental rates to record highs.

For those working within the industrial real estate market, business was and is still phenomenal. However, it is no secret that finding, constructing, and securing space has become incredibly difficult. This was to be expected as the low-hanging fruit of developable land and e-commerce demand were gathered.

Now, with whispers of an economic downturn, coupled with rising interest rates and inflated material, labour, and real estate costs, one must ask the question:

Have we burned the candle at both ends?

Are we at a turning point? Or is this simply a bump in the road to continued success?

While it is impossible to predict outcomes, one should note that costs are themselves, too, squeezing stakeholders from both sides. Developers must pay more to borrow and build, forcing rents ever upward to justify the opportunity. As a result, this begs the question if tenants will be able to continue to pay more and more as their input costs soar. Will investors continue to support the delivery of new inventory, or will they re-allocate capital elsewhere with greater yields?

These are just some of the questions and concerns being raised by decision makers looking to formulate a strategy for the coming months and year.

That all said, ingenuity and creativity are the prerequisites to finding solutions when they are not readily apparent. It is this writer’s belief that the market will eventually return to a healthy state, even though opportunities may be more difficult to uncover or riskier to execute.

On that note, for this week’s newsletter, we will revisit the topic of industrial construction costs across the Greater Toronto Area.

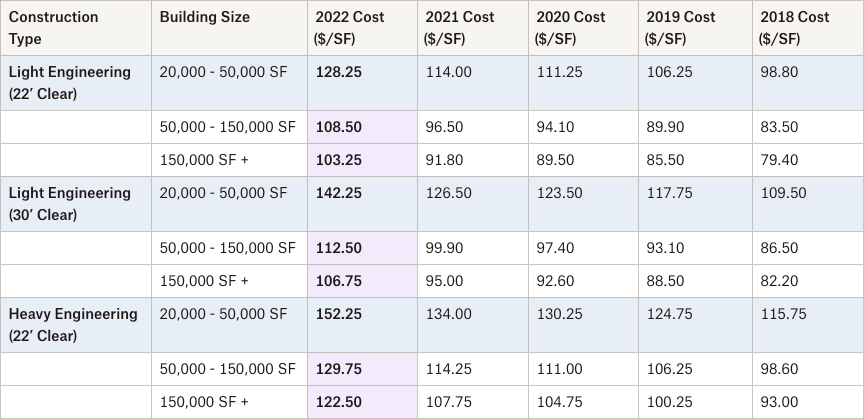

How quickly are industrial construction costs accelerating in the Greater Toronto Area?

Industrial Construction Cost Breakdown

- Allowances

- Design Allowance (changes to design excluding scope increases);

- Escalation Allowance (increase in costs from estimate to tender dates);

- Construction Allowance (for ‘change orders’ during construction period).

- Soft Costs

- Architectural, engineering, legal, land surveying, marketing, development, or administrative fees;

- Land transfer tax, HST tax, sewer levies, assembly fees, and development charges;

- Brokerage commissions, appraisals, surveys.

- Land Costs

- Land, site services, landscaping, financing, title insurance, etc.

- Project Specific Costs

- Special foundation requirements;

- Tenant inducements, special equipment, or furnishings.

Industrial Construction Cost Index

Conclusion

If you are looking to construct an industrial property in the GTA, then you should be aware that, for the foreseeable future, the cost to do so will only go up. Of note, materials, labour, industrial land, and development charges have all significantly increased.

Even if the market cools or should we enter a downturn, labour and development charges are unlikely to go down quickly, if at all, due to unions, contracts, and legislation. Materials and industrial land could, in theory, become less costly. However, there are no clear signals that this will happen any time soon.

The big question mark remains around the full impact of interest rates on investors and developers, and whether or not rents can continue to rise to create the yields necessary to outstrip borrowing cost increases. Should we find ourselves in an environment where construction and financing costs disincentivize investors, then market forces may indeed push costs down over time. How and when this may occur remains to be seen.

For those who own existing industrial properties, these assets may become even more sought-after should supply be further constrained; something hard to conceive of given our historically low availabilities and high valuations. The buyer pool may thin, but those with cash on hand and economies of scale will still be able to execute.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com