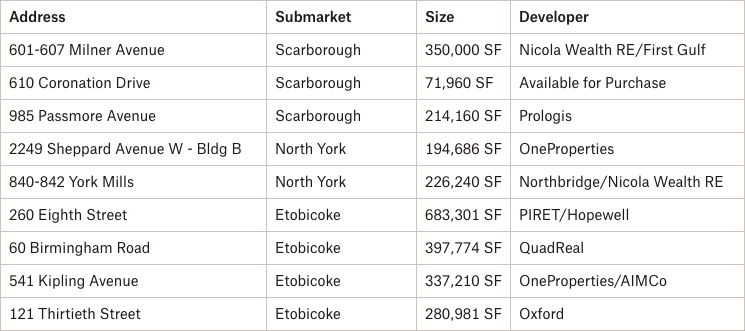

GTA Industrial Infill Developments in 2022

August 19th, 2022

Circumstances have a way of changing things.

We may believe that we are different, and that we can deal with anything that comes our way, however, pragmatism and risk-tolerance often dictate how we respond to changing conditions.

As summer rolls towards a close, we typically ramp up towards a busy fall through the holiday season. Per the ebbs and flows of the annual cycle, business decision-makers and investors – after having returned from some well-deserved rest – find themselves staring down the runway of the final third of the year, ready to make the necessary moves to hit their year-end goals.

However, the past two and a half years have been anything but normal. In 2020, we saw a ‘black hole’ of activity from early March through summer’s beginnings, after which, there was a flurry of activity from June through December. Both were atypical, albeit, the busy period was welcomed by those sitting on the sidelines and waiting to see how events would unfold.

Since then, we have seen a bull industrial market unlike ever before. Retailers went all-in on e-commerce and omni-channel fulfilment. Logistics and transportation firms, feeling the squeeze of supply chain and labour constraints on one end, and unending consumer demands on the other, scooped up unparalleled volumes of warehousing and distribution space.

Which leads us to today. After many corporations and developers played the clear winning hand of industrial ‘Big Box’ development, we see some firms pulling back, while investors struggle to find industrial land.

Furthermore, many users and investors are unclear as to what the next ‘shift’ will bring; or even what the next shift will be, or when. Will our current paradigm continue? Will we see a reversal towards small- and mid-bay manufacturing? Will remote work spread populations and extend industrial networks further out? Or will we see Big Box morph into mega multi-storey warehouses and further intensification of use? Or all of the above?

So many forces seem to be converging, and the noise in the marketplace is so unbearably loud, with the ‘influencers’ peddling their version of the truth (never biased or oversimplified in any way).

All that is for certain is that we will see change. How, when, or what will be the trigger event, remains to be seen. In any event, industrial real estate is what facilitates the production, processing, storing, and movement of goods. And the need for all that, too, will remain indefinitely.

With that said, for this week’s newsletter, we will revisit the topic of industrial infill developments within the 416-area of North York, Etobicoke, and Scarborough, while taking a look at some of the major projects underway.

Why is the 416-area so attractive to industrial investors, developers, and occupiers?

While land and industrial assets within these submarkets can be quite expensive when compared to developing in municipalities such as Waterloo, Brantford, Pickering, Caledon, or Aurora, the fact is that location, location, location has and always will drive real estate. And given we may experience an economic contraction in the coming months, these areas may represent a hedge against speculative risk.

For occupiers: As mentioned, being well-located within the Core means proximity to labour and a higher-density consumer base.

For investors: As occupiers look to take advantage of the location benefits, investors can satisfy that need and collect a premium on rents or sale values.

- 601 Milner Avenue – Toronto East Logistics – Redevelopment

Toronto East Logistics, located at 601 Milner Avenue, will bring 350,000 SF of warehousing and logistics space that will be ready for occupancy in Q2 2024.

The state-of-the-art facility will have:

- 40’ clear height;

- 56’ by 40’ bays;

- 61 TL shipping doors;

- 43 trailer parking spots; and

- 1,600A/600V heavy power.

Strategically located with over 1,000 ft of frontage on Highway 401 at Markham Road, and with excellent access to the labour pool, public transit, and major transportation routes, this is a great opportunity for any business with logistics and warehousing needs. For more information, contact our team.

- 610 Coronation Drive – Redevelopment – Available for Purchase

Our team is currently offering 610 Coronation Drive for sale. Situated on approximately 5.49 acres of industrial land in Scarborough, there is a site plan approval in place for the development of 71,960 SF of industrial space (4th round SPA submission, soon to be approved). Zoning is E.07 and would permit a wide range of uses.

The subject asset provides excellent access to the labour pool, public transit, and other amenities. This opportunity would work well for an Investor or a User looking for a modern industrial building. For more details on this development opportunity, contact us.

- 985 Passmore Avenue – Prologis Tapscott DC – New Development

985 Passmore Avenue, Prologis Tapscott DC. Source: Prologis.

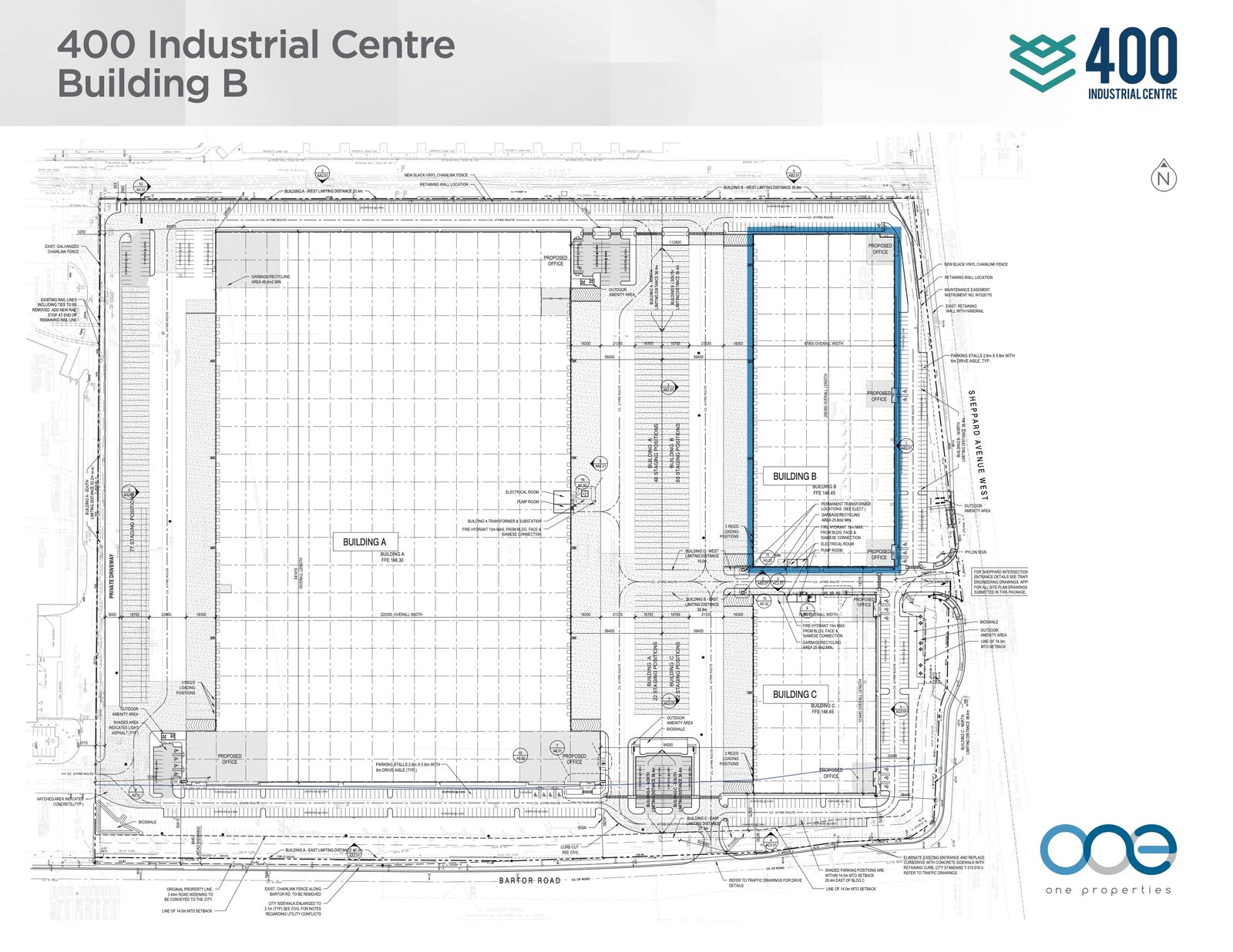

- 2249 Sheppard Avenue West, Building B – Redevelopment Under Construction

400 Industrial Centre – 2249 Sheppard Ave W , Building B. Source: OneProperties.

That said, the 194,686 SF Building B is still under construction with expected availability in Q3 2033. The facility will offer a 40’ clear height with 43 truck-level and 2 drive-in doors and 60 trailer parking stalls. For further information, please contact us.

Buildings A and C are 836,210 SF and 101,260 SF in size, respectively, and have already been leased to the TTC and Riverside Natural Foods (the latter occupying Building C and part of Building A).

One Properties is redeveloping 2233-2249 Sheppard Avenue West – the former Home Depot distribution and innovation centre – into a multi-property business park. Located on the south side of Sheppard Avenue West, and with great exposure along Highway 400, “400 Industrial Centre” is extremely well-located.

- 840-842 York Mills Road – The Hub at York Mills – Proposed Development

One of many renderings of 840-842 York Mills Road. Source: Northbridge, Nicola Wealth, Colliers.

With transportation costs rising and greater emphasis placed on access to consumers and the labour pool, this centrally located facility will be a phenomenal option for a wide range of tenants. Colliers is representing Northbridge and Nicola. For further information, please contact us.

The speculative build is being touted as a ‘blank canvas’ with numerous concept designs with buildings ranging from 35,000 SF to 226,240 SF; a flexibility strategy to cater to potential users‘ needs, which includes the potential for a multi-storey warehouse.

Northbridge Capital and Nicola Wealth have partnered to develop a last-mile warehousing and distribution centre at 840-842 York Mills Road. The 15.86 acre site is located at York Mills and Lesmill Road, just minutes from Highways 401 and 404.

- 260 Eighth Street – 683,301 SF – Multi-Storey Redevelopment

Rendering of 260 Eighth Street, Etobicoke. Source: PIRET, Hopewell, CBRE.

Pure Industrial REIT and Hopewell have partnered to construct a 2-storey, 683,301 SF last-mile logistics facility on 20 acres. Level 1 is reportedly 460,714 SF with 31 truck-level doors and 2 drive-in doors, while Level 2 will comprise 222,587 SF with 25 truck-level and 2 drive-in doors.

Both floors will have 36’ clear heights. Located in proximity to the QEW and Highway 427, this opportunity would cater well to any User looking to fulfil general or last-mile distribution and warehousing needs. CBRE is leading the leasing of the facility.

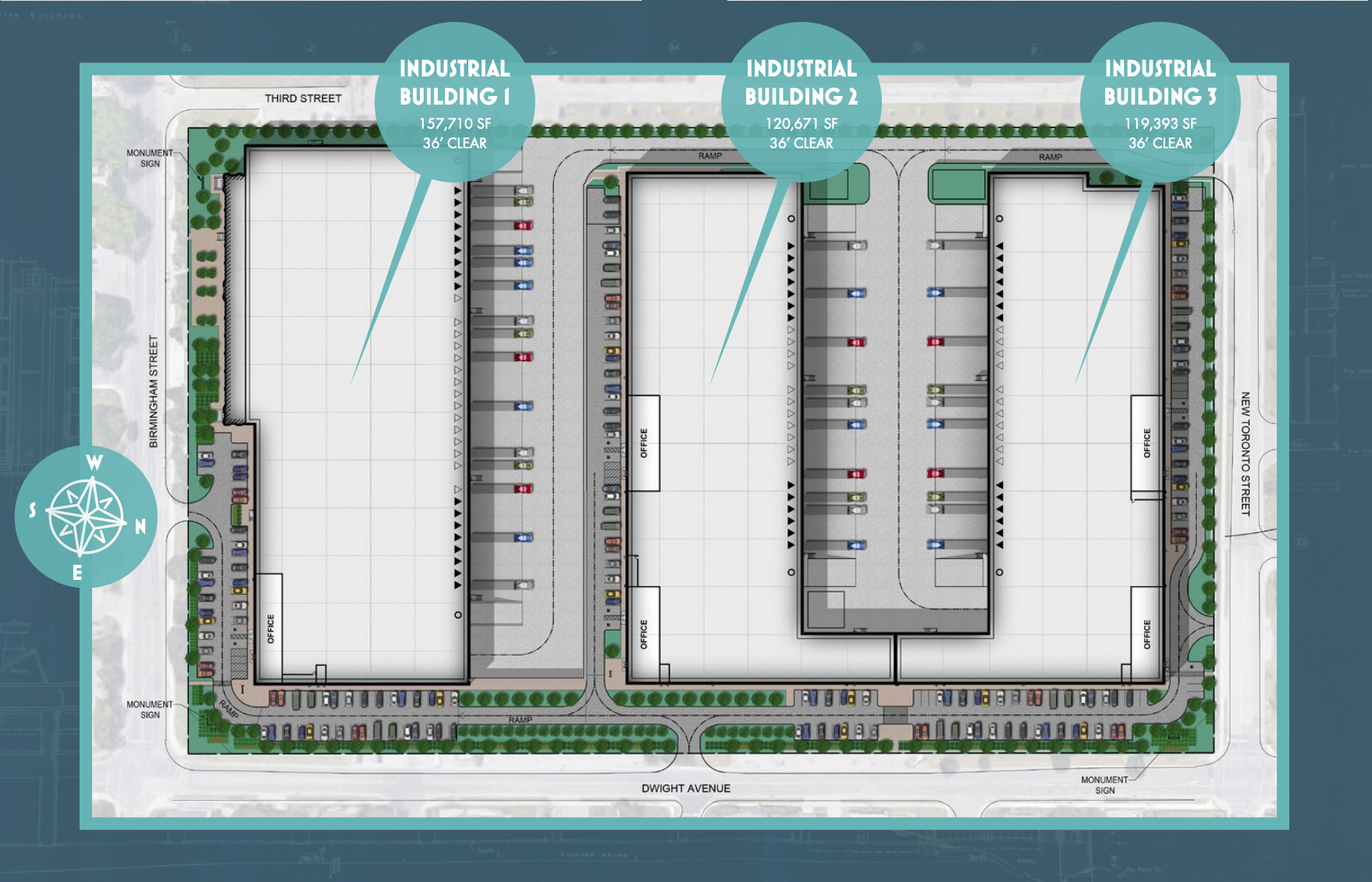

- 60 Birmingham Road – 397,774 SF Redevelopment

60 Birmingham Road – Source: QuadReal, Cushman & Wakefield.

In 2018, when Campbell’s Soup decided to sell its property in South Etobicoke, a large group of investors and developers showed a great deal of interest in this property. QuadReal, a real estate investment, development and management company was the successful bidder. With a Purchase Price of $2,407,000 per Acre (plus demolition cost, less development charge credit, etc…), it was the highest price paid for industrial land in the GTA at that time.

Currently, demolition has been completed and construction is underway. The project will consist of 397,774 SF over 3 buildings, with expected completion in December 2022, February 2023, and March 2023. Collectively, the properties will have 80 truck-level and 6 drive-in doors, as well as 36’ clear height throughout. For more information on this exciting project visit www.60birmingham.ca

- 541 Kipling Avenue – 337,210 SF Redevelopment

- 121 Thirtieth Street – 280,981 SF Redevelopment

If you are looking to pre-lease or acquire an industrial infill development site within the GTA’s core, you will need to move quickly, as the demand remains strong, despite any economic uncertainty. Further, if you are looking to break ground and move in sometime in 2023, you will need to engage with municipalities as soon as possible and if not then it is probably already too late.

However, it is never too late to begin planning and exploring. The GTA’s industrial market is truly one of the most dynamic in the world; and opportunities arise each and every day. Land will be the key to success, because once in hand, the rest of the industry will work to help convert it into much-needed industrial space.

On the flipside, if you are thinking of selling industrial-zoned or designated land, then you are in control of a much-needed and prized asset. Selling can generate a nice capital injection or set up your retirement. However, for those with the desire and appetite, partnering with the right developer can potentially result in equity and long-term cashflow, if executed properly.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com