GTA Industrial Investment Market in 2022

December 10th, 2021

“Make time for planning. Wars are won in the general’s tent.”

- Stephen R. Covey

The holidays are coming. And with it comes a slowdown in activity as decision makers, businesses, and the rest of the industry enjoy some time off. It is a natural period in which to reflect on the past year and make plans for the future.

That being said, it’s difficult to chart a trajectory to meet any specific future goal without knowing where you currently stand; as a destination is meaningless without the proper directions.

If you have been on my list or following my blog for any period of time, then you have probably seen my reports on the GTA industrial market, including deep-dives into the historical data, trends, and notable development, sales, and leasing activity.

If you have missed any of those pieces, simply reply or contact me and I would be happy to provide any relevant information.

For the purposes of this week’s discussion, however, I wanted to give my take on what is happening as it relates to industrial investment sales over the past 12 months, and where, based on observations and street-level intel, I believe things are headed. So let us begin…

So let us begin…

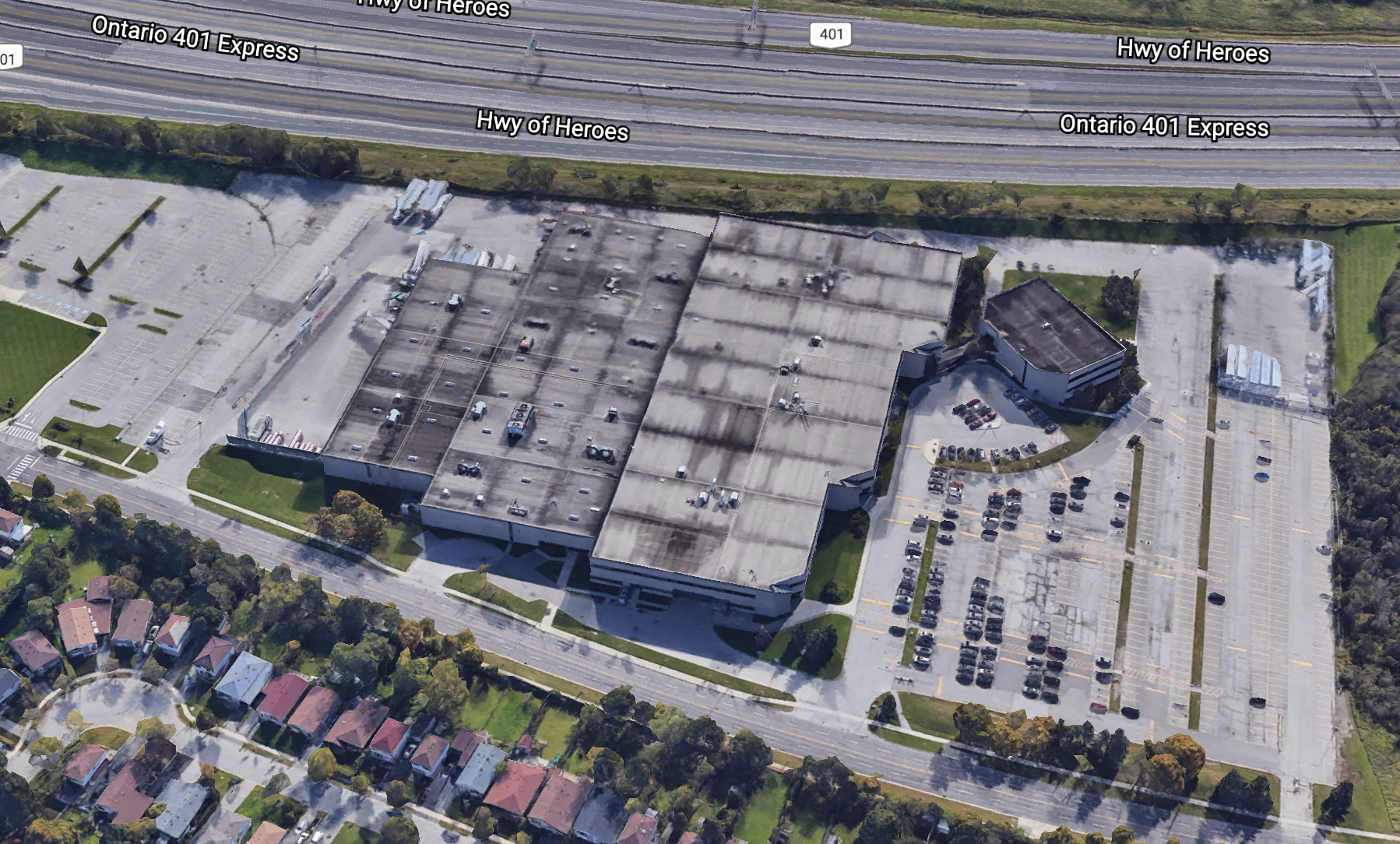

601 Milner Avenue, Toronto, Sold by our Team in 2021 for redevelopment (20 Acres of land on Hwy #401)

Investment Strategy

- For family offices or privately owned portfolios: there are some generational portfolios that are occasioanlly offered for sale; especially with the current, favourable market making the option enticing. Families who inherit portfolios are often large groups of people who may not be interested in managing commercial asset, and who may have conflicting interests. And so, in many cases, the best outcome is to sell the portfolio.

- Some institutional investors are rebalancing their portfolios towards the end of the year, and we may see some properties may be offered for sale on a single-property of portfolio basis.

- At the same time, there are a number of private and institutional investors that are looking to acquire properties, and – in many cases – submitting unsolicited offers; hoping to shake something loose. However, even if the offers presented are strong, we recommend that property owners prepare these buildings for sale by conducting a pre-due diligence process (such as a building inspection or environmental report) to ensure any potential transactions go smoothly. Doing this before going to market can maximize offers and values. We have executed this exact strategy many times this year, and every single time, it has resulted in a more favourable outcome.

Challenges and Opportunities

- Many investors are looking to deploy capital and there is such little inventory, creating a competitive biding scenario for assets that do come to market;

- Cap rates are compressing and may seem to low to a prospective investor, however, there is a reason for this. If you look at the underlying value of any industrial asset – there is typically an opportunity to add-value, reposition, increase in-place rents, replace tenants with better covenants, negotiate leases with higher escalations, etc.

- For assets with existing leases in place with below-market rents and upcoming renewals – rental rates are almost doubling on every renewal – starting from $12.00 – $15.00 PSF net with 3% – 4% annual escalations. This offers an avenue to improve cashflow and investment return, as well as hedge against inflation… but makes the investments pricier.

- The general scarcity of opportunity has resulted in many mergers and acquisitions between REITs and many out-of-province and out-of country deals. Further, these investors have turned towards development to create product (as we covered last week), as is there is little to buy.

Industrial Investments in 2022

- Demand will remain strong, if not increase, as investors look to deploy capital and favour industrial assets over others, such as retail and office.

- Supply will remain limited. That being said, developers or institutional investors often rebalance their portfolios and dispose of assets; for a premium. And generational landlords have taken notice of the strong market fundamentals and valuations.

- Income-producing industrial real estate is increasingly viewed as a hedge against inflation due to the significant growth in rents and values.

- When it comes to industrial investments: everything is in demand; from value-add opportunities to brand-new, state-of-the-art faclities, or even multi-tenant properties for hold-and-collect or industrial condo conversion strategies.

168 Rexdale Blvd, Toronto – Sold by our Team in 2021, Value-add play for repositioning (51,000 SF on 2.79 Acres)

Conclusion

In any event, if you are looking to purchase or dispose of income-producing industrial assets in 2022, expect to be (pleasantly or otherwise) surprised by valuations. With capital fleeing many other types of assets, industrial has cemented its reputation as a low-risk, dependable, long-term play. In a world full of uncertainty, investors are allocating at least some of their investments towards direct or indirect ownership of these facilities and portfolios.

These circumstances mean that – if you are considering selling – then there may not have ever been a better time. A word of caution: make sure you have a strategy and plan in place to maximize offers and values as the difference could mean leaving millions of dollars on the table.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com