The Greater Toronto industrial market appears to be living in its own world.

Whether as a result of management or insulation, we have yet to see any persistent effects seeping through from the plethora of economic uncertainty and news around the world.

Rising interest rates – as we explored in previous issues – did result in a temporary drop in acquisitions through mid-2022 before bouncing back by end of year.

Prior to this, supply chain bottlenecks, labour shortages, and immense increases in construction costs did little to stop the emergence of the largest industrial pipeline we have ever seen.

And it is this precise phenomenon which we will try to peel back the proverbial layers and analyze the data to establish if there are any deeper cause-effect relationships.

As a rule, suppliers respond to price signals in the market, which are themselves a function of variables such as inputs, scarcity, and demand. Simply put, it is profitable to produce a good that everybody wants.

Within the context of the GTA’s industrial market, the bull run on property values and industrial rents certainly provides an incentive to build, lease up, and hold for cashflow or sell. And this trend would support a thesis that low availabilities spurred a jump in pricing, which kickstarted more construction.

However, input costs such as materials, labour, land, and borrowing costs similarly increased quickly and were exacerbated throughout and after the pandemic. Furthermore, rising rates and an already tripling in both values and rents are leaving some wondering if the market can continue to bear much more.

If pricing begins to stabilize – and it is – then we should expect to see a flood of competing product hit the open market in the coming one to three years. We would also expect investors to bring onboard new developments more strategically and with a close eye on absorption and competing projects.

Theory aside, there is one key fact that leaves this writer feeling optimistic, no matter the flavours of trend and circumstances, and it is this: everybody wants industrial real estate in the Greater Toronto Area.

That is why, as an addendum to last week’s analysis, we will analyze the GTA industrial pipeline to gain a better understanding of how the market has evolved, and to help get a sense of what is to come.

GTA Historical Availabilities and Forecast

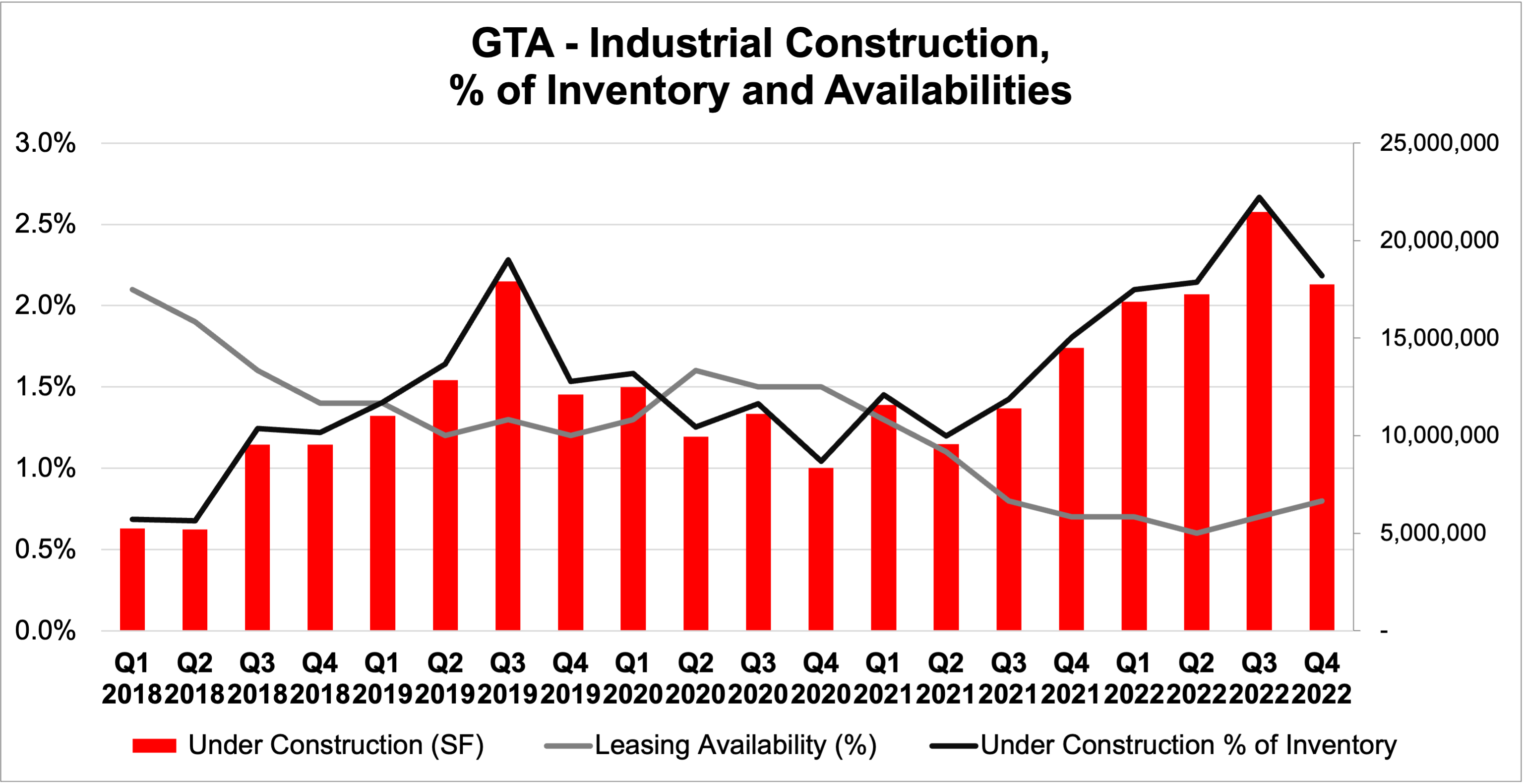

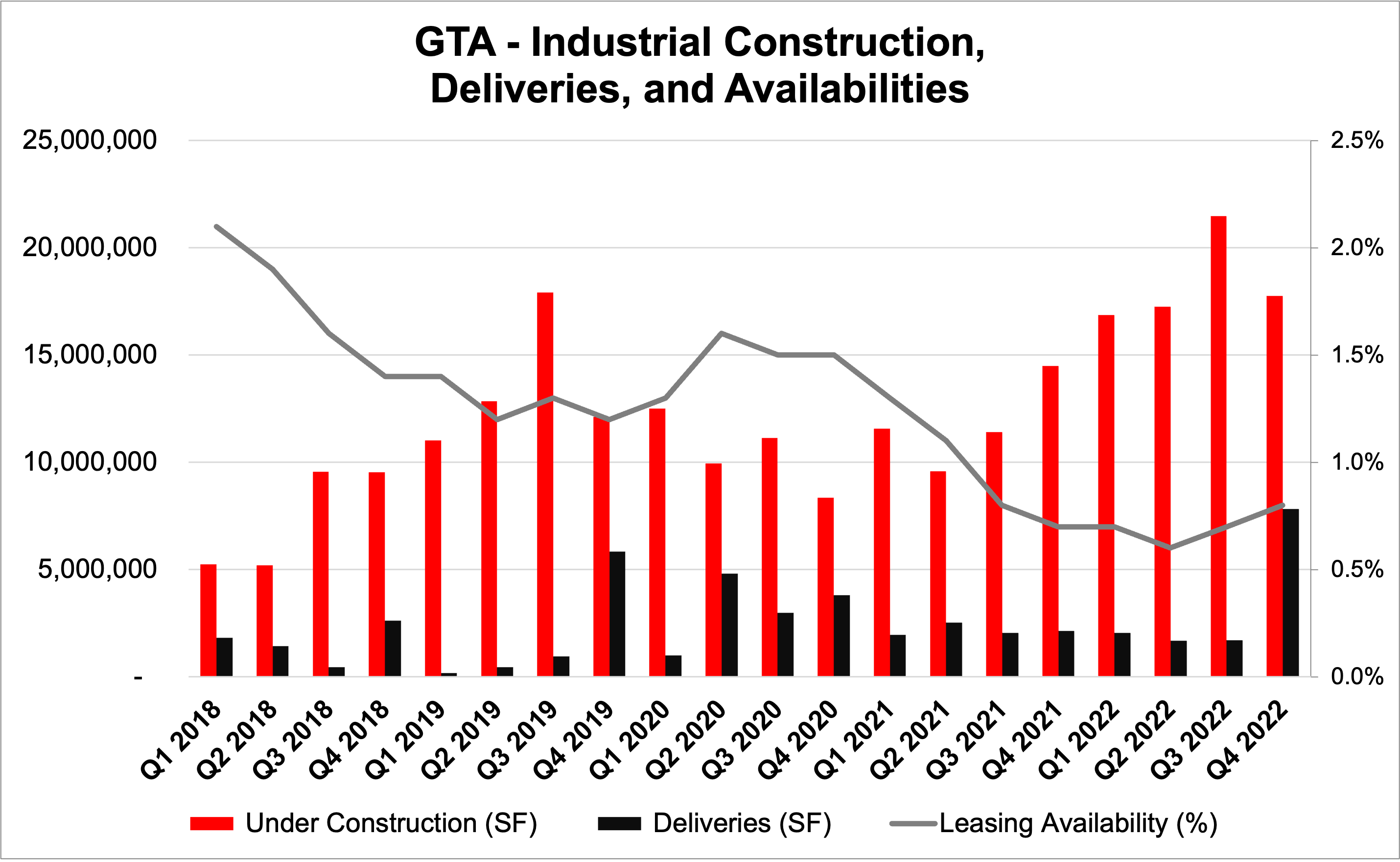

As you can see below, the Greater Toronto industrial market has undergone a significant change over the past five years. Overall availabilities have dropped from 2.2% in Q1 2018 to a low of 0.7% in Q2 2022 and now sit at 0.9% as measured in Q4 2022.

Meanwhile, as we covered in our last issue, developers rushed to bring new supply to market in response to raging demand and an appreciation in rents and values. The biggest quarterly jump in pipeline occurred from Q2 2019 to Q3 2019 where we saw increase from 12.8 MSF to 17.9 MSF in just 3 months (so, an additional 6 MSF with 940k SF delivered… netting an increase of 5.1 MSF).

Working back, we can assume that these were greenlit prior to this… so let’s see if anything else of note occurred within that timeframe.

What’s interesting is that in Q4 2018 there were over 2.6MSF of deliveries into a market with 1.5% availabilities… a 0.7% decrease in three quarters that also saw a combined delivery of approximately 3.7 MSF. Therefore, we can deduce that about 9.1 MSF of space was absorbed in 2018 (0.7% of existing inventory plus the deliveries) to see such a dramatic decrease in vacancy while at the same time seeing historic (at that time) levels of new construction.

Following this, over 5.8 MSF was delivered in Q4 2019 and 4.8 MSF in Q2 2020; projects that were begun 12 to 18 months prior, and which contributed to the rise in availabilities over Q1 and Q2 of 2020 back up to 1.5% and 1.9%, respectively.

What stymied the continued momentum was the pandemic and its resulting lockdowns and labour and material shortages. Up until that point, the market was adjusting remarkably quickly to supply needed space. However, and as we can see later on in 2020 through 2022, the delays in new supply, coupled with extraordinary demand, took the market out of equilibrium and into a prolonged space deficiency.

Now, however, an enormous flood of new inventory hitting the market in 2023 and through 2025 will really test just how robust demand is. Given the metrics on pre-leasing percentages… given just how many deals are being completed at watermark levels… and given just how far in advance both owners and occupiers are planning their real estate decisions, we expect this surplus to quickly work its way through the system.

GTA Industrial Construction, % of Inventory, and Availability, 2018 to 2022. Source: Cushman & Wakefield.

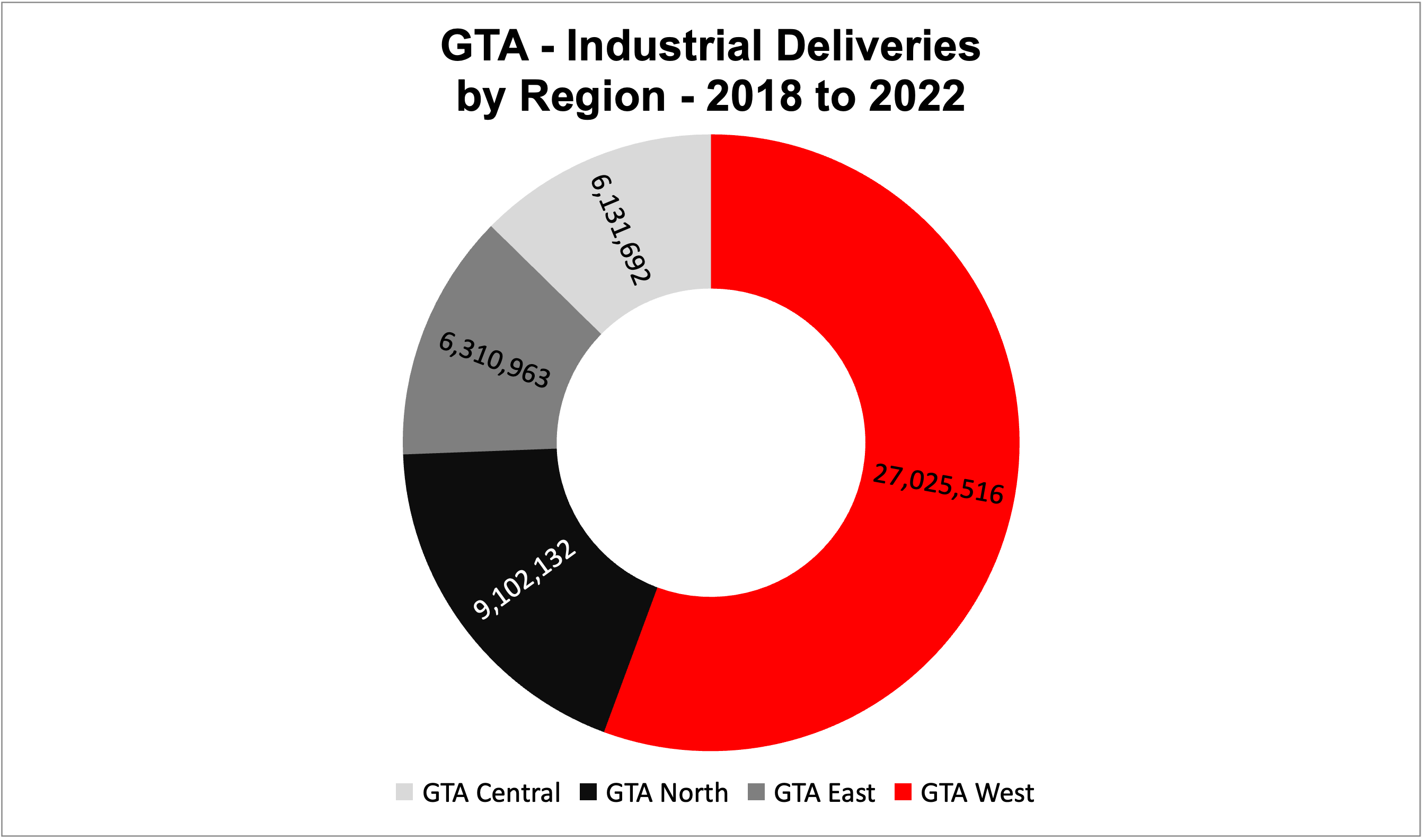

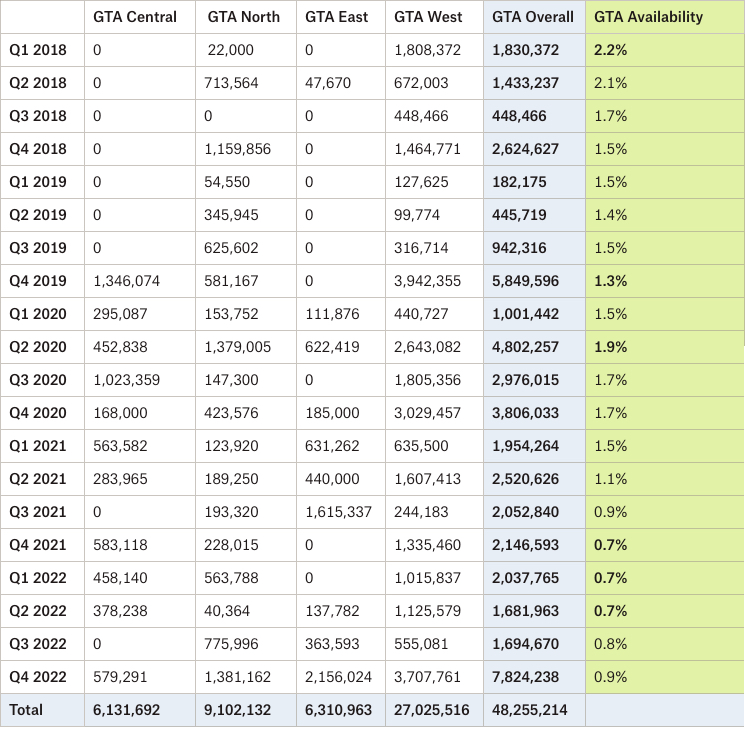

GTA Industrial Quarterly Deliveries by Region – 2018 to 2022

Below, we see a table showcasing industrial quarterly deliveries broken down by Region, as well as the total GTA quarterly deliveries and availability.

What’s important to take away from these graphs is:

- The West markets dominate in terms of industrial deliveries (and pipeline) over the past five years. With its maturity, access to transportation and infrastructure, strong but reasonable pricing, and proximity to the major Golden Horseshoe markets of Hamilton, Guelph, Waterloo, and Brantford… it comes as no surprise.

- What may be surprising to some are the North markets. However, Vaughan, Markham, and Richmond Hill have all seen significant population increases, infrastructure projects such as subways, light rail, and highway improvements. And with very little land remaining in the Central region, going north along the major 400-series highways is the logical next step for retaining access to the Core.

- The Central and East markets have the least amount of industrial deliveries for the same reasons discussed last week regarding space under construction.

- The Central region has little land available at much higher pricing, and its maturity and density pose challenges to bringing onboard industrial space as infill redevelopments when there are many other competing uses.

- The East markets, much younger in their overall development, have recently seen some major industrial business parks being built, but are not yet as established as their counterparts.

- The table below further exemplifies these observations and visually depict the differences in consistency by region quarter over quarter, as well as the direct and lagging impact of new inventory on general availability. Historically, large amounts of deliveries cause the availability rate to increase. That said, to what degree and how quickly depend greatly on pre-leasing rates and broader demand. How this metric reacts to the enormous 7.8 MSF delivered in Q4 2022 will be a solid litmus test as we close out Q1 2023.

GTA Industrial Deliveries by Region, 2018 to 2022. Source: Cushman & Wakefield.

GTA Industrial Deliveries by Region & Availability, 2018 to 2022. Source: Cushman & Wakefield.

Conclusion:

Looking ahead, the industrial market continues to defy the broader economic uncertainty by remaining highly sought-after. Rising interest rates, insolvent banks, and a myriad of other macro concerns have not put a dent in industrial construction or values, yet.

The delivery of a historic amount of industrial space as we enter talks of a recession may result in properties taking longer to lease and help with the stabilization of rents and values.

That said, given we are still at 0.9% availability, there is hardly any cause for concern. Owners and occupiers continue to look for industrial space in Southern Ontario for their reliability, simplicity, and as a hedge against equities, bonds, and currencies.

We may see a more strategic release of supply… However, yet again, at current pre-leasing rates, the GTA industrial market does not seem to dance to anyone’s beat but its own.

Next week, we’ll take a closer look at historical industrial construction costs by building size and region, and analyze their impact on the broader pipeline of projects.

In the meantime, for a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com

Newsletter

Join our mailing list to receive the latest news and updates from our team.