The Greater Toronto industrial market appears to be living in its own world.

Whether as a result of management or insulation, we have yet to see any persistent effects seeping through from the plethora of economic uncertainty and news around the world.

Rising interest rates – as we explored in previous issues – did result in a temporary drop in acquisitions through mid-2022 before bouncing back by end of year.

Prior to this, supply chain bottlenecks, labour shortages, and immense increases in construction costs did little to stop the emergence of the largest industrial pipeline we have ever seen.

And it is this precise phenomenon which we will try to peel back the proverbial layers and analyze the data to establish if there are any deeper cause-effect relationships.

As a rule, suppliers respond to price signals in the market, which are themselves a function of variables such as inputs, scarcity, and demand. Simply put, it is profitable to produce a good that everybody wants.

Within the context of the GTA’s industrial market, the bull run on property values and industrial rents certainly provides an incentive to build, lease up, and hold for cashflow or sell. And this trend would support a thesis that low availabilities spurred a jump in pricing, which kickstarted more construction.

However, input costs such as materials, labour, land, and borrowing costs similarly increased quickly and were exacerbated throughout and after the pandemic. Furthermore, rising rates and an already tripling in both values and rents are leaving some wondering if the market can continue to bear much more.

If pricing begins to stabilize – and it is – then we should expect to see a flood of competing product hit the open market in the coming one to three years. We would also expect investors to bring onboard new developments more strategically and with a close eye on absorption and competing projects.

Theory aside, there is one key fact that leaves this writer feeling optimistic, no matter the flavours of trend and circumstances, and it is this: everybody wants to own or occupy industrial real estate in the Greater Toronto Area.

So, without further ado, for this week’s newsletter, we will analyze the GTA industrial market’s historical industrial pipeline data to gain a better understanding of its impact on pricing, as well as to help get a sense of what is to come.

GTA Historical Industrial Pipeline and Its Impact on Pricing

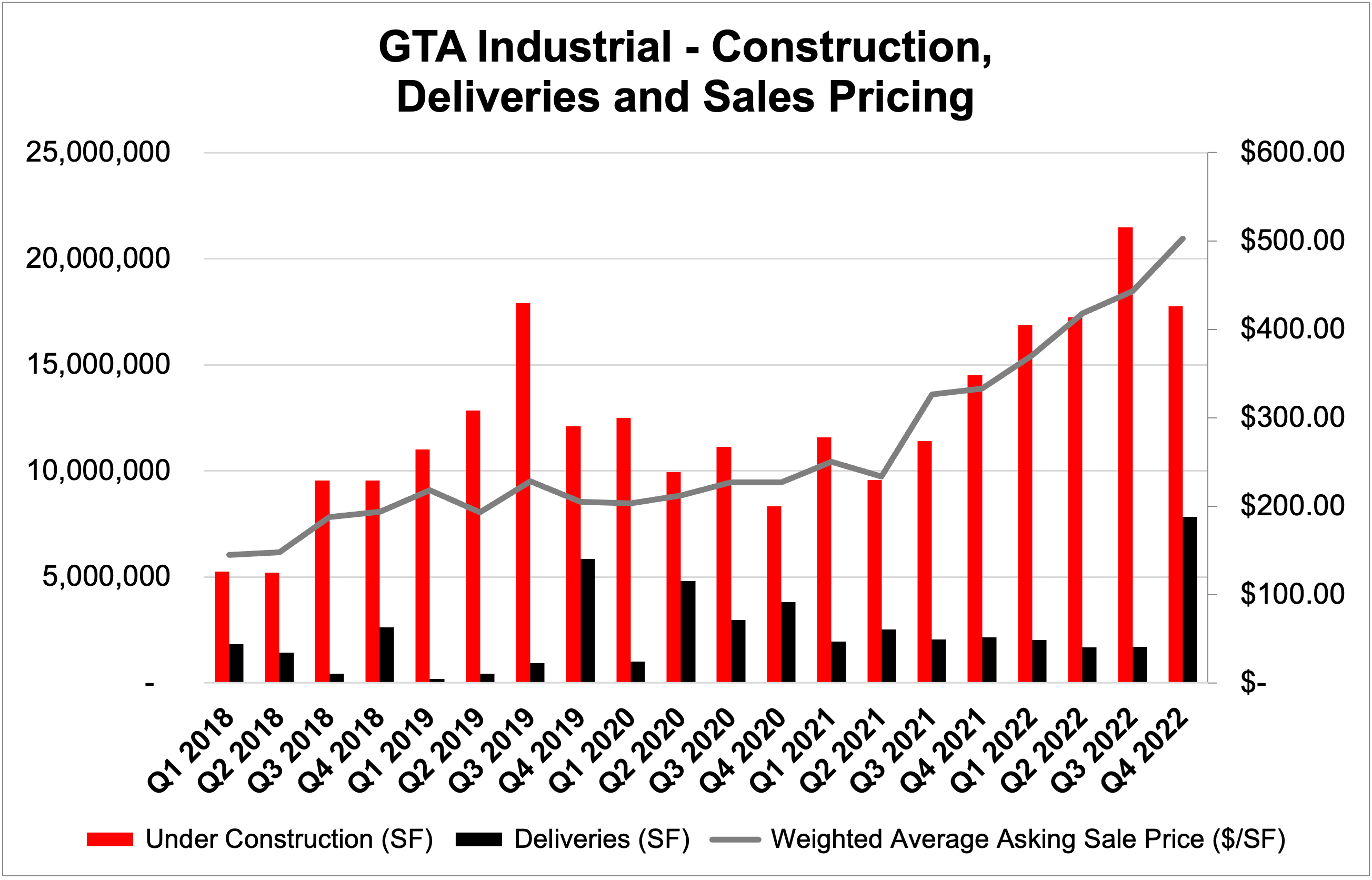

As you can see below, the industrial pipeline in the Greater Toronto Area has increased dramatically over the past five years, from a low of 5.2 MSF under construction in Q2 2018 to a high of 21.5 MSF being built in Q3 2022.

Looking deeper at our second chart, and what is most extraordinary is – despite having an inventory that increased from 765 MSF to 813 MSF in a few short years – the amount of product under construction as a percentage of total inventory continues to increase, from a low of 0.68% in Q1 2018 to a high of 2.67% in Q3 2022.

Why might this be? Well, another key visual element we observe is the lack of consistent deliveries, especially from Q2 2020 through until Q4 2022 – which we can easily explain due to the lockdowns and shortages of labour and materials.

Meanwhile, we see values and rents decouple from the trend and explode mid-2021 – an inflection point where relentless demand and supply delays finally took their toll.

As alluded to earlier, a steady and large flow of new inventory should bring relief to pricing, however, decreases are unlikely due to two factors: prolonged demand and elevated replacement costs.

GTA Industrial Construction, Deliveries, and Pricing, 2018 to 2022. Source: Cushman & Wakefield.

GTA Industrial Supply and Pipeline Breakdown by Region

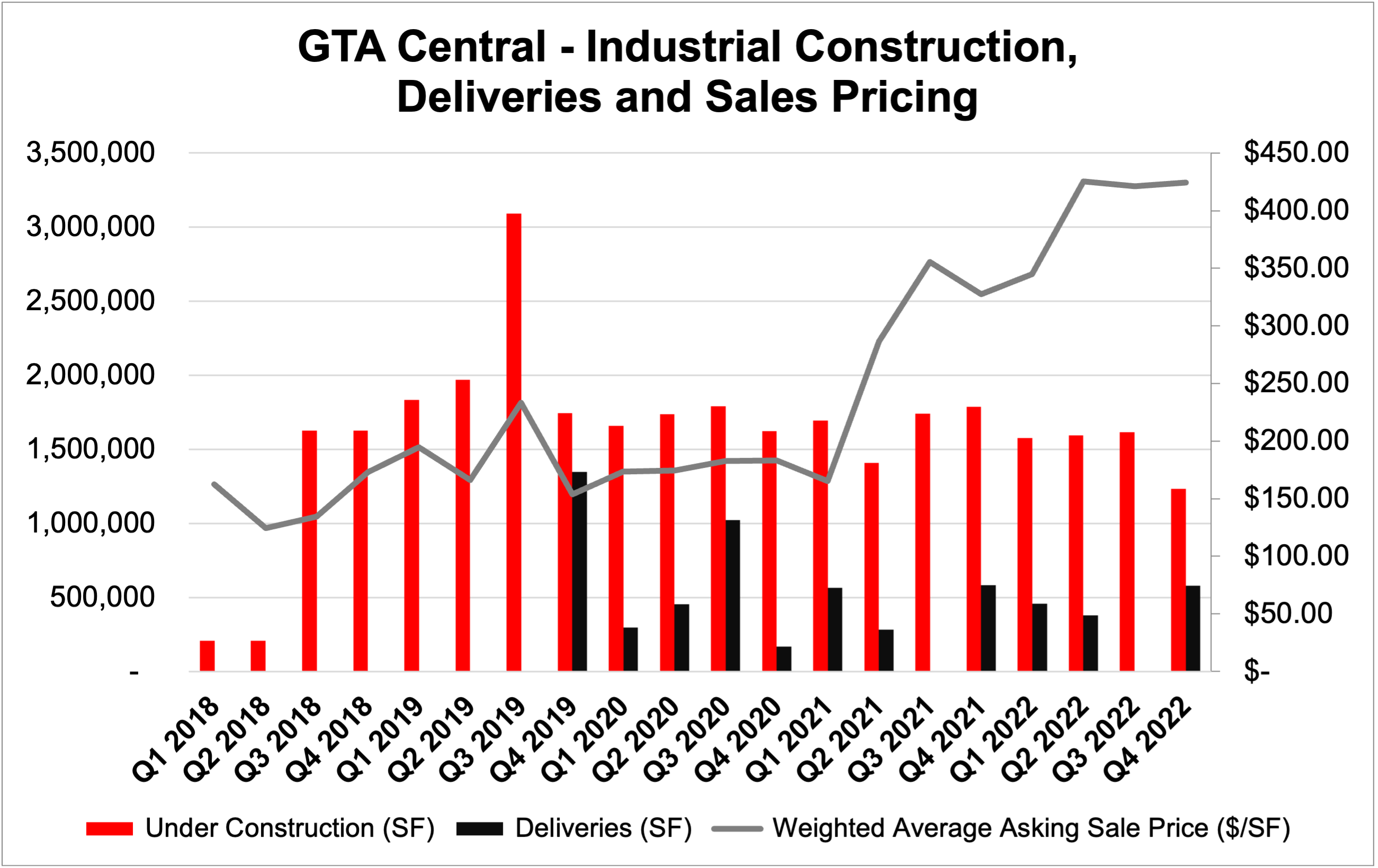

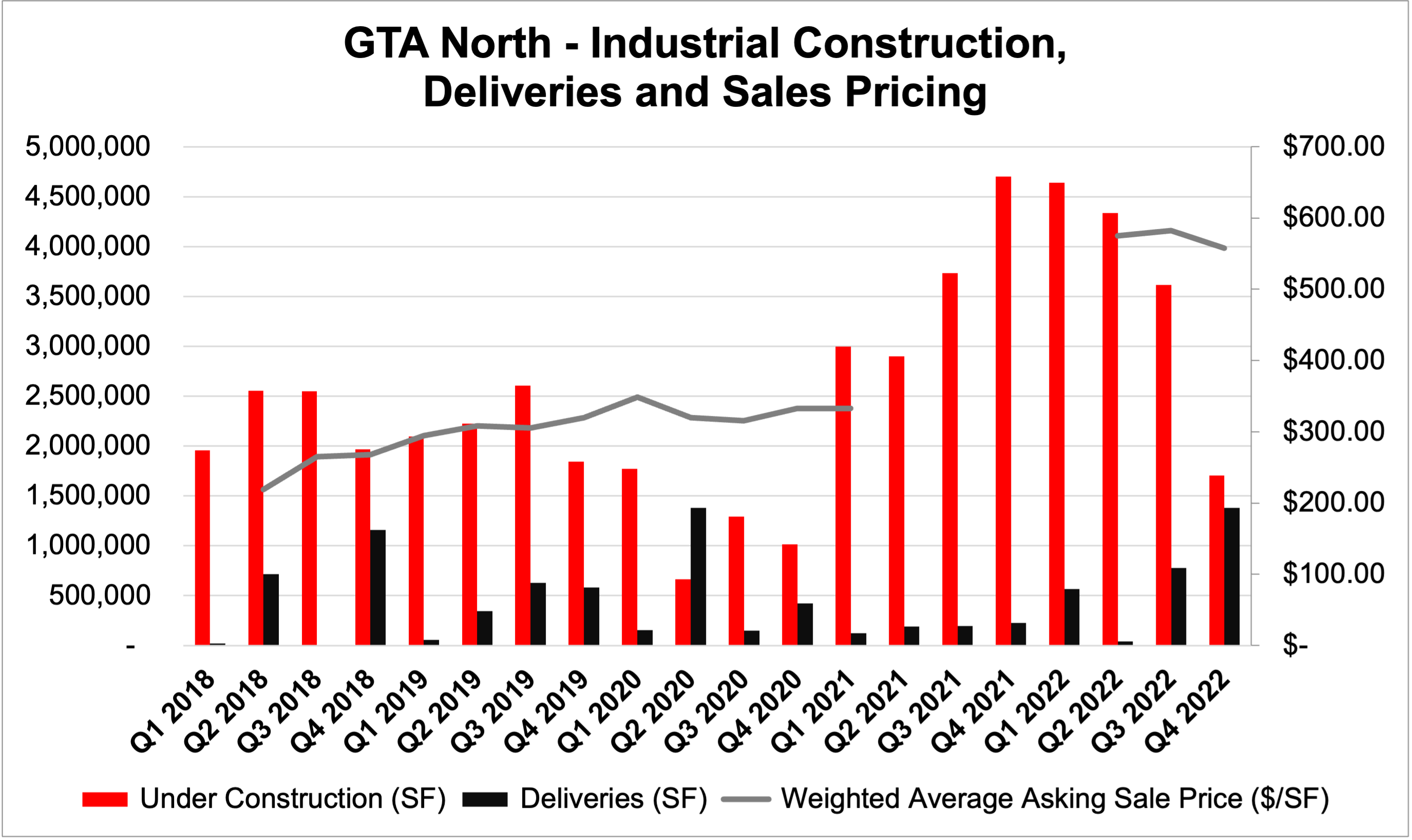

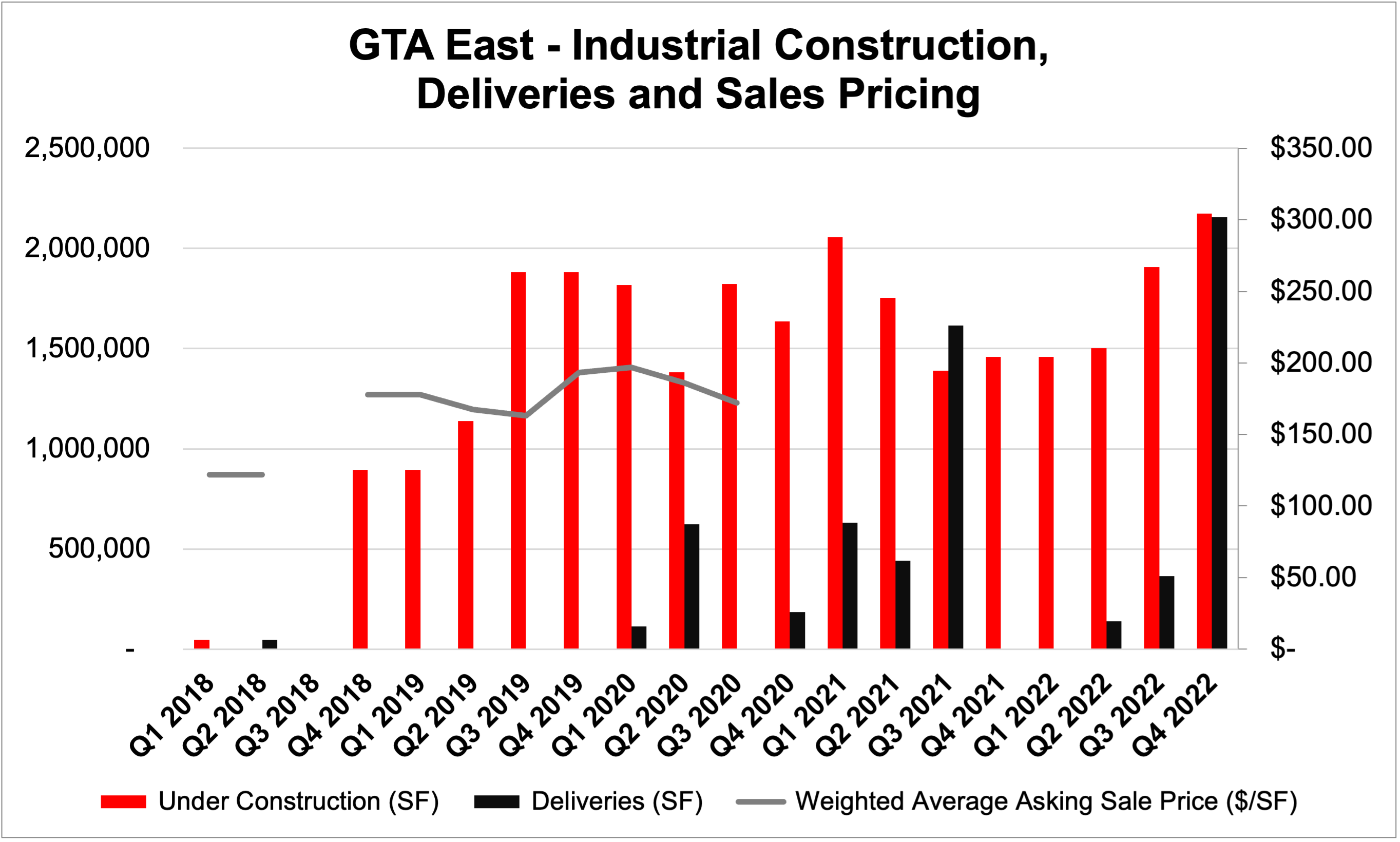

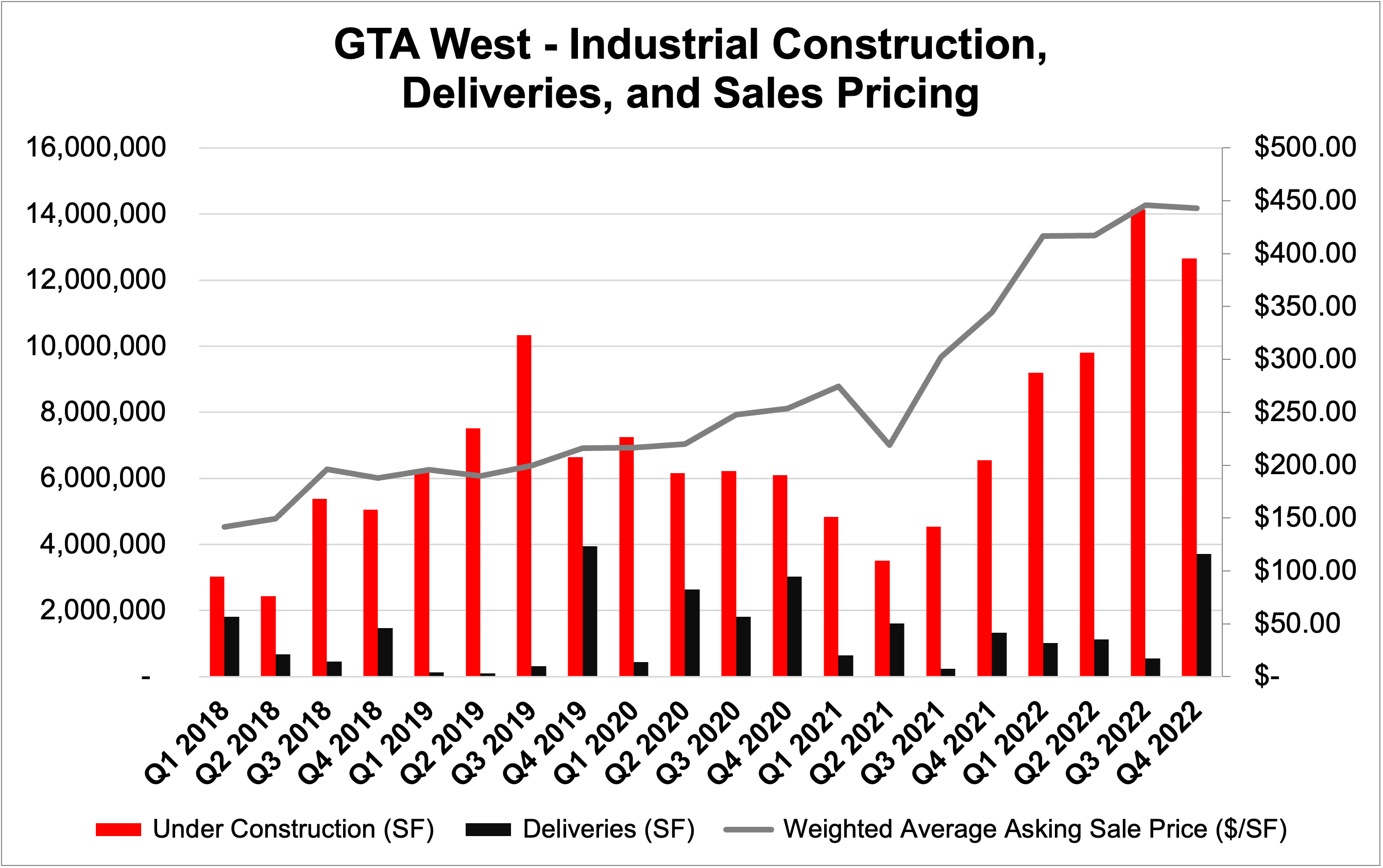

Below, we see the differences in industrial pipeline and weighted average sales pricing, broken down by Region.

What’s important to take away from these graphs is:

- The Central and East markets typically have less space under construction; the former due to its maturity and the latter due to its location, although the East has become more popular as of late with several sizeable industrial parks. One key difference: pricing. The Central markets are considerably more expensive due to land values – a result of competing land uses, location, and density.

- The North markets have seen a spike in pipeline due to major projects in Vaughan and business parks along Highways 400 and 404. Pricing is extremely strong, development charges are costly, and deliveries have been historically low for a Region in such high demand. The completion of the aforementioned projects will bring much needed supply, however, we expect the lion’s share to be pre-leased.

- The West markets are the largest and most consistent in terms of pricing, pipeline, and deliveries. Despite cyclical spikes and changes due to supply-side shocks, the West is predictable in that it will always perform. We expect nothing less from the industrial hub of Canada.

GTA Central Industrial Construction, Deliveries, and Pricing, 2018 to 2022. Source: Cushman & Wakefield.

GTA North Industrial Construction, Deliveries, and Pricing, 2018 to 2022. Source: Cushman & Wakefield.

GTA East Industrial Construction, Deliveries, and Pricing, 2018 to 2022. Source: Cushman & Wakefield.

GTA West Industrial Construction, Deliveries, and Pricing, 2018 to 2022. Source: Cushman & Wakefield.

Major Industrial Developments

Below, we are featuring a few major industrial developments either recently completed or currently in the pipeline.

- 5185 Garrard Road, Whitby – Broccolini & Concert Properties

5185 Garrard Road, Whitby. Source: Concert Properties.

Amazon Robotics has signed a 15-year lease on approximately 703,527 SF (518,731 SF with 184,796 SF mezzanine) of industrial space at 5185 Garrard Road in Whitby to house a robotics sortation facility. Concert Properties recently acquired the property from the developer Broccolini, who will continue as a 10% equity partner.

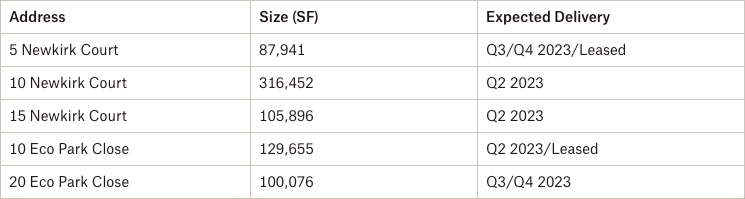

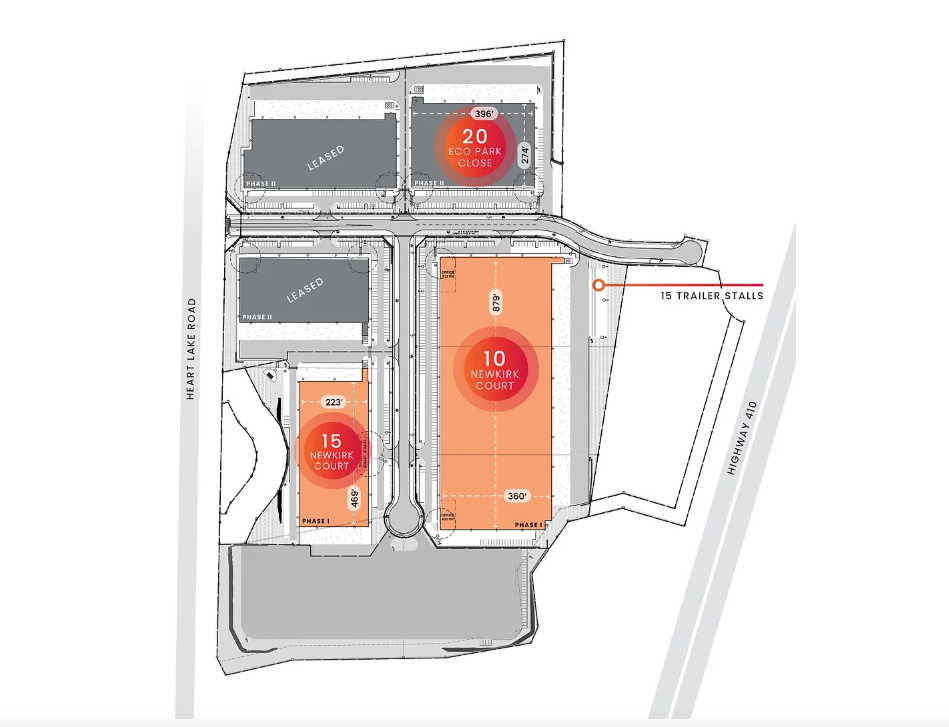

- Heart Lake Business Park – 5,10 & 15 Newkirk Court and 10 & 20 Eco Park Close – Fiera/Berkshire Axis

5,10, & 15 Newkirk Court and 10 & 20 Ecopark Close, Brampton. Source: Cushman & Wakefield.

Fiera Real Estate and Berkshire Axis are developing the Heart Lake Business Park in Brampton – touted as the submarkets few remaining greenfield developments.

The park is comprised of five buildings with 40 foot clear heights ranging from 87k SF and 316k SF; two of which are already leased (5 Newkirk Court and 10 Eco Park Close). Both 10 and 15 Newkirk Court are projected to be completed in Q2 2023, with 20 Eco Park Close slated for delivery in Q3/Q4 2023. For more information, please contact us.

- 40 Norelco Drive, North York – Triovest

40 Norelco Drive, North York. Source: Triovest.

Triovest completed the construction and lease-up of its 148,595 SF industrial facility at 40 Norelco Drive in North York in 2021. With direct frontage on Highway 400 and ample clear heights and shipping, this is a textbook example of a high-quality asset in a great location being taken as soon as it was available.

Conclusion:

Looking ahead, the industrial market continues to defy the broader economic uncertainty by remaining highly sought-after. Rising interest rates, insolvent banks, and a myriad of other macro concerns have not put a dent in industrial construction or values, yet.

As mentioned earlier, the delivery of a historic amount of industrial space as we enter talks of a recession may result in properties taking longer to lease and help with the stabilization of rents and values.

That said, given we are still at 0.9% availability, there is hardly any cause for concern. Owners and occupiers continue to look for industrial space in Southern Ontario for their reliability, simplicity, and as a hedge against equities, bonds, and currencies.

We may see a more strategic release of supply… However, yet again, at current pre-leasing rates, the GTA industrial market does not seem to dance to anyone’s beat but its own.

Next week, we’ll take a closer look at the industrial pipeline’s impact on availability and try to conduct our own forecast based on the numbers.

In the meantime, for a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com