March 24th, 2023

The Greater Toronto industrial market appears to be living in its own world.

Whether as a result of management or insulation, we have yet to see any persistent effects seeping through from the plethora of economic uncertainty and news around the world.

Rising interest rates – as we explored in previous issues – did result in a temporary drop in acquisitions through mid-2022 before bouncing back by end of year.

Prior to this, supply chain bottlenecks, labour shortages, and immense increases in construction costs did little to stop the emergence of the largest industrial pipeline we have ever seen.

Now, a crisis with certain financial institutions south of the border is brewing.

In economic theory, any sort of liquidity or credit crunch would directly impact consumers, and thus, play out in the retail markets. Coupled with rising interest rates, and both businesses and consumers will be less incentivized to make purchases. This domino effect could, again, in theory, lower consumer demand and result in lower demand for warehousing space.

Specifically, we already see headlines whereby manufacturers are destroying surplus inventory due to lower demand, higher storage and container costs, and a need to slash operating costs. Case in point, Funko is reportedly destroying between $30 and $36 million worth of toys to help reduce its additional $85 million in annual fulfillment expenses.

Regardless of these developments, up to this point, the GTA industrial market has absorbed new deliveries and maintained upward pressure on both rents and values. While we have seen a stabilization effect with respect to industrial rents, they continue to increase, with escalations priced in at around 4%.

Values, too, are increasing, and are in many cases defying the narrative of cap rates vs. interest rates because of the enormous long-term value of the assets themselves, coupled with long-term expectations of a reversion with respect to rates.

Whatever the reason (or reasons) may be for this resilience, it is critical to examine the main drivers and outcomes in the market to filter through the noise and try to forecast where we are heading.

For this week’s newsletter, we will analyze the GTA industrial market’s historical rental rates and growth data to gain a better understanding of how the market has evolved, and to help get a sense of what is to come.

GTA Historical Industrial Rents and Growth Analysis

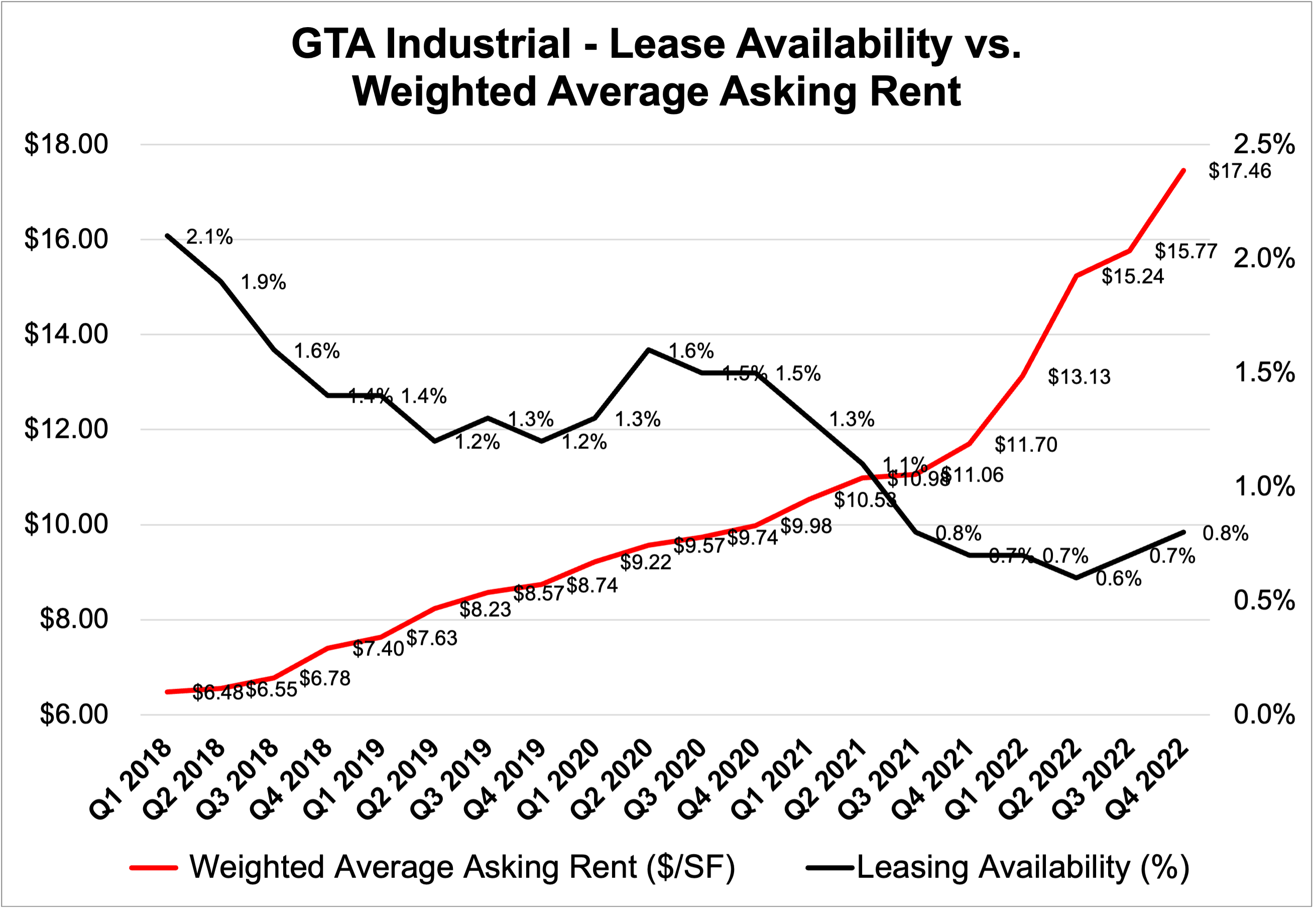

As you can see below, the weighted average asking rent has almost tripled since Q1 2018 from $6.48 PSF net to $17.46 PSF net, with the broader trendline sitting at over 30% year-over-year increases.

While rents are forecast to increase at more modest 10-15% levels and eventually revert to the mean of 2-4%, it is impossible to ignore just how quickly rental rates have ballooned over the last 5 years.

To add some context, depending on the asset, landlords are expecting to lease or renew in the $18 to $22 PSF net range; especially for new construction and well-located facilities.

Turning to availabilities, we observe a rapid tightening that began well before 2018 but then accelerated from the period of Q1 2018 to Q1 2020, where the availability rate plummeted from 2.1% to 1.2%. This may not seem like much of a drop, but breaking the sub-1% threshold is extremely difficult due to the ongoing churn and stream of oncoming deliveries. And as we will explore in future issues, this is exceptional given just how much industrial inventory is under construction and set to deliver in the coming 12-24 months.

Zooming in further, we then notice a slight bump as a result of the pandemic, followed by another major tightening from Q4 2020 through Q3 2022, which as we well know was caused by the rise of e-commerce and a multitude of supply-side challenges.

Looking ahead, we see an uptick in availabilities which we could attribute to the aforementioned wave of supply, coupled with general economic uncertainty. However, up to this point, this bump could be considered negligible as we remain at sub-1% levels.

GTA Industrial Availability vs Asking Rents, 2018 to 2022. Source: Cushman & Wakefield.

GTA Historical Industrial Rent Breakdown by Region

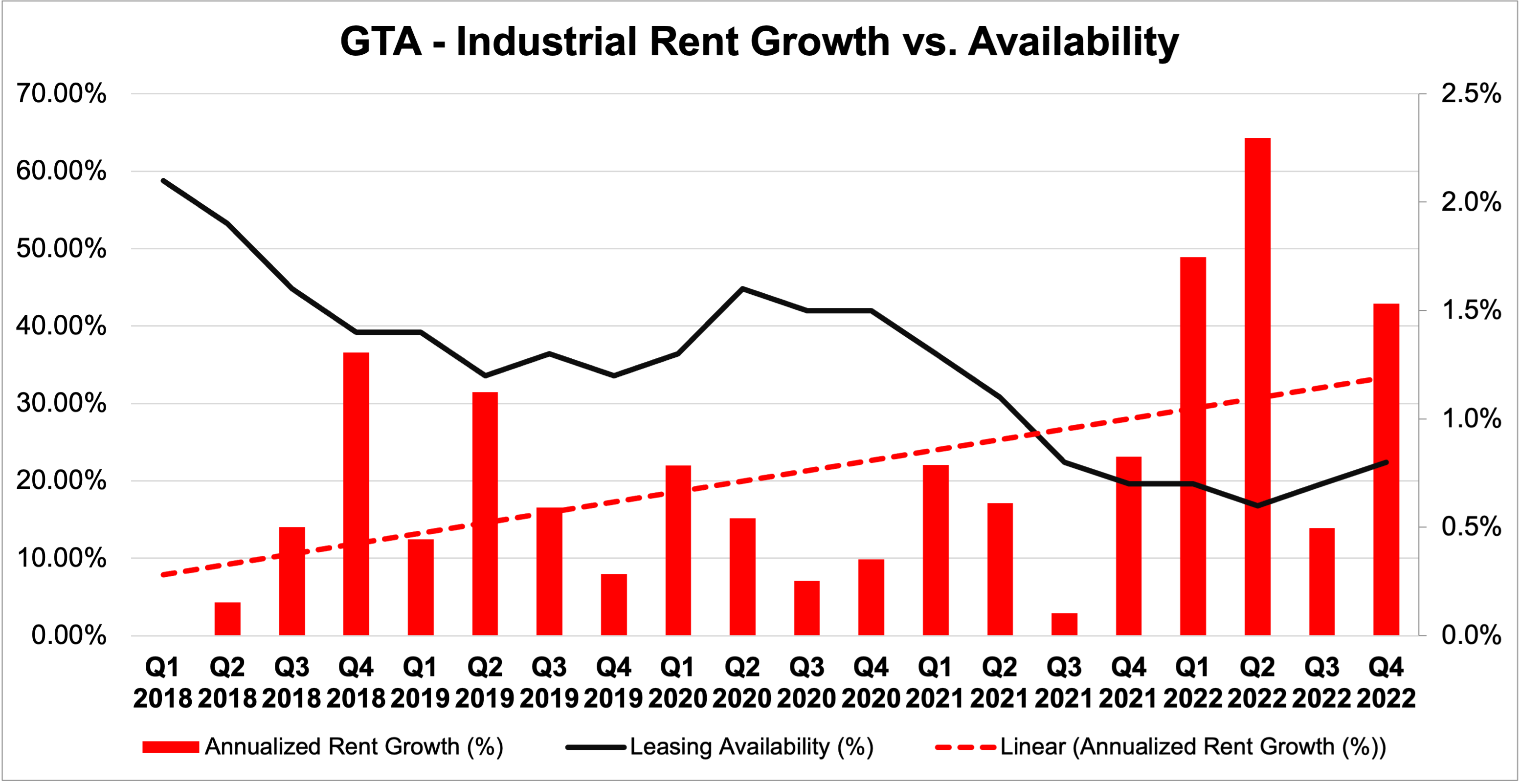

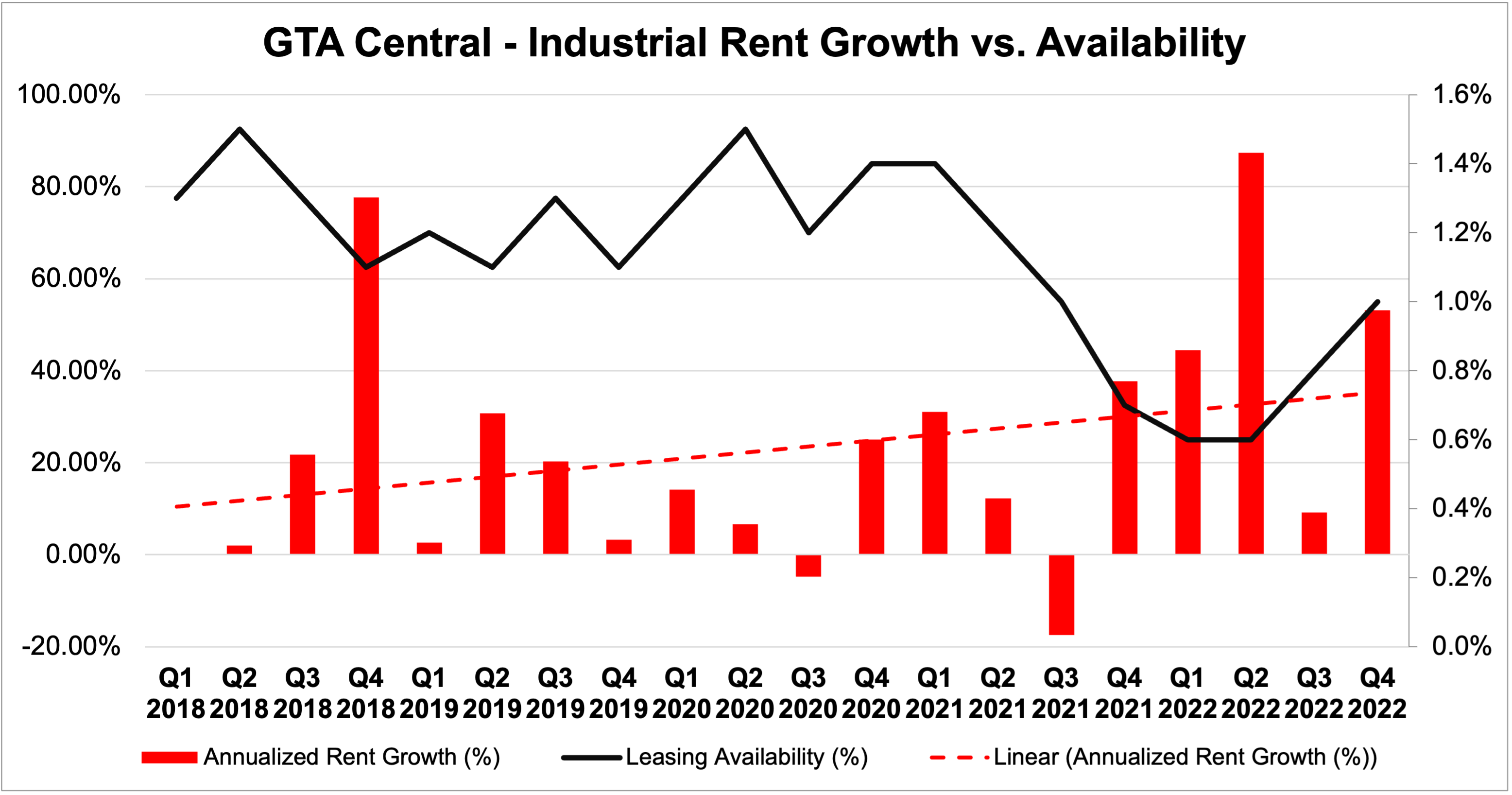

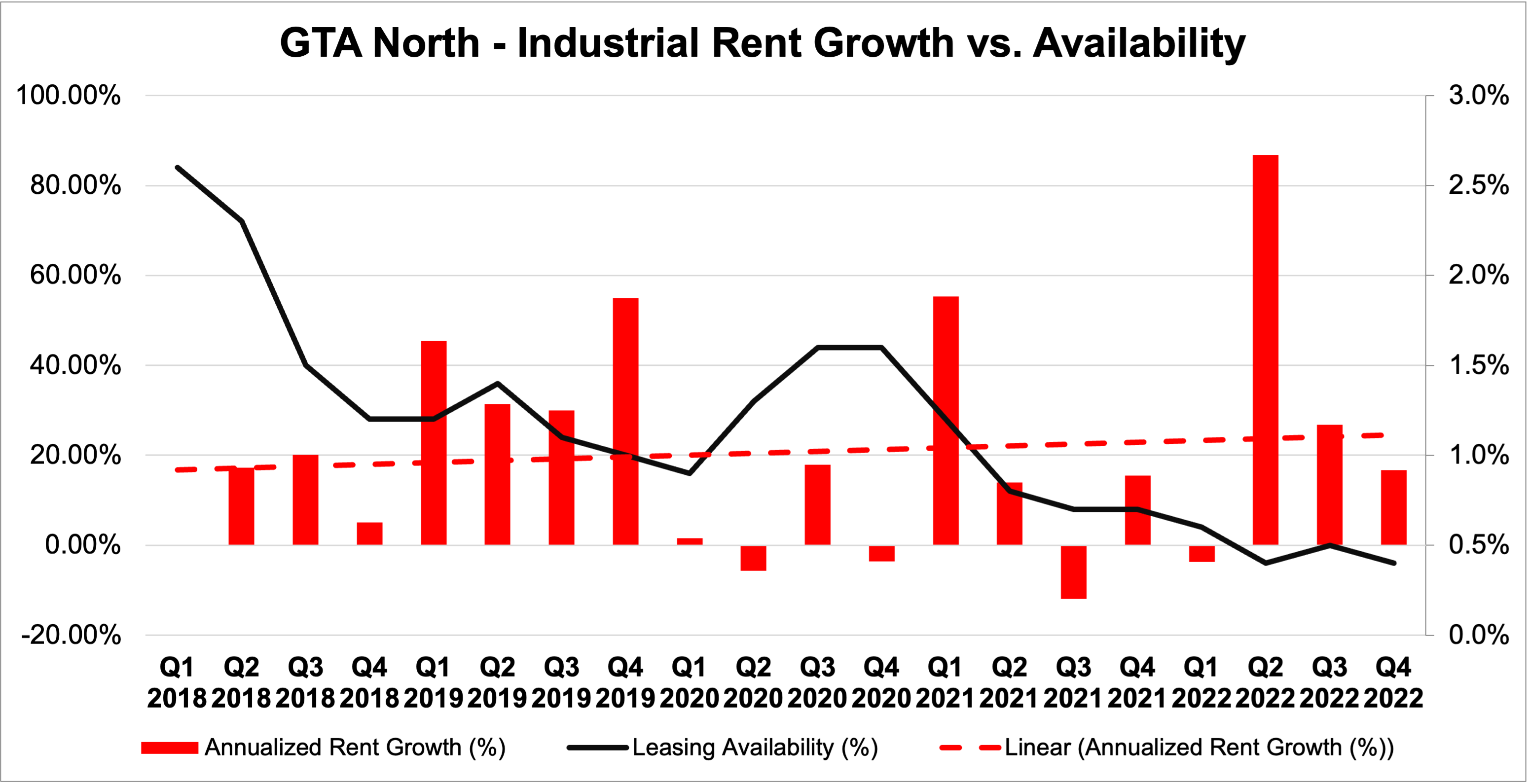

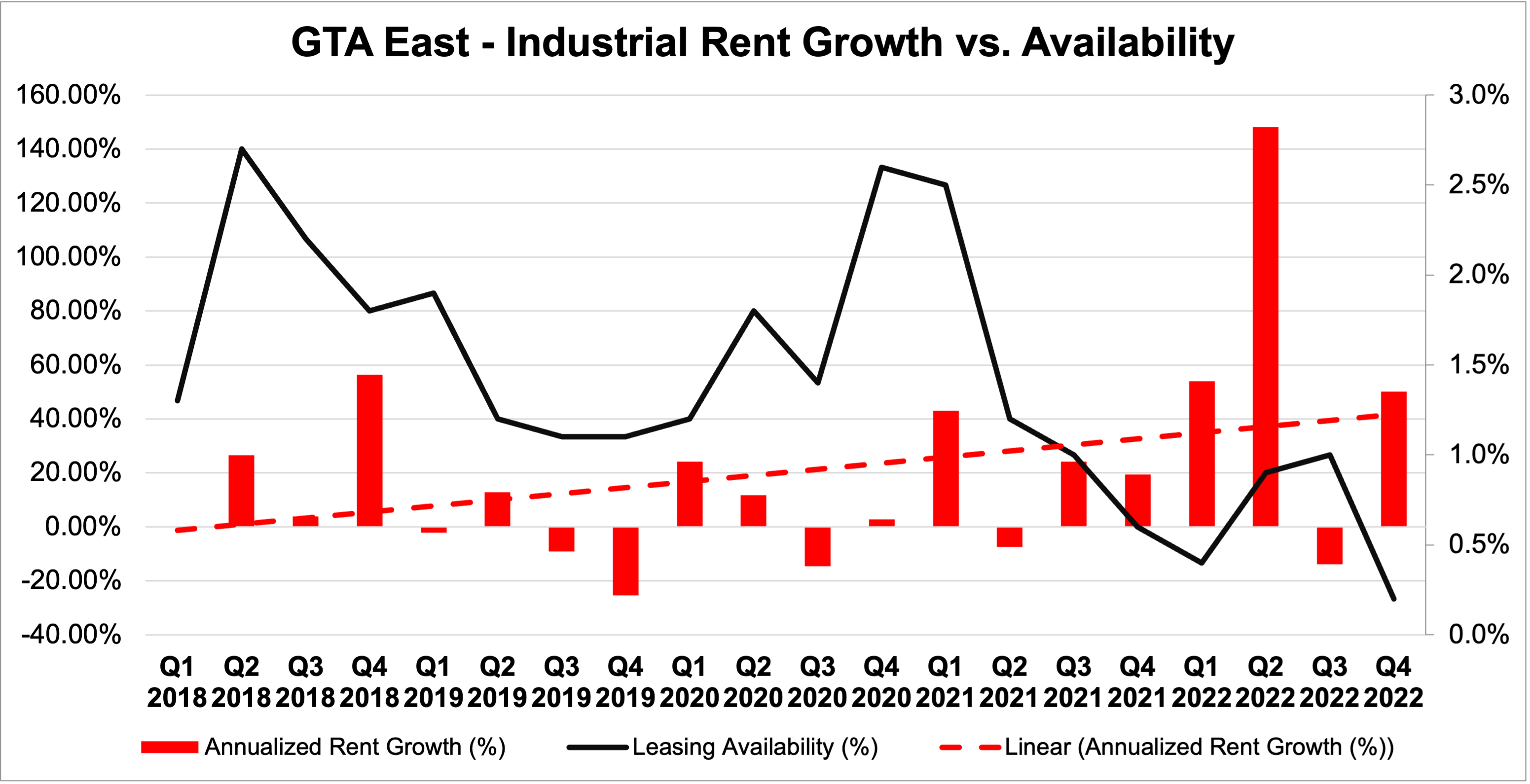

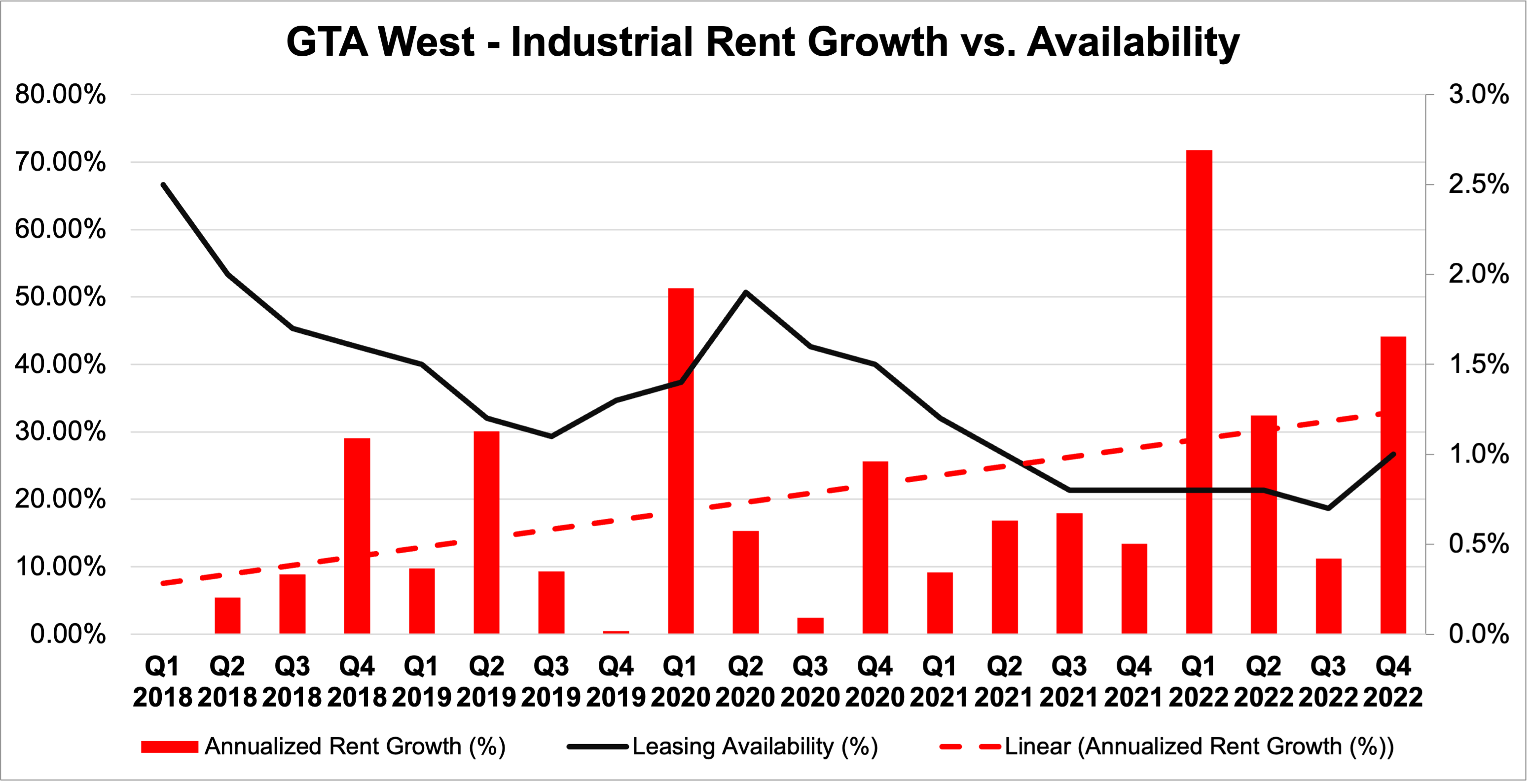

Below, we see the differences in weighted average rental rate PSF, as well as the quarterly rent growth by Region.

What’s important to take away from these graphs is:

- The Central markets lead all Regions at $17.65 PSF net, followed by the West at $17.52, the North at $17.26, and East at $14.63.

- The Central and West markets have close to 1% available, while the North and East markets have less than 0.5% available. This could be attributed to the generally smaller amount of inventory and rapid lease-up of any new construction.

- Rents in the East markets have grown the quickest, mainly as they continue to catch up with their counterparts, which have historically been much pricier.

- Rents in the North markets have historically been pricy due to limited inventory and the cost to develop. As a result, they remain high with more modest increases.

- The West markets show a steady quarter-over-quarter increase in rents with a predictable tightening of availability, only recently bumping up due to a flood of new construction that is largely pre-leased and expected to be absorbed quickly.

GTA Central Industrial Rent Growth vs. Availability, 2018 to 2022. Source: Cushman & Wakefield.

GTA North Industrial Rent Growth vs. Availability, 2018 to 2022. Source: Cushman & Wakefield.

GTA East Industrial Rent Growth vs. Availability, 2018 to 2022. Source: Cushman & Wakefield.

GTA West Industrial Rent Growth vs. Availability, 2018 to 2022. Source: Cushman & Wakefield.

Major Industrial Lease Transactions

- 10254 Hurontario Street, Brampton | 1.2M SF | Completed 2018 | Canadian Tire

10254 Hurontario Street, Brampton

Panattoni Development Company completed construction of a 1.2 million square foot industrial warehouse on 52.86 acres in 2021, which has become a national distribution centre for Canadian Tire Corporation.

According to the site plan, the modern facility is located north of Bovaird Drive on Hurontario Street, and includes 40 foot clear heights, 220 loading dock doors and 325 trailer parking stalls.

- 50 & 51 Keyes Court, Vaughan | 292,240 SF | Q3 2020 | Amazon

50-51 Keyes Court, Vaughan

In late 2020, Amazon announced it would open two new delivery stations totaling 292,240 SF over 2 buildings at 50 & 51 Keyes Court – in the heart of the Vaughan Enterprise Zone – with 2021 occupancy. Delivery stations are part of Amazon’s last-mile fulfillment strategy and have been constructed in key submarkets such as Kitchener, Stoney Creek, Etobicoke, and Scarborough.

- 2750 Morningside Avenue, Scarborough | 333,638 SF | Q4 2022 | Avenue Industrial Supply

2750 Morningside Avenue, Scarborough

Oxford Properties completed and leased a brand-new, state-of-the-art warehouse and distribution facility in Q4 2022. The 333,638 SF property has a 36’ clear height with 46 truck-level and 2 drive-in doors. Located close to Highways 401 and 407, the new tenant will have great access to transportation and the labour pool.

Conclusion:

Looking ahead, the industrial market continues to defy the broader economic uncertainty by remaining highly sought-after. Rising interest rates, insolvent banks, and a myriad of other macro concerns have yet had a significant impact on the leasing of industrial properties; especially modern, high-clear warehouses.

Despite the fact that availabilities have slightly increased, rents are increasing at a decelerating rate and users still have limited options. This fact creates a challenge when going through renewal or relocation negotiations – specifically when looking at older, small- and mid-bay properties.

With that said, the general stabilization of the market is bringing landlords to the table, who are interested in working to keep their portfolios fully-leased with no interruptions.

Whether you are looking to secure or fill space, successfully completing your objectives begins with having up-to-date market data, an understanding of available and competing inventory, and strategic insight into structuring and negotiating terms that are tailored to you. That’s where an experienced, street-level broker can provide additional guidance.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com