GTA Mid-Bay Industrial Portfolio Acquisition Spree

November 18th, 2022

We find ourselves at staring down an uncertain path ahead.

Both internal market forces and external economic headwinds are shaping the GTA industrial market.

The Greater Toronto Area has approximately 17 MSF of industrial properties under construction, as well as a reported 67 MSF of ongoing and pre-construction pipeline. Developers and institutional investors are rushing to produce inventory and capture demand, with the bulk being Class-A, Big Box warehousing and logistics facilities.

Increasing construction costs and low vacancies have all but locked in continued rent increases for the years to come. At the same, a softening economy may materialize as a pullback in demand or pushback from tenants looking to renew or lease space at rates double and triple that of just five to seven years ago.

Will the glut of incoming supply provide more leverage for users in negotiations as product sits? Or will everything be quickly and systematically absorbed through pre-leasing as is being predicted?

From the perspective of the Big Box segment, developers may be more cautious around competing pipelines and delivering on spec; perhaps opting to feel out the market and break ground with a tenant in tow. That said, with how robust new projects have pre-leased, it’s unlikely we’ll see a ton of slack for very long.

As we analyze the industrial market and observe just how competitive development has become, one may ask if there is another strategy that is simpler to execute and with less risk?

While all of the focus has been centred on mega-developments, the GTA has a sizeable supply of small- to mid-bay industrial properties and occupiers, with almost no vacancy whatsoever, a plethora of upcoming renewals to significant upside, and extremely limited pipeline as the product type offers less economies of scale and higher per-square-foot construction costs.

And as developers have to deal more with competition, issues surrounding zoning and official plans, and pricey industrial land and construction costs, acquiring small- and mid-bay properties at below replacement cost and with upside in rents may just be a more straightforward alternative strategy.

That is why, today, we will examine some of the largest small- to mid-bay industrial portfolio acquisitions of 2022, and what they mean for the market moving forward.

Blockbuster Industrial Portfolio Acquisitions

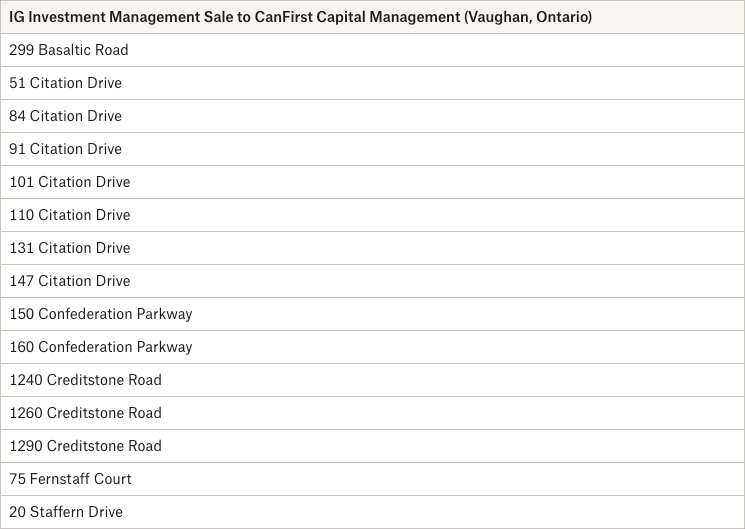

- November 2022 – CanFirst Capital Management’s Industrial Realty Fund VII LP acquired 13 industrial properties in Vaughan totalling 710,389 SF from IG Investment Management for $222.6 million.

In what is the latest blockbuster industrial portfolio acquisition, CanFirst has acquired a mix of 13 small- and mid-bay properties – all located within about a kilometre of one another in Vaughan at a price of $313 PSF.

What’s interesting to note is that, with a reported occupancy rate of 99.8% and a WALT of 2.5 years, CanFirst’s executives have stated that existing rents are at 50% of the current market rate.

This potential upside is a key factor in acquiring properties in any market, however, with the accelerating rental rates, this additional future rental income is gravy on top of assets which were secured at a great value (and likely below replacement cost).

- November 2022 – Through a joint venture, Dream Industrial REIT and Singapore-based GIC have acquired Summit Industrial Income REIT for $23.50 per share, or $5.9 billion in cash, representing a 31% premium on last closing price.

The acquisition, whereby Dream secured a 10% stake (with GIC retaining the other 90%), made waves throughout the Greater Toronto commercial real estate community.

According their Q3 reports, Summit owns or has a stake in 162 properties totalling 21.8 MSF, with $3.5 billion of unencumbered assets, a 99.6% occupancy rate with an average lease term of 5.5 years, and 14 buildings under development aggregating 2.5 MSF of potential GLA. Revenues from investment properties totalled $63.048 M in Q3 2022.

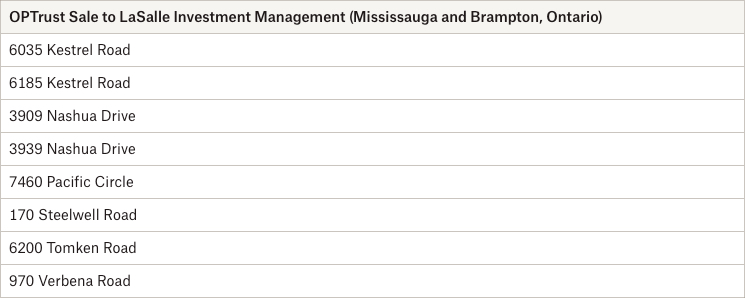

- October 2022 – Lasalle Investment Management’s BVK Canada Advantage Fund has acquired eight single- and multi-tenant industrial buildings totalling 397,948 square feet from OPTrust for $133.3 million.

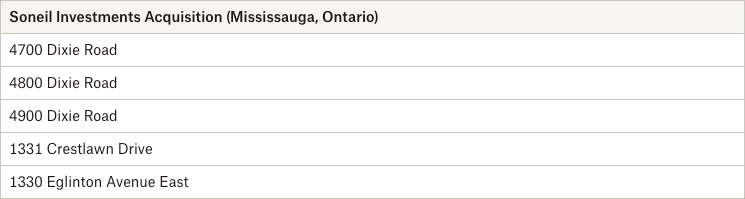

- August 2022 – Soneil Investments acquired a 5-property industrial portfolio totalling approximately 140,000 SF for $46 million.

- May 2022 – KingSett Capital acquired 16 single-tenant buildings and 5 multi-tenants buildings totalling 1.47 MSF from Sagitta for $461 million.

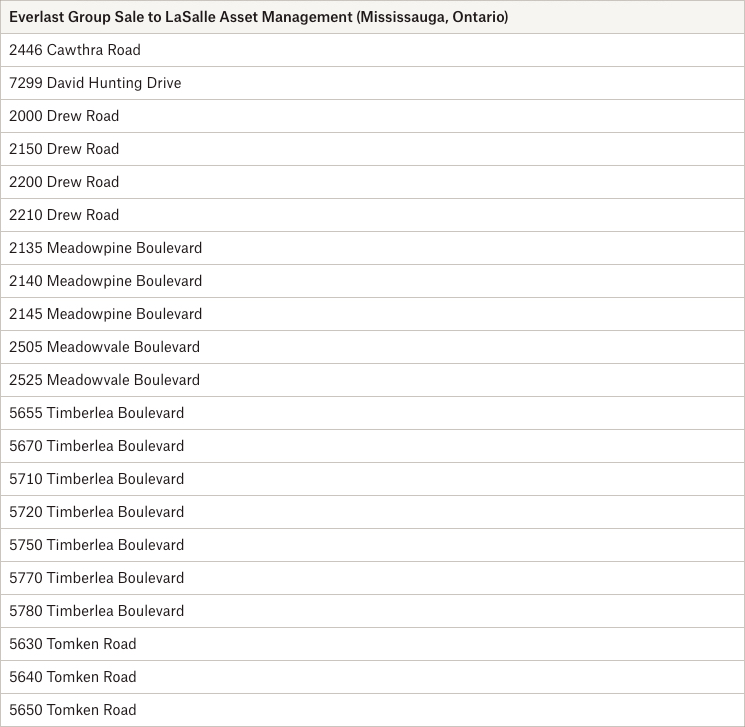

- June 2022 – LaSalle Canada Property Fund, in conjunction with an unnamed European investor, acquired 21 mid-bay industrial buildings totalling approximately 810,000 square feet from Everlast Group for approximately $295 million.

Given the healthy appreciation in rents, as well as the continued demand for industrial product, it’s no surprise that institutional developers are looking to acquire cashflow while adding assets with long-term value upside.

Despite the fact that the GTA has approximately 17 MSF of industrial properties under construction, as well as a reported 67 MSF of ongoing and pre-construction pipeline, this looming mass of space has not deterred investors or developers from buying or building.

Will changing economic conditions see rents and values soften as tenants see more available options in the coming years? Perhaps. Will this incoming glut of inventory flip the script on landlords, who have largely been in the driver’s seat these past 5 to 7 years?

It would take a significant trend of defaults or downsizing, with the resulting negative absorption, for any major uptick in vacancies to materialize. Even then, a worst-case scenario may not take us much past 3 or 4 percent; a fairly healthy metric for any industrial market.

What would happen before the AAA-covenant tenants or capital-flush institutions pivot course is the crowding out of smaller investors and businesses occupying space. And in practical terms, as we have discussed before, we would sooner observe a bifurcation in the market, whereby small- to mid-bay would see its own dynamics and pricing at play compared to Big Box, Class A warehouses taken by large users.

Even with that said, as shown above, we have recently seen a flurry of portfolio sales of small- to mid-bay as some private landlords cash out. This means the positive trajectory in rents and values is unlikely to change in the coming months and years, although we do expect their acceleration to slowly stabilize.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com