June 2nd, 2023

“The Renaissance took place in chaos and plague.”

While nothing as dramatic took place in Hamilton, the sixth-largest city in Canada has certainly seen its ups and downs over the past hundred and twenty years.

The early 20th century saw major companies such as Stelco and Dofasco (reportedly producing 60% of Canada’s steel at one point), Procter & Gamble, and the Beech-Nut Packing Company set up shop. This was followed by infrastructure such as McMaster University, the Burlington Skyway, an international airport (Canada’s busiest cargo/freight airport), and Ontario’s busiest port.

Since the 1960’s or so, however, the manufacturing prominence of the city went into decline. Although it has always been a beautiful city to live and work in, its industrial market lagged behind the GTA and was characterized more by older, small-bay product and as a regional distribution hub and stopover point on the way to the US border.

It is also because of this strategic location and access to ‘rail, road, and water’ that it has begun its own industrial renaissance.

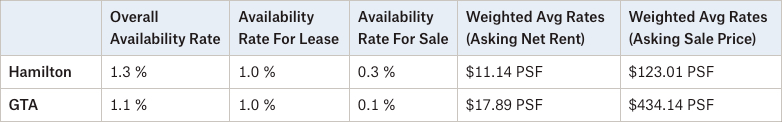

About five years ago, Hamilton was truly ‘second choice’ relative to the GTA. Now, due to the lack of space and cost to purchase, lease, and construct, it has seen strong interest from tenants, as well as major investment. Looking at the differences in asking net rents and sales pricing, it’s not difficult to understand why.

Initially led by developers such as Panattoni, who are bringing online at least 2 million square feet of industrial space in the area, we recently saw Slate Asset Management acquire 800 acres from Stelco for $518 million with newly unveiled plans to build Steelpoint – the major redevelopment that will see up to 12 million square feet of industrial space coming online.

These announcements are not the end of the story; it is only beginning.

And we have seen a similar story in several submarkets adjacent or in proximity to the GTA – an opportunity to revitalize and expand.

That’s why, in the coming weeks, we will analyze a number of sought-after periphery markets within the broader Greater Toronto Area and Greater Golden Horseshoe. We will aim to provide some deep insight into each, as well as provide some detail on potential opportunities that may fit in with your real estate or investment strategy.

For this week’s newsletter, we’ll feature the City of Hamilton and examine the state of its industrial market, including trends, transactions, and developments.

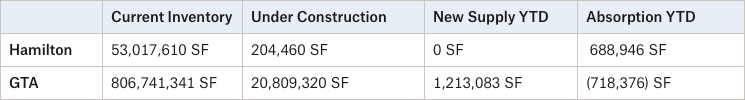

Hamilton Industrial Market Snapshot – Q1 2023

Source: Cushman & Wakefield Research.

Looking at the numbers, we have over 806M SF of industrial space across the GTA; yet Hamilton has just over 53M SF of inventory. This disparity, however, is changing rapidly and the broad-stroke statistics are not indicative of the real situation on the ground.

Despite the number of proposed, under construction, and recently delivered projects, space is tight. We expect values to remain below that of the GTA, although they should continue to increase due to tenant demand and the elevated cost to construct and borrow.

Located approximately an hour and twenty minutes south-west of Toronto along Lake Ontario, the City of Hamilton is strategically situated along major transportation routes, such as Highway 403 and the QEW. Further, it boasts the Great Lakes’ busiest port and possesses its own international airport; with its cargo and freight operations the largest in Canada.

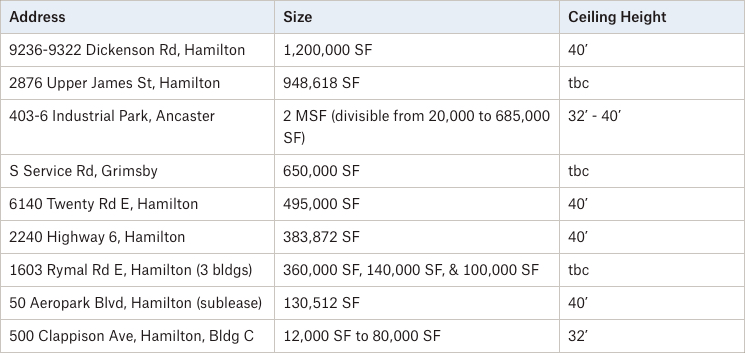

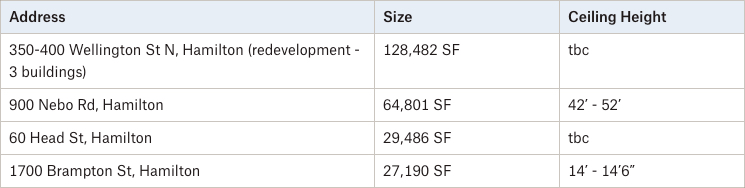

Below, we are featuring three of the most recent, larger, state-of-the-art distribution facilities that are either under construction or in planning stages.

9236-9322 Dickenson Road. Source: Panattoni.

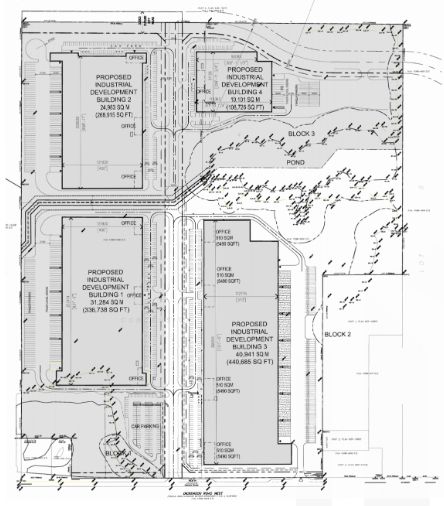

Panattoni is developing an industrial park adjacent to Hamilton International Airport comprised of four freestanding buildings totalling 1.2 million square feet.

The properties will range in size from 110,000 to 440,000 square feet, divisible to 50,000 square feet. Phase 1 of construction will see a 439,060 square foot warehouse with 40 foot clear height and 62 truck-level doors going up this year.

2. 2876 Upper James Street – 948,618 SF – Development

2876 Upper James Street. Source: Rice Group.

Steelport. Source: Slate Asset Management.

Slate Asset Management purchased the 800-acre, former Stelco site at 386 Wilcox St in Hamilton for $518 million. Now, the developer has unveiled its vision for ‘Steelport,’ a “ world-class industrial park connecting rail, road, and water in the historic port of Hamilton, Canada.”

The massive undertaking is expected to create 23,000 new jobs across the GTHA, inject $3.8 billion into Ontario’s economy over the next decade, and re-activate 3,400 metres of Lake Ontario waterfront. Current zoning would allow Slate to develop up to 12 million square feet of industrial space. What happens next has investors and occupiers across the region anxiously waiting.

Conclusion

With the Greater Toronto Area noticeably more expensive than some of its counterparts, such as the City of Hamilton, it is no wonder that businesses and investors have turned their eyes to what is one of the most sought-after municipalities for industrial development.

The GTA itself will continue to command premium rents and pricing which will be paid by investors and occupiers looking to remain in one of North America’s premiere markets. That said, acquiring or leasing is difficult to execute due to competition and cost. As Hamilton attracts people leaving the big city, businesses and capital are following close behind.

The Steelport development, along with the myriad of Class-A, modern warehouses being built along the QEW and Highway 403, seem to be just the beginning of an industrial renaissance taking place.

In the coming weeks, we will continue our examination of various submarkets with the aim of uncovering potential opportunities and strategies for industrial Owners and Occupiers. In the meantime, if you are an owner of industrial land or property with redevelopment potential, there are plenty of institutional and private buyers who would be willing to pay a premium to take it off your hands.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com