Establishing True Valuations Across Different Markets and Building Types Across the GTA

At this time of year, every brokerage comes out with their Market Stats, an overview of 2018, as well as the Outlook for 2019. In essence, they are looking back to be able to predict the future.

So here it is: Market Stats for the Greater Toronto Area – Q4 2018

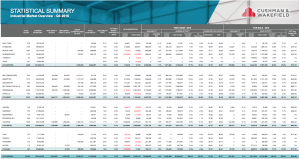

Q4 2018 Market Stats – Credit: Cushman & Wakefield ULC

GTA Overall Vacancy Rates

Vacancy rates in the Greater Toronto Area plummeted to 1.5% of the overall inventory – a new historical low. Just one year ago, vacancy rates were at 2.4%.

Based on the supply of new properties and unprecedented demand, we expect vacancy at even lower rates by the end of the first quarter of 2019. Vacancy rates for leasing are at about 1.4% while only 800,000 SF of the overall inventory in GTA is available for sale – or to put that into perspective, just a staggering 0.1%.

GTA Average Net Rent

All of the above has caused the GTA average net rent to climb to $7.40 PSF, again, a new historical high. As it continues on its upward trajectory we can expect even higher net rental rates.

GTA Development Pipeline

In 2018, developers in the Greater Toronto Area produced 6.3 Million SF of new buildings. With absorption of over 9.5 million, and given the gap of about 3.2 Million SF, it is no surprise as to why net rental rates are on the rise. This has caused a lot of capital to move into the arena and accelerate construction of new product, reaching a rate of 9.5 Million SF at the end of 2018.

Q4 2018 Market Stats – Credit: Cushman & Wakefield ULC

GTA Property Values

With vacancy rates for sale being only about 0.1%, the WTD Average sale price in the Greater Toronto Area climbed to $193.58 PSF.

Being able to understand general trends is great, but you may be asking yourself…

“How much is my property really worth?”

What rental rate can I expect? How much PSF would I be able to get if I sold my building?

These questions are being asked all the time. Well, it depends on many factors, including the age and size of the building, lot size, ceiling height, office component, parking, trucking access, truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper in each submarket.

So let’s start this week with our first submarket profile.

Toronto Central (Toronto, North York, York, East York) Markets

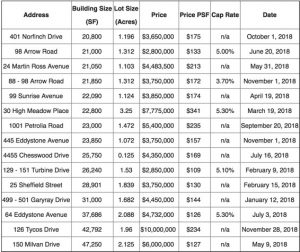

Properties Sold in 2018, Size Range 20,000 – 50,000 SF

In 2018, a total of 15 properties between 20,000 – 50,000 SF were sold. The prices achieved were in the rage of $109 – $341 PSF, with an average building size of 27,737 SF and an average price of $175 PSF.

555 Oakdale Road, Toronto

Toronto Central (Toronto, North York, York, East York) Markets

Properties Sold in 2018, Size Range 50,000 – 100,000 SF

Further, in 2018, a total of 6 properties between 50,000 – 100,000 SF were sold. Prices achieved were from $108 – $265 PSF, with an average building size of 58,947 SF and an average price of $157 PSF.

150 Milvan Drive, Toronto

Toronto Central (Toronto, North York, York, East York) Markets

Properties Sold in 2018, Size Range 100,000 SF plus

When looking at properties larger than 100,000 SF, a total of 3 sold in 2018. Prices achieved were from $51 – $78 PSF, with an average building size of 128,642 SF and an average price of $66.67 PSF.

724 Caledonia Road, Toronto

To be continued with Toronto Central leasing activity…..

CONCLUSION:

So, how much is your property really worth?

What rental rate can you expect or how much PSF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

For a confidential consultation or a complimentary Opinion of Value for your property, please give us a call.

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.