Establishing True Valuations Across Differing Markets

What is the overall sentiment of the industrial investment market in the Greater Toronto Area?

Well, that’s a great question that can be broken down further.

Looking squarely at the numbers, it generated sales in excess of $900M in Q2 2019 and $800M in Q1 2019, meaning we are on pace for a record year.

Why are smart people investing in the industrial market (AND the GTA in general)?

Industrial product is the flavour of the month, because of:

- An incredibly low number of available offerings on the market,

- It is a simple product with incredible demand driven by e-commerce and retail supply chain, and

- Toronto is experiencing some of the largest growth in rental rates among all North American markets.

And so, if you can’t find any industrial investment product, you’ll likely have to build to enter the market.

Whether it be through:

- greenfield,

- brownfield, or

- infill sites.

Thus, developers and investors are looking to acquire land anywhere from 100s of acres on the outskirts of the city to just 5-10 acres which is suitable for infill development.

In addition, big funds are building on spec and leasing to e-commerce and retail operators, thus creating value.

You just may come across an opportunity to purchase, however, those are far and few in between.

Yet if you are one of the landlords or investors observing the market and wondering if now is the opportune moment…

When it comes time to actually sell your industrial investment property, you may be wondering…

“How much is my property really worth?”

What cap rate can I expect? What end value will this result in?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- asset quality,

- tenant quality,

- lease term,

- lot size,

- rental rates,

- location, or the

- highest and best possible use, etc…

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Greater Toronto Area Investment Sales for Q2 2019.

Before you dive into the tables, you will notice that much of the investment activity was led by PIRET, Bentall Kennedy, as well as Canfirst Capital Management and Berkshire Axis Development.

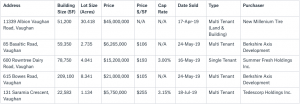

GTA North Markets (Markham, Richmond Hill, Vaughan, Aurora & Newmarket)

Properties Sold between April 2019 – June 2019 larger than 20,000 SF

Featured above are a number of significant investment sales completed in the Greater Toronto-North markets.

The Cap rates reached a low level of 3.0%-3.15%.

The main reason for this is the ability of an investor to improve the Net Rental rates already in place to (considerably higher) current Net Rental rates within a relatively short period of time.

In addition, the motivation of the purchaser (being an end-user) acquiring a property based on a short term sale-leaseback with plans to occupy later on can further accentuate this.

Stable assets typically generate lower Cap rates, in high-3’s (%) or low- to mid-4’s (%), depending on the asset and location.

615 Bowes Road, Vaughan

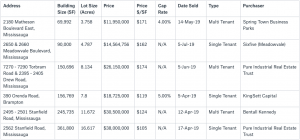

GTA West Markets (Mississauga, Brampton, Oakville, Caledon & Burlington)

Properties Sold between April 2019 – June 2019, larger than 20,000 SF

Featured above are a number of significant investment sales completed in the Greater Toronto-West markets.

The Cap rates achieved were between 4.0%-5.0%.

- The property at 2562 Stanfield Road was acquired based on a sale-leaseback, however, it also represents an excellent infill site for potential future redevelopment.

- A few major investment funds – including Pure Industrial Real Estate Trust (PIRET) – continue to be active buyers in this tight market.

2562 Stanfield Road, Mississauga

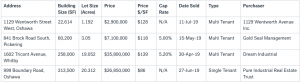

GTA East Markets (Ajax, Pickering, Whitby & Oshawa)

Properties Sold between April 2019 – June 2019, larger than 20,000 SF

Featured above are a number of significant investment sales completed in the Greater Toronto-East markets.

The Cap rates achieved were between 5.0%-5.20%.

- It appears to be that investment transactions completed in GTA East markets are more “affordable,” with higher Cap Rates and a lower average price PSF.

1602 Tricont Avenue, Whitby

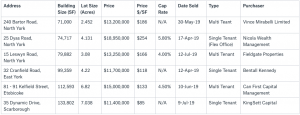

GTA Central Markets (Etobicoke, North York, East York, York, Toronto & Scarborough)

Properties Sold between April 2019 – June 2019, larger than 20,000 SF

Featured above are a number of significant investment sales completed in the Greater Toronto-Central markets.

The Cap rates achieved were between 4.0%-5.80%.

- The property at 240 Bartor Road was sold to a private investor that will, following the completion of the transaction, be converted into industrial condominiums and offered for sale on an individual basis.

- The property at 15 Leswyn Road was sold to a private investor looking to renovate and reposition to a higher and better use.

- Nicola Wealth Management, an Investment fund from Vancouver was the successful winning bidder for a single-tenant flex-office property located at 25 Dyas Road.

25 Dyas Road, North York

Conclusion:

As discussed previously, the GTA market continues to perform well. Vacancy rates are, in some areas, sub-1%; with increasing rental rates and CAP rates continuing to compress.

We seem to re-iterate the point (once again) that we have not seen anything like this in the past. Overall, Toronto is becoming a leader among markets in North America for investors that are upgrading their portfolios.

Seasoned investors are adjusting their portfolios and selling some non- or lesser-performing assets while looking to reinvest that money into newer facilities.

Private investors are considering selling their assets for different reasons; and this might be the best and most opportune time to do so, given the very low supply (almost non-existent) and the great demand for any kind of investment product in Toronto.

That all being said, having the right team of advisors on your side is crucial to maximizing the value of your investment(s).

For a confidential consultation or for complimentary opinion of value of your property please give us a call.

Until next week….

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.