Identifying and Analyzing Trends Across Sub-Markets…

Unlike most years when we see lots of ongoing activity, the current environment is marked by an ever-tightening market and lack of product.

What this means is that we are seeing a pool of hungry buyers, ready to pounce on opportunities that may (or may not) arise.

And so, as we come to the end of another quarter, we have very few transactions to report given the market size.

When examining the values, rates, and happenings in such an out-of-equilibrium state, one should take these numbers with a grain of salt – as they may be both distorted and statistically insignificant.

If you are a landlord or investor looking to properly evaluate and assess what your building is worth right now – today – it may be prudent to look deeper into each sub-market, as well as taking into accounting any prevailing trends.

Even then, many trades are occurring in uncharted territory; a place ripe for receiving multiple, competitive, record-breaking, firm offers… if you have the right strategy, timing, and team in place.

You may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time. The answer will depend on a range of factors, including the age and size of the building, lot size, ceiling height, office component, parking, trucking access, truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-North Markets (Vaughan, Markham, Richmond Hill, Newmarket & Aurora)

Toronto North Market (Vaughan)

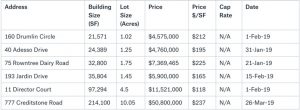

Properties Sold between January 2019 – March 2019, Size Range 20,000 SF plus

In 2019, a total of 6 properties were sold. The prices achieved were in the range of $118 – $237 PSF, with an average building size of 70,993 SF and an average price of $192 PSF.

777 Creditstone Road, Vaughan

Toronto North Market (Vaughan)

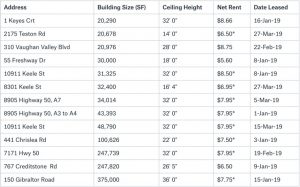

Properties Leased between January 2019 – March 2019, Size Range 20,000 SF plus

Asking Net Rental Rates*

On the leasing side, a total of 13 properties were leased. The net rental rates achieved were from $5.60 – $8.66 PSF, with an average building size of 96,389 SF and an average net rental rate of $7.58 PSF.

7171 Highway 50, Vaughan

Toronto North Market (Markham, Richmond Hill, Newmarket & Aurora)

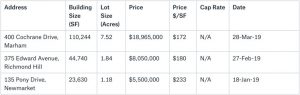

Properties Sold between January 2019 – March 2019, Size Range 20,000 SF plus

A total of 1 property was sold in Markham. The prices achieved is $172 PSF, with a building size of 110,244 SF and a price of $18,965,000.

A total of 1 property was sold in Richmond Hill. The prices achieved is $180 PSF, with a building size of 44,740 SF and a price of $8,050,000.

1 property was sold in Newmarket. The price achieved is $5,500,000, with a building size of 23,630 SF and a price of $233 PSF.

In Aurora, there were 0 properties sold this quarter.

375 Edward Avenue, Richmond Hill

Toronto North Market (Markham, Richmond Hill, Newmarket & Aurora)

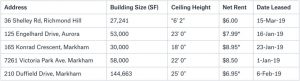

Properties Leased between January 2019 – March 2019, Size Range 20,000 SF plus

Asking Net Rental Rates*

On the leasing side, a total of 1 property was leased in Richmond Hill. The net rental rate was $6.00 PSF, with a building size of 27,241 SF.

There were 0 properties leased for this quarter in Newmarket.

In Aurora, 1 property was leased. The net rental rate was $7.99 PSF, with a building size of 53,000 SF.

A total of 3 properties were leased in Markham. The net rental rates achieved were from $6.95 – $8.95 PSF, with an average building size of 77,554 SF and an average net rental rate of $8.13 PSF.

210 Duffield Drive, Markham

Conclusion:

Looking back at the North markets for the first quarter, we see more of the same in terms of high demand and low supply.

However, Vaughan, in particular, seems to define the North as the strongest sub-market, with Markham and Richmond Hill in second and third place, respectively.

Vaughan has the highest values in the GTA, with the lowest vacancy rates, record low CAP rates and pricing per square foot.

Word on the street is that several properties are coming to the market asking net rental rates in the low teens… almost double what they were even only a year ago.

Sometimes change doesn’t happen gradually, but rather, the buildup of pressure cooks and cooks despite everyone agreeing that prices should remain the same… until they wake up and agree that things are different.

Based on the current forces and trends, we can only expect values and rents to continue to increase.

So, how much is your property really worth?

What rental rate can you expect or how much PSF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

What levels in price are achievable for you will depend on your specific situation.

For a confidential consultation or for a complimentary opinion of value of your property please give us a call.

Until next week….

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.