Establishing True Valuations Across Differing Markets

Overall, the GTA Central Markets were on fire this quarter, with more than 2.2 million SF transacted, leased or sold; 57% of which took place in North York alone! We have seen investment sales, large sales as part of business transactions, the consolidation of Apotex’s portfolio, sales to existing tenants, etc…

With a severe lack of investment product on the market, developers, REITs, pension funds, private investors, life insurance companies and users alike are looking for sites across Scarborough, North, York, and Etobicoke. Everyone’s goal is to acquire land for development with a preference for constructing the largest building (warehouse) possible due to the per-SF discount on construction costs.

Especially considering that demand for distribution centres of every size is strong, and there is not much of a spread in net rental rates between smaller and larger buildings…. plus most of these sites are built on spec and pre-leased prior to the commencement of construction.

Key Takeaways from Q3 2019

- Investors are looking for product; to buy or create

- Massive transactions are taking place despite the historic-low availability rate

- Availability rates were stable at 1.5%, although it’s still incredibly tight with only 0.2% of inventory available for sale, despite the fact that North York had a flurry of sales activity in Q3 2019. As we previously alluded to, off-the-market deal-making is largely responsible for this phenomenon.

- Investors are trying to deploy capital; albeit without much success. Canadian REITs have poured capital south of the border looking for action and more desirable yields. This doesn’t mean they are uninterested in the GTA… It means they have had tough luck finding enough product that meets their investment criteria, or gaining access to them as they arise off-market. Deals are happening… just not enough to satiate them. If you are thinking of Selling, these are your prime Buyers, willing and able to pay with hard cash if you could just prepare, position, and prime your asset properly beforehand.

- Property values are increasing, however, they are directly proportional to a Seller’s proper preparation and ability to negotiate with one of the many Investors and Occupiers currently scouring the GTA Industrial Market.

- Most activity is off-market

Three Interesting Announcements This Quarter – New Construction:

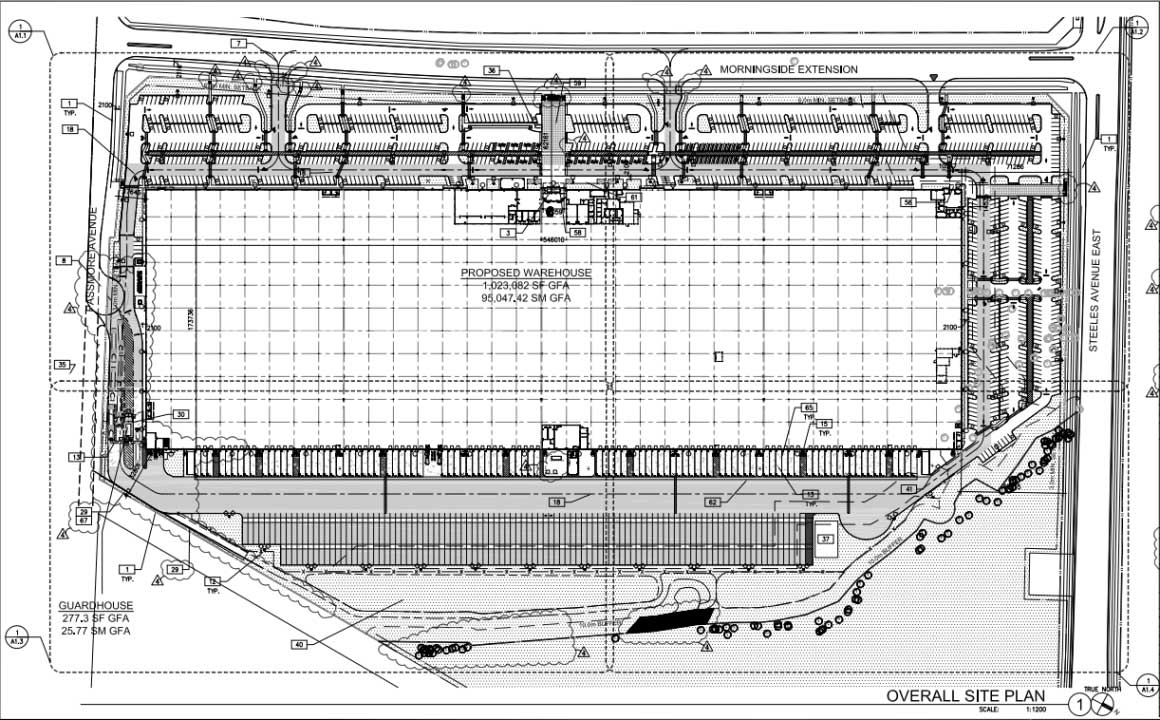

- Major User: Amazon announced a new 1,023,000 SF distribution centre in Scarborough, at 6351 Steeles Avenue East at Tapscott and Steeles.

6351 Steeles Avenue East, Toronto – Source: City of Toronto

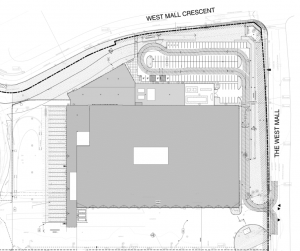

- Major User: Metro commenced with the construction of their new Fresh Distribution Centre at 17 and 25 Vickers Road of about 537,000 SF and Frozen Distribution Centre at 170 The West Mall of about 210,000 SF, with 80 feet clear height, for a total of about 747,000 SF.

170 The West Mall, Toronto – Source: City of Toronto

17 and 25 Vickers Road, Toronto – Source: City of Toronto

- Major Investor: Oxford submitted for the Site Plan Approval for 283,000 SF industrial distribution centre, 36’ clear at 121 Thirtieth Street in Etobicoke.

121 Thirtieth Street, Toronto – Source: City of Toronto

Why are the GTA Central Markets in such demand?

Is it proximity to labour, proximity to a higher population density and thus most likely a reduction in transportation cost, savings on development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc….. or all of the above?

So, you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

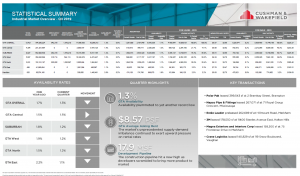

Statistical Summary – GTA Industrial Market – Q3 2019

GTA Industrial Market Overview – Q3 2019 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA Central Markets (Toronto, North York, Etobicoke & Scarborough), Q3 2019

Q3 2019 GTA Central Markets Industrial Stats – Source: Cushman & Wakefield ULC

Strong demand and brisk leasing coupled with a lack of new vacant space in the GTA Central Markets pushed the availability rate down further to just 1.3% for Leasing and 0.2% for Sales. We had a negative absorption of more than 500,000 SF this quarter.

Much of this absorption can be attributed to strong activity across the board, as well as a number of larger lease transactions.

Let’s take a closer look at how different Toronto Central Markets performed during Q3 2019…

GTA Central Markets (North York)

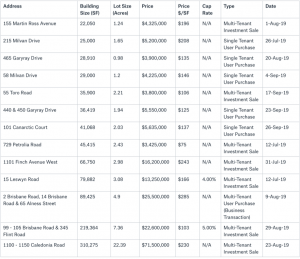

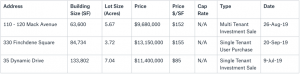

Properties Sold between July 2019 – September 2019, from 20,000 SF and up

In the North York Sub-Market in Q3 2019, a total of 13 properties were sold (1,029,458 SF); 7 were investment sales and 7 were sales to users. The prices achieved were in the range of $75 – $285 PSF, with an average building size of 79,189 SF and an average price of $166 PSF.

15 Leswyn Road, Toronto

GTA Central Markets (North York)

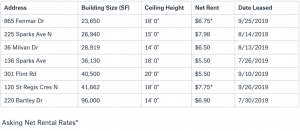

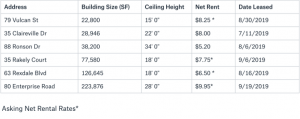

Properties Leased between July 2019 – September 2019, from 20,000 SF plus

In the North York Sub-Market in Q3 2019, a total of 8 properties were leased (293,801 SF). The net rental rates achieved were from $5.50 – $7.98 PSF, with an average building size of 54,850 SF and an average net rental rate of $7.00 PSF.

120 St. Regis Crescent North, Toronto

GTA Central Markets (Scarborough)

Properties Sold between July 2019 – September 2019, from 20,000 SF plus

In the Scarborough Sub-Market in Q3 2019, a total of 3 properties were sold (282,136 SF); 2 were investment sales and 1 was user sale. The prices achieved were in the range of $85 – $155 PSF, with an average building size of 94,045 SF and an average price of $131 PSF.

330 Finchdene Square, Scarborough

GTA Central Markets (Scarborough)

Properties Leased between July 2019 – September 2019, from 20,000 SF plus

In Q3 2019 we had no lease transactions in the Scarborough market larger than 20,000 SF.

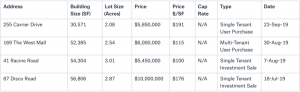

GTA Central Markets (Etobicoke)

Properties Sold between July 2019 – September 2019, from 20,000 SF plus

In the Etobicoke Sub-Market in Q3 2019, a total of 4 properties were sold (194,066 SF); 2 were investment sales and 2 were user sales. The prices achieved were in the range of $100 – $191 PSF, with an average building size of 48,517 SF and an average price of $146 PSF.

87 Disco Road, Etobicoke

GTA Central Markets (Etobicoke)

Properties Leased between July 2019 – September 2019, from 20,000 SF plus

In the Etobicoke Sub-Market in Q3 2019, a total of 6 properties were leased (491,995 SF). The net rental rates achieved were from $5.20 – $9.95 PSF, with an average building size of 86,341 SF and an average net rental rate of $7.61 PSF.

35 Claireville Drive, Toronto

What Lies Ahead:

- Rental Rates: Expect them to continue to increase at a similar pace.

- Property Values: With this low-supply environment, high demand, and cheap money, they can only go in one direction… and that is up.

- Development Opportunities: Look to see more re-development of older industrial buildings.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

For a confidential consultation or for a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.