Establishing True Valuations Across Differing Markets

This week we are covering the Toronto West Markets (Mississauga, Brampton, Milton, Caledon, Oakville & Burlington)…

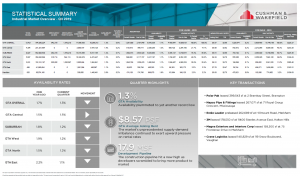

Statistical Summary – GTA Industrial Market – Q3 2019

GTA Industrial Market Overview – Q3 2019 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA West Markets (Mississauga, Brampton, Milton, Caledon, Oakville & Burlington)

The GTA West Industrial Markets are by far the largest industrial markets in the GTA, representing about 45% of the GTA Industrial Inventory, or about 358,000,000 SF. The markets were very active this quarter, with more than 10,000,000 SF under construction and few large lease and sale transactions completed, bringing vacancy rates down to historically low levels.

Key Takeaways from Q3 2019 ….

- Vacancy rates were only 1.2% for lease and 0.2% for sale

- There is currently more than 10,000,000 SF under construction in the GTA-West Markets

- Notable transactions completed this quarter in the GTA West Markets are:

- Berkshire Axis purchasing 132,402 SF in Brampton at 2500 Williams Parkway East

- KingSett Capital purchasing 151,167 SF in Mississauga at 1200 Aerowood Drive, and

- PIRET purchasing 568,000 SF in Mississauga at 12333 Airport Road

- Metro Canada Logistics leasing 292,000 SF in Mississauga at 6065 Millcreek Drive

- 3M leasing 178,550 SF in Halton Hills at 11400 Steeles Avenue East

- Polar Pak leasing 399,543 SF in Brampton at 2 Bramkay Street,

So, you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

So let’s take a closer look at how different Toronto West Markets performed during Q3 2019…

GTA West Markets (Mississauga)

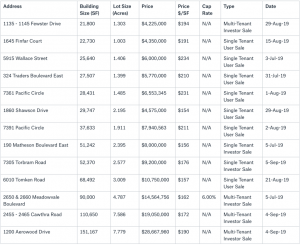

Properties Sold between July 2019 – September 2019, from 20,000 SF plus

In Q3 2019, a total of 13 properties were sold in Mississauga. The prices achieved were in the range of $157 – $234 PSF, with an average building size of 55,185 SF and an average price of $188 PSF.

2650-2660 Meadowvale Boulevard, Mississauga

GTA West Markets (Mississauga)

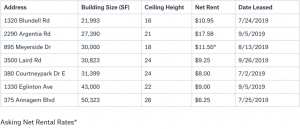

Properties Leased between July 2019 – September 2019, from 20,000 SF plus

On the leasing side, a total of 5 properties were leased. The net rental rates achieved were from $8.95 – $9.95 PSF, with an average building size of 44,735 SF and an average net rental rate of $4.19 PSF.

3500 Laird Road, Mississauga

GTA West Markets (Brampton)

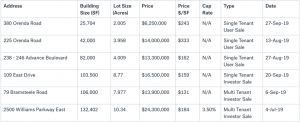

Properties Sold between July 2019 – September 2019, from 20,000 SF plus

A total of 6 properties were sold in Brampton. The prices achieved were in the range of $131 PSF – $333 PSF, with an average building size of 81,934 SF and an average price of $202 PSF.

79 Bramsteele Road, Brampton

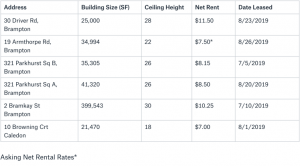

GTA West Markets (Brampton & Caledon)

Properties Leased between July 2019 – September 2019, from 20,000 SF plus

On the leasing side, a total of 5 properties were leased in Brampton and 1 in Caledon. The net rental rates achieved were from $7.50 – $11.50 PSF, with an average building size of 92,939 SF and an average net rental rate of $8.82 PSF.

321 Parkhurst Square, Brampton

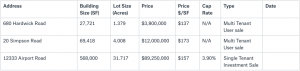

GTA West Markets (Caledon)

Properties Sold between July 2019 – September 2019, from 20,000 SF plus

A total of 3 properties were sold in Caledon. The prices achieved were in the range of $137 – $173 PSF, with an average building size of 221,713 SF and an average price of $156 PSF.

680 Hardwick Road, Caledon

Interesting Developments in the GTA-West Industrial Markets

With more than 10,000,000 SF under construction, the GTA West Industrial Market is the most active among all GTA Markets. This is where the largest number of big warehouse distribution centres are located, most of which are speculative construction, and with the vast majority being pre-leased prior to completion. Much of this demand comes from E-commerce companies driven by a continual increase in online retail sales.

12724 Coleraine Drive, Caledon – 1,021,611 SF

Amazon announced the partial occupancy of this new, state-of-the-art distribution centre in Caledon, built by TriAxis Construction Limited, and creating 800 new jobs in the process.

Interior of 12724 Coleraine Drive, Caledon – Source: TriAxis

2200 Yukon Court, Milton – 1,100,000 SF

Built by Leeswood Construction, DSV’s state-of-the-art, brand-new logistics centre with Head Office in Milton is scheduled for completion this quarter. DSV Canada is consolidating its Air & Sea, Road, and Solutions divisions under one roof. This is the largest facility of its kind in the DSV network worldwide, in over 80 countries. About 800 employees will be working on this site.

20 Westbridge Drive, Halton Hills – Steeles Ave & Fifth Line – 1,100,000 SF

A major lease transaction has been announced with Kraft-Heinz leasing 1,100,000 SF, of which about 300,000 SF is cooler space. Occupancy is expected for Q1 2020. Congratulations to Quadreal, First Gulf Group, and CBRE teams.

20 Westbridge Drive, Halton Hills Site Plan – Source: Quadreal

12424 Dixie Road, Caledon – 850,000 SF

According to a release from UPS (United Parcel Service) Canada, construction of a $200 million, 850,000 square foot advanced scanning and sorting facility is underway in Caledon. The small package operations hub will provide UPS with additional processing and service capacity to the GTA. Fully automated, the new Caledon facility will sort up to 35,000 packages per hour and house a fleet of more than 200 package cars. Congratulations to Prologis and Cushman & Wakefield teams on this transaction.

12424 Dixie Road, Caledon

2300 North Park Drive, Brampton – 235,000 SF

Carttera broke ground on their 2300 North Park Drive speculative industrial development in Brampton, which is scheduled for completion and occupancy in Q2 2020. This state-of-the-art facility will feature LEED Certification, 40′ Clear Height, 3% office or to suit, 33 truck level doors: 1 per 7,100 and 2 drive-in doors, 1,200 AMPs (expandable) and Secured Yard (optional). More information is available at www.2300northparkdrive.com.

2300 North Park Drive, Brampton – Source: Carterra

What Lies Ahead:

- Rental Rates: Currently at $8.33 per SF net, rental rates are trailing behind the GTA North Markets ($9.32 per SF) and GTA Central Markets ($8.69 per SF). I expect them to remain slightly behind in the next quarter, which we could attribute to a larger overall market…

- Property Values: The average sale price is about $199 per SF, which is considerably lower than in the GTA Central and GTA North Markets. I expect these prices to increase but still remain lower than in the Central and North markets…..

- Development Opportunities: The GTA West Markets will continue to be the most active as far as development is concerned… in this quarter alone we had over 10 Million SF under development…

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

For a confidential consultation or for a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.