Establishing True Valuations Across Differing Markets

Overall, the GTA Central Markets were busy during the last quarter of 2019, with more than 1.3 Million SF of new supply and more than 1.7 Million SF under construction. This was almost identical to the Toronto North Markets but way below the Toronto West Markets, where most of the GTA’s new construction is taking place.

Key Takeaways from Q4 2019

- Users have very few quality options for relocation while net rental rates increased over 30% from Q4 2018

- Large transactions are taking place: Amazon leasing 1 Million SF at 6351 Steeles Avenue East and Bombardier leasing 41.2 Acres of land for a term of 38 years from the Greater Toronto Airport Authority at Pearson Airport to construct a 1 million SF facility, opening in 2023, to name a few.

- Availability rates were stable at 1.4%, although it’s still incredibly tight with only 0.3% of inventory available for sale. Off-the-market deal-making continues……

- The demand is there while the supply of available properties has never been lower, causing property values to continue to increase …

Interesting Announcements This Quarter – New Construction:

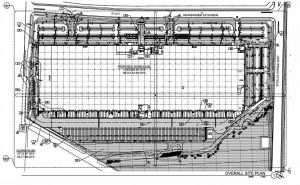

- Major User: Bombardier announced a relocation to the Toronto Pearson lands where a brand new 1 Million SF facility with a scheduled opening in 2023 will be constructed.

Proposed Facility for Bombardier at GTAA Pearson Lands

- Major User: Canada Post closed land acquisition at 1395 Tapscott Road in Scarborough where they are proposing the development of a two-storey, industrial mail-sorting building with an office component with a total gross floor area of approximately 583,118 square feet, including approximately 67,665 square feet of office space and 990 parking spaces.

1395 Tapscott Road, Scarborough

Why are the GTA Central Markets in such demand?

Is it proximity to labour, proximity to a higher population density and thus most likely a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

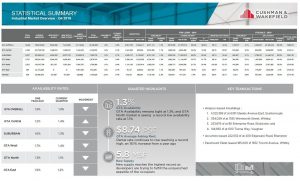

Statistical Summary – GTA Industrial Market – Q4 2019

GTA Industrial Market Overview – Q4 2019 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA Central Markets (Toronto, North York, Etobicoke & Scarborough), Q4 2019

Q4 2019 GTA Central Markets Industrial Stats – Source: Cushman & Wakefield ULC

Strong demand and brisk leasing coupled with a lack of newly vacant space in the GTA Central Markets pushed the availability rate down further to just 1.1% for Leasing and 0.3% for Sales. We had absorption of more than 1,500,000 SF this quarter.

Much of this absorption can be attributed to strong activity across the board, as well as a number of larger lease transactions.

Let’s take a closer look at how the different Toronto Central Markets performed during Q4 2019…

GTA Central Markets (Scarborough)

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019 one property was sold; it was an investment sale.

1160 Birchmount Road, Toronto

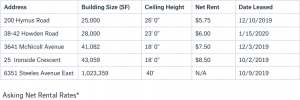

GTA Central Markets (Scarborough)

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019 in the Scarborough Sub-Market, a total of 5 properties were leased (1,160,500 SF). The net rental rates achieved were from $5.75 – $8.50 PSF, with an average building size of 232,100 SF and an average net rental rate of $6.94 PSF.

6351 Steeles Avenue East, Toronto

GTA Central Markets (North York)

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019 in the North York Sub-Market, a total of 4 properties were sold (249,141 SF); 2 were investment sales and 2 were user sales. The prices achieved were in the range of $95 – $170 PSF, with an average building size of 62,285 SF and an average price of $133.50 PSF.

60-74 Gervais Drive, Toronto

GTA Central Markets (North York)

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

In the North York Sub-Market in Q4 2019, a total of 7 properties were leased (261,364 SF). The net rental rates achieved were from $5.00 – $9.95 PSF, with an average building size of 37,338 SF and an average net rental rate of $7.48 PSF.

140 Wendell Avenue, Toronto

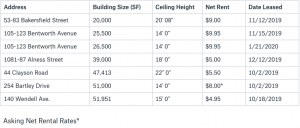

GTA Central Markets (Etobicoke)

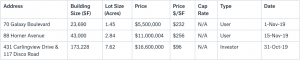

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In the Etobicoke Sub-Market in Q4 2019, a total of 3 properties were sold (239,918 SF); 2 were investment sales and 1 was a User sale. The prices achieved were in the range of $96 – $256 PSF, with an average building size of 79,973 SF and an average price of $195 PSF.

70 Galaxy Blvd., Etobicoke

GTA Central Markets (Etobicoke)

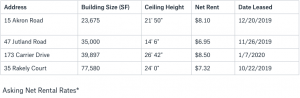

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

In the Etobicoke Sub-Market in Q4 2019, a total of 4 properties were leased (176,152 SF). The net rental rates achieved were from $6.95 – $8.50 PSF, with an average building size of 44,038 SF and an average net rental rate of $7.72 PSF.

35 Rakely Court, Etobicoke

What Lies Ahead:

- Rental Rates: We have experienced rental rate growth in excess of 30% since Q4 2018 and expect to see increases at a similar pace.

- Property Values: With this low-supply, high demand, and cheap money environment, they can only go in one direction… and that is up.

- Development Opportunities: With almost no available land in the Toronto-Central Markets we will see more re-development of older industrial buildings. Examples include 75 Venture Drive in Scarborough (PIRET), 2235 Sheppard Avenue West in North York (ONE Properties), and 1330 Martin Grove Road in Etobicoke (Carttera).

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.