Establishing True Valuations Across Differing Markets

The GTA-East Industrial Markets are the smallest in the GTA with about 42,000,000 SF; comprising just 5% of overall Industrial Inventory in the entire region.

In 2019, we had approximately 1.88 Million SF under construction in the Toronto-East Markets and last quarter we saw a few large lease transactions in excess of 560,000 SF, as well as seven sales transactions larger than 20,000 SF.

Key Takeaways from Q4 2019

- Vacancy rates are just 1.1% for Lease and 0.1% for Sale;

- The weighted average asking lease rate was $6.77 PSF and the weighted average sale price was $193.24 PSF;

- Fiera Capital purchased Canada Post’s Durham portfolio, 313,000 SF for $48.2 Million;

A few large lease transactions were completed in the GTA East Markets this quarter, including:

- Paramount Pallet leasing 185,000 SF at 1672 Tricont Avenue also in Whitby, and

- Amazon leasing 354,029 SF at 1555 Wentworth Street in Whitby.

Interesting Announcements this Quarter

The GTA East Industrial Market is increasingly being viewed as a value play with lower land costs, growing rents, and a surge in demand for Class A product. With historically low vacancy rates, many developers, as well as users, have begun purchasing land and announcing new projects.

- Toyota Canada will be moving into its new 350,000 SF parts distribution centre in Clarington in Q2 2020… the property will be a LEED Silver certified building situated on 30 Acres of land.

Toyota Canada Inc. – Clarington Parts Distribution Centre

- Kubota Canada commenced the construction of its new head office and distribution centre in Pickering. The Property will start with 565,500 square feet with the possibility of increasing to 1,000,000 SF in the future.

Kubota Canada Pickering Head Office with distribution

GM’s Final Farewell

After operating for more than 100 years (since 1907, if you can believe that!), GM’s plant in Oshawa closed its doors in late December of 2019. Most of the property, approximately 10 Million SF on hundreds of acres of land, will become vacant with a small part being utilized for parts manufacturing, advanced vehicle development, and a testing facility. Approximately 100 acres are to be donated to the City of Oshawa

GM Plant in Oshawa

So, if you own or occupy (or are looking to do so) in the Greater Toronto Area… then you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-East Markets (Ajax, Oshawa, Pickering, & Whitby)…

Statistical Summary – GTA Industrial Market – Q4 2019

GTA Industrial Market Overview – Q4 2019 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA East Markets (Ajax, Oshawa, Pickering, & Whitby)

Q4 2019 GTA Industrial Market Statistics

So let’s take a closer look at the transactions completed this quarter….

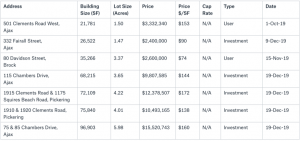

GTA East Markets (Pickering & Ajax)

Properties Sold between October 2019 – December 2019, from 20,000 SF and larger

In Q4 2019 in the Toronto-East markets, a total of 7 properties were sold (totaling 396,636 SF). Five were investment sales. The prices achieved were in the range of $74- $172 PSF, with an average building size of 56,662 SF and an average sale price of $133 PSF.

501 Clements Road West, Ajax

GTA East Markets (Pickering & Ajax )

Properties Leased between October 2019 – December 2019, from 20,000 SF and larger

In Q4 2019, 0 properties were leased in Pickering and Ajax.

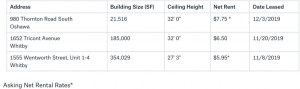

GTA East Markets (Oshawa & Whitby)

Properties Leased between October 2019 – December 2019, from 20,000 SF and larger

In Q4 2019 in the Toronto-East Markets, a total of 3 properties were leased (totaling 560,545 SF), with the activity happening in Whitby & Oshawa. The net rental rates achieved ranged from $5.95 – $7.75 PSF, with an average building size of 168,848 SF and an average net rental rate of $6.73 PSF.

1555 Wentworth Street, Whitby

GTA East Markets (Oshawa & Whitby)

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019, 0 properties were sold in Oshawa and Whitby.

What Lies Ahead:

- Rental Rates: Being at a significantly lower level than the rest of GTA Industrial Markets, expect them to increase at a proportionally higher rate

- Property Values: With this low-supply environment, high demand, and cheap money, they can only go in one direction… and that is up.

- Development Opportunities: It feels like everyone is focused on Durham, with its low cost to enter, and the potential higher upside in value driving the development in the region.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

For a confidential consultation or for a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.