Establishing True Valuations Across Differing Markets

In the final quarter of 2019, the City of Vaughan’s Industrial Market was once again the most active among the GTA-North Markets, with more than 1,200,000 SF transacted, leased, or sold. As a matter of fact, the Bolton/Caledon Market (GTA West) led the pack among all GTA Markets, with almost 1.7 Million SF leased or sold… and the Milton/Halton Hills Market came in second with 1.27 Million SF; while Vaughan was a close third in absorption.

The Vaughan Leasing Market achieved the highest net rental rates at $11.24 PSF while Richmond Hill was a close second with $10.92 PSF.

The largest transaction this quarter by dollar volume ($95,900,000) and by size (794,000 SF) was an investment sale; the purchase by Crombie REIT of the remaining 50% of the ownership of Sobey’s distribution centre, located at 8265 Huntington Road.

Key Takeaways from Q4 2019

- Strong demand and brisk leasing of available space pushed the availability rate down to just 1.1% in the GTA-North Markets in Q4 2019, with only 0.1% available for purchase.

- Absorption rose to a little more than 1 million SF this quarter and 2.387 Million SF for all of 2019.

- Currently, there is about 1,385,000 SF under construction in the GTA-North Markets in Q4 2019, representing only 11.4% of the total construction in GTA for this quarter.

- A few large lease transactions were completed in the GTA-North Markets, including:

- 277,600 SF of New Spec development at 141 New Huntington Road was pre-leased to three tenants with completion expected in late Q1 2020.

- Amazon leased 144,862 SF in Vaughan at 600 Tesma Way,

- With all of this activity and demand, and existing inventory being reduced to a historically new record of 1.1% of overall inventory, the weighted average net rental rates reached $10.59 per SF; still the highest in the GTA Industrial markets.

Interesting Announcements This Quarter:

Highway 427 Expansion Update

The Highway 427 Expansion project will extend the highway 6.6 km, from Highway 7 to Major Mackenzie Drive, and will widen the existing highway to 8 lanes between Finch Avenue and Highway 7. To continue construction of the interchange, Huntington Road between McGillivray Road and Major Mackenzie Drive will be closed permanently beginning October 28, 2019. The construction on the Highway 427 expansion began in May 2019 and the targeted completion is in 2021.

Road Shifts

At the end of 2019, the road alignments for both Major Mackenzie Drive and Langstaff Road shifted several metres to the north. Shifting these roads was necessary to accommodate two future interchanges being built as part of the Highway 427 Extension. New bridges were built to accommodate the road shifts. Each road shift occurred overnight, with Langstaff Road shifted on November 29, 2019, and Major Mackenzie Drive shifted on December 20, 2019. The old road alignments for both Langstaff Road and Major Mackenzie Drive have been permanently closed.

Hwy #427 Extension – Langstaff Road shift

Hwy #427 Extension – Major Mackenzie Drive shift

Winter Construction

At the end of 2019, the Highway 427 widening section was staged for winter to optimize the road for snow clearing. This means the shoulders of the road are kept wider for snow storage and the lanes were configured in a way that makes it easier for plows to navigate. Some construction will continue over the winter months as the Highway 427 Expansion Project progresses towards completion. Some of the work to be done over the next few months includes bridge construction and drainage, and electrical work.

So, if you own or occupy (or are looking to do so) in the Greater Toronto Area… then you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto-North Markets (Vaughan, Markham, Richmond Hill, Newmarket & Aurora)

Statistical Summary – GTA Industrial Market – Q4 2019

GTA Industrial Market Overview – Q4 2019 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA North Markets (Vaughan, Markham, Richmond Hill, Newmarket & Aurora), Q4 2019

Q4 2019 GTA Industrial Market Statistics

So let’s take a closer look at the transactions completed this quarter….

GTA North Markets (Vaughan)

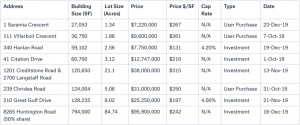

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019, a total of 8 properties (totaling 1,350,494 SF) were sold in GTA-North markets. The prices achieved were in the range of $131 – $315 PSF, with an average building size of 168,812 SF and an average price of $234 PSF. Seven transactions were investment sales and one was user purchases.

210 Great Gulf Drive, Vaughan

GTA North Markets (Vaughan)

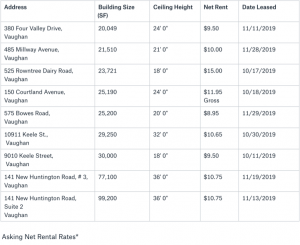

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

On the leasing side, a total of 9 properties (totaling 351,220 SF) were leased. The net rental rates achieved were from $8.95 – $15.00 PSF, with an average building size of 89,806 SF and an average net rental rate of $10.79 PSF.

9010 Keele Street, Vaughan

GTA North Markets (Markham, Richmond Hill & Aurora)

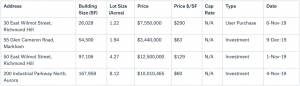

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019, a total of 4 properties (totaling 345,592 SF) were sold in GTA-North markets. The prices achieved were in the range of $60 – $290 PSF, with an average building size of 86,398 SF and an average price of $136 PSF. Three transactions were investment sales and one was a User purchase.

200 Industrial Parkway North, Aurora

GTA North Markets (Markham and Newmarket)

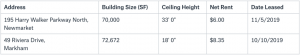

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

On the leasing side, a total of 2 properties (totaling 142,672 SF) were leased. The net rental rates achieved were from $6.00 – $8.35 PSF, with an average building size of 71,336 SF and an average net rental rate of $7.18 PSF.

49 Riviera Drive, Markham

What Lies Ahead:

- Rental Rates: Expect them to continue to increase at a similar pace.

- Property Values: With this low-supply environment, high demand, and cheap money, they can only go in one direction… and that is up.

- Development Opportunities: In addition to opportunities for development along the Highway 427 extension, a number of new blocks for industrial development will be released along Highway 50. Having said that, there are a total of 13 applications at the moment to re-zone industrial sites to mixed-use – all of them in Woodbridge – in close proximity to the new Vaughan Metropolitan Centre and subway.

Vaughan Metropolitan Centre

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

For a confidential consultation or for a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.