Establishing True Valuations Across Differing Markets

The GTA-West Industrial Markets are by far the largest industrial markets in the GTA, representing about 45% of the GTA’s Industrial Inventory, or about 362,000,000 SF.

The Markets were very active this past quarter, with more than 6,600,000 SF under construction and a few large lease and sale transactions completed, bringing vacancy rates down to historically low levels.

Key Takeaways from Q4 2019…

- Overall Vacancy rates were 1.4%, with 1.3% available for lease and 0.1% available for sale

- Currently, there is more than 6,600,000 SF under construction, of which 4,400,000 SF was completed in 2019… while 3,900,000 SF was delivered in Q4 2019 alone!

Notable transactions completed this quarter are:

- Accuristix leased 222,032 SF in Brampton at 200 Edgeware Road,

- Indigo Books renewed their lease on 610,000 SF of space in Brampton at 100 Alfred Kuehne Blvd, and

- Kraft Canada leased 345,000 SF in Halton Hills at 20 Westbridge Drive.

Interesting Announcement this Quarter – Largest Industrial Investment Transaction in 2019

- DSV ‘s 1,100,000 SF leaseback and $180,000,000 sale to GWL Realty Advisors of 2200 Yukon Court in Milton was the largest investment transaction in the GTA Industrial Markets in 2019.

2200 Yukon Court, Milton – Source: DSV

So, if you own or occupy (or are looking to do so) in the Greater Toronto Area… then you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

In order to get to the truth, we need to dig a bit deeper…

This week we are covering the Toronto West-Markets (Mississauga, Brampton, Milton, Caledon, Oakville & Burlington)…

Statistical Summary – GTA Industrial Market – Q4 2019

GTA Industrial Market Overview – Q4 2019 – Credit – Cushman & Wakefield ULC

Statistical Summary – GTA West Markets (Mississauga, Brampton, Milton, Caledon, Oakville & Burlington)

Q4 2019 GTA Industrial Market Statistics

So let’s take a closer look at the transactions completed this quarter…

GTA West Markets (Mississauga)

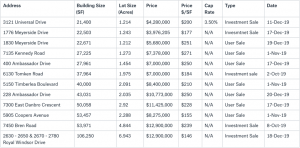

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

In Q4 2019, a total of 12 properties were sold in Mississauga. The prices achieved were in the range of $146 – $250 PSF, with an average building size of 42,208 SF and an average price of $213 PSF.

7450 Bren Road, Mississauga

GTA West Markets (Mississauga)

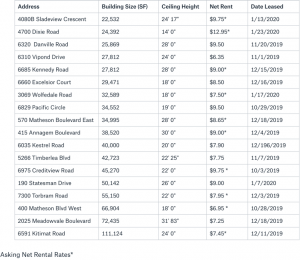

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

On the leasing side, a total of 18 properties were leased. The net rental rates achieved were from $6.95 – $12.95 PSF, with an average building size of 43,461 SF and an average net rental rate of $4.19 PSF.

6591 Kitimat Road, Mississauga

GTA West Markets (Brampton)

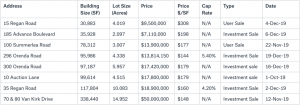

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

A total of 8 properties were sold in Brampton. The prices achieved were in the range of $144 PSF – $308 PSF, with an average building size of 111,769 SF and an average price of $187 PSF.

70 & 80 Van Kirk Drive, Brampton

GTA West Markets (Brampton)

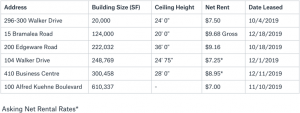

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

On the leasing side, a total of 6 properties were leased. The net rental rates achieved were from $7.25 – $9.68 PSF, with an average building size of 254,266 SF and an average net rental rate of $8.26 PSF.

104 Walker Drive, Brampton

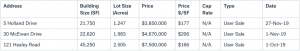

GTA West Markets (Caledon)

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

A total of 3 properties were sold. The prices achieved were in the range of $166 – $206 PSF, with an average building size of 29,873 SF and an average price of $183 PSF.

On the leasing side, zero properties were leased in Caledon in Q4 2019.

30 McEwan Drive, Caledon

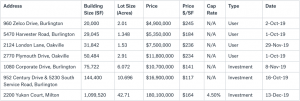

GTA West Markets (Burlington, Oakville & Milton)

Properties Sold between October 2019 – December 2019, from 20,000 SF plus

A total of 7 properties were sold, 4 in Burlington, 2 in Oakville, and 1 in Milton. The prices achieved were in the range of $117 – $245 PSF, with an average building size of 207,288 SF and an average price of $189 PSF.

1080 Corporate Drive, Burlington

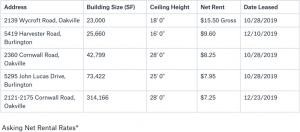

GTA West Markets (Oakville & Burlington)

Properties Leased between October 2019 – December 2019, from 20,000 SF plus

On the leasing side, a total of 5 properties were leased: 3 in Oakville and 2 in Burlington. The net rental rates achieved were from $7.25 – $15.50 PSF, with an average building size of 95,809 SF and an average net rental rate of $9.71 PSF.

2121-2175 Cornwall Road, Caledon

What Lies Ahead:

- Rental Rates: Currently at $8.34 per SF, the net rental rates in the GTA-West Markets are trailing behind the GTA-North Markets ($10.59 per SF) and GTA-Central Markets ($8.76 per SF). I expect them to remain slightly behind in the next quarter which we could attribute to the West being a larger market overall….

- Property Values: The Average Sale Price is about $199 per SF, which is far behind the GTA-North Markets ($319.89 per SF). I expect these prices to increase but still remain lower than in the Central and North markets…..

- Development Opportunities: The GTA West Markets will continue to be the most active as far as development is concerned. In 2019 we had 4,486,000 SF of new supply, which represents 60% of new supply across GTA Industrial Markets. In Q4 2019 alone we had over 6.64 Million SF under development…

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

For a confidential consultation or for a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.