Industrial Construction Costs in an Overheated and Undersupplied Market

March 19th, 2021

The path to owning an industrial property in the Greater Toronto Area is no easy feat. No matter if you purchase a building or develop one from the ground up, it will require a significant chunk of change.

In fact, there is a direct relationship between industrial ownership and how deep a prospective Buyer’s pockets can go.

On the acquisition side, we all know how the story goes. Nothing is readily available, and if it is, you’re competing against multiple other offers from some of the largest, most sophisticated institutional and private investors. That’s why they’re extremely active and in touch with the marketplace.

Find something off-market? You better make your best offer… and quick.

Want to develop or reposition an asset? Well, land is in scarce supply. Furthermore, land costs are increasing so rapidly that they may be an even better ‘paper investment’ than cryptocurrencies… if you could only get your hands on any. On the bright side, we know for certain the land will still be there in a year or two.

The permitting and servicing process is also being stretched out and delayed.

And construction costs are being squeezed as a pure function of supply and demand in both labour and materials.

Over the past two issues, we examined land values and development charges.

This week, we will take a closer look at how construction costs have evolved over the past 15 years… and what it means for developers and investors today.

And by doing so, we will also try to understand how the construction management process and may differ in response to changing building designs, as well as the previously stated labour and material shortages.

To that regard, we asked Ron Buffa, Chief Development Officer of Torque Builders, to provide us with some insight on this topic…

Here is the reality.

- Steel prices have skyrocketed (delivery time takes around 10 weeks minimum to order from approved drawing).

- Material prices have all increased. Electrical, masonry, lumber (if you can even find any). Not to mention that HVAC components are also in short supply.

- A lot of mechanical equipment is typically brought in from the United States… which has slowed down considerably due to the pandemic and tightened borders.

- Pre-cast is not only more expensive, but can take 8-10 MONTHS to be delivered.

- Labour prices continue to increase 3-5% each year, whether it be union or non-union. And due to general trades shortages and health protocols, there are typically fewer people on-site and fewer people available. Project durations are averaging around a 10% increase as a result.

- Overall construction costs have increased 16% year-over-year.

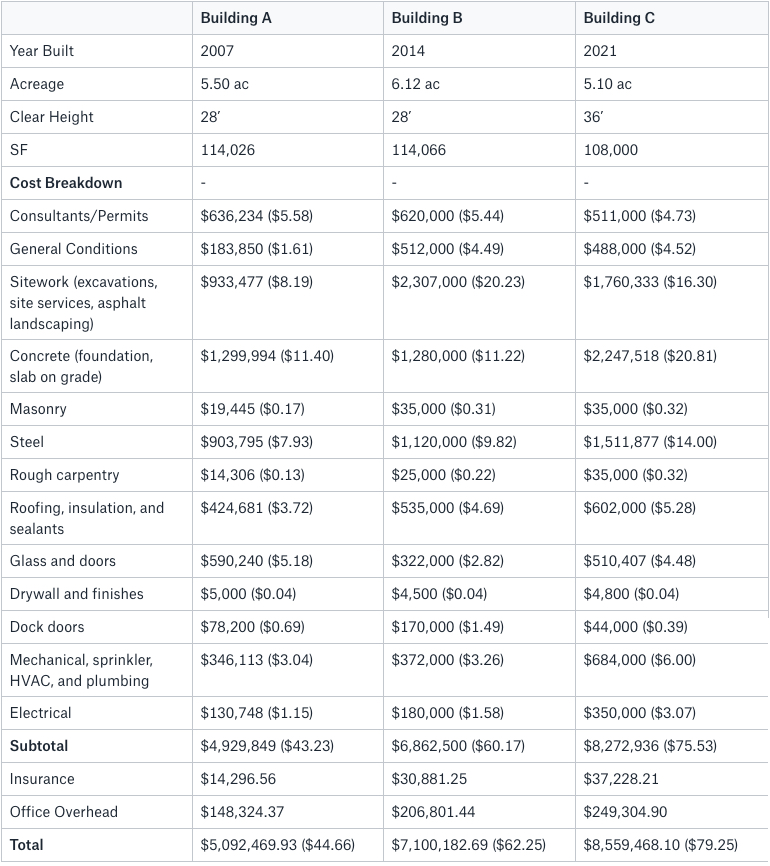

Changes in Construction Costs From 2007 to 2021

Sample Construction Costs of 3 Similar Buildings (2007, 2014, 2021), courtesy of Torque Builders

Note: PSF costs in brackets

To help explain some of the fluctuations in the pricing, let’s briefly talk about…

Building Design

Today, there are some minor differences in preferences and norms. Depending on the Client, there may be a preference of design with pre-cast, metal panels or glass. Many new facilities have more glass to increase the curb appeal, while also providing employees with the satisfaction and comfort or ‘feel’ of a downtown office in a warehouse setting. These upgrades come at a greater expense, however.

- Ceiling heights are getting closer to 40’ as a standard, while bay sizes have gone from 40’ by 40’ to 50’ by 50’, and now even 50’ by 52’.

- Bay sizes (but even ceiling heights, to some extent) are based entirely on the client and their racking. This then requires thicker steel, thicker concrete slabs, which makes it more costly.

- Further, truck aprons are becoming a standard, spanning around 60 feet out from the building and at a width of the docks. They are also now predominantly built with concrete (as opposed to asphalt) to improve the lifespan.

- Power capacities are increasing significantly as industrial buildings get more and more into automation, and we can see a jump from 1200A to 2000A.

- Lighting has moved primarily towards LEDs.

- HVAC systems are moving to MUA (make-up air) units as standard. Seeing Tenants driving trucks into their warehouses for small deliveries, with automatic conveyors or sorting systems may also require mechanical systems for emissions and CO2 systems from the vehicles.

These factors can help give some context to why we may use more or less of a specific material type today than 15 years ago.

Overall, however, there is generally a low availability and higher material prices.

It’s ALL supply and demand.

Meaning, it’s important to buy materials on time. And since General Contractors generally cannot inventory anything, they need to get in queue with the trades or sub-contractors for supplies and deliveries as soon as possible.

After reading the above, Owner-Occupiers, Developers, and Landlords may be feeling some heartburn. They may also have some questions, including…

How can we ensure the fastest path to a completed development?

How can we ensure quality work amidst time pressure, as well as labour and material shortages?

How can we properly forecast our projects and stay on or under budget?

Generally speaking, managing a construction project involves juggling many moving parts within the constraints of the budget, time, materials, and labour.

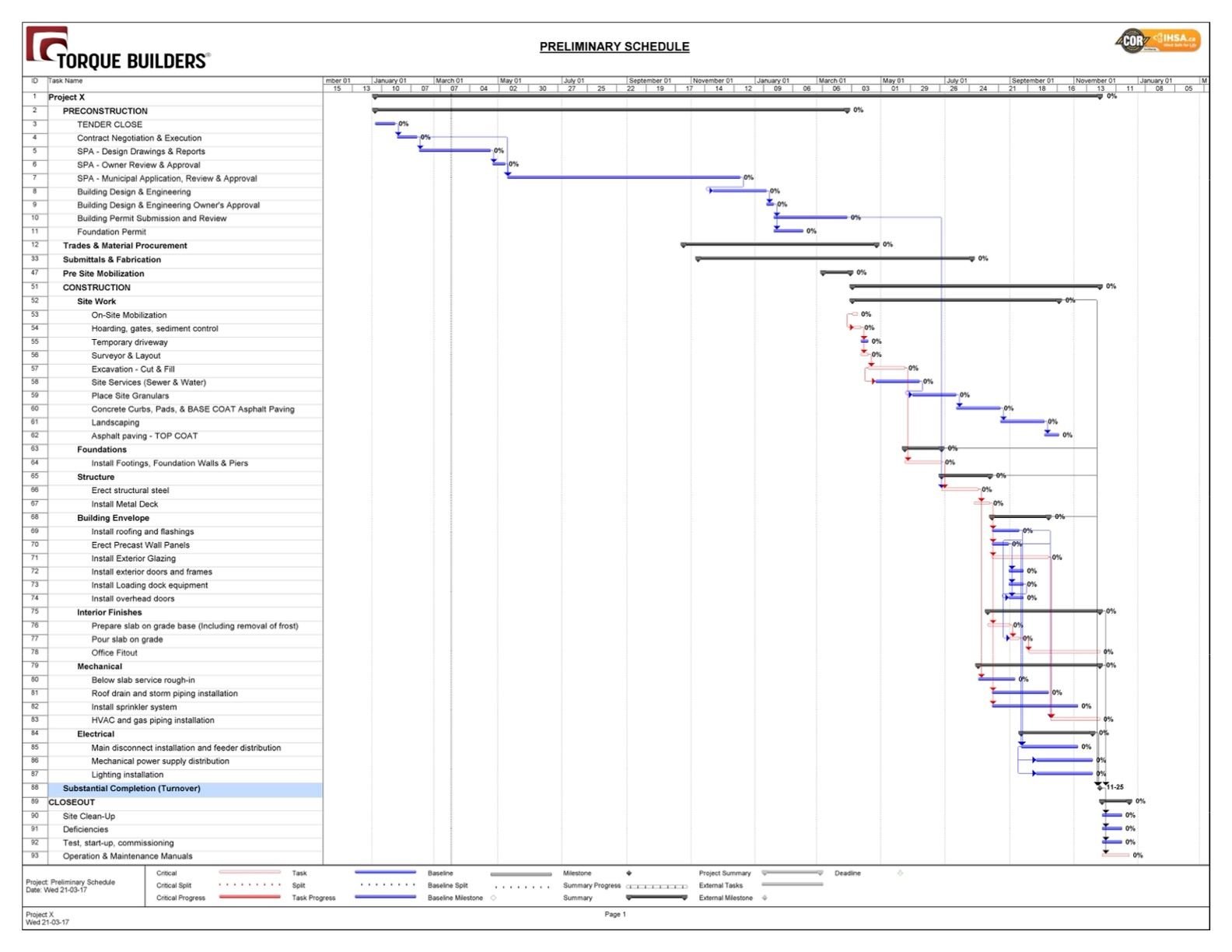

When planning a new development, there are critical paths which determine the schedule.

Sample Preliminary Construction Schedule

Sample Preliminary Schedule. Credit: Torque Builders

For example, you must typically obtain approved shop drawings before ordering material.

And the majority of the time, you wouldn’t break ground until the Municipality approves the site plan and permit.

That being said… what if your typical 8- to 12-month schedule is extended considerably because you must wait 8-10 months for your pre-cast to come in?

And what if, because of the pandemic, it now takes 6-8 months to receive the final approval from the Municipality? (And this is excluding cases where a site may rest on or abut conservation lands, which could result in a year-long study to even determine what may be the proper next step).

Wouldn’t you try to find a creative solution to compress the construction schedule and lock in your tender/pricing as soon as possible?

That’s where strategies such as construction management versus a traditional design-build versus a hybrid of several approaches may come into play.

Lump Sum

In this traditional scenario, the client would be responsible for the design, and consultants for all elements of the project. The General Contractor would tendered to sub-trades come up with a final price.

Typically the project is ready to start with all permits in place.

Design-Build

In this scenario, the Design Builder would be responsible for all Design, consultants etc. You would start with the concept from the client, a preliminary design is produced and refined, and committed to a specific price.

All site planning and permitting is the responsibility of the Design Builder and the may be a lengthy process.

As a rule, and in the context of construction in today’s market… you can always delay delivery but you cannot speed up production of materials when they have yet to be made!

Which leads to:

Construction Management Proposals

The Client has started the process. Here, the General Contractor creates a line-item budget estimate and will work to have a concept and 60-80% of the drawings complete before starting work. This means because certain tendering and construction can be started earlier, they can order materials sooner and speed up the process. In fact, it could save 1 month alone in the tendering process compared to a Lump Sum.

Further, there are fewer extras or additional charges as compared to a hard bid because of the early involvement of the General Contractor’s input.

Hybrid Strategies

Finally, you can use a hybrid strategy to get a project off the ground based on the current situation and any potential roadblocks or bottlenecks. For example, one could start with a construction management proposal and, at 70% completion, convert to a Lump Sum bid contract. At a high-level, what you decide to do is completely dependent on the project, the Client, and the circumstances… and would require the assistance of a knowledgeable advisor.

On that note…

For further information on the subject of Construction Management in the Greater Toronto Area, please contact:

Ron Buffa

Chief Development Officer

Torque Builders

O: 905-660-3334 x341

M: 647-669-6673

rbuffa@torque.ca

www.torque.ca

At Torque®, we’re driven to provide excellent customer service in a collaborative environment to get the Job. Done.®

With over a decade of experience working with partners and clients in the construction industry, Torque® now serves North America’s leading developers, pension funds, REITs, retailers, telecom companies, banks, airports, retirement residence operators, manufacturers and many others.

Our portfolio spans across a diverse body of work, including warehouse & industrial, education, office, mission critical, retail and restaurant, aviation and transportation, hi-rise residential and multi-unit residential renovations.

Conclusion

I wanted to thank Ron for sharing his time and wisdom with our readers. With the unrelenting demand for new industrial product in the Greater Toronto Area, it is but a natural evolution that land values, development charges, and construction costs have become the limits to scale and roadblocks to acquiring or developing new facilities. Ron has been able to tie together many of the trends and themes we have been tracking and has provided us with great detail as to how these underlying forces are influencing the market in real-time.

Overall, there is a price to pay to develop in the Greater Toronto Area. And it’s a game played by some of the most sophisticated institutional and private investors and developers. So, simply looking at relative costs or rates cannot give you the entire picture… nor should it be used on its own to justify green-lighting a project. One should think through the entire initiative and ensure that long-term, stable income will be a by-product of the capital, energy, and time ventured.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com