Navigating the Industrial Site Selection Process

March 26th, 2021

Right now, the entire world is going through a period of transition. Everything that seemed to be fastened in the halls of tradition has been thrown up in the air.

Whether it be cultural norms, the debate regarding cryptocurrency, e-commerce’s proliferation, working from home, a roaring stock market, material and labour shortages, or inflation in general… many Parties are betting on a lot of vastly different outcomes; some of which may or may not come to pass.

Indeed, we are living in the strangest of times.

In any event, individuals and organizations are scanning the information in front of them to compile a risk profile to make – in their minds – the best possible decisions.

Similarly, Investors and Occupiers of industrial real estate are stacking and placing their chips, too.

Some are adamant that the frothiness will settle down or that a bubble will burst, leaving them with opportunities to find distressed assets on the cheap. Meanwhile, others are worried that inflation will erode their purchasing power and are – thus – going all in on real assets, while they can…

Seen through the lens of industrial real estate, a few usual suspects are driving the market; along with some young bucks entering the play. E-commerce is continuing to absorb warehousing and distribution space at a torrid pace while cold storage – and even film production space – is beginning to be in demand as a result of online grocery sales, ‘just in case’ inventories, and gargantuan content budgets.

These requirements are no issue under normal circumstances.

However, the present constraints pose quite a challenge. Soaring land values, hefty development charges, and now, expensive construction costs driven by material and labour shortages are putting in jeopardy the feasibility of many projects and pursuits within the Greater Toronto Area.

Running a formal “Industrial Site Selection” process has often been thought of as necessary for complex requirements such as consolidating multiple facilities or expanding a portfolio across various markets or within a complicated supply chain. Simply put, it may be overkill in situations where a broker may only need to generate a shortlist of options within a few submarkets.

Nevertheless, in said market with 0.5% to 1.5% availabilities, little available land, and an expensive and delayed development process, it may be prudent to formally go through the site selection exercise to:

- Ensure you are 100% certain of your decision; and

- That you absolutely cannot solve your operational problems within your current footprint.

While most brokers can help with the former, every business owner should be sure of the latter. As they say, avoiding a loss can impact your bottom line more than generating a win, and with less risk. So if you can streamline your operations’ processes or improve throughput within your existing facility, you can save yourself the headache of having to look elsewhere.

With that said, we will be taking a closer look at how an Investor or Occupier of industrial real estate can select the right site given their organizational objectives, as well as the constraints on hand.

What is Industrial Site Selection?

Industrial Site Selection is the process by which a User selects the ideal location for its operations, as analyzed against a set of criteria and constraints. It could also be applied in the context of an Investor or Developer looking for the right place to construct a facility. This new ‘site,’ or location, can be either a piece of land that is slated for development or an existing property.

Site Selection Road Map. Source: AreaDevelopment.com.

Site Selection Process

Typically, a User or Investor will seek to first understand and clarify the objective of the search, followed by identifying and prioritizing a list of factors or criteria.

We will examine these individual criteria – as well as their implications and benefits – more closely in our next issue. But for now, we’re going to look at a high-level view of the process itself.

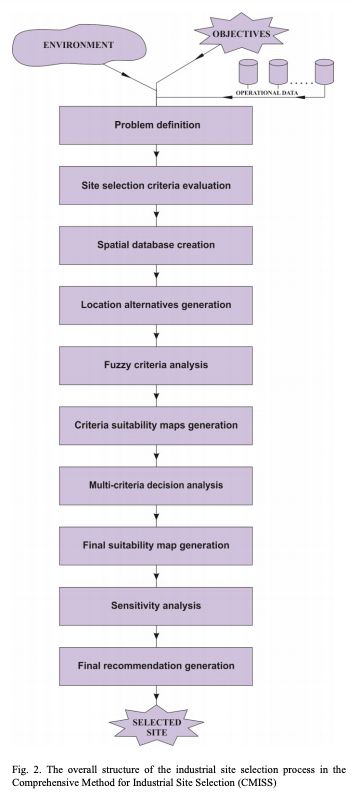

Sample Site Selection Process Flow. Source: (Rikalovic, et al.. IEEE, 2015)

Once the initial criteria have been established, an experienced broker can assist in validating the assumptions of the requirement and then formulating a strategy that can satisfy the needs of their Client. This point is important because, sometimes, Parties may not need what they initially thought… and their goals may change after thorough discussions.

As part of this strategy development, a number of suitable properties can be identified and then evaluated against the Client’s own criteria, as well as the market constraints, such as rental rates, availabilities, access to transportation routes, the labour pool, construction costs, development charges, land values, and sales pricing.

Depending on the individual circumstances of the Client, they may choose to pursue different routes based on their own internal management, their risk tolerance, their turnaround time, available options, as well as initial cost and timeline estimates.

Once the Client approves a shortlist of options, they may begin to visit the facilities or land in person to help rank and organize the various options, as well as get a sense of the overall project scope.

Following this, a broker may begin collecting proposals from Landlords or engaging with potential Sellers to gauge expectations on pricing, concessions, timing, and competition. At this point, a greater in-depth analysis may be performed to better allow for comparisons between each, as well as to get initial cost estimates.

From here, you would pursue your options from the top down and work with the other Party to finalize the pricing, terms, and timing. Your broker, project manager, and/or internal team would close things out from here as per a regular purchase, lease, or development scenario.

Conclusion

Overall, when your options are constrained by the market and you are embarking on a potential multi-year project worth tens of millions of dollars… you need to ensure you are doing your due diligence when selecting the appropriate site.

Some real estate decisions may not be as dramatic or as impactful. However, even a small amount of time and effort invested prior to execution can not only save significant amounts of time and money later on, but can result in the acquisition, development, or occupancy of an industrial facility much better suited to your needs.

Next week, we will take a closer look at industrial site selection criteria and the benefits of each to Investors and Occupiers.

In the meantime, please give us a call for a confidential consultation or a complimentary opinion of value of your property.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com