What To Do When Phase 2 Identifies Contamination…

If you’ve ever had to give a steep price reduction or had your sale process drawn out longer than you’d like to admit because of previously unknown contamination or poor soil quality…

Then this article will help outline the steps you can take to move forward and regain leverage as an owner.

So you’ve finally arrived at Phase 3, willingly or otherwise…

Whether you’ve been forward-looking and done the work in anticipation of going to market.

Or (as is often the case) you were handed a surprise by your prospective buyer during the due diligence process the first time around.

Well, it’s often back to the drawing board with respect to marketing the asset, however, with the right plan in place, and a commitment to doing what is required…

It is only a matter of time before you can step back up to the plate and get the deal done.

That is our commitment when guiding our clients through these unfortunate circumstances.

(And if you’re reading this and not in this scenario but trying to learn more, then read on, because…)

Over 25 years of representing landlords and investors, I’ve noticed this pattern over and over again. In order to maintain control over the disposition of an asset, we’ve had to ensure that every property or piece of land goes through a specific, repeatable process.

Without this, you expose yourself to the market.

To circumstance.

To luck.

Yet by running through the steps, you can not only nip any potential issues in the bud, but you can:

- uncover better ways to position or market the building,

- truly understand the highest and best use cases,

- compress the overall sales cycle, and

- leverage more and higher quality interest from buyers.

So, if you are considering purchasing or selling an industrial property, I would strongly advise that you complete a thorough pre-due-diligence so that you will know if there are any issues with the building or the site itself that need to be addressed before the property is taken to the market.

We are into the third issue of our series on Due Diligence, where we are diving into the different types of due diligence, case studies of successful assessment and remediation, and what exactly to look out for when preparing your property for sale.

Today we will examine Phase 3. So let’s begin…

Phase Three represents a report prepared by a Consultant that identifies the best available alternatives, costs, and strategy for remediation and environmental risk management. It will set out the steps required to perform site remediation and follow-up monitoring for residual contamination including monitoring wells if needed.

Site Remediation and Cleanup

When chemical impact on soil or groundwater are identified on a property – following a Phase Two ESA or subsurface investigation – remediation is undertaken, if required, to restore the contaminated land, to conditions that comply with applicable standards (based on the intended land use).

Remediation of chemical impact on soil and groundwater can be affected through a variety of in-situ and ex-situ techniques, including:

- Excavation & Off-Site Disposal (Soils)

- Chemical/Biological Injection (Soils & Groundwater)

- Pump and Treat (Groundwater)

- Pump and Off-Site Disposal (Groundwater)

The preferred remedial strategy is commonly a function of multiple factors, including:

- specific contaminant chemistry and concentrations,

- hydrogeological conditions,

- site constraints,

- budget, and

- treatment timeline requirements.

Site Risk Assessment Study

A Site Risk Assessment (SRA) is a study that offers an alternative to site cleanup, which can sometimes be elusive or cost prohibitive to achieve.

The process is recognized by the MOE site cleanup guideline and considers the real risks to human health or the environment from an evaluation of the contaminant toxicology, site characteristics, and the pathways of exposure to humans or the environment.

For instance, for a Brownfield, if a contaminant lies in the groundwater at a significant depth below grade, and is contained under a concrete floor slab or a paved parking lot, an SRA would likely have a favourable outcome.

When is a Record of Site Condition Required?

Any time the land use designation is proposed to be changed to a new form of higher activity, from industrial/commercial to residential development, a Record of Site Condition is required to be filed with the MOECC.

Achieving an acceptable Record of Site Condition will require in most cases, Phase One Environmental Site Assessment, Phase Two Environmental Site Assessment, and most likely, a Risk Assessment Study.

A Record of Site Condition (RSC) is an official document filed with the Ontario Ministry of the Environment (MOE) that confirms that the soils and groundwater (and any sediment) on a property have been shown to meet the applicable site condition assessment or cleanup standards at the time of testing.

An RSC is required by municipalities for various development application purposes, such as rezoning, site plan control, and building permit issuance.

Source – Brownfields Ontario

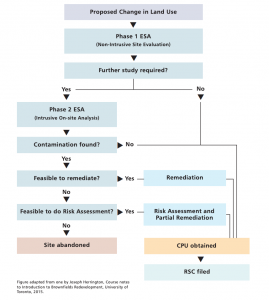

Brownfields Redevelopment Process

Brownfields Redevelopment Process

Disclaimer: The information provided is intended for general educational and informative purposes ONLY, and is NOT intended to be taken as legal, environmental, or tax advice.

Talk to your lawyer, accountant, attorney, or environmental or planning consultant before taking action.

I hope this can give you an idea of the general process used when doing an Environmental Site Assessment, Remediation, or Cleanup. Please note, that each case is unique and would require an expert opinion and guidance.

If you would like some help with your property, let us know, and we will do our best to point you in the right direction.

Next issue, we will go through some case studies of real properties that had to undergo various forms of Phase1, Phase 2, and site remediation.

Until then…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries. In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.