February 23rd, 2024

Time seems to have compressed ever since we came out of the pandemic.

Maybe it was simply a catalyst for change. Or perhaps we were all making up for lost time.

Or within the context of industrial real estate, the emergence of e-commerce and the resulting demand for warehousing and logistics facilities emphasized the need and signalled the profitability surrounding Bix Box space.

Whatever the reason may be, broad economic forces, regional drivers, and industrial real estate dynamics have been in constant flux. The rise of interest rates from all-time lows. The scale of the industrial pipeline and resulting flood of deliveries. The dramatic increase in costs to develop new facilities. The softening in demand from occupiers and investors.

All of these narratives and phenomena have led to an industrial real estate market that continues to be sought-after, but where decisions and negotiations have become more prevalent and more strategic.

In 2023, we saw the market cool; with rents and values stabilizing, as well as availabilities pushing up to 1.9% (the last time they were above that mark was in Q2 2018). Some tenants pulled back on expansion plans, while some downsized their footprints (see Amazon, for example). Developers became relatively more conscious of competing properties and less enthusiastic about building on-spec, while landlords also changed their mentalities from wanting to push the market’s limits on rents to being satisfied with quality tenants paying market rates.

So what will 2024 bring?

As inflation cools and interest rates are expected to plateau, perhaps we will finally see some predictability in terms of costs and values, although they will likely not come down to pre-expansion levels.

Elevated labour, land, development, and material costs mean that quality real estate will inherently maintain its value as it cannot be replaced easily, quickly, or cheaply.

Similarly, operating costs have increased noticeably in taxes, maintenance, and utilities. We are seeing a trend towards net-zero carbon (as discussed in past issues) and energy efficiencies to help offset this and meet upcoming mandates. Overall, high-cost environments lend themselves to better property management and fully-tenanted buildings.

More available options should see tenants focus more on building specifications and location, meaning high-quality facilities will continue to command a premium on older inventory. As a result, there are many opportunities to add value through infill redevelopment. Bifurcation between modern, Class-A space and functionally obsolete space will also continue.

Aside from these ‘crystal ball’ thoughts, we can be sure that there will be a curveball or two that will be impossible to predict. All one can do is try to study the market, be prepared for opportunity when it comes knocking, and do their best to roll with the punches.

That is why, for this week’s newsletter, we will analyze the GTA industrial market’s historical supply data to gain a better understanding of how the market has evolved, and to help get a sense of what is to come.

GTA Historical Industrial Pipeline Analysis

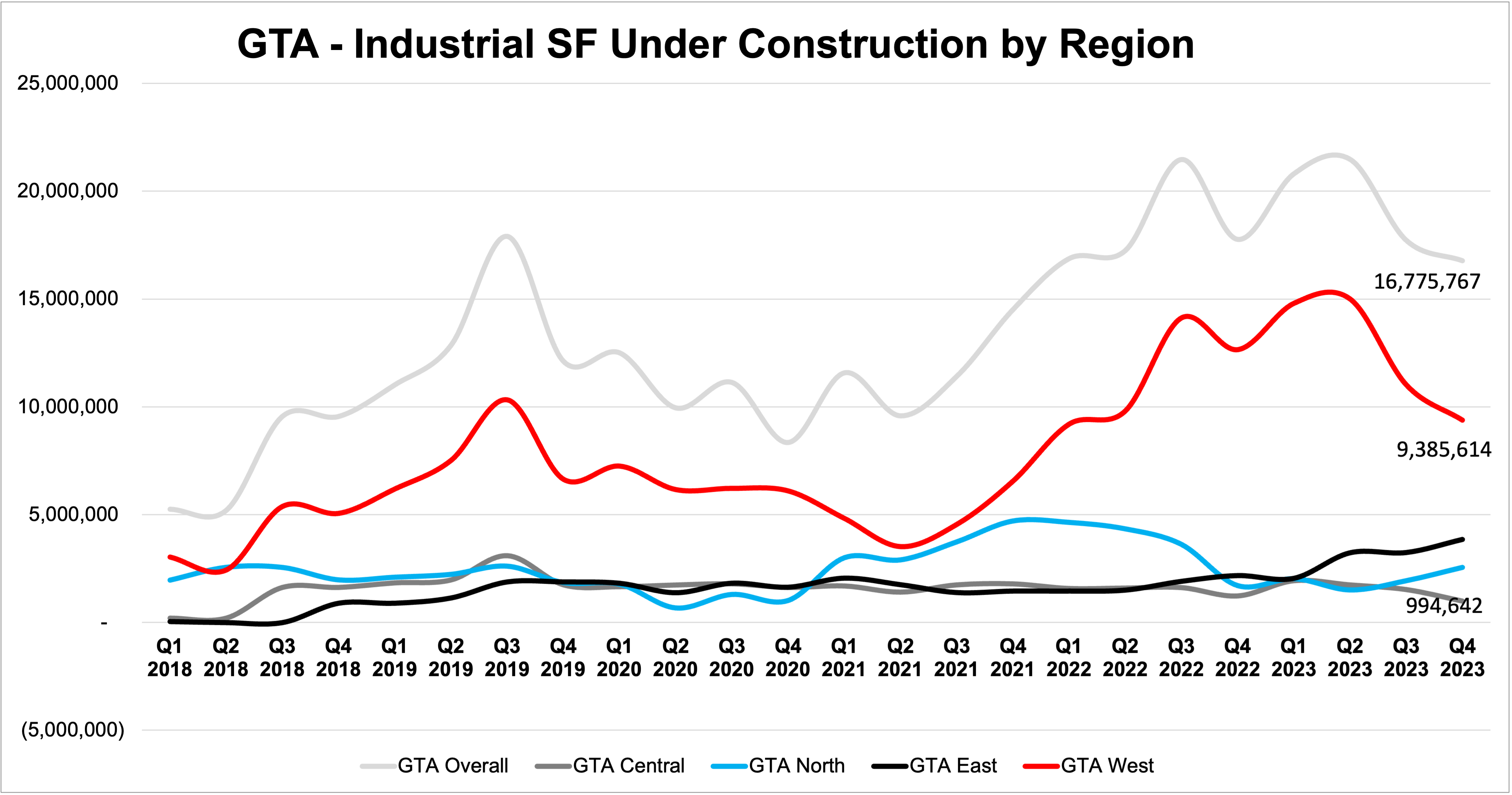

As you can see below, the industrial pipeline in the Greater Toronto Area has increased dramatically over the past five years, from a low of 5.2 MSF under construction in Q2 2018 to a high of 21.5 MSF being built in Q3 2022 before dipping to 16.7 MSF in Q4 2023.

Development has slowed modestly and deliveries continue to come online as projects work their way through. In terms of market signals, the slowdown in rent growth, increase in vacancies and sublets, and price reductions on sitting space are leading indicators of a shift. How far that shift goes depends on how efficiently the market re-leases what is now available; letting us know if we are simply seeing a re-shuffling at a time when Tenants finally have options… whether the market has taken all it can bear with respect to the dramatic pricing changes since 2018… or if we are truly heading into further economic uncertainty. Time will tell, as always.

The fundamentals of industrial real estate remain strong and, despite increases in availabilities, we see major projects announced regularly. Anecdotally, we have noticed several state-of-the-art, high-clear, net-zero-carbon, master-planned campuses ranging from 1.5-million to over 6-million square feet in size.

Investors and developers are paying attention to Tenants’ needs and are offering all the bells and whistles – whether it be 40’ clear heights, power up to 6,000 amps, sustainable construction, direct access to major highways, efficient layouts, Net-Zero Carbon Ready and LEED certifications, high door ratios, and generous trailer parking spaces – to help ensure their projects lease up ahead of completion.

GTA Industrial Construction, Deliveries, and Availability Rate, 2018 to 2023. Source: Cushman & Wakefield.

GTA Industrial Construction and Quarterly Rent Growth, 2018 to 2023. Source: Cushman & Wakefield.

GTA Industrial Supply and Pipeline Breakdown by Region

Below, we see a regional breakdown of industrial assets under construction and delivered from 2018 through 2023.

GTA Industrial SF Under Construction, by Region, 2018 to 2023. Source: Cushman & Wakefield.

GTA Industrial SF Delivered, by Region, 2018 to 2023. Source: Cushman & Wakefield.

Important Takeaways:

- Industrial space under construction first peaked in Q3 2022 at 21,472,971 SF, then just eclipsing that figure at 21,483,396 SF in Q2 2023 before slipping to 16,775,767 by Q4 2023.

- With the changing market dynamics, whereby landlords are experiencing some vacancies or longer lease-up periods, we expect fewer speculative developments to occur… at least until the enormous amount of deliveries are absorbed.

- At its peak in Q3 2022, industrial construction represented just 2.67% of total inventory.

- The GTA West markets historically dominate new construction and, as a result, deliveries. The difference between the two is, that in some cases, we see growth spurts in regions (as we have seen in 2023 in the East markets) due to incentives or large portions of re-designated lands.

- Deliveries historically range between 1.5 MSF to 2.5 MSF while typically dipping in Q1 due to weather, however, we have seen outliers. The biggest of all was the enormous 7.8 MSF delivered in Q4 2022 (where the West alone outperformed the entire GTA in most all other time periods); very likely a direct result of the pandemic, booming e-commerce, and flood of projects that commenced in early- to mid-2021.

- We continue to see space being delivered in robust numbers (5.7 MSF in Q4 2023), however, this may change if the pipeline continues its current tightening.

- If the availability rate continues to creep up, and if landlords experience difficulties in re-leasing space, then we may see some proposed projects put on pause or offered for sale more regularly, and done so on a case-by-case basis.

Major Industrial Developments in 2023

Below, we are featuring a few major industrial projects either delivered in 2023, currently under construction, or proposed for development.

- James Snow Business Park, Phase 1, Milton – 1.55 MSF – Oxford Properties – Phase 1 in Q4 2023

Oxford Properties is developing the James Snow Business Park in Milton; a master-planned project with 14 total buildings situated on 180 acres and spanning 3.3 million square feet.

Phase 1 saw the delivery of two state-of-the-art industrial facilities (Buildings C and D), as well as two commercial buildings (Buildings E1 and E2).

Building C – 10725 Louis St. Laurent Avenue – is 1,092,629 SF with a 40’ clear height, 174 truck-level and 4 drive-in doors, 180 trailer parking stalls, and 6000 amps of power.

Building D – 6440 Fifth Line – is 305,475 SF with a 40’ clear height, 47 truck-level and 2 drive-in doors, 48 trailer parking spaces, and 3,000 amps of power.

Buildings E1 and E2 (905 & 955 James Snow Parkway) are both 75,586 SF in size with 32’ clear heights, 23 truck-level and 2 drive-in doors each, and 1,200 amps of power.

- 4680 Garrard Road, Whitby – 780,000 SF – Panattoni – Delivered in 2023

- 210 Kerrison Drive East, Ajax – 716,548 SF – Nicola/Crestpoint – Delivered in 2023

Kerrison Drive & Salem Road Bldg B, Ajax, ON. Taken in 2022.

- 10750 Highway 50, Brampton – 670,485 SF – Orlando Corporation – Delivered in 2023

10750 Highway 50, Brampton. Source: BramptonGuardian.

- King Jane Business Park, King City – 1.7 MSF – Nicola – Proposed (2024/25)

King Jane Business Park, King City. Source: Nicola Blackwood.

Nicola Blackwood has announced the development of the King Jane Business Park in King City. With approximately 1.7 million square feet across five state-of-the-art buildings, the project is expected to be Carbon Zero Certified and will not only offer advanced energy efficiencies but excellent connectivity with direct access to Highway 400 along King Road.

Phase 1 will see Buildings A and B ready for occupancy in Q4 2024. The former property will be 411,978 SF in size with 51 truck-level and 2 drive-in doors, while the latter will be 413,470 SF in size with 54 truck-level and 2 drive-in doors. Both will have 40 foot clear heights and 40 trailer parking spaces.

Phase 2 will see the remaining 3 buildings constructed. Building C will be the largest of the park at 560,660 SF with 110 truck-level and 4 drive-in doors, as well as 75 trailer parking spaces. Buildings D1 will be 132,625 SF in size with 23 truck-level and 2 drive-in doors, while Building D2 will be 136,848 SF in size with 28 truck-level and 2 drive-in doors. All three properties will have 40 foot clear heights and 56’ by 40’ bay sizes. Colliers is leading the leasing of the properties.

- 5360 Thickson Road, Whitby – 1.6 MSF – Panattoni – Proposed (2025)

- Choice Caledon Business Park – 6.1 MSF – Choice Properties/RICE Group – Proposed (2025-2028)

5762 Mayfield Road – Choice Caledon Business Park.

RICE Group and Choice Properties are constructing a 6.1-million square foot industrial park at 5762 Mayfield Road in Caledon. With Loblaws pre-leasing 1,083,000 SF at Building A and NLS taking 620,000 SF at Building H with the option to expand to the full 911,300 SF, the project is well under way. CBRE is leading the leasing of the Zero-Carbon Ready assets.

The twelve properties will be constructed in stages, with:

- Phase 1 bringing Building A (1,083,000 SF) in 2025;

- Phase 2 seeing Buildings C, D, and H (totalling approximately 3 MSF) coming online in 2026;

- Phase 3 delivering Buildings E and F (about 1.8 MSF together) in 2027; and

- Phase 4 rounding out the development with Buildings I, K, J1, J2, J3, and J4 (representing around 700,000 SF) in 2028.

Conclusion:

Looking ahead, the industrial market continues to defy the broader economic uncertainty and remains highly sought-after; both to purchase and lease – it just will depend on the individual asset.

While some may say that sentiment has changed, or speak of both investors and occupiers putting plans on the shelf, vacating space, or downsizing, let’s not forget that this is typical in any normal market. What we had experienced over the past three to seven years was a landscape with constrained supply and a red-hot logistics and warehousing industry. As vacancies push up to the 2% mark (and as interest rates plateau or eventually and gradually fall) tenants will have more options, buyers will regain confidence, and pricing will further stabilize.

As is with common sense, it may certainly be more challenging or rigorous to complete a deal, obtain financing, go through development, or even secure a tenant. That said, if you currently own a well-maintained and -located industrial property within the GTA, there are still large institutional and private investors with dry powder seeking to obtain these assets, both for their strong cashflows and as a hedge against inflation and any potential threats to the financial system.

If selling your property is still something you would consider but have not followed through with for any reason, it is not too late to do so… just ensure that you go into any sales process with a clear strategy and expectations, as well as an understanding of potential outcomes.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com