Increasing Development Charges and Their Impact on New Inventory

September 23rd, 2022

People are sensitive to costs.

When a single item becomes more expensive, we take note. Perhaps we substitute the product with a different brand. Or we decide to shop with another vendor or retailer; the story in our head being that something is wrong.

That this was a mistake.

No matter. We will find a replacement of equal quality and similar function somewhere else.

However, when an entire product category increases in cost – such as all lumber tripling in price – we realize that the new cost must be borne by us (assuming we will still need to purchase it). We may do calculations in our head to save in other areas to offset our total expenses. We may simply save less or accept lower profits until pricing – we hope – eventually goes back down to normal. Or, if the market can bear it, we can pass them on to someone else.

This shift in our finances likely won’t be the end of the world. We can manage through creativity, frugality, and perhaps, ingenuity. Buying raw materials and assembling or processing them ourselves. Or procuring larger volumes wholesale to spread out the costs over time.

Whatever strategy or tactic we employ, we’ll be ok.

However, when many line items begin to balloon in cost, we begin to seriously reconsider our approach. In the context of development, this may mean reducing marketing expenses or brokerage commissions. Or it may mean raising rents and valuations; effectively passing these costs down the value chain.

The truth is, costs come in layers. Each layer can be spread out or absorbed over time without much difficulty. As the layers pile on, their effect is multiplicative; squeezing our balance sheet until the venture no longer becomes feasible.

Over the past several weeks and months, we have explored the changes in construction costs, such as materials and labour, and industrial land and property values.

We have also analyzed their impact on the broader industrial market; influencing the supply of new inventory, the acceleration of industrial rents, and the explosion of asset pricing.

For this week’s newsletter, we will dive a bit deeper into the less-talked-about industrial development charges in the Greater Toronto Area.

Because, when taken together with industrial land values and construction costs, an Investor or Developer can put together a conservative preliminary cost evaluation when considering a potential new project.

GTA Industrial Development Charges

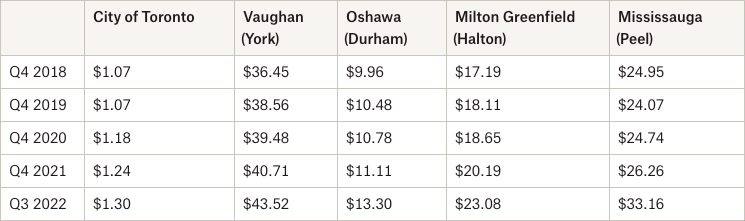

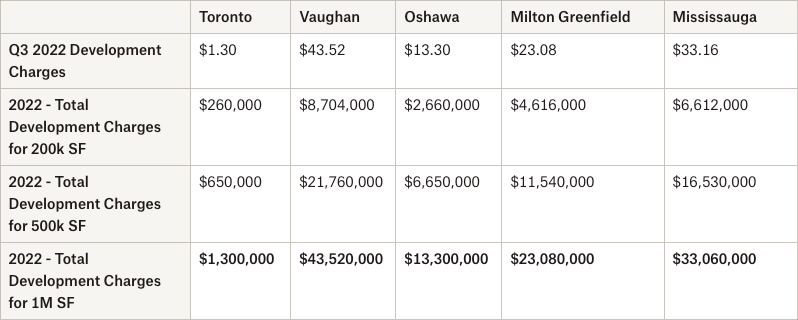

Looking at the table below, we can see the relative total development charges with sample municipalities from each major Region.

So, what accounts for the large variances in Development Charges between Region?

Well, if we look at what constitutes the total Development Charges, we see that a Developer must pay 1) the Town, 2) the Region, 3) Education charges, and 4) Storm Water charges; depending on which apply. There may also be area-specific charges, such as a charge of 2% of the property value, or other costs per-square-foot, as set out in the by-laws of the Municipality.

Of note, the City of Toronto does not have Town- or Region-specific charges, nor are their Storm Water charges; it only requires Education charges for new developments.

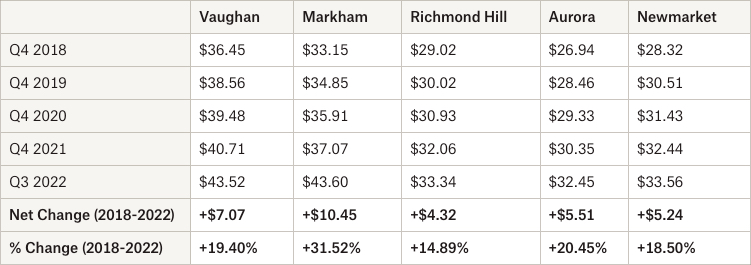

York Region Leading the Way in DCs

York Region has the highest overall DCs, thanks in large part to the $24.41 PSF Region charges. That said, costs have historically been high and the relative increases since 2018 have not been the largest across the GTA.

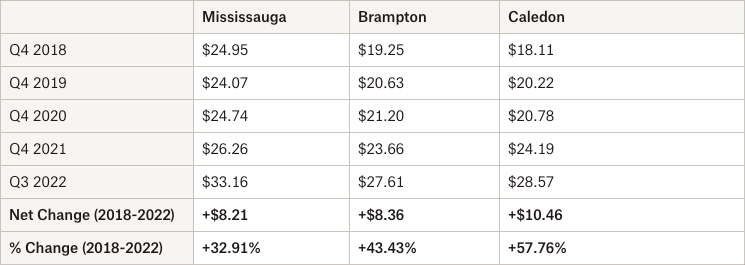

Peel Region Is Catching Up Quickly…

Peel Region’s DCs are accelerating at the fastest clip with Regional charges that have increased from $13.56 PSF in Q4 2018 to $19.91 PSF in Q3 2022, along with increased charges by each Municipality.

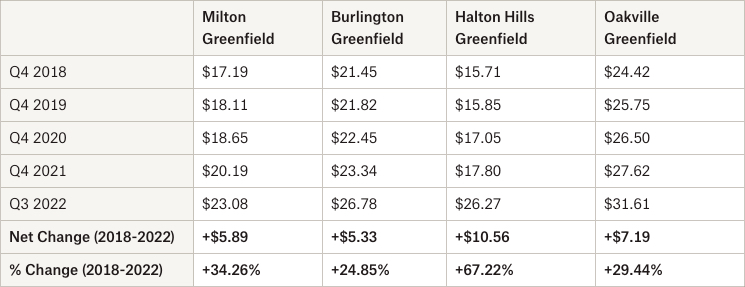

Halton Region Following Close Behind…

Halton Region has seen noticeable interest as developers move west of the Core. Here, we have seen the bulk of the cost increases coming from the Municipalities, with modest increases in the Regional portion of the total development costs.

Durham Region Increasing But Still a Value Play

Although Durham Region has seen a considerable percentage increase in DCs, the total costs remain well below its regional counterparts. The bulk of the changes stem from an increase in Regional costs from $9.96 PSF in Q4 2018 to $13.30 PSF in Q3 2022 (excluding the Seaton Lands in Pickering) with a small bump from the Municipalities.

Example: 2022 Development Charges for ‘Big Box’ Industrial Facilities

To cap off our breakdown of development charges across various GTA Regions and Municipalities, let’s look at a ‘quick and easy’ example of what it would cost to develop industrial facilities of 200,000 SF, 500,000 SF, and 1 million SF in Q3 2022.

While this calculation does not account for the differences in industrial land values, as well as the availability of land and other factors in the site selection process, we can see through this lens why an Investor or Developer might favour one submarket over another.

If you are looking to construct an industrial property in the GTA, then you should be aware that, for the foreseeable future, the cost to do so will only go up. Of note, materials, labour, industrial land, and development charges have all significantly increased.

Even if the market cools or should we enter a downturn, labour and development charges are unlikely to go down quickly, if at all, due to unions, contracts, and legislation. Materials and industrial land could, in theory, become less costly. However, there are no clear signals that this will happen any time soon.

The big question mark remains around the full impact of interest rates on investors and developers, and whether or not rents can continue to rise to create the yields necessary to outstrip borrowing cost increases. Should we find ourselves in an environment where construction and financing costs disincentivize investors, then market forces may indeed push costs down over time. How and when this may occur remains to be seen.

For those who own existing industrial properties, these assets may become even more sought-after should supply be further constrained; something hard to conceive of given our historically low availabilities and high valuations.

With that said, if you would like a confidential consultation or a complimentary opinion of value of your industrial asset, please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is a Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com