Industrial & E-Commerce: A Love Story

The Impact of E-Commerce on the GTHA Industrial Real Estate Market

September 25th, 2020

The recent pandemic and economic shutdowns forced all of us to re-establish our priorities and to re-think our businesses, our relationships, and our lives, in general.

The weaknesses and risks in our day-to-day were exposed, leaving us with the opportunity to form new habits and find innovative solutions.

If we look at our world from March 2020 onward, the majority of our services and day-to-day operations moved indoors. Many of us adopted systems to communicate and collaborate virtually, while also implementing protocols to ensure safe meetings and tours should we be forced to venture out. Were one to sit on a Toronto rooftop and observe the passer-goers, they would find, well, that there weren’t very many. Life would seem still; almost tranquil.

Except for one constant.

The movement of things.

Specifically, the transportation of physical goods to places of business and residence.

E-commerce. Online retail. Grocery delivery. Meal kits. Home office equipment. Pet food. You name it. All delivered to your door (oftentimes) within 24 hours… except for the sold-out stationery bikes, PPE, and office furniture.

These novel behaviours were borne out of necessity, however, as we adapted to our new situation, we began to realize some of the benefits, such as convenience, cost savings, time efficiencies, and work-life balance. As we emerged from the quarantine and trickled back into the ‘new normal’ daily life, it made sense to keep some of these newfound benefits and integrate them into our pre-existing schedules and routines.

And that is how we embraced the adoption of the single force driving the explosion in industrial real estate demand.

The Explosion of E-Commerce

What was once just a niche space to purchase books and bid on used or collectible items has turned into “instantly-buy-anything-and-have-it-delivered-to-your-door-tomorrow-with-one-click.”

And despite the amazing customer service, rock-bottom prices, the endless selection, and convenience factor found online, many of us still held on to our past habits of shopping in-person; whether it be to see or feel the product, for the experience, or for social reasons.

That all changed with the pandemic and stay-at-home orders across the globe.

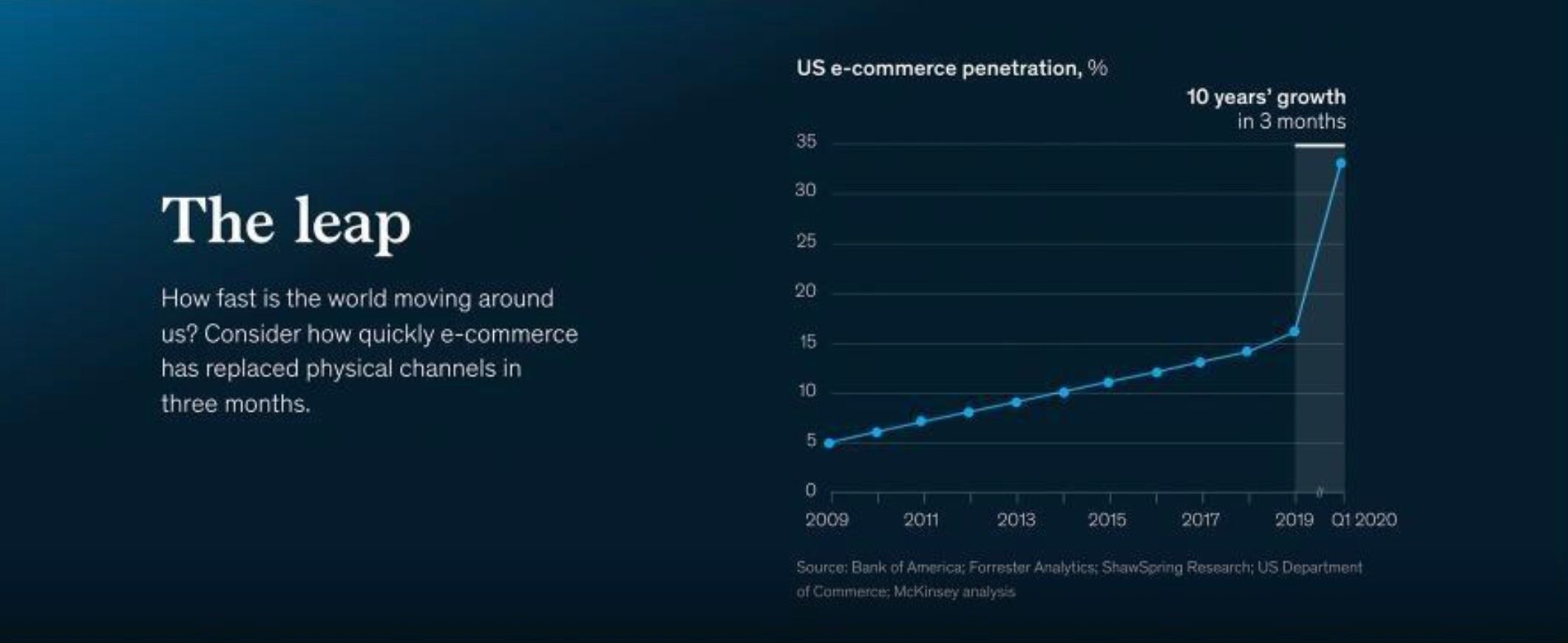

Source: McKinsey

According to McKinsey, e-commerce penetration in the United States saw 10 years’ worth of growth (from roughly 16% to 33%) during the first 3 months of the shutdowns. And according to newly released statistics from TechCrunch and referencing IBM’s U.S. Retail Index, the pandemic has accelerated the shift away from physical stores to digital shopping by roughly five years.

And when you take a closer look, the numbers are staggering…

According to Retail Insider and referencing a StatsCan report, e-commerce sales reached a record $3.9 billion in May 2020 in Canada, which is a 2.3 % increase over the previous month and a 99.3 % increase from February 2020.

Year-over-year, looking back to May 2019, online retail sales more than doubled; increasing by 110.8%.

On the flipside, total retail sales plummeted to $33.9 billion in April 2020, representing a 29.1 % decline from February 2020 and a 26.4 % decline from April 2019. During that same period, e-commerce saw a 63.8 % monthly increase, as in-store sales dropped 25.3 %.

Overall, whether we look at the data or examine our own personal experiences during those challenging times, many of us would agree that we turned to e-commerce platforms for many of our non-essential needs. Essential providers, such as grocery stores or wholesalers like Costco and Walmart were typically busy each and every day.

This begs the question…

Aside from the obvious answer that many non-essential retailers were forced to close…

Why did so many of us choose to purchase essential goods in-person instead of online?

Was it because food delivery platforms and supply chains were not robust or mature enough? Or didn’t have competitive variety and pricing?

Or was it because we prefer to buy those items in-store?

Whatever the answer, it appears as though the former will not be an excuse for much longer.

Industrial is the new Retail….

With a proven pool of consumers and vastly untapped potential, the race towards omnichannel retail and supply chains has become a cultural phenomenon. Amazon is/was (depending on when you read this) the most valuable company in the world, largely driving value from its massive scale, its technology, and its ability to gobble up entire industries at will. And WalMart, its rival, and at one-time the market leader, isn’t going down without a fight.

As the behemoths battle for market share, each brings different competitive advantages. Amazon is a tech giant with unfathomable amounts of data on its consumers and a whole host of industry verticals, all integrated together to create synergies and economies of scale.

WalMart, the grizzled veteran, possesses decades and decades of experience and the ingrained relationships and influence with vendors, manufacturers, governments, and suppliers across the globe that come with it.

Differences aside, both recognize and see the value in fulfillment and last-mile strategies.

Source: Bloomberg

Amazon’s strategy has been to establish large fulfillment centres around the periphery while building a last-mile facility network throughout urban neighbourhoods as close to consumers as possible.

In fact, according to Bloomberg, Amazon plans to put 1,000 (and eventually 1,500) warehouses in suburban neighbourhoods around the United States and Canada and have their own integrated network to compete with WalMart on same-day deliveries. The announcement was made, in part, as Amazon failed to fulfill its two-day delivery guarantee during the lockdown, despite the hiring of over 175,000 new workers. The bold splash comes in preparation for the 2020 holiday season and beyond.

And WalMart, the dinosaur turned e-commerce professional, carries a network of stores it ingeniously converted into last-mile facilities; whether it be for deliveries or in-store pickup. Further, it’s made a multi-billion-dollar commitment to cutting-edge technologies that would make even Jeff Bezos worried, or at least, a tad bit jealous.

Source: Walmart

In the not-so-distant future, we can expect all of the big players in the warehousing, distribution, and logistics space to have these mini-shipping centres scattered throughout municipalities and neighbourhoods – both urban and suburban, ready to deliver goods to consumers.

Once strategic positioning and locations have been obtained by all Parties then the war will rage on inside the four walls of each of these fulfillment and distribution centres.

The competitive advantages will then lie in: efficiencies derived from robotics, racking, Internet-of-Things sensors, data networks, blockchain, electronic shelves, AI software for predictive supply chains, and automated manufacturing and distribution.

While those innovations continue to be dreamed of, built, and made ready, we are just scratching the surface as it relates to building and occupying the ideal industrial facilities.

And when considering the Greater Toronto and Hamilton Area’s Industrial real estate market, one would wonder where and how and when these companies could secure the amount of space that is being projected will be needed to meet rising demand and changing consumer behaviours.

CONCLUSION

Up until now, we have identified the lead dominos in the tangled love story that industrial and e-commerce have become.

Online sales drive continued demand for space while more extensive warehousing and distribution networks drive faster deliveries and higher customer satisfaction rates, creating the flywheel effect that Amazon founder Jeff Bezos is famous for coining.

Next week, we’ll examine exactly how these events have impacted the GTHA’s industrial real estate market, with key analysis regarding last-mile/last-touch facilities, fulfillment centres, and cold-storage facilities… three of the most sought-after property types in 2020.

In the meantime, if you require guidance regarding your commercial real estate property or portfolio, please contact us.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com