Industrial Facilities Completed & Under Construction in 2020

Examining the GTA’s Industrial Pipeline & Supply Challenges

October 16th, 2020

Historically, developers and investors in the GTA have only been able to complete and bring online about 5 Million SF of new construction every year. This flow has remained fairly constant throughout the years, with about 10 Million SF in the pipeline….

Despite the relatively large number of ongoing projects and levels of activity throughout one of North America’s hottest industrial markets…

It Simply Isn’t Enough!

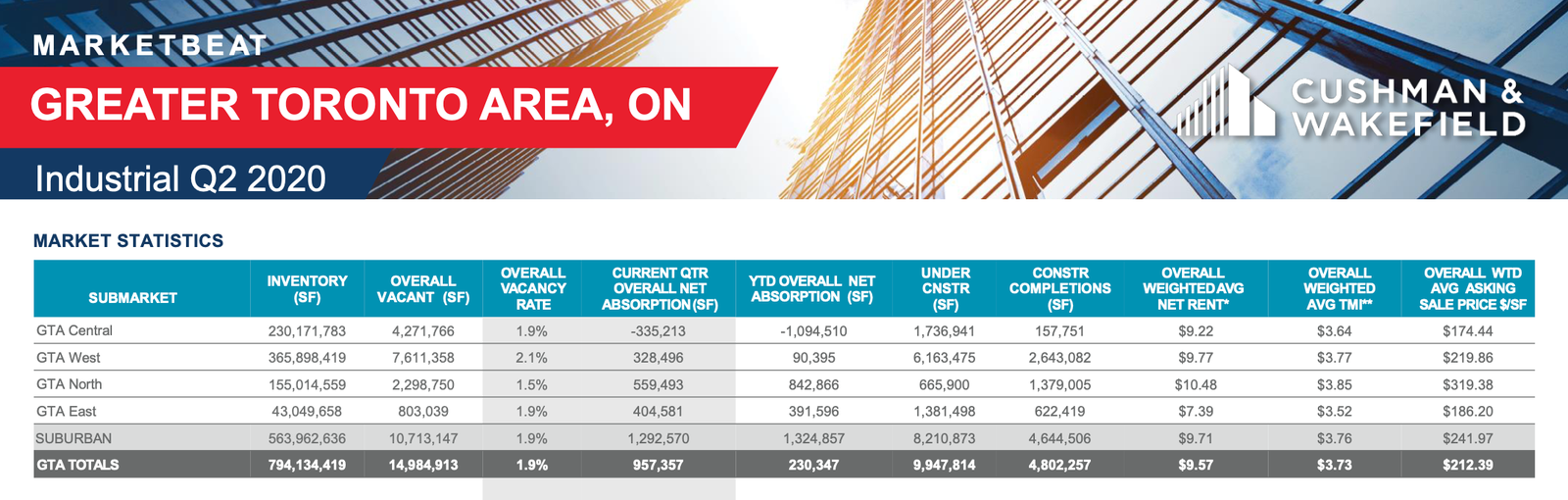

Q2 2020 CW Marketbeat

- Under Construction – 9,947,000 Million SF

- Construction Completion – 4,802,000 Million SF

The reasoning behind this statement is that almost nothing sits on the market. A good percentage of buildings are pre-leased or built-to-suit while most of the remaining product built on spec is filled with high-quality tenants well before completion of construction.

This shortage isn’t due to a lack of competent developers or institutional backing in the GTA. No, we’ve got plenty of high-performing organizations breaking ground, submitting applications, organizing projects, and getting deals done.

A friend and leader of one such organization described the demand for product as having “5 really nice steaks for dinner and not being able to eat all of them.” Having said that, these groups are working around-the-clock to move projects through the pipeline.

The surface-level issue here is easy to spot. It’s not just a lack of land in general. It’s a shortage of developable and shovel-ready land.

Even investors and developers that own large portfolios of land from Hamilton to Barrie and out past Oshawa have their hands tied when it comes to going through the planning and approval process.

The underlying culprit behind the chronic lack of supply is, indeed, red tape and regulation.

Last week, we examined a comprehensive (but not exhaustive) list of documents that developers likely have to submit to complete the planning and approval process.

This week, we will take a deeper look at the GTA Industrial pipeline.

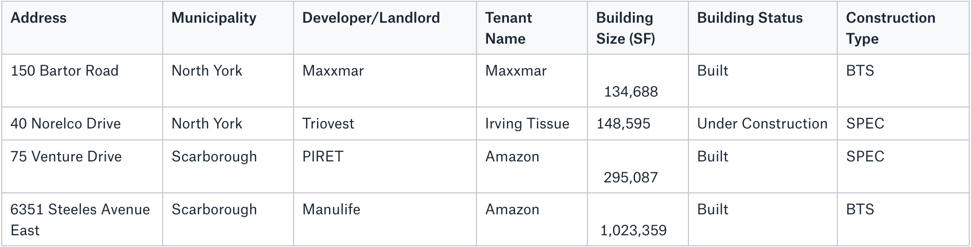

Buildings completed, currently under construction and scheduled to be completed in 2020 – GTA Central Markets

40 Norelco Drive, North York – Source: Triovest

Buildings completed, currently under construction and scheduled to be completed in 2020 – GTA East Markets

Buildings completed, currently under construction and scheduled to be completed in 2020 – GTA North Markets

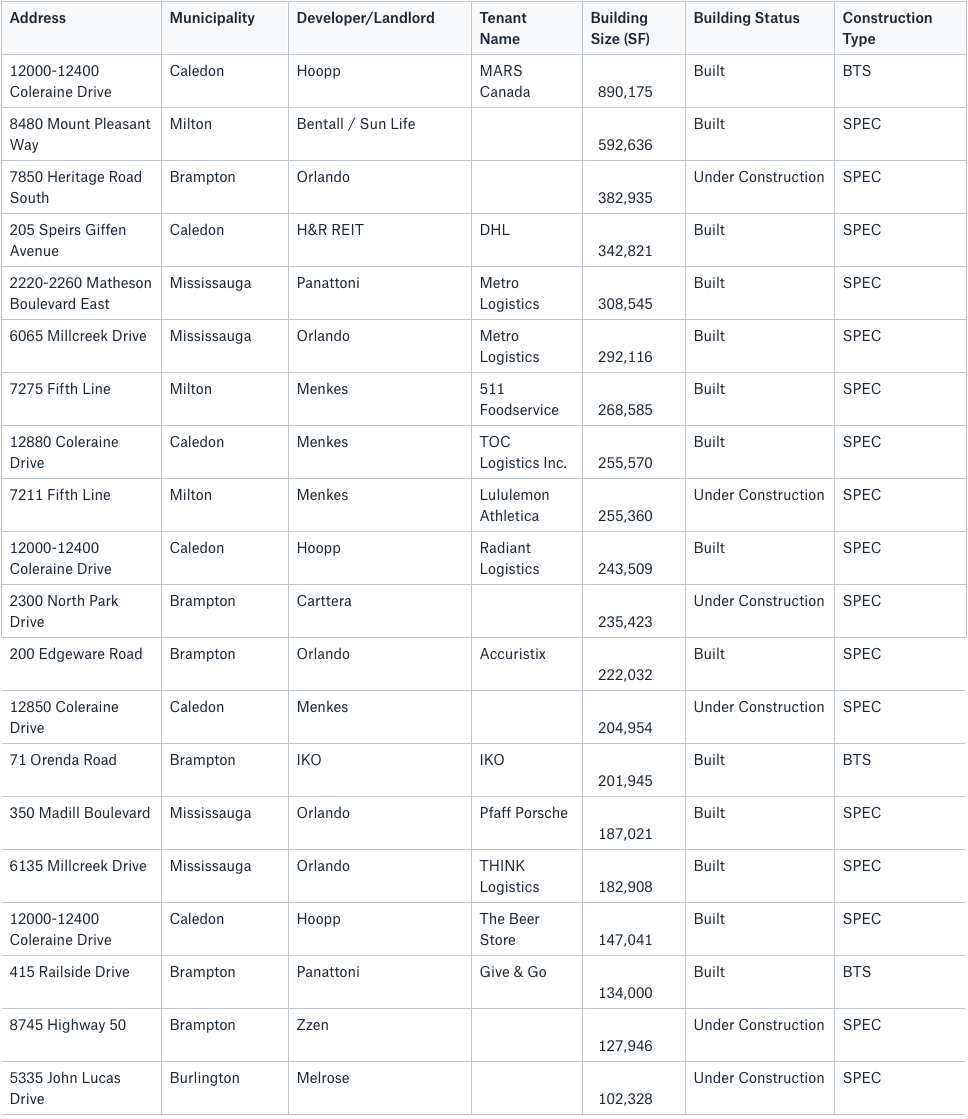

Buildings completed, currently under construction and scheduled to be completed in 2020 – GTA West Markets

Key Takeaways:

- Most of the construction is taking place in the GTA-West markets; the majority of buildings are speculative construction;

- The second most active markets are the GTA-North markets, where most of the construction is Built-to-Suit;

- The GTA-East markets are opening up and, given the lower cost of industrial land, we will see a lot more construction there in the years to come;

- Most of the new construction in the GTA-Central markets is “infill redevelopment.”

Conclusion

We see developers and investors pursuing any available opportunities to purchase development land or infill opportunities… without it, you are just not in the business…. you ought to have a considerable amount of said product in your pipeline…

From purchasing significant acreage throughout the GTA and surrounding regions, to actively pursuing and engaging in the servicing, and eventually, the more formal approval and planning process. Not to mention the team of third-party experts and consultants that are brought in to execute… Overall, we can observe the most active developers are those who take a long-term, focused approach.

And, as we mentioned earlier, we do currently have about 10 million SF under construction…

When new, modern warehousing and distribution facilities go from 200k to 300k SF all the way to 1.5 million SF, the total volume adds up quickly. Finally, when the majority of new product is pre-leased or absorbed before completion, the relative risk associated with a traditional speculation build is lower than if one were to construct a different type of asset in a less sought-after market.

With respect to potential negative externalities or unintended consequences: from observing transactions, there is an obvious bias towards the ‘e-commerce-suited’ warehousing, distribution, transportation, and logistics facilities. Little attention is being given to smaller properties as of yet, that stock is pretty much constant so with this demand pricing just continues to escalate.

In terms of possible solutions regarding the approval process itself, that would require an open forum and a collaboration between many different Parties and authorities. Those working in and actively modifying the process would understand the reasons why certain steps and regulations exist.

Perhaps there may be a way to expedite certain projects to bring relief to a market that has predominantly supported larger developments, which we have seen a number of times in the past.

Next week, we’ll begin our 4-part analysis of the major GTA Industrial markets for Q3 2020.

Until then…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Immediate Past President, SIOR – Central Canada Chapter

www.siorccc.org

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com