Optimizing and Maximizing Your Industrial Facilities

Users of Industrial space are aware of the arduous process of identifying, securing, and occupying properties to house their operations. Space is hard to find… and it’s becoming expensive. And when you do find it, you’re on the hook for several years; so you have to make it work.

Therefore, the name of the game is in finding the balance between trimming excess capacity to reduce costs while maximizing available space to allow for growth (this is especially true in our wonderful City of Toronto).

So if you are interested in understanding how to strike this balance without the accompanying headache and overwhelm, then you may want to read on, as we’ve brought in some experts to impart on us their decades of wisdom on the matter.

The Greater Toronto Area’s Industrial Market is one of the fastest-growing in North America. All of the metrics show that we are among the top few, or in some cases, leading the pack with respect to rental rate growth, low vacancy rates, etc….

With almost 800 million SF of industrial space, ours is the third-largest industrial area in North America right behind Los Angeles and Chicago and is continuing to grow.

About 5 to 8 million SF of new industrial buildings are being delivered each year; mainly driven by e-commerce and the continuous increase in online retail sales.

And each and every building would be “useless” without the racking and automation systems that go inside “the box”.

Because with ever-increasing land values, development charges, construction costs, and net rental rates, maximizing the use of the “box” and its space within has become extremely important.

Finally, if we judge a “box’s” utility based on its volume, then we are faced with a simple math equation. As it is becoming more and more difficult to move, purchase, and build… the length and width of the base become more restricted and costly to expand. The simplest solution has been to increase the clear heights and go up…

As a result, buildings have grown from 28 feet high to 32, 36 and, even now, 40 feet high. And although we’ve said that going up is the lowest hanging fruit in space maximization, this growth is limited by material handling equipment. As of today, there is no equipment that can go higher than 40 feet.

One exception is a fully automated facility… in which case we could go up to 80 feet and above…

So as we reach the limit to scale through the expansion of building dimensions – whether it be to raise the roof or increase GFA – the next phase revolves around internal optimization.

One valuable option available to Occupiers of Industrial space is to leverage racking systems…

And there are so many different rack configurations to choose from…

You can decide between a:

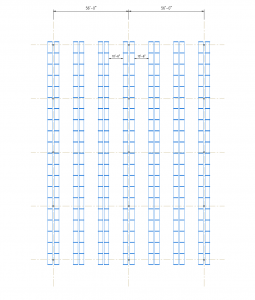

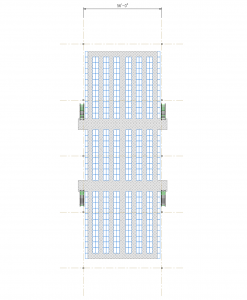

- Dense Single Deep Selective Rack Configuration (10’ Typical Reach Truck Aisle);

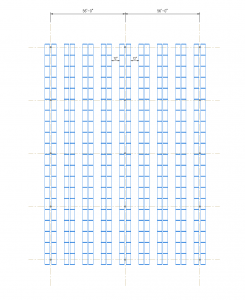

- Very Narrow Aisle (VNA) Selective Rack Configuration (6’ Typical VNA Truck Aisle);

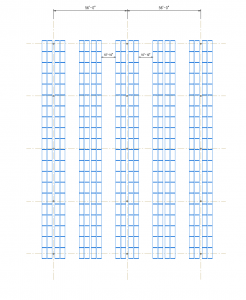

- Double Deep Selective Rack Configuration (10’ 6” Typical Reach Truck Aisle);

- Mixed Single/Double Deep Rack Configuration (10’ 6” Typical Reach Truck Aisle);

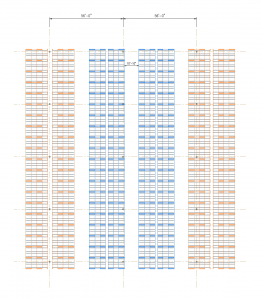

- 3 Deep Push Back Rack Configuration (10’ 6” Typical Reach Truck Aisle);

- Mixed 3 & 4 Deep Push Back Rack Configuration (10’ 6” Typical Reach Truck Aisle);

- E-Commerce Multi-Level Picking Modules (Customizable Aisles); or

- A High-Density System Utilizing Shuttles (10’6” Typical Reach Truck Aisle).

You can even mix and match all of the above.

Usually, capacities are estimated based on an average pallet height of 62” (including pallet), with a 4-6” beam height, 6-8” lift-off, and 32” top clearance allowances. This would allow for six levels of storage in a 40’ clear warehouse.

Single Deep Reach Racking Configuration

Very Narrow Aisle Racking Configuration

Due to the specific requirements of each User, as well as the unique nature of each Facility, a “one size fits all” approach does NOT apply here …

It is critical to understand that:

- Storage system designs and storage system types all start with data analysis on SKU type and quantities to be stored per SKU;

- Product throughput is a critical step to determine correct layouts;

- MHE selection impacts aisle dimensions;

- It is typically a combination of numerous types of storage systems that customers will benefit from when designing a final layout;

- Productivity vs density reviews are very important; and

- The cost per pallet position (budgetary constraints) will also determine final designs.

The fact is that we have numerous rules of thumbs on types of storage systems and when they would be best utilized.

Double Deep Reach Racking Configuration

Three & Four Deep Pushback Racking Configuration

E-commerce Shelf Module

To that point, we spent some time with Gerry Harte and Michael Wigle of Restack Holdings to discuss this further. They have years of experience in this field… Let’s see what they have to say on this topic.

==

The last 50 years has seen a very linear path to increase both the density and productivity of industrial distribution centres. Fifty years ago, our buildings were relatively short and have progressed to become taller and taller. This was driven by technology and lift equipment that kept enabling better and better designs for industrial distribution facilities.

Industrial distribution and the material handling industry have always done great jobs of marketing the latest and greatest systems to maximize returns for producers, distributors, and retailers alike. Some concepts were great and drove the industry forward, while others were systems that could only be categorized as “fashionable”.

Today, there is a vast array of systems and technologies that can be deployed within a supply chain. The pure scale of choice can be dizzying. Depending on the industry, geography, supply chain, and customer base, it is difficult to decide which technologies and systems companies should invest in. The wave of industry disruptors and the conversation focused on e-commerce with the buzz words of “last-mile” and “omnichannel”, cloud the conversation.

Within any industry, the real conversation is still about deploying capital most efficiently within the enterprise.

In terms of distribution, companies should still be cautious but willing to experiment. We are witnessing this with the Walmart’s and Amazon’s of the world in terms of their overall supply chain, distribution network, and the systems deployed on an Intra-Logistics level. This is also having a large impact on the real estate and facility part of the equation.

For distribution, in general, we may be witnessing what was postulated a few years ago, that distribution will eventually look more utilitarian than it does today. And that Amazon may be perhaps the first “distribution utility” that the world has seen. We agree with this tectonic shift and the distribution of goods will be viewed more along the lines of our roads, power, and other elements of global infrastructure.

But in this series of articles, we want to focus on the intra-logistics side and what companies can do when evaluating their options to have the greatest return on capital within their distribution networks. The majority do not have access to capital like the big boys, and the experimental part of their efforts has a level of risk that makes it unrealistic.

It’s all about the data…

The last twenty years has put us in one of the best positions ever to make better decisions. Even the smallest of companies have data at their fingertips like never before. Everything is now online; whether it be sales forecasts, production schedules, product development, SKU information, or global inventories.

This is where the analysis begins.

Distribution network design is a whole entity unto itself and focuses on the long term plans of the business; the intra-logistics portion is the end result of the execution of that plan. So in this series, we will look at:

- The data analytics from a facility design perspective;

- The system options that affect facility design;

- How these system options should be viewed in terms of capital return and risk;

- The productivity versus density equation;

- The automation equation;

- Existing assets and leveraging those; and

- Pitfalls along the way.

These are all big topics to explore but we will chip away at them one by one.

On that note…

For further information on the subject of Racking and Automation Systems and Industrial Buildings in the GTA please contact:

Gerry Harte

https://www.linkedin.com/in/gerryharte/

or

Michael Wigle

https://www.linkedin.com/in/michaeljwigle/

Restack’s mission is to Organize the World’s Inventory. Their premier storage and handling solutions have helped distribution, retail, and production facilities throughout North America optimize space, improve efficiency, and reduce cost and waste in the supply chain since 2004.

Comprehensive services for design, construction and decommissioning, maintenance, and safety and compliance help you maximize your investment while ensuring the safety of your employees.

CONCLUSION

I wanted to thank Gerry and Michael for providing their expertise on this topic and generously devoting time to making this issue happen.

If you are looking for more details on this or if you need advice on racking and automation systems, then please connect with Gerry Harte or Michael Wigle directly (contact info is above).

Finally, if you are thinking of moving, selling, or acquiring a commercial property in the GTA and would like to consult regarding on-site selection, industrial land values and development charges, construction costs, property values, rental rates, etc please call Goran Brelih…

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.