Major GTA Industrial Developments – Part 1

March 4th, 2022

If you find yourself thinking that the GTA Industrial market is a little bit crazy – that’s because it is.

From over 800 million square feet of space with 0.6% vacancy and rents doubling over the past five years, to industrial land selling for up to $4 million an acre and beyond… What we are currently experiencing is a rare confluence of events.

Industrial occupiers are fighting for space. Investors are repositioning portfolios and pouring billions into the asset class. Meanwhile, developers (and brokers) are scouring planning reports for newly designated parcels of land. Product is most definitely king.

The ironic part of it all is that the frenzy seems to be coming to a head just as inventory dries up and both shortages and inflation make development more costly than ever. Or perhaps I’m wrong and we’re just getting started. Only time will tell.

Does this mean there are no deals out there? No!

Acquiring and developing industrial assets has certainly become more expensive, however, opportunity awaits those who can creatively dig it up. The market is as busy as ever, although it feels as if it is on a never-ending treadmill trying to bring onboard more supply.

Industrial facilities are the backbone of our real (and quickly digitizing) economy. Supply chain shortages have spurred the slow trickle of manufacturing on-shoring. Booming online sales have made logistics and warehousing facilities highly sought-after. The behemoths who have profited the most over the past two years have an insatiable appetite for space and are willing to pay a premium. As a result, and thanks to their relative simplicity, dependability, and low risk, these facilities have attracted enormous amounts of capital.

Which is why – over the next several weeks – we will examine some of the major transactions that have recently occurred in the GTA industrial market.

Investment and portfolio sales. Land transactions. Value-add plays. Proposed developments.

Because, whether you are an investor or occupier looking to buy or sell, it’s important to gauge the market in order to develop the right strategy.

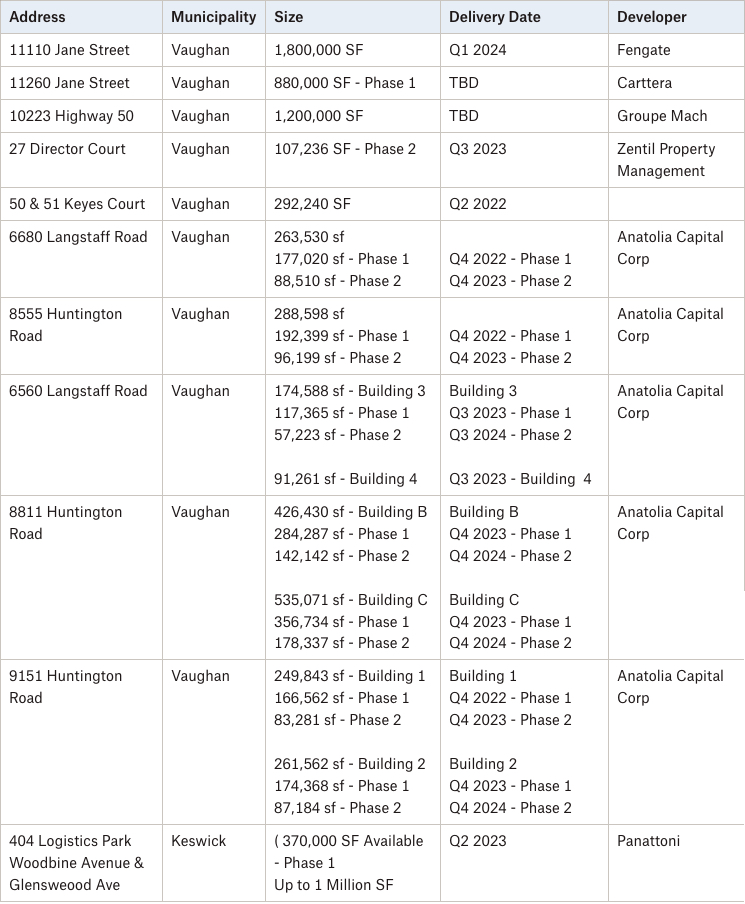

For this week’s newsletter, we’ll continue our conversation with a look at some of the most recent industrial developments across the GTA Central and North markets.

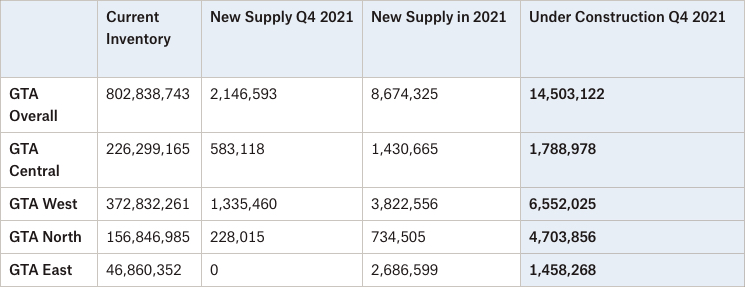

Statistical Summary – Industrial Market – Q4 2021

Major GTA Industrial Developments

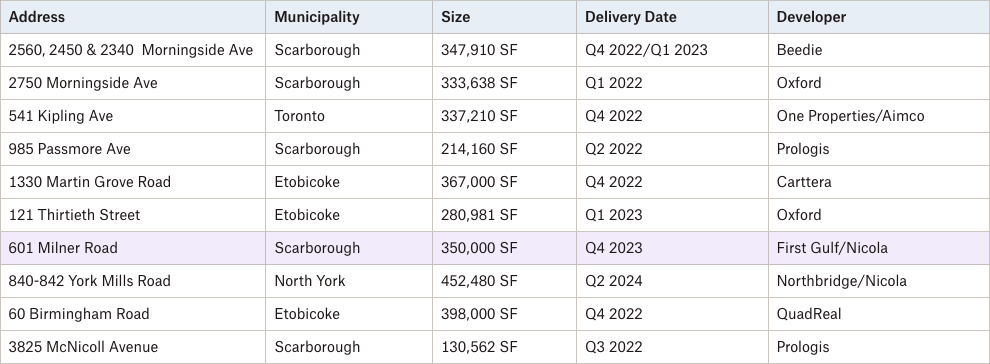

GTA Central

601 Milner Avenue, Scarborough

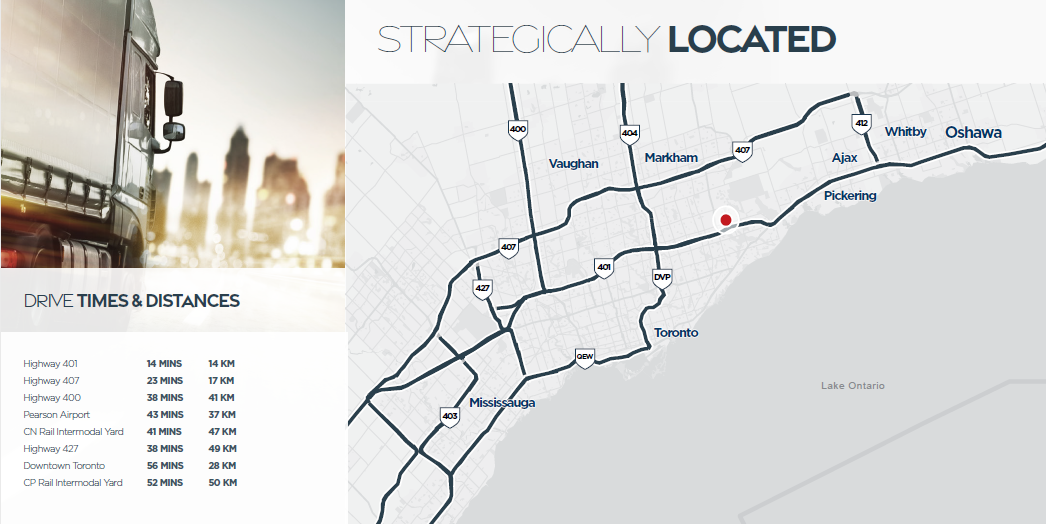

404 Logistics Park (Woodbine Avenue & Glenswood Avenue, Keswick)

Panattoni is developing an industrial park on approximately 200 acres that can accommodate buildings in excess of 1 Million SF. It is located in Keswick, Ontario – about 3km from a Highway 404 interchange and 30 minutes from Highway 401. Similar to 601 Milner, this represents a great opportunity for companies looking for warehousing and logistics space.

Conclusion

Although approximately 8.7M SF of new industrial space was delivered across the GTA in 2021, we also saw just over 14M SF of absorption. This means that, although the commercial real estate community is making great strides in developing enormous quantities of state-of-the-art industrial facilities, we are still swimming against the current of massive demand.

Looking upstream, and as we have covered in previous issues, we see multiple bottlenecks – from available land to construction and zoning delays and rising labour and material costs – contributing to the ongoing supply challenges.

As a result, we notice a massive land rush in the GTA, as well as a major push into the outlying Greater Golden Horseshoe and Southwestern Ontario markets. As the inventory of available land continues to dry up with each new 300k SF to 1M+ SF Big Box warehouse development, putting together these projects will involve more creative solutions, such as redevelopments of older, existing properties or infill sites.

The great news for investors and developers is, that because of the expanding economic base throughout Southern Ontario and retailers’ growing need for warehousing and distribution, the appetite for industrial developments will likely remain robust for many years to come.

One headwind to look out for, however, is the alleged pullback from behemoth Amazon – which will supposedly slow down its expansion as it completes its network; instead focusing on efficiencies within its facilities. How will this impact the overall industrial market? While the e-commerce giant can single-handedly make markets, we believe that there are many other retailers and 3PLs who have been vying for space but unable to secure it due to the competition and scarcity.

Finally, we leave you with a question or though on the matter of distribution. As retailers such as Amazon and WalMart spill over into third-party delivery service offerings and compete with like the likes of UPS, Fedex, DHL, and even Canada Post… will we see a consolidation within the sector?

Is it feasible to have delivery trucks from 5 different companies lined up on residential streets, each operating at less-than-full capacity? Or is this quickly becoming an issue of the ‘natural monopoly,’ such as seen in the development of public transit networks?

How this plays out remains to be seen. In the meantime, if you are an owner of industrial land or property with redevelopment potential, there are plenty of institutional and private buyers who would be willing to pay a premium to take it off your hands.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com