October 20th, 2023

“He, therefore, who is now against domestic manufacture, must be for reducing us either to dependence on that foreign nation, or to be clothed in skins, and to live like wild beasts in dens and caverns. I am not one of these; experience has taught me that manufactures are now as necessary to our independence as to our comfort.”

- Thomas Jefferson, in a letter to Benjamin Austin – January 9, 1816

While many pundits may proclaim novel concepts and fashionable trends to be innovative and groundbreaking, the truth is that history repeats itself.

It certainly does.

The issue is that it is only known until the memory of the last person to experience it has faded or been extinguished.

And thus today, the act of near-shoring (moving operations to a more proximate location) or re-shoring (returning a once-present operation to its place of origin) is touted as a cutting-edge solution to supply chain bottlenecks, global instability, inflation, and labour shortages.

Yet, these very ideas were once a virtue of independent and wealthy nations.

While technology has certainly reshaped the world and made possible the arbitrage of input costs and the creation of an intricate, global network of trade, the aforementioned principles remain.

Consumers relished the power and convenience of one-click, next-day delivery of goods from a catalog with billions of choices. However, as our online shopping addictions were rocked by the pandemic, we began to temper our preferences to include stability, reliability, quality, and affordability; even at the expense of waiting just a little bit longer.

Not only that, but we began to see the effects of a dependence on global partners unfold before our eyes in sectors with high-value and high-priority goods, such as automobiles, groceries, medicines, and commodities.

A slight delay in the delivery of that new gadget or wardrobe item paled in comparison to empty food shelves and electric vehicles with year-long waitlists and jaw-dropping prices. It was no longer a theory or distant concern, but one that raised questions as to how can we, as a collective, ensure that there was a backup option should ports jam, factories shut down, or countries limit exports.

And so businesses began adding contingencies to their operations. First, we saw buffer inventories that led to a significant supply glut (fueling even larger holidays sales), followed by the shift to ‘just-in-case’ models, and announcements of operations moving to Mexico, the United States, and Canada.

This isn’t to say that a single nation, like Canada, needs to produce everything and anything and turn its back on the world.

No. What it means is that this is an opportunity to be a part of the broader competitive landscape, provide more options to consumers and at a lower price, reignite our struggling manufacturing sector, and reap the benefits of a growing and highly-skilled labour force. It’s the excuse we need to take a few steps forward.

We’ll be just fine importing wine and olives from the Mediterranean; so long as we can produce the staples and aim to lead in a few key sectors best-suited to us.

In our previous issues we have highlighted Ontario’s newfound leadership in electric vehicle manufacturing, green technologies, and the innovative production of food and pharmaceuticals.

We also highlighted the key concepts of superclusters and how public and private partnerships are helping to finance the development of innovation hubs, as well as real estate pockets with growing densities of businesses.

What we will embark on in this, and coming, issues is a closer examination and spotlight on various hubs throughout Southern Ontario, and how they are slowly transforming the province back into a manufacturing leader.

So without further ado, let’s take a brief look at the Cities of Kitchener, Cambridge, and Waterloo and note a few of the more prominent businesses, along with their real estate.

K-W-C Spotlight on Manufacturers and Cornerstone Businesses

The municipalities of Kitchener, Cambridge, and Waterloo are established leaders in technology, automotive, and advanced manufacturing, so much so that the Toronto-Waterloo Corridor has gained a reputation as the “Silicon Valley of Ontario.”

From aerospace, food and beverage and cleantech, to fintech, life sciences, robotics and automation, KWC boasts a vibrant ecosystem of startups and established players in research, manufacturing, and technology. This is largely due to the area’s unparalleled access to global corporations and top-notch secondary education institutions such as the University of Waterloo.

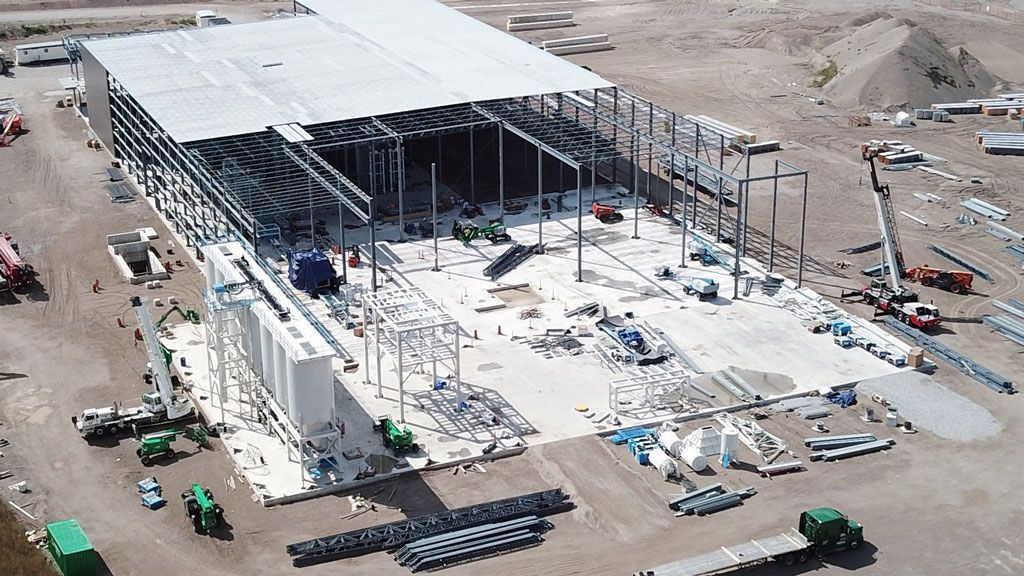

Newcomer: Quebec-based Techo-Bloc received $4-million in government grants and loans as part of its broader $45-million investment into a new hardscape manufacturing plant at 2852 Cedar Creek Road in Ayr, Ontario. The plant will be Techo-Bloc’s ninth – as well as one of the largest industrial permeable pavement facilities – in North America.

According to the announcement by the federal government, “in addition to its Ayr, Ontario facility, Techo-Bloc Inc. operates three manufacturing plants in Quebec and five in the United States.”

Notable Expansion: In January 2023, ATS Automation announced it would open its third Cambridge plant at the 106,000 square-foot 1574 Eagle Street North property. In addition, the company announced expansions to its facilities at 730 Fountain Street North and 1 Natura Way. ATS cited over $110-million worth of new EV battery orders, as well as $513-million in fulfilled orders in 2022, as the catalyst for growing its operational footprint.

Established Player: With three manufacturing plants in Ontario, two of which are located in Cambridge, Toyota Manufacturing Canada is a major, long-term manufacturing employer. The carmaker’s Cambridge facility, now dubbed TMMC South, produced its first vehicle, the Corolla, in 1988.

TMMC North would later open in 1997, with the Woodstock facility beginning production of the RAV4 in 2009. Today, the North and South plants produce 350,000 RAV4 vehicles annually in their combined industrial space of approximately 3 million square feet. In August 2022, Toyota celebrated the production of its 10 millionth vehicle; a red Lexus NX.

Notable Investment Announcements:

- German auto parts manufacturer PWO Group is investing $9.6-million into a line at its Kitchener facility;

- Kuntz Electroplating has received $3-million in federal funding to help expand into production of electric vehicle part production at its Kitchener facility;

- Moderna and Novocol Pharma announced a $4-million investment partnership with the provincial government to produce vaccines at Novocol’s Cambridge facility;

- The federal government announced a $22-million program for 6 aerospace industry projects across Ontario which include $9.2-million and $1.2-million to the University of Waterloo and Shimco North America, respectively.

- VueReal is investing $40-million – along with $10.5-million in support funding – into creating microLED displays and sensors to expand its manufacturing capacity at its Waterloo facility.

- Miovision raised $260-million in funding in a round led by Telus Ventures, Maverix Private Equity, and Export Development Canada.

- Kitchener-based Avidbots raised $70-million USD in its Series C round, helping it to expand its fleet of commercial-cleaning robots and add-ons in its 70,000 SF facility at 45 Washburn Drive.

Other businesses not featured but worth noting: Beckhoff Automation, Bend All Automotive, BWX Technologies, Canadian General-Tower, Christie Digital Systems, Clearpath Robotics, COM DEV, Conestoga Meat Packers, Dare Foods, Descartes Systems Group, Devtek Aerospace, Eclipse Automation, Ford, Grand River Foods, Frito-Lay Canada, HDT Automotive, Inksmith, Interbake Canada, Krug, Linamar, Magna Corporation, Mitchell Plastics, PepsiCo, Rinowa North America, Rockwell Automation Canada, Sandvine, Strongco, Teledyne Dalsa, Ultra Manufacturing, Unilever, Weston Bakeries.

What’s Next for Kitchener, Cambridge, and Waterloo?

While there are numerous noteworthy initiative underway in Kitchener, Cambridge, and Waterloo, there are a few key projects worth highlighting again.

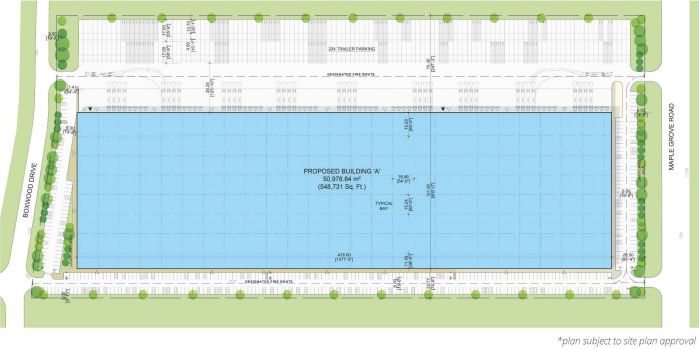

- 800 Maple Grove Road, Cambridge – 550,000 SF – Development

Caplink is developing a 550,000 square-foot, modern industrial warehouse situated on 25 acres of land at 800 Maple Grove Road in Cambridge, Ontario. The property is being marketed as a built-to-suit opportunity with sizes ranging from 100,000 SF to 550,000 SF, and will include a 40 foot clear height with 72 truck-level and 2 drive-in doors. Colliers is managing the pre-leasing of the project, which offers possession 18-24 months out from lease execution.

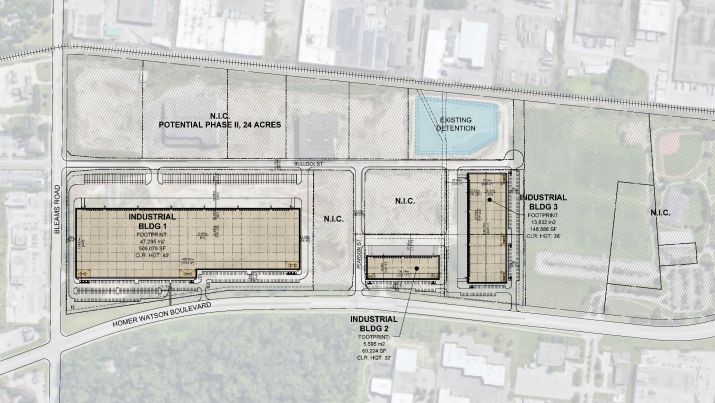

- 120 Bullock Street, Kitchener – 509,079 SF – Development

120 Bullock St, Kitchener. Source: C&W Research.

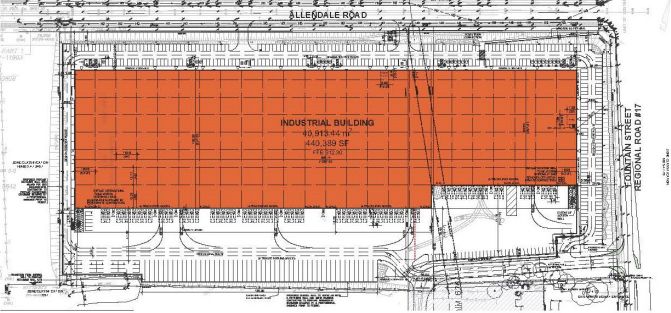

- 475 Allendale Road, Cambridge – 440,479 SF – Development

475 Allendale Rd, Cambridge. Source: C&W Research.

Conclusion:

All of these businesses are carrying the torch for domestic manufacturing. The hope is, as Canadian producers become more competitive, that exports and demand from increased in employment will support further investment and expansion.

This growth will manifest through the need for more modern manufacturing facilities and the creation of new businesses to supply talent, equipment, and materials.

Not only will all of this help bring in both investment and income from exports, as well as help employ hundreds of thousands of people in the long-run, but it will further secure supply chains, reduce waste in cross-globe transportation, and make us collectively independent from the many external factors which we saw play out during and following the pandemic.

In any event, industrial land and properties are the common element throughout and their development will play a pivotal role in the final outcomes.

When, where, what, and how these new projects come about is largely unknown but ready to be written by those with the vision and appetite to make it happen.

What we know for certain is why; and it has become clear that Ontario wants to be back in the conversation as an independent and innovative region.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com