August 25th, 2023

“If I had asked people what they wanted, they would have said faster horses.”

- Henry Ford

Every so often, we see a paradigm shift occur that completely changes how an industry operates.

In Henry Ford’s case, it saw the proliferation of automobiles in lieu of horse carriages; an obvious change in form but a brilliant transmutation in function.

Horses are still around today, however, they remain a much more ‘niche’ option for certain industries and hobbyists. It is rare to see one (or two) strolling down the street, however their value has likely increased and the community behind them is extremely passionate.

With that said, is it possible that we will see a similar but less drastic transformation take place in the business world with office space?

Remote work technologies have already offered an alternative to those needing or wanting to work from home (or on the road). Employees see the value in skipping the commute, spending more time with family, and having more freedom to work when and where they want.

Yet we have also seen the dark side of isolation, unproductive teams, and a lag in collaboration and communication when executed poorly. The truth is, meeting face-to-face will always be important and especially when solving complex problems, coming up with creative ideas, or ironing out crucial negotiations quickly.

Perhaps the office of the future be a super-high-tech refuge coupling as a wellness centre, serving to increase productivity, collaboration, and employee health.

But will we need the same volume of space as before, when businesses had their workforce in five days a week?

And if not, what will be done with the excess space, especially that which is functionally obsolete or left vacant by market forces?

Amidst the backdrop of explosive industrial demand and a housing shortage, many experts are calling for the re-allocation of finite space to providing relief where the needs are greatest.

Office certainly is not dead, but it is changing. And the fact remains, if a considerable portion of inventory – as dictated by the market and tenant’s dollars, not armchair experts – remains vacant for a long enough time period to prove financially unfeasible, then alternative solutions should at the very least be considered.

So with that said, let’s explore the latest phenomenon of office to industrial conversions, and analyze how, and to what extent, this trend may continue…

Office to Industrial Conversions: Fad or Lasting Trend?

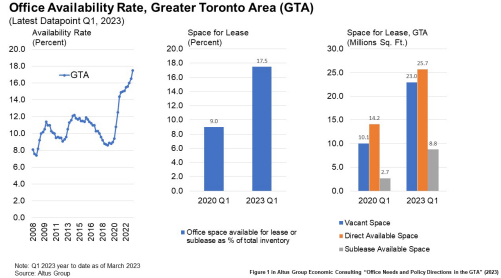

According to a report by Altus, the GTA office market has historically absorbed 2 million square feet per year, with the time period between 2014 and 2019 seeing approximately 2.8 million square feet taken by tenants annually.

And given the region’s growing notoriety as a technology and finance hub with a strong labour and talent pool, it’s plausible that this figure would have grown had we not had lockdowns and a shift towards work-from-home and hybrid scenarios.

Since this occurred, the GTA has experienced a negative absorption of 5 million square feet of office space, and around 35 million square feet of space is available for lease/sublease; double the amount since Q1 2020. Contrary to what you may think, Altus found that Class A offices up 63% of total office inventory and have a 19% available for lease, with 29% available for sub-lease; the highest availability rates across classes. Further, there appears to be no correlation geographically – whether looking to the suburbs, midtown, or downtown – as each region has rates in line with their proportionate share of inventory.

What this means is that the asset class is universally experiencing vacancy challenges. We can infer that this is both good and bad; businesses still need space, just not as much of it, and being located downtown in Class A space won’t insulate you from all the risk.

Current Office Forecast

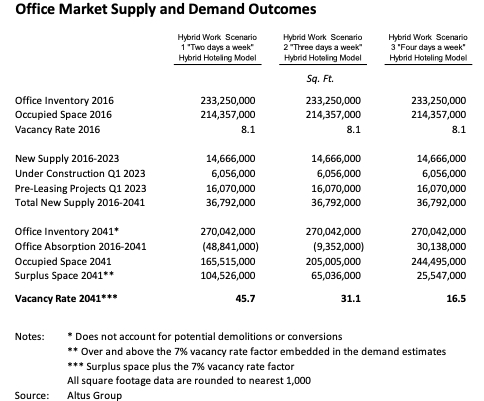

GTA Office Market Outcomes. Source: Altus.

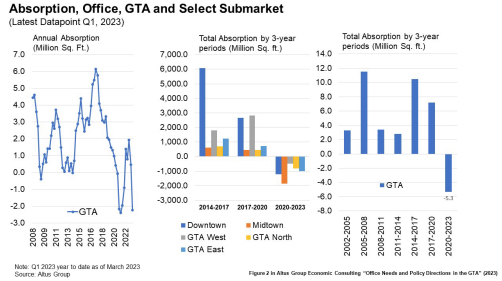

Looking forward, the report suggests that anything less than a 4-day-per-week schedule would result in further negative absorption over a 25-year period, and the forecast availability rates for 2041 range from 16.5% to 31.1% to 45.7% based on four, three, or two-day-per week hybrid hoteling models, respectively. Accounting for functional obsolescence, this puts inventory at an over-supply of 25.5 MSF, 65 MSF, or 104.5 MSF in 2041, based on the same three models.

Potential Solutions

As you will see below, solutions to any commercial real estate challenge revolve around similar principles.

If we can agree that the main objectives are to increase overall value, equity, and cashflow, then a shortcoming in any area can be resolved through a single move or set of moves taken together.

Most asset management issues can be addressed through simple protocols, such as regular maintenance, releasing, or refinancing. However, in the case with an uncertain and substantially depressed market, we may see more drastic actions such as repositioning to a better use and/or conversions or demolition/redevelopment. What is most likely is that prized land sites and functionally obsolescent buildings will slowly be repositioned in the coming years or decades.

Examples of Office to Industrial Conversions

Below are a few examples of assets which have been partially or completed converted, or where plans have changed ahead of ground-breaking to move away from office towards industrial development. As you will notice, there is a fairly broad spectrum as it relates to the extent of change; from minor reconfigurations to completely new site plans and redesigned projects.

While many are touting the end of office; we are not. We are simply showcasing instances where landlords have chosen to – based on feasibility studies – reposition their assets to their highest and best use, which in this case, involves adding industrial space.

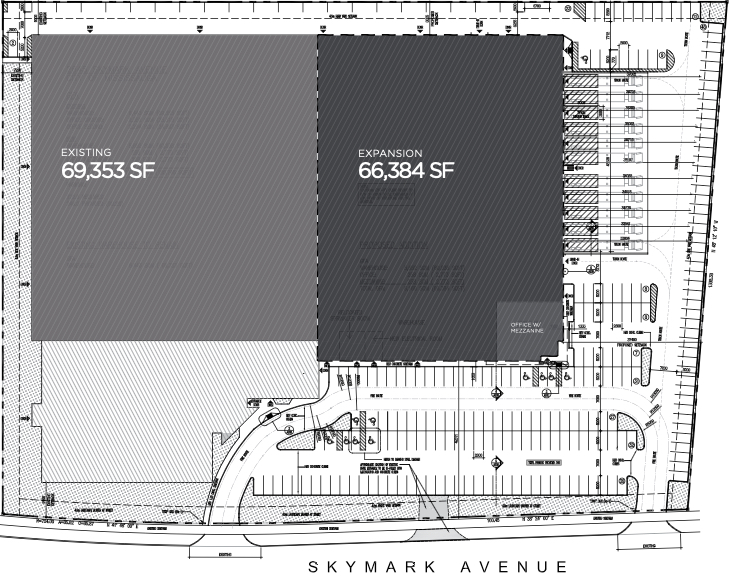

- 2645 Skymark Avenue, Mississauga – Office Reduction and Industrial Expansion

2645 Skymark Avenue, Mississauga. Source: Cushman & Wakefield.

2645 Skymark Avenue, a prime industrial leasing opportunity in Mississauga’s prestigious Airport Corporate Centre, is an example of optimization (through a reduction of the office component) and expansion (an almost doubling of industrial space).

Slated for completion in Q3 2024, this remarkable 136,000 sq ft facility combines existing warehouse space with a modern, newly constructed addition. The warehouse features an impressive 30-36 ft clear height with 2,773 sq ft of finished office space, 11 truck-level and 1 drive-in doors.

The facility provides ample parking and exceptional access for 53-foot trailers, ensuring smooth logistics and efficient operations. Situated near the 400 series highways (401, 427, and 409), transportation to and from the facility is hassle-free.

Located just minutes from Toronto’s Pearson International Airport, this prime location is ideal for businesses focused on import and export operations, offering unparalleled connectivity.

Seize this opportunity to secure a state-of-the-art industrial facility that meets the highest standards for your business. Elevate your enterprise and set the stage for continued growth and success. For more information, contact our team.

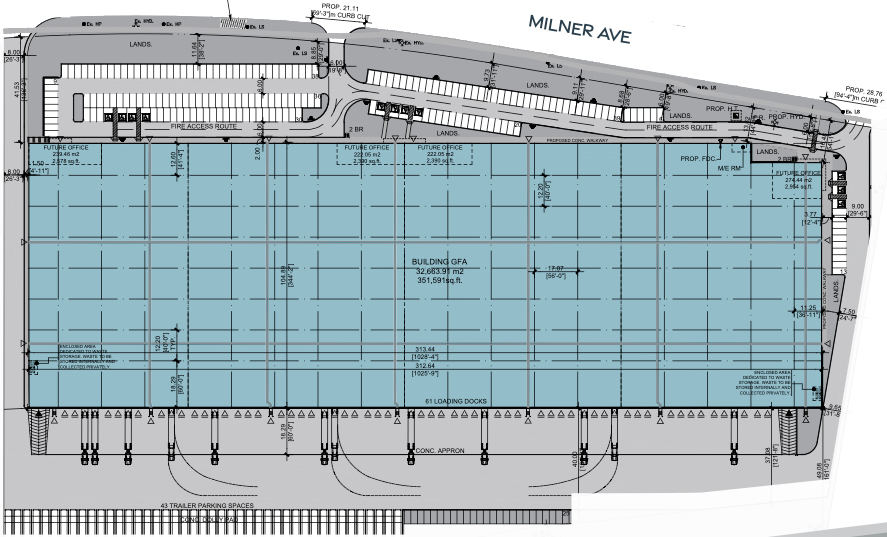

- 601 Milner Avenue – Toronto East Logistics – Redevelopment with Office Reduction

601 Milner Avenue, Scarborough. Source: Cushman & Wakefield.

The site at 601 Milner Avenue in Scarborough saw an older, industrial building with less site coverage and a higher office component than normal, as well as a smaller office building adjacent to it.

The state-of-the-art facility will have:

- 40’ clear height;

- 56’ by 40’ bays;

- 61 TL shipping doors;

- 43 trailer parking spots; and

- 1,600A/600V heavy power.

- CanFirst Capital – Demolition of 17 Older, Single-Storey Office Buildings to Construct ~270,000 SF of Industrial

Rendering of CanFirst’s Development in Mississauga. Source: Renx.

CanFirst Capital Management has started a speculative industrial development of 272,379 square feet on 14.08 acres in Meadowvale by Erin Mills Parkway and Mississauga Road. The property will replace 17, older, single-storey office buildings with a combined area of 142,772 square feet.

While on the surface, it may appear that this is purely an “office vs. industrial” move, it makes sense to reposition 50-plus year-old buildings with a reported 26 percent vacancy rate in any event; whether you were to construct mixed-use, residential, or industrial.

In this case, it was reported that the cashflow is strategically being used to finance the project, while most tenants had demolition clauses, making it even more attractive of a strategy. And given the location and surrounding area, as well as the current state of the market, building industrial is a natural conclusion.

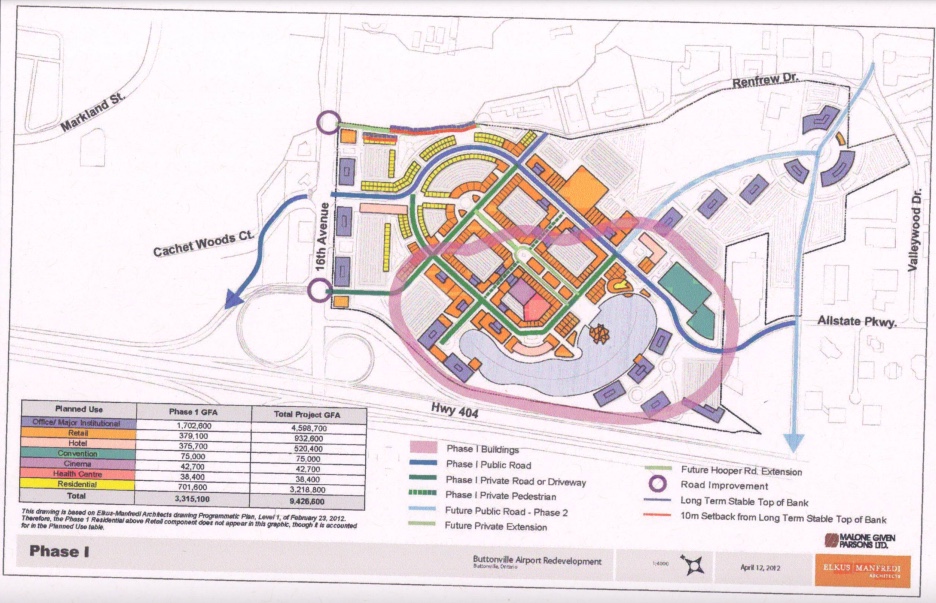

- Buttonville Airport Lands – Industrial Redevelopment Originally Slated for Mixed-Use Residential

Cadillac Fairview’s Buttonville Airport Development Site Plan. Source: YorkRegion.com.

After acquiring the 169-acre, Buttonville Airport lands for $193 million, Cadillac Fairview had originally planned to develop 10 million square feet of office, retail, hotel, entertainment, public use, and residential space. Since its initial proposal in 2011, the entire project had been put on hold in 2020 before being recently brought back to life.

Cadillac Fairview’s Buttonville Airport Original Master Site Plan from 2011. Source: UrbanToronto.

With the airport officially closing at the end of this coming November, the developer has put forth a proposal to construct 11 industrial properties over several phases. Phase 1 would see two buildings of 247,721 and 335,673 square feet, with another nine buildings ranging in size from 37,887 to 816,378 square feet to follow. All in all, approximately 2,775,000 SF of industrial assets is planned for, along with internal road networks, the widening of Highway 404, stormwater management, and two additional development blocks.

Conclusion:

Let’s be clear: office space still has and will continue to play a pivotal role in the broader commercial real estate landscape. That said, as general demand for the asset class remains unclear, vacancies stay elevated, and functional obsolescence creeps in, certain owners may make the decision to pull the plug and convert. This is especially true for sites with considerable excess land traditionally used for parking and/or older, obsolete inventory that would have been redeveloped anyways.

And office isn’t the only one. Older, retail strip plazas and/or well-known malls strategically located throughout the City are also seeing conversions to high-density residential or industrial to take advantage of the well-located and under-utilized land. Look at CentrePoint, Fairview Mall, Square One, or Sherway Gardens, to name a few. It doesn’t mean they’ll be demolished; simply intensified and improved.

Land is and will continue to be the largest, driving factor. And repositioning assets to their highest and best use will be the key strategy when decisions are made.

As the Greater Toronto market as a whole sees fewer greenfield development options, it’s not surprising that some developers will turn inward to add value through the redevelopment of infill sites and older, obsolete product.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com