Property Taxes and Industrial Buildings in the GTA

Benjamin Franklin, in a letter to Jean-Baptiste Le Roy, 1789

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world, nothing can be said to be certain, except death and taxes.”

It is an old axiom, actually, 231 years old to be exact… And most people would agree that it still applies…

The only question, as far as taxes are concerned, is how much?

How much in taxes should you pay? What is equitable? And how do you get there?

If you are an owner-occupier of an industrial building, you know that occupancy cost is the second largest cost against your bottom line.. therefore, it is of utmost importance to keep it as low as possible…

One part of occupancy cost would be the mortgage payment (or net rent if you are a tenant), and the second part would be the additional rent or so-called TMI; Taxes, Maintenance, and Insurance.

If you are an investor, you know that keeping additional rent as low as possible would allow you to achieve higher net rental rates, as all tenants are really concerned with is their gross occupancy cost (and with higher net rental rates come higher property value as well…).

Being able to “control and contain” realty taxes will directly impact the performance and value of your real estate investment….

So it is important to understand:

How is Realty Tax calculated?

How can you ensure that you are not overpaying?

And, if you are not happy with your Assessed Value… what can you do?

Is there a deadline for appeal?

Is there a professional out there who can assist you along the way and ensure the successful outcome?

To that regard, we asked Property Tax expert Bob Langlois to provide us with an insight into this extremely important matter…

Here is what Bob had to say…..

Property taxes are derived from an estimate of value as prepared by MPAC and the applicable tax rate as set by the City (Municipal portion) and Province (Education portion of your tax bill).

The one variable that can be somewhat controlled and/or managed within this scenario is your assessed value and classification as determined by MPAC (there are other strategies which may be employed, but for the purposes of this article, we will narrow our focus).

So how can you control or manage your property tax bill?

Well, the current assessment regime uses January 1st, 2016 as the benchmark for valuation, and this value is subsequently used to determine taxes for the 2017 – 2020 window – referenced in the property tax world as the 2016 CVA or Current Value Assessment.

For owners, users, and/or tenants of industrial buildings there are a number of key points to understand as it relates to:

- How the value is arrived at;

- How changes in the value may or will affect the tax liability;

- What efforts can or should be made to understand the value; and subsequently

- Determining if an appeal or review of the assessed value is warranted.

MPAC values industrial properties using the cost approach, which stated is a function of:

- The value of the land as if vacant as of the valuation date (January 1st, 2016) plus;

- The Replacement Cost New Less Depreciation (RCNLD) of the building as of the valuation date (January 1st, 2016)

Changes in value from one cycle (2016 CVA) to the next cycle (2019 CVA) are normally Phased-In, meaning that the difference between the two values is divided equally over the Phase-In period. The taxable value is different from the CVA as outlined below.

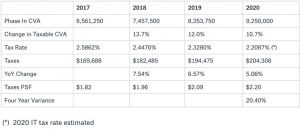

As noted in the table above, the change in value from 2012 CVA to 2016 CVA of 3,585,000 (or 63%) is phased in equally ($896,250) over the four-year cycle and it is the Phased In values that are subject to the applicable tax rate.

If and when an appeal is filed, the value that you are challenging is the 2020 figure or what is referenced in the industry as the Destination CVA.

In terms of the second half of the equation, being the tax rate that is applied to the Phased In value, we know from history that as the Phased In values for all properties increases the size of the assessment base at a greater percentage rate than the budgetary increases that are derived through the tax rate.

This means that year over year, as your taxable assessment is increasing (for the most part), the tax rate is dropping.

The brief history of the IT Tax rate in Toronto over the past three years demonstrates this change.

Property Tax Example

- A 93,000 SF industrial building with 18-foot ceilings on 4.1 acres of land trades twice in the span of four (4) years. Once in 2015 and again in 2019;

- Sept 2015 it trades in a sale-leaseback for $9,250,000 ($100 PSF);

- At the time of this initial trade, its 2012 CVA is 5,665,000 ($61 PSF), or 60% of the sale price;

- The taxes in 2015 were approximately $153,000 or $1.65 PSF;

- MPAC updates the value as at January 1st, 2016 to $9,250,000;

- The taxes escalate from $1.65 PSF (’16) to $2.20 PSF (’20) or 33% over five (5) years.

The phased-in value and ensuing tax rate application produces the following results:

Summary/Observations

The phased-in value increases are transpiring at a greater percentage rate than the tax rate is declining, resulting in significant Year-over-Year (YoY) increases in taxes, with a five-year growth rate of 33%.

Fast forward to the 2021-2024 cycle (2019 CVA) that is forthcoming…

This cycle will be updating values as of January 1st, 2019 and presumably changes from the 2016 CVA to the 2019 CVA will continue to be Phased In as has been the historical practice (this taxation policy is subject to provincial regulations that are reviewed and updated with each new cycle).

This same building traded again in September 2019 (this time between a value-add investor [vendor] and institutional/private investment entity [buyer]).

- September 2019 trade for $18,950,000 ($203 PSF)

- Current tax burden of $2.20 PSF is based upon CVA of $9,250,000

- MPAC will be rolling out updated 2019 CVA in September/October 2020 affecting the 2021-2024 taxation cycles

Tax Planning/Fiscal Management Challenge

MPAC’s objective is to arrive at Current Value as at January 1st, 2019 using one or more of the standard appraisal approaches to value (Cost, Income, or Direct Comparison).

MPAC responds to and updates the values based upon market evidence. In the case of the subject property, the 2016 CVA was updated to the actual 2015 sale price of $9,250,000.

If MPAC elects to update the value to align with the 2019 purchase price, the 2019 CVA will double from its current level.

Taxation Theory of Relativity

The old adage that “it’s all relative” is tried, true, and tested in the property tax world. Where your assessed value from one cycle to the next changes at the same percentage rate as the overall population, and the tax impact will be comparable to the budgetary increases set down by the local taxation authority. Where your property-specific change in CVA exceeds the average increase of the population (where population means the RT, CT, or IT group of properties within a taxation jurisdiction, you can expect annualized increases that are above average; (where the average is in the 3 to 4% range).

Where Is the Relief?

If you are faced with a situation where your assessed value spikes and the spike is in direct relation to a property-specific transaction (as suggested in the example herein), there is potential relief based upon the principle of Equity. The rules that govern the valuation and “assessment” of real property in Ontario provide for an equity provision that is to be applied after the value is determined.

In practice, the value is prepared and returned by MPAC (and the valuation policies and procedures are fairly institutionalized). The current system does not provide for a meaningful way for Equity to be “institutionalized” in a mass appraisal model and does create an opportunity to reduce a value.

There are two basic questions to be asked:

- Is the value, as returned, indicative of market value at the valuation date? (Yes or No) and;

- Is the returned value, equitable when compared with similar or like properties?

There are a variety of tests and means by which the Equity can and should be tested but as noted herein, these are not part of MPAC’s process of preparing the value and are generally only explored by Appellant (Property Owner or their Agent) and Respondent (most often MPAC) upon appeal.

Overall, if you are an Investor, Owner-Occupier, Developer, or Operator of commercial property in the GTA, then you should leverage a tax professional to test and apply this Equity principle to legally and ethically reduce your valuation, resulting in an optimized real estate tax bill.

***Disclaimer: The information provided in this newsletter is for educational purposes only. Bob is a certified expert, however, to receive the appropriate guidance for your unique situation, please contact a legal, tax, accounting, or financial expert before taking action. We are not liable for any damages – perceived or otherwise – as a result of your own personal decisions.***

On that note…

For further information on the subject of Property Taxes and Industrial Buildings in the GTA please contact:

Bob Langlois

https://www.linkedin.com/in/boblanglois/

416-625-7801

Argil Property Tax Services

ArGil is a team of property tax professionals and real estate valuators who provide property tax recovery and consulting services to multi-residential, commercial and industrial property owners.

In addition to municipal tax application filings, strategic litigation, and property tax budgeting, ArGil brings to the table an astute understanding of the assessment appeal process and the unique issues relevant to each case.

CONCLUSION

I wanted to thank Bob Langlois for providing his expertise on this topic and generously devoting time to making this issue happen.

For some property owners, this knowledge may be very timely, and overall, it’s importance cannot be understated, since, for the majority of people in the Commercial Real Estate industry…. who are in the business of acquiring, developing, selling, and leasing properties… the name of the game is in maximizing cash flow, property value, and return on investment…..

For non-residential property types, property owners can choose to either file an RfR (Request for Reconsideration) with MPAC or file an appeal with the ARB (Assessment Review Board). For years in which there is an Assessment Update, the deadline to submit an RfR is 120 days from the issuance date printed on the Property Assessment Notice. For non-reassessment years, the deadline to submit an RfR remains March 31. However, if an owner chooses to file with the ARB, the deadline to file the appeal is also March 31 of the tax year or 90 days from the notice date for other types of assessments.

Every person involved in the process is crucial. We all play our part. Yet it is through the creativity and analytic-nature of professionals such as Bob Langlois, who can efficiently navigate the tax system, where we can optimize our investments to minimize costs and accrue wealth.

For those of you reading this who have had negative experiences in the past, or who have been consciously or unconsciously seeking a solution, then this may be an exciting revelation.

If you are looking for more detail on this or if you need advice on property taxes, then please connect with Bob Langlois directly (his contact info is above).

Finally, if you are thinking of moving, selling, or acquiring a commercial property in the GTA and would like to consult regarding on-site selection, industrial land values and development charges, construction costs, property values, rental rates, etc please call Goran Brelih…

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 25 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 27 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Goran is currently serving as Immediate Past President of the SIOR ‐ Society of Industrial and Office Realtors, Central Canadian Chapter and on the Board of Directors of Muki Baum Accessibility Centre, a Toronto‐based NGO which provides support to children and adults with complex disabilities.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield is a leading global real estate services firm that delivers exceptional value by putting ideas into action for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with 48,000 employees in approximately 400 offices and 70 countries.

In 2017, the firm had revenue of $6.9 billion across core services of property, facilities and project management, leasing, capital markets, advisory, and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.