May 5th, 2023

The first thing one learns in selling real estate is that the market doesn’t lie.

You know this. It is why people ‘test the market’ when trying to establish true valuations or gauge interest from prospective buyers or tenants.

It is why we lean so heavily on comparables and historical information, coupled with real-time data, to make decisions.

It is also the crushing weight falling on every unmanageable expectation and reality distortion.

There may be an entire media circus on social media proclaiming that, for example, industrial can “do no wrong” and will appreciate endlessly. Conversely, we may see temperance in the form of stabilization of rents and locking in of values.

Yet, no matter which camp you may fall into, no amount of charisma, unshakeable belief, or online engagement can outdo a single, firm offer in-hand.

The market simply does not lie.

We can do our best to crunch the numbers, manage expectations, and creatively maneuver to deal with uncertainty. However, at the end of the day, we cannot control the motives and actions of a vast marketplace constituted by an even greater number of different individuals and organizations.

The market will do that on its own, no matter if it is regulated, supported or left to its own devices… the outcome will simply vary.

Looking specifically to the Greater Toronto industrial market, most of us are well aware of the prevailing trends. We may also be in tune with how both demand and supply could – emphasis on could – cross paths in the upcoming years, depending on how the economy fares and on how quickly the gargantuan industrial development pipeline comes online.

What is important to take away is that your best bet to actionable intel is that coming from the street level – from a broker observing and participating in the day-to-day flurry of activity. Taken together with both the unemotional datasets and emotional market noise, it offers insight into opportunity beyond the numbers and through strategic thinking. In leveraging these expectations into your favour.

So with that said, let’s examine how each of the Greater Toronto Area regions performed in Q1 2023, and where we expect the market to go moving forward.

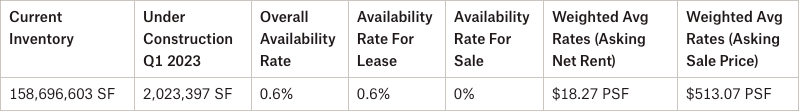

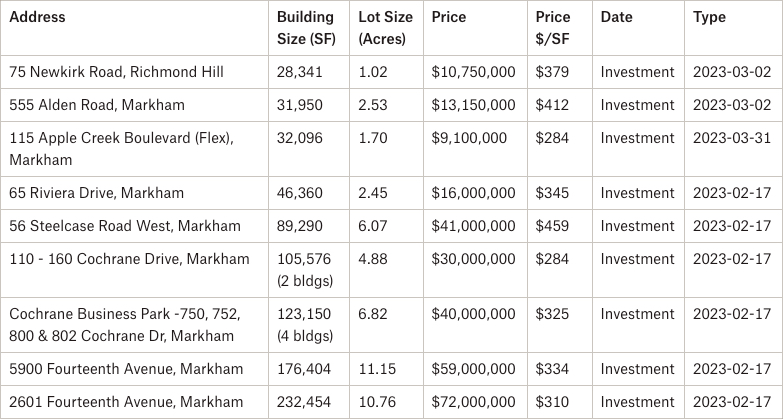

- The availability rate increased from 0.4% to 0.6%, with a lease availability rate of 0.6% and a sale availability rate close to 0% (76,958 SF out of 158M SF of inventory);

- We had 144,709 SF of new supply and 2,023,397 SF still under construction;

- We had negative absorption of 267,944 SF;

- The weighted average asking net rent was $18.27 with additional rent of $4.41 PSF; and

- The weighted average asking sale price was $513.07 PSF.

Why are the GTA North Markets in such demand?

Generally, the Toronto-North markets have newer product with higher ceiling heights and better shipping access. Further, there are benefits from access to major transportation routes.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

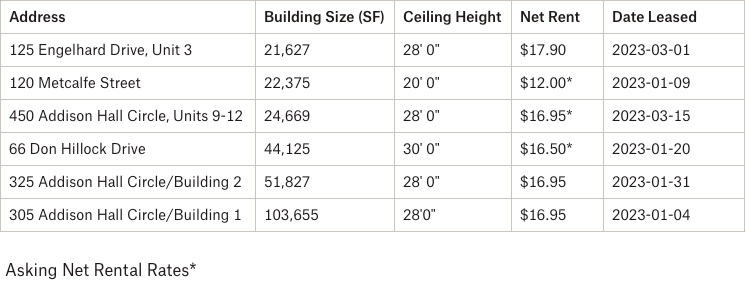

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto North Markets (Vaughan, Markham, Richmond Hill, Aurora, Newmarket, Stouffville, East Gwillimbury)

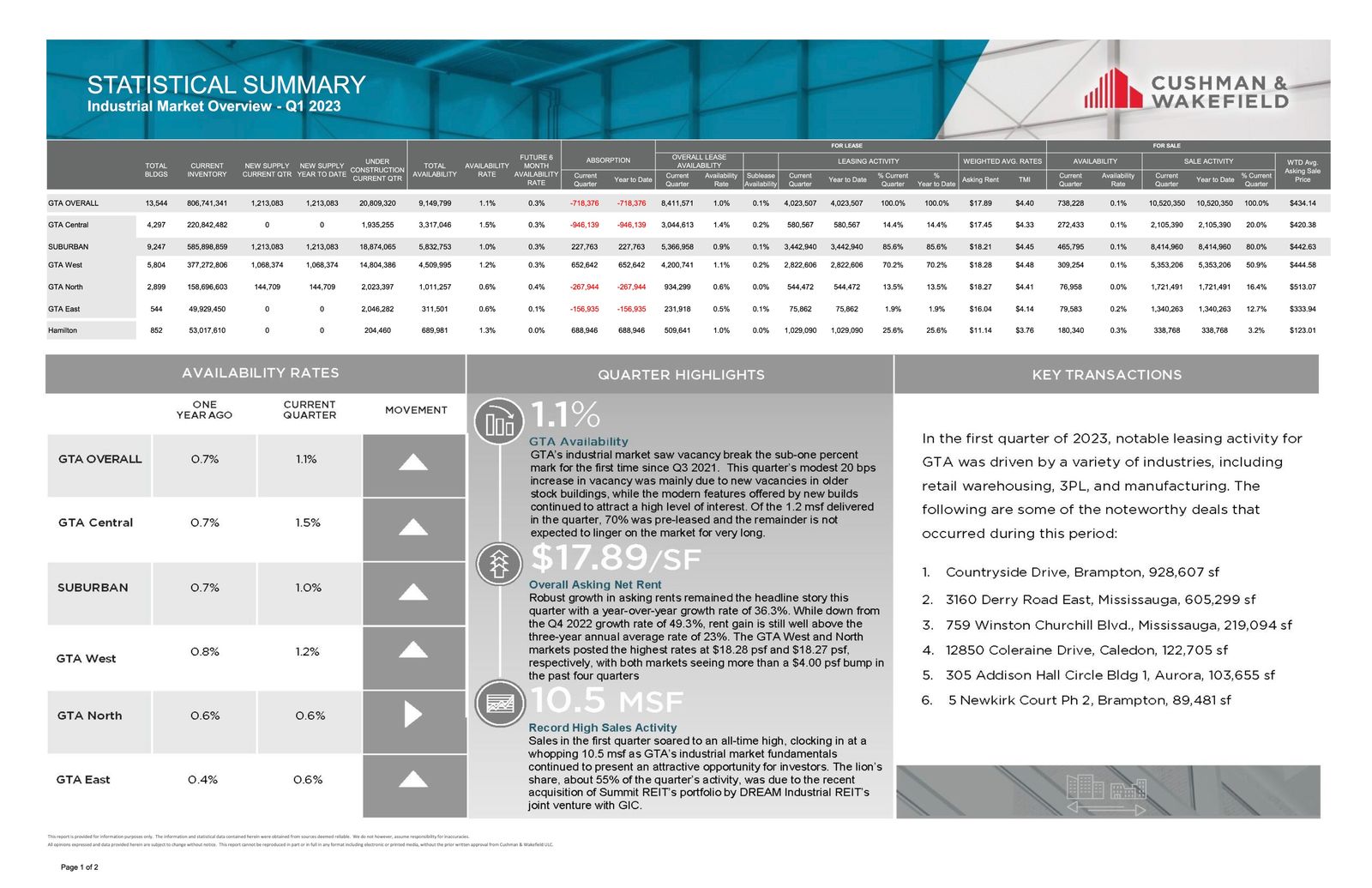

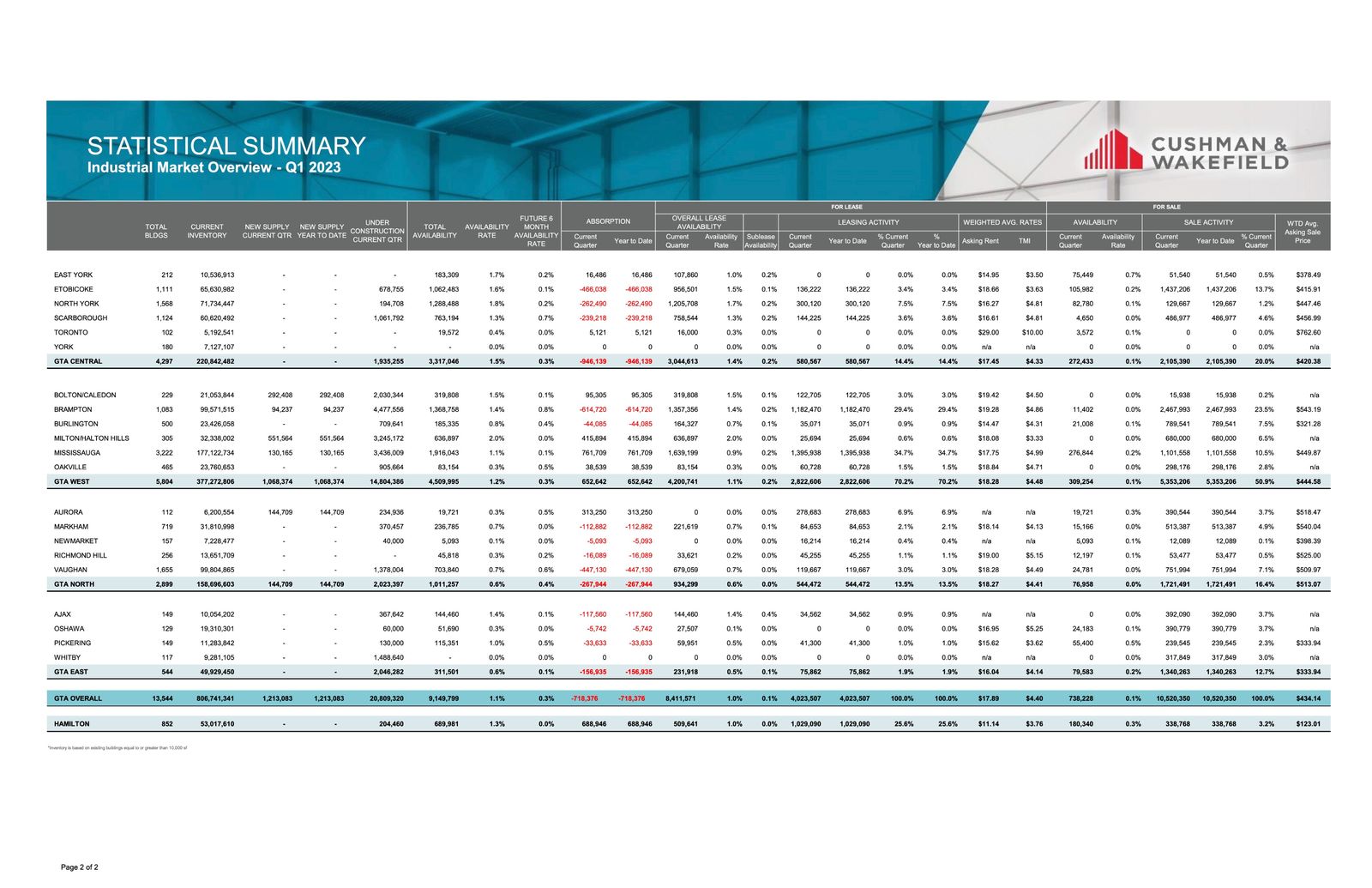

Statistical Summary – GTA North Markets – Q1 2023

Q1 2023 GTA Industrial Market Overview – Source: Cushman & Wakefield

Q1 2023, Industrial Market Overview – Source: Cushman & Wakefield

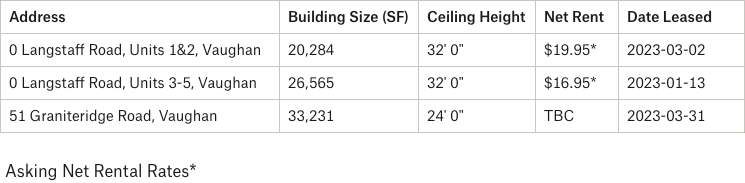

GTA North Markets (Vaughan)

123 Great Gulf Drive, Vaughan

51 Graniteridge Road, Vaughan

2601 Fourteenth Avenue, Markham

50 Vogell Road, Richmond Hill

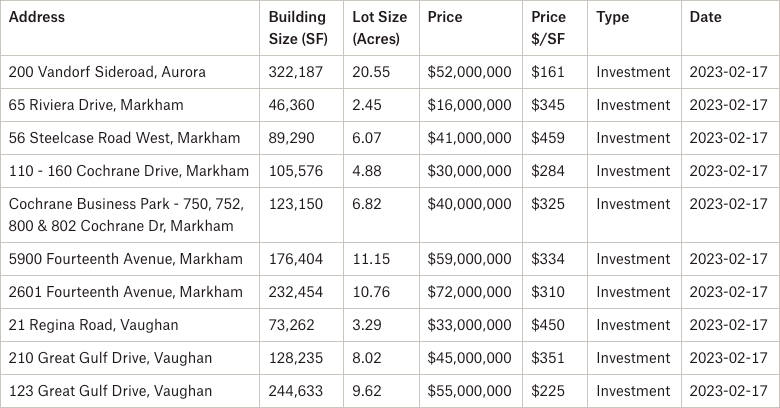

In Aurora and Newmarket in Q1 2023, just one property was sold, with a building size of 322,187 SF and at a price of $161 PSF.

200 Vandorf Sideroad, Aurora

305/325 Addison Hall Circle, Aurora

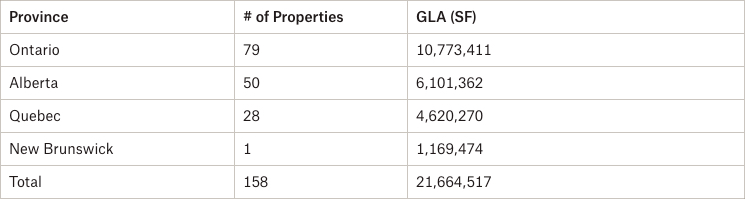

Portfolio Sale

This sale was a business transaction between Summit Industrial Income REIT and a joint venture between GIC (90% interest) & Dream Industrial REIT (10% interest), in which the latter parties acquired the former’s business for $5.9 billion. It is our understanding that the real estate assets were a component of the overall acquisition of the business, which included 158 properties broken down as follows:

Below are assets from that portfolio that lie within the North markets.

- Rental Rates: The Toronto-North markets now have a weighted average rental rate of $18.27 PSF net – almost a full dollar more than Q4 2022 – and just one cent behind the West markets for the highest rents across the GTA. Keep in mind that rental rates are a weighted average, and also subject to annual escalations. We continue to see a general upward pressure across the board into the high-teens to low-twenties, depending on a number of factors, such as building size, location, ceiling height, etc. Based on the increase of value of industrial land, infill sites, construction costs, etc… we can only see these rates continue to grow. Overall, we are still in a Landlord’s market.

- Property Values: The Toronto-North markets have the highest weighted-average asking sale price across the GTA at $513.07, due to the lack of availabilities and cost to construct. Depending on the building size and location, and especially for Class A, well-located space, pricing shall remain strong. Given the most recent increases in interest rates, we will see an impact on CAP rates.

- Development Opportunities: The Toronto-North markets still have quite a bit of land available for development in Vaughan-West along Highway 50. We are also going to see further development along Highway 400 as land sites in more central areas become more scarce. Regarding industrial land, pricing generally continues to increase.

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com

Newsletter

Join our mailing list to receive the latest news and updates from our team.