April 26th, 2024

“Negotiation is not an act of battle; it’s a process of discovery. The goal is to uncover as much information as possible.”

- Chris Voss

Few statements could be as true or relevant right now within the context of the Greater Toronto industrial market.

Although said market remains incredibly robust and sought after, it is not running at the same blistering clip that it did coming out of the economic lockdowns and throughout the boom in e-commerce and logistics.

From around mid-2020 and through 2022, there wasn’t much negotiation to be had if you were looking for warehousing and distribution space. Especially if we use Mr. Voss’ definition as quoted above.

There was space – and not much of it available.

And if you wanted it, you had to act quickly; often times paying a premium to secure it.

Time spent going into too great of discovery was counterproductive; the nature of the business landscape at that time being more opportunistic and expansionary than hyper-strategic.

That all said, in Q1 2024, we saw the industrial vacancy rate break the 3%-mark, alongside the lowest leasing activity in 14 quarters with a total volume of just 4 million square feet.

Rents appreciated just 4% year-over-year – and although reasonable – are a far cry from the 22.3% year-over-year average over the past five years.

Meanwhile, renewals continue to come up as normal as we experience an economic slowdown and continued increases in operating costs. Although businesses can smell a market in flux with potential deals to be had and price reductions hitting the MLS, for those coming off 10-year terms, they are still facing a doubling or tripling of rents from the $5-8 PSF net range to anywhere in the mid- to high-teens.

Sales regained momentum at 8.6 million square feet of volume in Q1 2024 despite elevated borrowing costs as both users and investors alike seek shelter through ownership of high-quality assets.

As we look forward, decisions will have to be made. Negotiations will be had.

And these discussions will be grounded in discovery and strategy; understanding the options and market rates while thinking outside the box to make footprints as efficient as possible. That is where a trusted advisor can assist; in leveraging the data and applying a deep insight of these relational and market-based dynamics to create opportunity that may not readily exist on the surface.

So without further ado, let’s examine how each of the Greater Toronto Area regions performed in Q1 2024, and where we expect the market to go moving forward.

- The availability rate increased from 1.8% to 2.1%, with a lease availability rate of 2% and a sale availability rate of 0.1%;

- We had 1,154,152 SF under construction;

- We had 458,282 SF of negative absorption;

- The weighted average asking net rent was $17.41 PSF, up from $16.99 the previous quarter, with additional rent of $4.30 PSF (an increase from $4.23 PSF); and

- The weighted average asking sale price increased from $417.68 PSF to $438.35 PSF.

Why are the GTA Central Markets in such demand?

Is it proximity to labour and a higher population density, and thus, a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

Well, one thing is for certain, the Toronto-Central Markets are highly sought-after by both Investors and Occupiers of commercial real estate and is an environment worth exploring for opportunities.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

Statistical Summary – GTA Central Markets – Q1 2024

Q1 2024 GTA Industrial Market Overview – Source: Cushman & Wakefield

Q1 2024, Industrial Market Overview – Source: Cushman & Wakefield

GTA Central Markets (Scarborough)

31 Rolark Drive, Scarborough

GTA Central Markets (Scarborough)

480 Tapscott Road, Scarborough

GTA Central Markets (North York)

225-237 Limestone Crescent, North York

GTA Central Markets (North York)

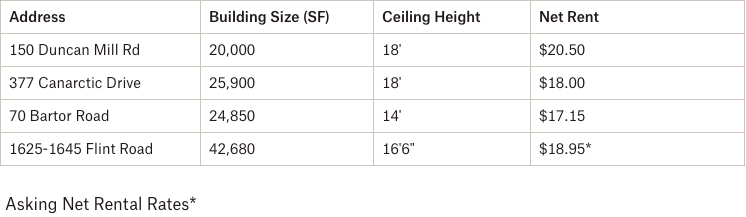

1625-1645 Flint Road, North York

1625-1645 Flint Road, North York

190 Norseman Street, Etobicoke

Properties Leased between January 2024 – March 2024, from 20,000 SF plus

37 Bethridge Road, Etobicoke

- Rental Rates: Rents have levelled off and, in some cases, we have seen rate reductions. We expect this to continue. Likewise, annual rental escalations have plateaued and may decrease. Leasing is slower and it is taking longer to complete a deal as Tenants have become more cautious. Finally, as vacancies increase and we see negative absorption, Tenants are beginning to have options, which may spur more movement and breed competition, putting more downward pressure on rents, specifically in Class B or C industrial buildings. Overall, we are heading towards a more balanced market between Landlords and Tenants.

- Property Values: As rental rates plateau, and as we see rents decrease in certain properties, coupled with upward pressure on cap rates, we are going to see a decrease in value of investment properties. For users, even though the Buyer pool may have thinned due to increased interest rates, we expect to see values remain elevated as supply is extremely limited. Finally, due to the aforementioned interest rates, the value of development land has decreased.

- Development Opportunities: Looking across the Toronto-Central markets, there is still great interest from developers to purchase infill sites and redevelop older and obsolete industrial buildings to newer, modern distribution centres, as well as industrial condos. Given its central location and proximity to major highways and labour, larger industrial sites in the Toronto-Central markets will continue to be in great demand.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 30 years.

Goran Brelih is an Executive Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 30 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Executive Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com