Q2 2022 Insight, Toronto-Central Markets

Establishing True Valuations Across Differing Markets

July 15th, 2022

You are undoubtedly aware of the inflationary pressures not last seen since November 1981. What is more concerning, however, is the structural economy that underlies it; with stagnating production, an energy crisis, the beginnings of food scarcity, and a labour shortage.

While up here in Canada, we are relatively better insulated against these forces due to our more fiscally responsible approach, global economies are so intertwined that we will continue to feel the effects of supply chain bottlenecks and increasing shipping costs, among other issues.

Juxtaposed to this is an industrial market that has defied all odds to outperform most other asset classes – real estate or otherwise – as well as become a hedge against uncertainty. The momentum carrying this ‘antifragile’ product type feels like we are riding a hundred-foot wave, racing towards the coast.

The speed is exhilarating. The view is tremendous. The height is a rush.

It is one of the biggest waves ever seen.

The only question is, will it roll out slowly to shore; carrying us with it?

Or will one of the many headwinds knock us off kilter and send us plunging to the depths?

The reality is, there are many dangers circling beneath the surface. Rising interest rates will have yet unknown effects on developers’ ability to underwrite new projects, while industrial users will feel the squeeze on their operating costs; a straw on the camel’s back as inputs, labour, and rent costs rise ever further.

Meanwhile, real estate costs will contribute to ‘demand destruction’ as some parties may walk from deals, relocate into secondary markets, or streamline their footprints. At the same time, a record-high amount of construction will see an injection of inventory coming online in the next few years. Will we see a ‘bullwhip effect’ in similar fashion to the retailers dealing with overshot inventory orders and slipping consumer demand?

In this writer’s opinion, while there may very well be challenges in the industrial market in the coming months and years, it may only lead to its strengthening. Yes, financing is likely to become more difficult. And yes, some investors and occupiers may exit to less competitive markets. Yet, this slack may spur the dozens of parties eagerly sitting on the sidelines, patiently waiting for some breathing room to jump back in.

At under 1% availabilities in a market of some 800-odd-million-square feet, it would take something truly catastrophic to take out the ‘darling’ of the commercial real estate world. In any event, it will likely remain the last asset class standing together with multifamily.

So with that said, let’s examine how each of the Greater Toronto Area regions performed in Q2 2022, and where we expect the market to go moving forward.

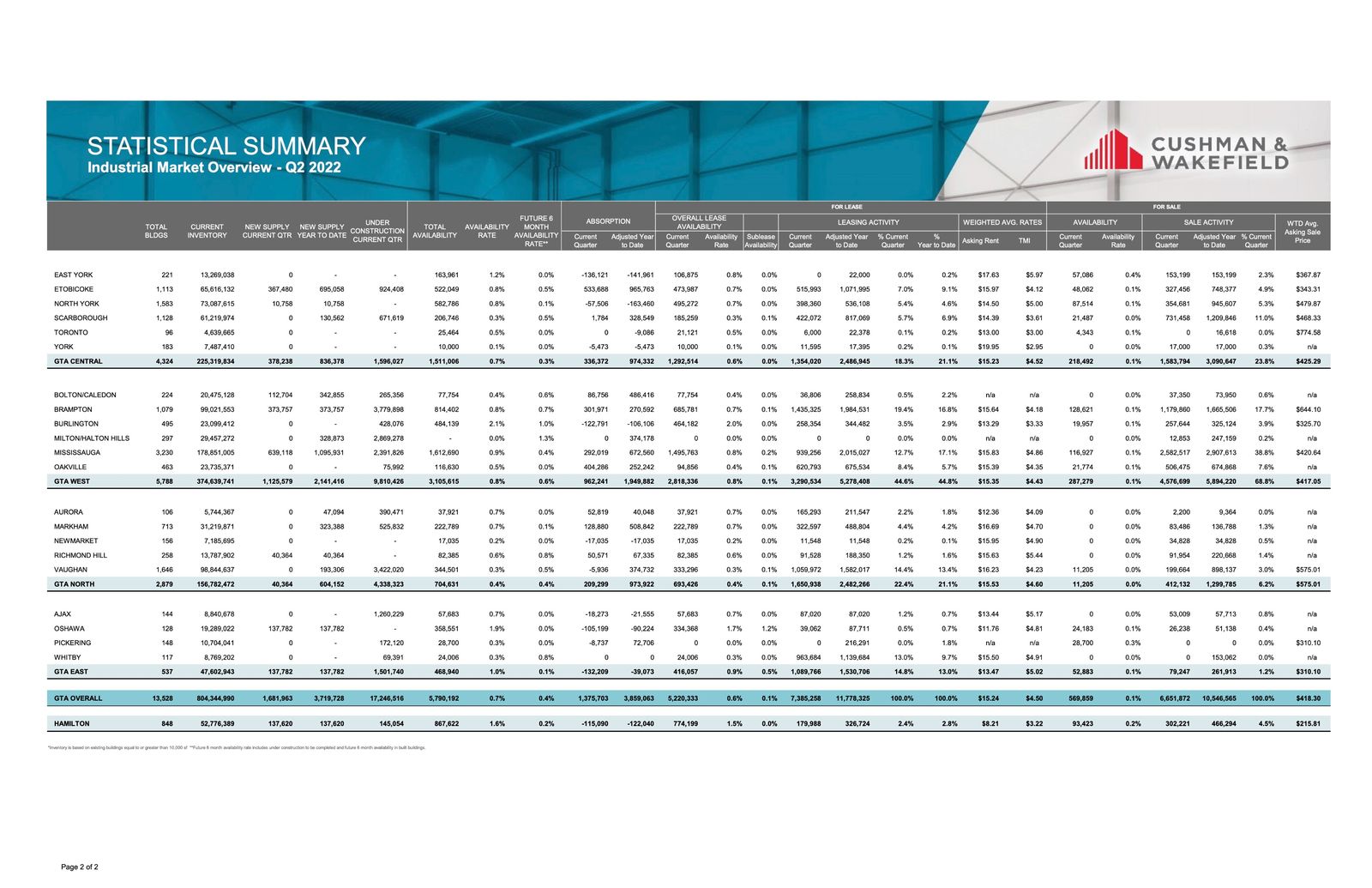

- The availability rate stayed level at 0.7%, with a lease availability rate of 0.6% and a sale availability rate of 0.1% (just 218,492 SF available for sale out of 225M SF of inventory);

- We had 1,596,027 SF under construction;

- We had 336,372 SF of absorption;

- The weighted average asking net rent was $15.23 PSF, up from $12.50 the previous quarter, with additional rent of $4.52 PSF; and

- The weighted average asking sale price was $425.29 PSF.

Why are the GTA Central Markets in such demand?

Is it proximity to labour and a higher population density, and thus, a reduction in transportation cost? Or is it savings in development charges vs 905 areas, proximity to major transportation nodes, highways, public transportation, etc?… Or all of the above?

Well, one thing is for certain, the Toronto-Central Markets are highly sought-after by both Investors and Occupiers of commercial real estate and is an environment worth exploring for opportunities.

So, if you are an Investor, Landlord, or Owner-Occupier you may be wondering…

“How much is my property really worth?”

What rental rate can I expect? How much $/PSF would I be able to get if I sold my building?

These questions are being asked all the time.

The answer to this will depend on a range of factors, including:

- the age and size of the building,

- lot size,

- ceiling height,

- office component,

- parking,

- trucking access,

- truck parking if available, etc….

This week we are covering the Toronto Central Markets (Toronto, North York, Etobicoke & Scarborough)

Statistical Summary – GTA Central Markets – Q2 2022

Q2 2022 GTA Industrial Market Overview – Source: Cushman & Wakefield

Q2 2022, Industrial Market Overview – Source: Cushman & Wakefield

GTA Central Markets (Scarborough)

Properties Sold between April 2022 – June 2022, from 20,000 SF plus

440 Comstock Road, Scarborough

Properties Leased between April 2022 – June 2022, from 20,000 SF plus

2750 Morningside Avenue, Scarborough

Properties Sold between April 2022 – June 2022, from 20,000 SF plus

4590 Dufferin Street, North York

Properties Leased between April 2022 – June 2022, from 20,000 SF plus

Properties Sold between April 2022 – June 2022, from 20,000 SF plus

1180 & 1196 Martin Grove Rd,

1,7 &21 Vulcan Street, Etobicoke

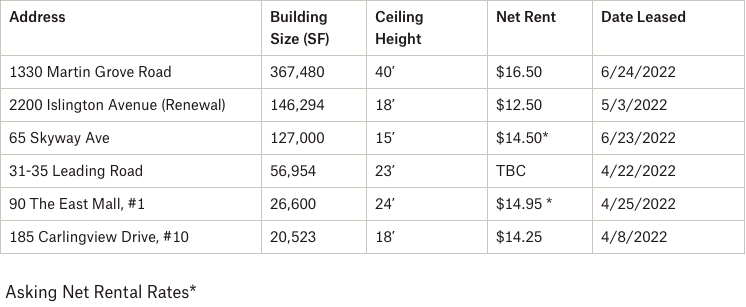

Properties Leased between April 2022 – June 2022, from 20,000 SF plus

1330 Martin Grove Road, Etobicoke

- Rental Rates: We continue to see a general upward pressure across the board into the mid- to high-teens PSF net, depending on a number of factors, such as building size, location, ceiling height, etc. Based on the increase of value of industrial land, infill sites, construction costs, etc… we will see these rates continuing to grow. Overall, we are still in a Landlord’s market.

- Property Values: We have seen a decrease in some properties offered at the new watermark values. That said, depending on the building size and location, and especially for Class A, well-located space, pricing shall remain strong. Given the most recent increases interest rates and further anticipated hikes in September, we will see an impact on CAP rates.

- Development Opportunities: Looking across the Toronto-Central markets, there is still great interest from developers to purchase infill sites and redevelop older and obsolete industrial buildings to newer, modern distribution centres. Given its central location and proximity to major highways and labour, larger industrial sites in the Toronto-Central markets will continue to be in great demand.

Conclusion:

So, how much is your property really worth?

What rental rate can you expect or how much per SF would you be able to get if you sell your building? How much can we compress CAP rates to create even greater value?

Well, the answers to these questions will depend on a variety of factors, many of which we can quickly uncover in an assessment of your situation. And with our rental rates and valuations at all-time highs, and vacancy rates low, finding the right property is a real challenge.

Having said that, a lot of transactions are being done off the market.. and to participate in that, you should connect with experienced brokers that have long-standing relationships with property owners.

For a confidential consultation or a complimentary opinion of value of your property please give us a call.

Until next week…

Goran Brelih and his team have been servicing Investors and Occupiers of Industrial properties in Toronto Central and Toronto North markets for the past 29 years.

Goran Brelih is a Senior Vice President for Cushman & Wakefield ULC in the Greater Toronto Area.

Over the past 29 years, he has been involved in the lease or sale of approximately 25.7 million square feet of industrial space, valued in excess of $1.6 billion dollars while averaging between 40 and 50 transactions per year and achieving the highest level of sales, from the President’s Round Table to Top Ten in GTA and the National Top Ten.

Specialties:

Industrial Real Estate Sales and Leasing, Investment Sales, Design-Build and Land Development

About Cushman & Wakefield ULC.

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 53,000 employees in 400 offices and 60 countries.

In 2020, the firm had revenue of $7.8 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit www.cushmanwakefield.com.

For more information on GTA Industrial Real Estate Market or to discuss how they can assist you with your real estate needs please contact Goran at 416-756-5456, email at goran.brelih@cushwake.com, or visit www.goranbrelih.com.

Connect with Me Here! – Goran Brelih’s Linkedin Profile: https://ca.linkedin.com/in/goranbrelih

Goran Brelih, SIOR

Senior Vice President, Broker

Cushman & Wakefield ULC, Brokerage.

www.cushmanwakefield.com

Office: 416-756-5456

Mobile: 416-458-4264

Mail: goran.brelih@cushwake.com

Website: www.goranbrelih.com